Summary:

- DraftKings is a compelling buy due to its first profitable quarter since 2020, strong brand, and ability to adapt to regulatory changes.

- Despite the Illinois tax hike, DraftKings is expected to manage the increased burden and maintain its market position, with projected EBITDA between $900M and $1B for FY 2025.

- The acquisition of Simplebet enhances DraftKings’ micro-betting capabilities, offering real-time betting opportunities and driving user engagement, positioning it ahead of competitors.

- Analysts are bullish on DraftKings, with an average 12-month price target of $49.3, suggesting over 40% upside, supported by strong financials and innovative technology.

- As such, we rate DKNG as a buy.

South_agency

Introduction

Football Season is officially back, and soon, the NBA will return once again to what is sure to be another exciting year in the league. Why do we care about this? With sports comes betting, and one particular company is looking to continue building on the momentum that it has had since mid-2020—the company in question is DraftKings (NASDAQ:DKNG).

Since our last article on DraftKings, the stock has tumbled due to headwinds and obstacles, which we will discuss throughout this article.

As seen from the chart above, the stock has been down approximately 13% since we last covered it, but this could prove to be an exciting time to either start a position in it or add additional shares if you are already holding on to DraftKings.

DraftKings has also turned a major milestone in reaching the first profitable quarter dating all the way back to FQ12020 – this is huge as it seems like they once and for all have gotten over the hump all growth companies look to get past.

In this article, we will discuss the arguments and numbers that make us confident that DraftKings is currently a great stock to buy. We will also highlight some of the company’s recent adversity.

The Illinois Tax Hike

DraftKings recently found itself in a bit of a bind after the Illinois Senate approved a hefty tax increase on sports betting companies. This new legislation means that instead of the flat 15% tax rate DraftKings has been paying, they could now face taxes as high as 40% on their adjusted gross revenue, significantly impacting them since Illinois is one of their biggest markets.

With its large population and enthusiastic sports betting community, Illinois is critical for DraftKings, making this tax hike an annoyance but still manageable.

As soon as the news hit, DraftKings’ stock dropped more than 6%. Investors were understandably worried. Their main concern? How DraftKings would handle the increased tax burden. Would the company be forced to pass some of these costs onto its customers by reducing promotions or offering.

Despite the initial shock, many industry analysts haven’t hit the panic button yet, which we will see later in this article. They see this as a short-term challenge that DraftKings can manage. In fact, they remain bullish on the company’s long-term potential.

DraftKings has built a strong brand, has a sizable market share, and demonstrated an ability to adapt to regulatory changes. This latest tax bump, while significant, is something analysts believe DraftKings can absorb and continue growing from in the future.

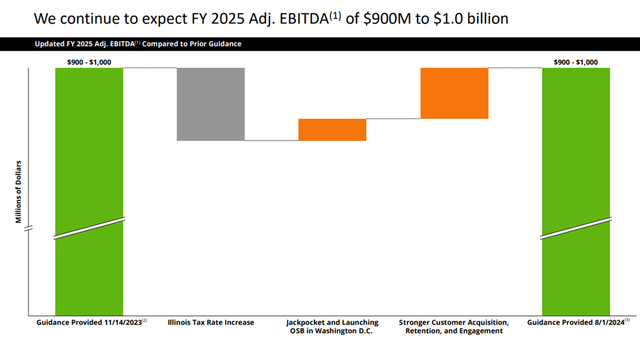

In their second quarter presentation, DraftKings showed that despite the hike in Illinois tax rates, they still expect their adjusted EBITDA to be between $900M and $1B for FY 2025.

In essence, while the Illinois tax hike is a headache for DraftKings, it is still important to remember similar companies are subject to the same change. Therefore, it should not worsen DraftKings’ overall market positioning, and based on the graph above, the expected losses are expected to be mitigated.

Simplebet’s Transformative Impact

DraftKings may be facing short-term hurdles with the Illinois tax hike, but it’s not letting that slow down its game. In fact, DraftKings has been making smart moves to solidify its position as a leader in the sports betting industry. One of the most exciting moves is its acquisition of Simplebet, a company specializing in micro betting technology.

So, what exactly is micro betting, and why does it matter? Unlike traditional betting, where you might place a wager on the outcome of a game, micro-betting lets you bet on individual moments as they happen in real-time.

Essentially, you can bet on whether the next pitch in a baseball game will be a strike or a ball or whether a basketball player will make both free throws or just one. This makes watching sports even more interactive, as you’re not just waiting for the end result—you’re engaged in every moment of the action. We like this acquisition for DraftKings as it goes hand in hand with their mission of making the user experience as easy and seamless as possible.

By acquiring Simplebet, DraftKings is investing in a product that is not just another platform but instead a technology. Simplebet’s machine-learning technology allows for highly accurate predictions and real-time betting opportunities, which means DraftKings can offer an even more immersive and engaging experience to its users.

While other platforms, such as FanDuel (owned by Flutter (FLUT)), also offer micro betting on their platform, Simplebet’s tech is simply some of the best in the industry and will put DraftKings ahead of its competition.

But why are we spending so much time talking about micro betting? Well, micro-betting is becoming a major growth area for sports betting, as it appeals to a wide range of bettors, from casual fans looking for fun bets to more seasoned players who enjoy the thrill of constant action.

In fact, market experts are projecting the micro-betting environment to be a $182B industry by 2030, which constitutes a 10.3% CAGR between 2023 and 2030. By integrating Simplebet’s tech, DraftKings is opening the door to new revenue streams because bettors are likely to place more frequent bets throughout a game rather than just a few big ones before it starts.

When you compare this acquisition to DraftKings’ other recent deals, like its purchase of Jackpocket (a digital lottery company) or Golden Nugget Online Gaming (which expanded DraftKings’ presence in the iGaming world), Simplebet stands out because it doesn’t just grow the company’s reach—it transforms the betting experience itself.

Simplebet gives DraftKings a technological edge that’s hard to beat, driving innovation and ensuring that users stay engaged with live events in real time.

Key Valuation and Growth Metrics

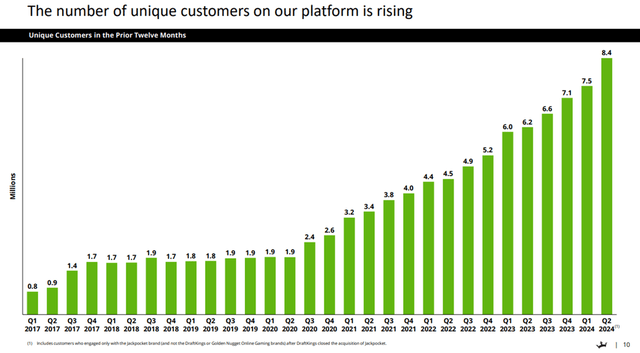

In our last article, we went through DraftKings’ historical financials, which you can find here. If we look at more recent data, DraftKings has generated $4.3B in revenue over the past 12 months – a clear indication of its growing customer base and the rising popularity of its services. As a matter of fact, DraftKings’ customer base has exploded since mid-2020, when the world went into lockdown as a consequence of the COVID-19 virus.

However, DraftKings remains in the investment phase, with a net loss of $406.5M in TTM. As we mentioned earlier, though, this is a common phase every company has to go through during growth. Besides, with Q2 ending with a profit for DraftKings, it looks like they have cracked the code.

DraftKings currently has a price-to-sales ratio of 3.92, which is definitely on the lower side compared to an 18-month timeframe. It still signals strong investor confidence in the company’s future potential, but let’s assume a price-to-sales ratio of 5, which is around the average for the period shown in the graph below.

In this case, DraftKings would have to trade at close to $45 – a 28.5% upside based on this metric alone. In the next section, we will highlight why this may be just what the market is expecting DraftKings to trade around in the coming year.

We are using the P/S ratio rather than the more commonly used P/E ratio due to a very simple reason. When a company has negative earnings, such as what DraftKings had in the previous quarter, the P/E ratio becomes irrelevant and meaningless as it would yield a negative result. For this reason, we use the P/S ratio.

With that being said, the median P/S for the sector is 1.30 according to Seeking Alpha, and in that sense DraftKings could appear somewhat expensive. It is important to remember, however, that the historically elevated P/S ratio also can be a sign of bigger growth prospects for DraftKings compared to the rest of the sector. We like DraftKings precisely because of these growth aspects.

Lastly, despite facing some challenges, like a negative EBITDA margin of -5.80%, DraftKings is in a strong financial position with over $815.9M in cash reserves.

This is a substantial financial buffer that makes potential quarterly losses easier to cope with, as it keeps investing in growth opportunities while handling short-term obstacles.

Analyst Ratings and Target Price

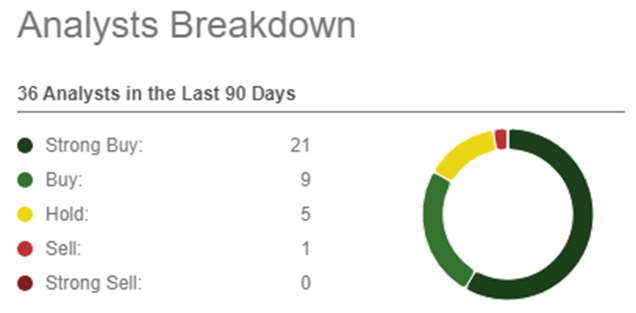

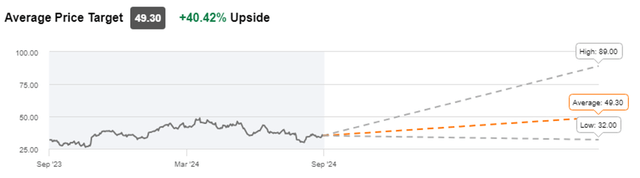

There’s plenty of optimism around DraftKings, and much of it comes from strong analyst ratings. Recent projections for the stock show a 12-month price target ranging between $32 and $89, with the average price target being $49.3, suggesting the stock could rise by over 40%.

Among 36 analysts, 30 recommend buying the stock (buys and strong buys), with five rating it a hold and only one analyst rating DraftKings a sell. Basically, Wall Street is feeling very bullish on this stock for the foreseeable future.

In short, analysts are feeling optimistic about DraftKings, largely due to its growing presence in legalized sports betting markets across the U.S. and increased market share. What’s really boosting confidence is the company’s innovative use of technology, like Simplebet’s micro-betting features, which helps set DraftKings apart from its competitors.

This combination of expanding market reach and cutting-edge product offerings is reinforcing the positive outlook on the company’s future.

With an average price target of $49.50 and DraftKings’ increasing market dominance, there’s a strong indication that the company has more potential for growth than risk. Analysts believe that DraftKings’ innovative approach to live betting and a strong focus on customer engagement make it a compelling long-term investment opportunity, reinforcing the view that the stock could continue to rise.

We are well aware that price targets can sometimes be deceptive, and that is why it is very important to sometimes take a quick look under the hood. In our case, a look under the hood is looking at the option chain and what that is telling us.

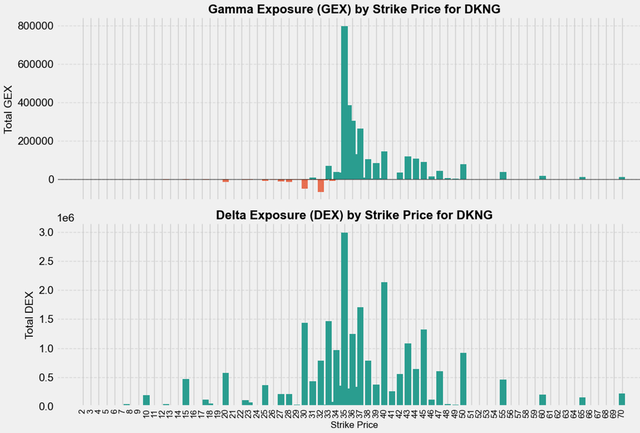

Below, we have visualized the total amount of gamma and delta exposure (GEX and DEX) for DraftKings across all expiration dates following market close on September 6th.

What we see if there is a lot of call gamma, especially at $35, given that the stock closed at $35.11 on September 6th, is that the GEX at $35 could act as a very strong cushion and prevent further downside moves.

We also want to highlight the spikes in GEX at around $42 – $45 and $50, which overlap very well with the average target price mentioned earlier.

We also see that the same strike prices have a significant amount of DEX, which could act as a magnet for the stock to climb toward this area.

On the other side of the coin, looking at put gamma in the graph on top, it is clearly very limited with the amount of negative gamma currently in the option chain. For this reason, we see $32 as a very strong level of support, with the upside being around $50, as mentioned before.

Risks

We should also mention that, although we see very limited downside at the moment, further regulatory shocks to the gaming market could potentially undermine our bullish theory. As of this writing, we are not aware of any such possibilities and consider them unlikely. Furthermore, the battle for market share in the gambling space is intense, and with Flutter being the giant that it is, it definitely has the potential to reclaim some of the market share from DraftKings.

That being said, the recent acquisitions made by DraftKings make us confident that it is likely to gain even more market share in the near term.

In addition to sector-specific risks, DraftKings is not immune to broader market movements. Should the market experience a period of uncertainty and risk-off sentiment, DraftKings is likely to face consequences as well.

Conclusion

To sum everything up, DraftKings presents an attractive buy opportunity with a limited downside at around $32, which we see as a strong level of support. On the upside, the stock has the potential to climb toward $50, leaving significant room for growth.

Our analysis of the P/S multiple yielded a fair value of around $53, with the positioning in the options market and current price targets supporting this thesis.

With DraftKings’ continued expansion and smart acquisitions, we believe DraftKings is well-positioned to thrive in the future, making it a compelling investment for those looking to capitalize on both stability and future potential.

We rate this stock as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.