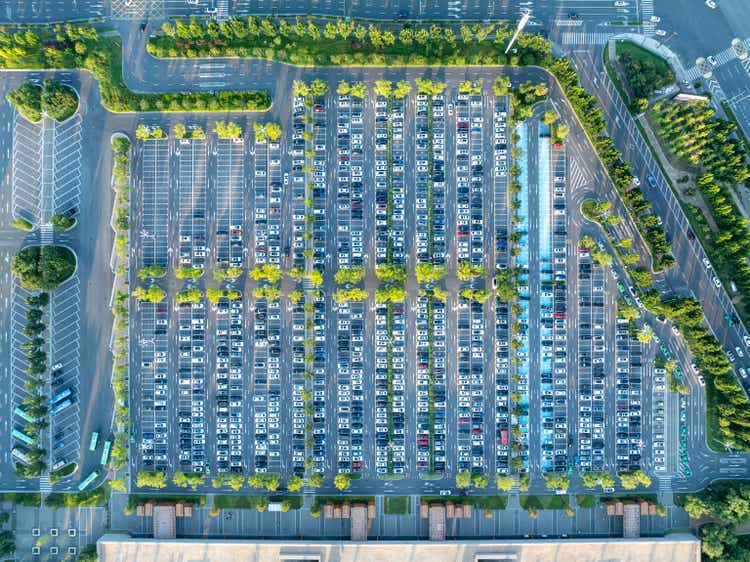

sinceLF/E+ via Getty Images

Morgan Stanley downgraded the entire U.S. auto industry view to an In-Line rating after having the broad sector set at Attractive.

“At a high level, our downgrade is driven by a combination of international, domestic and strategic factors that we believe may not be fully appreciated by investors,” warned analyst Adam Jonas. The firm thinks U.S. inventories are on an upward slope, with vehicle affordability still unreachable for many households. Also in the mix, credit losses and delinquencies continue to trend upward for less-than-prime consumers. Jonas also highlighted that China’s two-decade-long growth engine has reversed in terms of China profits flipping to losses and China producing nearly 9 million units more than it sells locally, which is a figure equal to 15% of non-China global volume.

Jonas and his team also said the optimism around auto stocks getting credit for being AI enablers and beneficiaries is being countered by concerns over the significant capital commitment required to follow through on large-scale AI development, AI infrastructure, and building out AI cloud/datacenter hyperscalers.

As part of the auto industry reset, Morgan Stanley downgraded Ford Motor (NYSE:F) to Equal Weight from Overweight, General Motors (NYSE:GM) to Underweight from Equal Weight, Rivian Automotive (NASDAQ:RIVN) to Equal Weight from Overweight, Phinia (PHIN) to Equal Weight from Overweight, and Magna International (MGA) to Equal Weight from Overweight. The firm was more positive on the auto retail part of the business and boosted Group 1 Automotive (GPI), Lear Automotive (LEA), Penske Group (PAG), and AutoNation (AN) to Overweight ratings. The MS view is that franchise dealer multiple expansion can continue as auto loan payments move lower.

Tesla (TSLA), Ferrari (RACE), CarMax (KMX), and AutoNation (AN) were maintained at Morgan Stanley with Overweight ratings, while Adient (ADNT), Aptiv (APTV), QuantumScape (QS), and Lucid Motor (LCID) were kept with Underweight ratings.

The top-rated auto stocks by quantitative analysis are General Motors (GM), Toyota (TM), BYD Company (OTCPK:BYDDF), Strattec Security (STRT), Dorman Products (DORM), and Garrett Motion (GTX). All those stocks have a Seeking Alpha Quant Rating of Buy.