Summary:

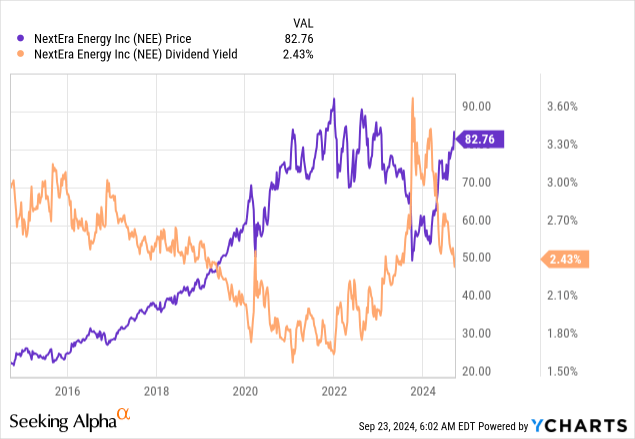

- Since 2016, NEE’s dividend yield has rarely exceeded 3% for any sustained period, indicating limited appeal as a high-yield dividend stock.

- NEE has a huge scale. It is the largest green energy producer in the world.

- Long-term revenue and dividend growth seem assured, but it is hard to justify investing now at current share values.

ANPerryman

In a recent Analyst call, NextEra Energy (NYSE:NEE) Management said

we believe we are at an inflection point for electricity demand in the U.S. and … no company is better positioned than NextEra Energy to meet that demand.

(NEE: 2024 Analyst/Investor NextEra Energy, Inc. Transcript, 2024-6-11)

Later in the call, the CEO said NEE was made for this moment.

The electricity supply industry is changing, entering a period of growth following one of stagnation. The move away from fossil fuels is changing the cost dynamic of the industry, and new technology is having an increasing impact on operations. The industry has reached a point of flux; almost everything is changing, and inevitably, there will be winners and losers. It presents opportunities for careful investors, and I am looking at the different players to find a solid investment.

Where better to start this search with NEE, the world’s largest green energy generation company and the largest player in the U.S. market with more than 20% market share.

NEE has the scale and the technology to drive prices lower, the interconnection points to have competitors waiting in line and a backlog capable of driving growth for at least the medium term. This article tries to answer the following question.

Does the combination of NEE’s dividend yield, business model, and growth prospects present a compelling investment case?

Due Diligence: On September 9th NEE announced it would meet with investors during September to discuss growth rates for NEE and NextEra Energy Partners (NEP). I was invited to one of these meetings and met with a company representative on September 18th, where I discussed the contents of this article and the company’s views for the future.

The Changing U.S. Electricity Market

The U.S. is forecast to experience a significant growth in electricity demand in the coming years, fuelled by the growth in data centers and AI, the proliferation of electric vehicles, the increased use of energy in the home and the increasing number of extreme weather events, especially prolonged heat spells.

Estimates vary, but NEE is expecting a 38% growth in power demand over the next 20 years (Statistica says 27%); that growth is 4 times higher than the growth seen in the previous 20 years.

On top of this growth in demand comes a changing industry dynamic as regulators and the general public push for green energy production and low carbon emissions; the price of renewable energy generation has fallen and now seems to have a lower total cost of ownership and shorter lead time than fossil fuel. A ramping up of production and improved technology have changed the cost dynamic for green production.

In analyst call NEE put forward the case that Solar is now the cheapest form of energy:

Solar also has a capital revenue requirement, including a return on that investment. However, that is primarily offset by fuel savings and production tax credits. When you run all of that out over a 35-year life of a solar facility and then discount that back to today’s dollars, results in nearly 0 cost for customers over its life

Of course, we know the sun doesn’t shine all of the time, and the wind doesn’t always blow. As a result, NEE is investing $1.5 billion in battery storage and has completed its first Hydrogen plant to use solar energy to produce hydrogen.

Business Model

Understanding the NEE business is critical for evaluating the company as an investment possibility. The business model is designed to win in the electrical utility industry, a highly regulated, capital-intensive industry. Numerous regulators control most aspects of the business. Regulation defines this industry and dictates the strategy needed for success.

From the analyst call

I thought it would be a good time to take a brief moment and remind you all of the simple earnings equation at FPL. It all starts with our regulatory capital employed. You multiply our capital employed, times our allowed equity ratio and multiply that by our return on equity and that serves as a great approximation for FPL’s net income.

It all starts with capital employed and the allowed equity ratio; to grow net income they must grow the amount of capital employed. In NEE’s case, the old adage is true: you must spend money to make money.

To grow income, they must build more generation facilities, connect them to the grid and sell the electricity they have generated and that needs money. Lots of money, NEE has three avenues for acquiring the capital, cash generated from operations, debt and issuing equity.

A key goal is to recycle the capital raised; they want to use the cash from operations and the money raised by debt more than once. NEE has not been raising capital by selling shares; the IR representative said they had no plans to change this policy.

NEE refers to capex as an opportunity, they actively look for ways to invest money that they can add to their rate agreement. An example is storm hardening, in the June 24th earnings call they discussed how they had hardened their network to storms in peninsula Florida but still are only 50% of the way to hardening the entire system.

while we’ve made great progress on our laterals and are already seeing day-to-day reliability benefits, we’re only roughly 50% of the way there, representing a tremendous investment opportunity, $25 billion over the next 15 years.

I cannot think of another industry where spending $25 billion would be described as an opportunity but that is the case in this industry. The more they can invest the more they can make, it is the only way to increase shareholder value.

Regulation

Regulatory bodies determine the prices (rates) that suppliers may charge for electricity, different bodies govern retail and wholesale rates. The regulators are tasked with setting a rate that covers the cost of service and provides a reasonable rate of return for the supplier.

The base rate is meant to cover the cost of providing service and includes the cost of construction, operation and maintenance of power plants, crucially, it dictates the allowed return on investment. The actual return is monitored monthly, but it is the company’s responsibility to achieve the permitted rate of return.

Prices

NEE has to build the sites to generate electricity, but it would be somewhat pointless if they didn’t sell it. People, on the whole, buy electricity on price; it has been impossible to create a brand for electricity, no one cared as long as the lights come on, and the monthly bill is not high. That is beginning to change with more retail and business customers preferring to buy green energy.

The perfect electricity generation site currently is a large, environmentally friendly one that produces low-cost power. That is exactly what NEE is in the business of developing.

NEE has operational costs 70% lower than the national average and residential bills 40% lower than the national average (investor deck slide 4)

With low prices, it can sell electricity and its low operating costs allow it to generate profit at these prices.

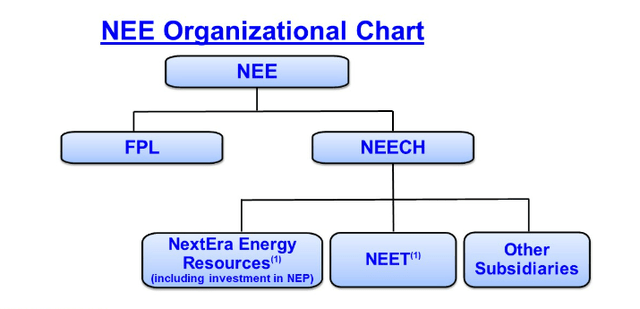

NEE: The Structure

NEE consists of two companies FPL and NEECH. It is the combination of the two businesses from which NEE derives its competitive advantage. NEECH owns and provides the funding for NEE’s subsidiaries other than FPL.

NEECH is the world’s largest generator of renewable energy as well as being a leader in battery storage. (FY 2023)

NEE reports NextEra Energy Resources and NEET a rate regulated transmission business as a single business unit called NEER. NEER constructs, owns, develops and operates electricity generation facilities in the U.S. and Canada. It also owns battery storage facilities and other renewable fuel businesses.

NEER operates sites in which it has partial or full ownership, it sells its output through long-term power purchase agreements with utilities, retail electricity suppliers and large industrial customers. NEER has more than 330 substations and 3,500 miles of transmission lines.

Recycling Cash

The structure of NEE seems complex, that complexity is due to the need to raise and recirculate capital. NEE borrows money, adds it to cash generated by operations and then builds or acquires a new facility.

After constructing or acquiring sites NEE recycles its cash by selling part of its facilities. The facilities are often turned into limited partnerships, and NEE sells a portion of the facility’s earnings for a set time period. The largest partner it has is Next Era Energy Partners (NEP), NEE has a 51.4% ownership interest in NEP’s operations.

NEP used the cash acquired at its IPO, and borrowings to purchase 48.6% of NEP OpCo, from NEE, and is the managing partner in the limited partnership. NEE operates all of the energy projects in NEP’s portfolio.

NEP and NEE have the same management team and their earnings calls are joint, management discuss the performance of both companies as if they were a single entity.

The plan was for NEE to continue dropping down assets to NEP OpCo, with NEP buying 46.8% of new facilities as they were dropped down. However, the cost of capital at NEP has made this operation difficult and management have said they do not expect to drop any more facilities this year. NEE is actively looking at ways to improve NEP’s balance sheet and reduce its cost of capital. I will look at NEP in a separate article that will be published shortly after this one, NEP has a 14% dividend yield, so I am very interested in it.

NEP is one of the counterparties NEE works with to recycle its capital, others are private equity firms parking their capital for a guaranteed low-risk return. Blackstone, the world’s largest alternative asset manager with more than $1 trillion UAM, was mentioned three times in my meeting with the investor relations representative of NEE, in July we heard of an additional plan where NEE and Blackstone will co-own a significant renewables site portfolio in the U.S.

The recycling of capital works because of the distributions or dividends the limited partnerships pay, NEP and private equity firms invest in return for future cash flows in the form of dividends.

For NEE, dividends are not a sign of success; they are the food that feeds success.

FPL

The second company in NEE is FPL. FPL is the largest electrical utility company in Florida and the largest rate-regulated entity in the U.S.; it has almost 6 million customers and boasts energy bills for its customers, which are 27% lower than the national average and have the lowest operating costs in the country. (NEE investor slide deck Q2 2024) 89% of its customers are residential, and it generates power from a fleet of power stations 73% Natural Gas, 11% Nuclear, 14% Solar. FPL operates 4 nuclear power plants and is currently investigating bringing a fifth back online. The Duane Arnold nuclear plant was closed in 2020 when it became uneconomic, but NEE has said it is considering bringing it back.

I discussed Nuclear in my meeting with NEE, the representative said a couple of important things: Firstly, NEE believes new nuclear technology, like small modular reactors being produced by NuScale (SMR) and NanoNuclear (NNE), are at least 10 years away. Secondly, NEE will not attempt to restart the Duane Arnold reactor without first de-risking it for shareholders. I asked him to expand on this, and he said they would want to have a large-scale customer in place to buy the electricity before they consider restarting. It was another example of the importance of dividends and how this is the primary focus of NEE. The plan would appear to be similar to the one with Microsoft that looks set to bring Three Mile Island back online.

In 2023, FPL commissioned its first Hydrogen plant a 25 Megawatt facility adjacent to its Okeechobee solar site. Solar energy is driving 5 electrolyzers producing green hydrogen mixed with natural gas at the Okeechobee turbines.

FPL has a rate authorized ROE of between 9.7% and 11.7% lasting from 2022 to 2025, a rise in the U.S. treasury rate triggered an increase in the rate to 9.8%-11.8%.

Competitive Advantage: Scale and AI

NEE has a massive advantage in scale, not only in terms of its operations, in the analyst call the executive highlighted the following facts. NEE has relationships with 85 banks in 20 countries giving them multiple capital recycling opportunities. They have 10,000 suppliers and secure labor three years in advance, they have opportunities to re-power facilities and many facilities have excess interconnect capacity allowing the construction of adjacent power generation facilities.

NEE was quick to employ machine learning and A.I. to improve its business. The 2006 purchase of WindLogics, formerly known as “Supercomputing Services and Engineering”, began NEE’s push into A.I. and has been used to develop applications that have led to significantly more efficient operations. NEE uses generative A.I. in their Discover Tool (showcased at the June Investor Day), NEE suggested that this A.I. tool could save hyper-scale data center operators as much as 45% on their operating expenditure by choosing the correct site to build the facility. (FPL has 50 data center customers and is expecting significant growth)

On the analyst call the representative said

We are leveraging generative A.I. across the business. Across generation, across transmission across our staff groups….Leveraging technology requires data, nobody has more proprietary data than we do

NEE can run many of its plants remotely, including fossil fuel plants. This ability brings efficiency of scale, every megawatt added to a remotely controlled site has no incremental addition to operations and management costs, so the gross margin goes up.

Scale

NEE currently has a 34 gigawatt operating footprint, a further 50 gigawatts can be co-located at existing sites, they have a 300 gigawatt pipeline with 150 gigawatts of interconnection queue sites plus 34 gigawatts of additional interconnection sites for storage (analyst call).

In the remainder of this decade, they expect to invest more than $37 billion, growing capital employed at a CAGR of 9%. One-third of the investment will be in generation with $12 billion going to be solar, building 20 gigawatts of capacity in a decade. Over the longer term NEE intends to add 100 gigawatts of renewable energy and be zero-emission by 2045.

The regulators approve new sites and interconnections to the grid, and these approvals are given many years in advance. As the NEE manager said, “new arrivals will have to get in line”.

Having the approval to build and connect greenfield sites as well as expansion to existing sites is a critical competitive advantage.

Financials

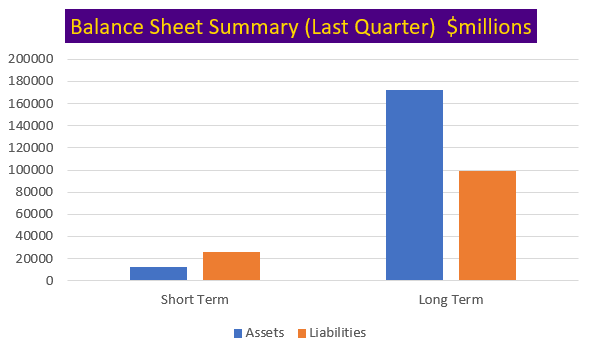

The balance sheet is the core of their operation; NEE has an A- credit rating, giving it excellent access to capital and a likely competitive advantage in terms of its cost of capital for some time.

NEE Balance Sheet LQ (Autor Database)

NEE has shareholder equity (assets-liabilities) of $59 billion, debt of $83 billion and cash of $1.6 billion. Debt to equity is 149% and that measure is up from 100% in 2019. EBIT is 2.5 x interest payments and operating cash flow is only 16% of debt.

These metrics reflect the company’s stated ambition of growing its operating footprint by raising as much capital as possible. I consider the balance sheet to be solid, and the long-term nature of their business and proven ability to generate cash over a long period de-risks the high level of debt.

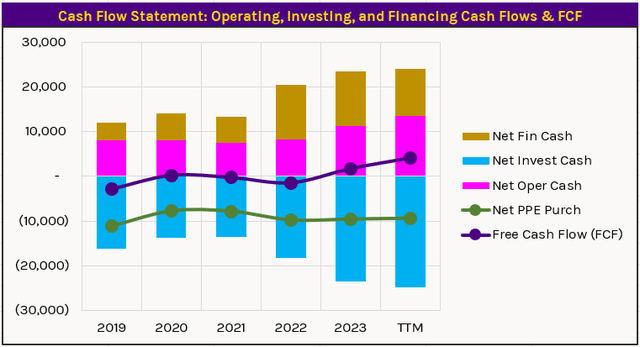

The following chart shows the level of investment and its growing trend met by cash from operations and cash raised.

NEE Cash Flow Summary (Author Database)

Dividends and Valuation

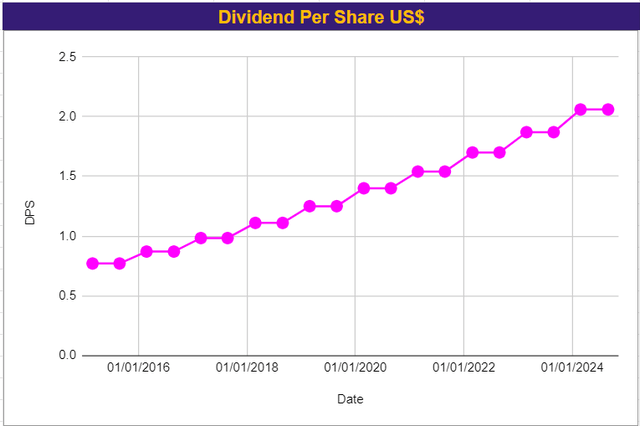

I have said that the dividend per share is a crucial success criterion for NEE, and this graph shows the consistent growth in dividends over the last 10 years. I expect this graph to follow the same pattern for the medium term. It makes it easy to see what you will get from NEE shares regarding dividends.

Dividend yield is currently 2.5%, not stellar by any means, but it is well covered by earnings with a payout ratio of 65%. The top 25% of industrial dividend payers pay over 4% and the average is 3%.

Management discussed forecasts for dividends in the most recent earnings call.

We expect to grow adjusted earnings per share expectations by 6% to 8% of our 2024 adjusted EPS range through 2027 ….. We expect to create significant shareholder value over the next 4 years.

The problem, for me, is the yield; if I buy a stock for its dividend, I need an above-average yield, otherwise, the opportunity cost of capital is too great. Opportunity cost is a big part of my trading, I try to ensure my capital is working well for me.

The dividend yield is calculated from the dividend per share and the share price, the constantly increasing dividend per share and the growth in operations has led to an increase in share price that is outpacing the growth in dividends.

Since 2016 NEE dividend yield has rarely broken above 3% for any sustained period. The growing share price makes it difficult to invest in NEE for its dividend alone.

If I cannot invest on the dividend alone, I consider the potential for share price growth.

Forecasting the future path of the share price is extremely difficult, one could just look at the chart and from any technical measure calculate it is on an upward trend and heading higher. I am not a technical analyst and do not invest on a technical set up.

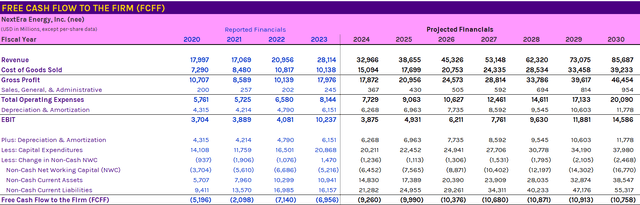

My preferred method is to calculate a fair value for the share price using a discounted cash flow analysis. I built a three-statement model for NEE using the guidance from management and applying 3-year metrics to drive the various schedules. The non-cash assets and liabilities plus the net working capital have been volatile in the past, but I have applied a smooth growth in the model. I ran multiple scenarios on the model changing these values, it did affect the FCCFF but not the conclusion that on a DCF calculation the company is overvalued.

Forecast free Cash Flow (Author Model)

NEE has not, and never intends to, generate positive FCFF. Its stated intention is to pay its dividend/distribution and invest the rest of its money along with as much as it can raise to continue building out its business.

The DCF method fails for NEE. A company with a negative FCFF will never be valued above its current value. The FCFF does not capture the company’s real value and makes me unable to calculate a fair value for the shares. It means I am left focusing on the dividend alone.

Conclusion

I have decided not to invest in NEE, a large business with a solid balance sheet and a growing pipeline of infrastructure investments that seems certain to continue growing and paying a dividend.

As the NEE executive said NEE is made for this moment, it is a leader in green electricity generation with the potential to grow its operating footprint to meet a growing demand.

The future success of this company is as guaranteed as any I have analyzed; as a result, its share price has moved to a level that makes it unattractive to me.

The dividend yield is modest at 2.5%, and although the dividend per share is rising, the share price is rising keeping the yield modest.

My attempt to create a fair value for the share price failed, it does not capture the intrinsic value of the company leaving me unable to forecast a future share price for NEE.

NEE was made for this moment, but unfortunately, I will not be investing in it.

I am rating NEE a hold, if its share price ever falls giving it a more attractive dividend yield I will become interested.

Next, I will look at NEP and its 14% dividend yield!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.