Summary:

- NextEra Energy is the leading US Wind Energy player. NextEra Energy Partners’ generation portfolio is also heavily geared toward wind power, making fundamental drivers of wind energy highly relevant.

- A 71% chance of entering La Niña climate conditions in the next 2-3 months is likely to lead to increased wind speeds for NextEra’s wind farms, boosting generation.

- Valuations are near fair value for both NEE and NEP, leaving little margin of safety for buys. Relative technicals also do not inspire much confidence.

- Key thesis monitorables include weather and climate. Distribution coverage is an additional key risk to track for NEP.

- From a ranking perspective, I prefer NEE, then NEP, NEEPRS, and NEP.PR.R, in that order. I believe equity exposure is needed to benefit from the weather- and climate-related catalyst.

rudi_suardi/E+ via Getty Images

Thesis

I have a neutral outlook on both NextEra Energy Partners (NYSE:NEP) and NextEra Energy (NYSE:NEE):

- NextEra is heavily geared toward wind power

- Expected La Niña climate conditions are a tailwind

- Valuations are near fair value

- Relative technicals are bearish but near monthly support

- Distribution coverage is a key risk monitorable

The fundamental analysis in my thesis is materially relevant to NEP, its parent company NEE and (NEE.PR.R) and (NYSE:NEEPRS) as well since my analysis and valuation focuses on the operating business on NEE, before the claims of equity and preferred shareholders.

The relationship between NextEra Energy and NextEra Energy Partners

NextEra Energy is a large energy company that operates via many subsidiaries such as Florida Power and Light Company (FPL) – an electric utility company – and NextEra Energy Resources – a renewable energy company focused on wind and solar. NextEra Energy Partners is also another subsidiary of NextEra Energy. Unlike FPL and NextEra Energy Resources, NextEra Energy Partners is listed in the stock market. So the 2 main options for investors to get exposure to these businesses are via NextEra Energy and its related securities, and via NextEra Energy Partners.

Here’s the difference between those 2 investment options:

NextEra Energy provides investors a higher reward and also risk potential. This is because via NextEra Energy Resources, there is exposure to the development of renewable energy projects, which involves project planning, financing, and construction. NextEra Energy Partners, on the other hand, is focused on the operations of the developed clean energy projects. The projects developed in NextEra Energy Resources is acquired and managed under stable, long-term (often multi-decadal) contracts. As project development is more volatile than simply operating an asset for decades, NextEra Energy is a higher risk, higher reward proposition for investors than NextEra Energy Partners, which tends to attract many income-focused investors looking for stable yields.

NextEra is heavily geared toward wind power

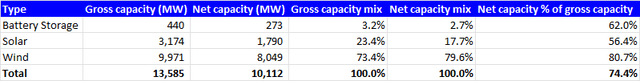

NextEra energy is the market leader in US Wind Energy. NextEra Energy Partner’s generation portfolio as of June 30, 2024 also shows us that most (79.6% of net megawatt capacity) of the renewables energy generation comes from wind power:

NEP Generation Portfolio (Company Filings, Author’s Analysis)

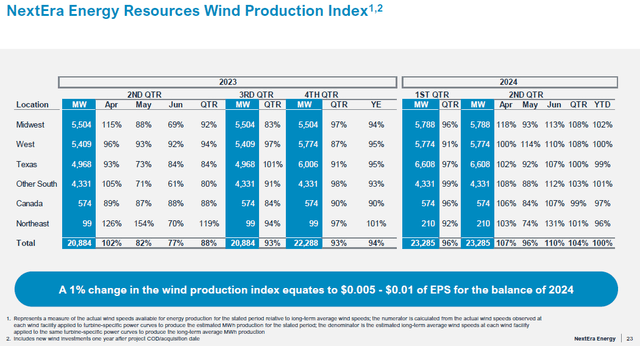

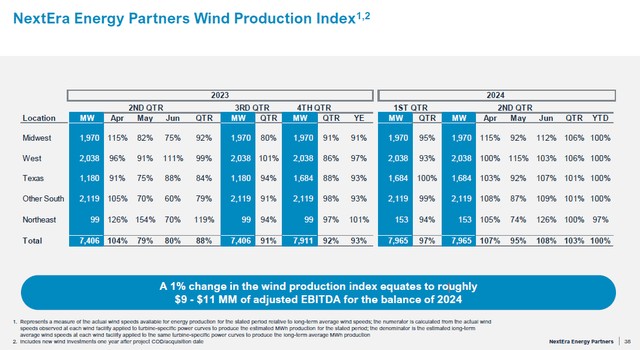

NextEra’s latest earnings presentation also noted how a 1% change in the wind production index leads to an average of $0.075 EPS movement for NEE and an average of $10 million of movement in adjusted EBITDA for NEP for the remaining 2 quarters of FY24:

NextEra Energy Partners Wind Production Sensitivity to Earnings (NEE and NEP Earnings Presentation) NextEra Energy Partners Wind Production Sensitivity to Earnings (NEE and NEP Earnings Presentation)

The percentage figures in the chart above represent a ratio of actual wind speed to the long-term average wind speed for that particular time period.

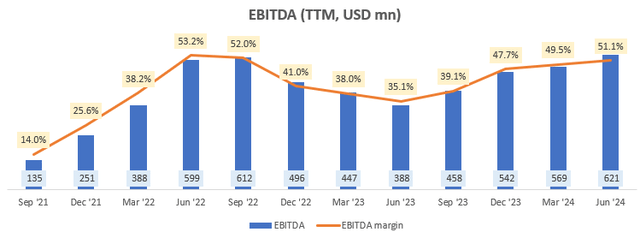

NEP EBITDA (TTM, USD mn) (Company Filings, Author’s Analysis)

NEP’s current TTM EBITDA run-rate is $621 million, at 51.1% margins. Hence, on an annualized basis, the 1% change in the wind production index corresponds to a +3.2% delta in annual EBITDA or a +164bps margin impact based on TTM figures as of the June 2024 quarter. A similar analysis on NEE’s TTM EPS figures of $3.1 implies a +4.8% delta impact on NEE’s EPS.

Expected La Niña climate conditions are a tailwind

Earth’s climate changes from hot to cold in specific geographies according to something called an El Niño Southern Oscillation (ENSO) cycle. Understanding the outlook here can help form seasonal climate and weather expectations.

Currently, we are in an ENSO-neutral phase, which corresponds to normal sea-surface temperatures. But according to the National Weather Service climate prediction center, there is a 71% chance of us entering into La Niña conditions during September – November 2024, which is expected to last till the end of Q1 CY25.

This has implications for NEP’s wind farm performance. Studies have shown that La Niña conditions tend to show above-average wind speeds in regions such as the Midwest and the Great Plains. Hence, I see this as a positive tailwind (literally) for NextEra’s wind energy generation.

Valuations are near fair value

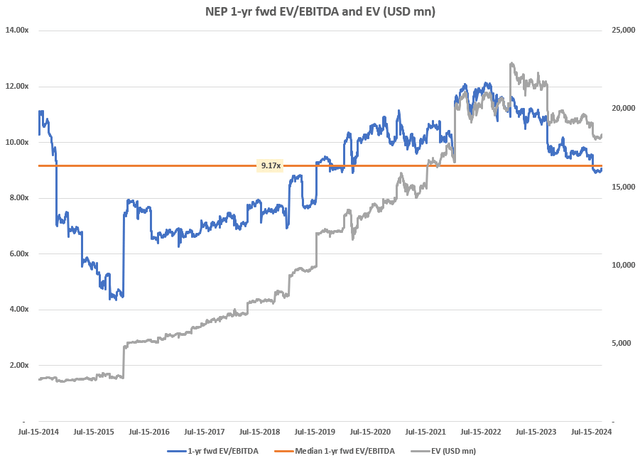

There has been a de-rating in NEP over the past 2 years, partly due to dividend cut concerns (discussed later). At 9.06x 1-yr fwd EV/EBITDA, NEP is trading close to its longer-term median multiple of 9.17x:

NEP 1-yr fwd EV/EBITDA and EV (USD mn) (Capital IQ, Author’s Analysis)

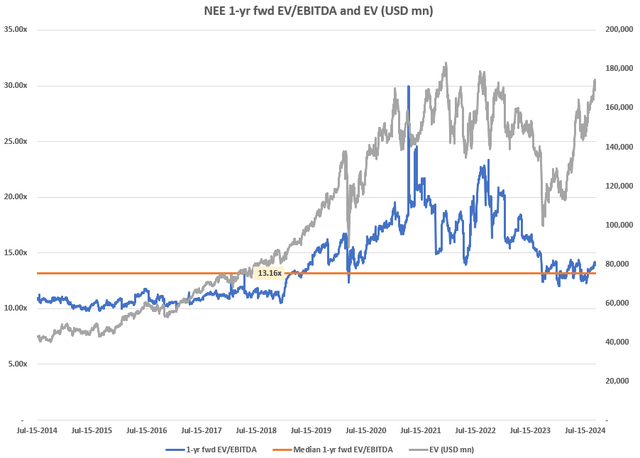

NEE’s 1-yr fwd EV/EBITDA of 13.93x is also near its longer-term median of 13.16x:

NEE 1-yr fwd EV/EBITDA and EV (USD mn) (Capital IQ, Author’s Analysis)

Given the favorable winds from La Niña, I believe arguments for buys at current valuations can be made. However, I do recognize that there is a lower margin of safety.

Relative technicals are bearish but near monthly support

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

I compare every security I analyze vs the S&P 500 as I view that as the main opportunity cost for engaging in active security selection. I find it also helps put into perspective the range of different investment opportunities, allowing for better rank-ordering and position sizing. Some investors may not agree with this approach. In that case, I would urge those investors to focus more on the fundamental thesis rather than the relative technicals view and my rating on the security.

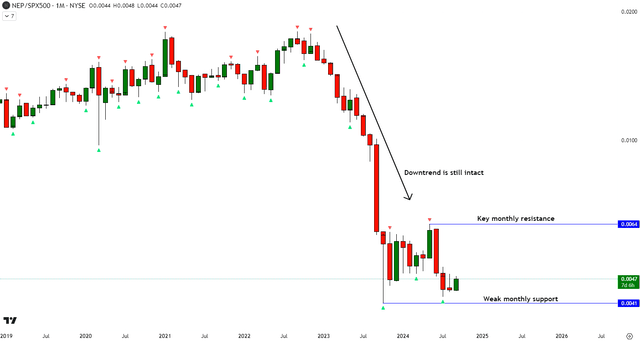

Relative Read of NEP vs SPX500

NEP vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P 500 (SPY) (SPX), NEP is still in a strong downtrend, although it may be forming a base. I do not see a very convincing buy trigger though, since there is no false breakout to the downside yet.

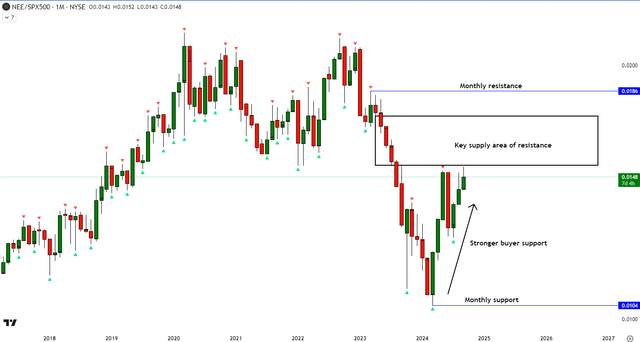

Relative Read of NEE vs SPX500

NEE vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

NEE relative to the S&P 500 looks comparatively more bullish as the push-up by the buyers is stronger. However, here too, I make note of a key supply area that can act as resistance for a continued push up.

Climate news and distribution coverage are key risk monitorables

As a key part of my fundamental thesis is based on seasonal climate impacts, and since weather and climate are higher frequency monitorables than the quarterly results of companies, news around these catalysts is something I will be tracking closely.

For NEP, I also note another risk to track:

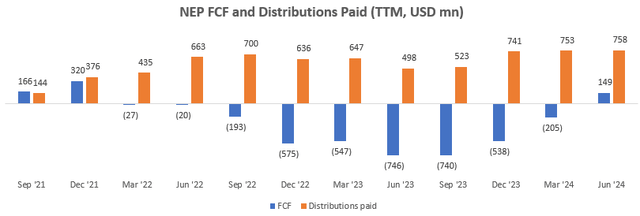

On a TTM basis, NEP’s distributions paid has consistently exceeded FCF for the past 3 years:

NEP FCF and Distributions Paid (TTM, USD mn) (Company Filings, Author’s Analysis)

This unsustainable distribution coverage has been funded via a combination of equity raises, debt raises (which have also contributed to a Net debt/annualized EBITDA of 8.8x and a BB+ credit rating by Fitch Ratings) and asset divestments. Over the long term though, I don’t view this as very sustainable. Hence, a distribution cut is a key risk monitorable.

Takeaway & Positioning

I am fundamentally bullish on NextEra Energy and NextEra Energy Partners as I believe the wind generation portfolio is likely to benefit from stronger wind speeds during the expected (71% chance) climate shift toward La Niña conditions. Valuations for both NEE and NEP are near long term median levels. Hence, I do not see a lot of margin of safety for buys. Technically relative to the S&P 500, both NEE and NEP do not align for buys just yet. However, I do note that NEE shows much higher relative strength than NEP. This may be because NEP has an additional risk factor of unsustainable distributions track, which increases the risk of a distribution cut.

Overall, I issue a ‘Neutral/Hold’ rating on all the securities covered. From a ranking perspective, I would put NEE first, then NEP and lastly the preferred share classes NEEPRS and NEE.PR.R. This is because I believe higher common equity exposure would reap more rewards from the higher wind speeds catalyst.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.