Summary:

- Carnival Corporation’s better-than-expected Q2 2024 results and upgraded full-year guidance resulted in a share price rally in recent months.

- Its upcoming results for Q3 2024 are expected to see a big earnings upside and margin expansion, even as revenue growth is seen softening compared to Q2 2024.

- Carnival’s forward P/E ratio remains unconvincing for a buy, however, though further forecast upgrades can change that.

Michael H/DigitalVision via Getty Images

Since I last wrote on the cruise company Carnival Corporation (NYSE:CCL) (NYSE:CUK) (OTCPK:CUKPF) in June, its price has risen by 14%. This is in contrast with my Hold rating on the stock, which, based on market multiples, indicated that it was fairly priced.

However, at that time, the company was due to release its second quarter results (Q2 2024, quarter ending May 31) at the time. If the results turned out better than anticipated and the company’s guidance for the full financial year 2024 (year ending November 2024) was upgraded, the rating was subject to change. That’s exactly what happened. As Carnival readies to release its result next week, here’s a look at what’s up ahead now.

Better than expected Q2 2024 results…

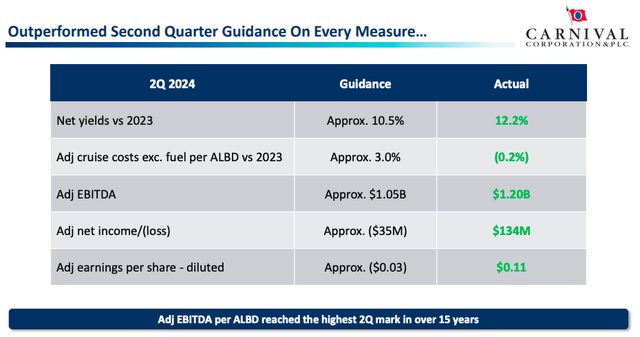

First, however, let’s take a look at last quarter’s numbers. As far as they go, I can’t put it better than Carnival itself, which says in its earnings presentation, “Outperformed Second Quarter Guidance On Every Measure” (see slide below).

The net yield, which is defined as the adjusted gross profit per average lower berth deck [ALBD], rose by 12.2% year-on-year [YoY] compared to the expectation of 10.5%. YoY. As a result, the total adjusted gross profit increased by 18.2% YoY, compared to the expected 16.5% YoY.

In my assumptions, the adjusted gross profit margin was assumed to remain static at Q1 2024’s level of ~75%. This resulted in a revenue growth expectation of 17.3% YoY, but the number came in slightly higher at 17.7% YoY. Further, with adjusted EBITDA coming in at $1.2 billion, 14.3% higher than the guidance, the margin was at 20.8%, compared to my forecast of 18.2%.

But the biggest positive was the positive adjusted net income of $134 million, compared to the expectation of a loss of $35 million. This was also noteworthy considering that the company also clocked a loss in Q1 2024.

… lead to full year 2024 guidance upgrade

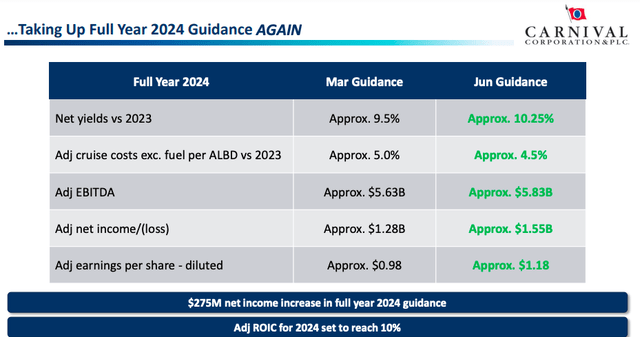

With two quarters of better than expected numbers behind it, it was little wonder that Carnival raised its projections for 2024 along with the Q2 2024 results.

The company now expects higher net yields than earlier (see table below). This, coupled with the assumption that adjusted gross margin for the full year 2024 will remain constant at 75.2% from the first half of the year, results in a projected revenue growth of 15.2% for the full year. This is higher than my projection of 14.4% forecast in June.

With the adjusted EBITDA forecast also higher now, the projected margin also increases to 23.4% from the earlier 21.7%. Further, with improved expectations for adjusted net income, the margin is seen improving to 6.2% from the earlier 5.2%.

What to expect from Q3 2024 results?

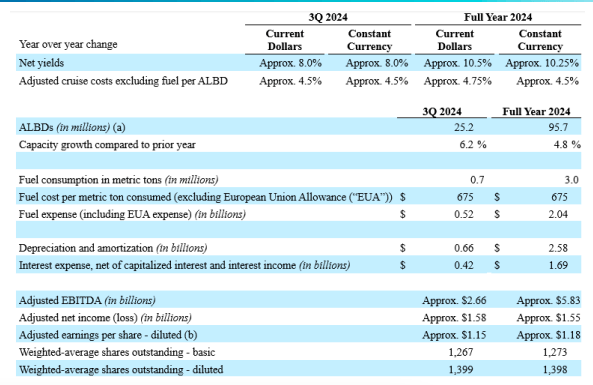

For the immediate future, however, the results are likely to be a mixed bag. Carnival expects net yield growth to be lower than the 12% YoY seen in Q2 2024 and the 10.25% expected for the full year. With the expected 8% YoY increase (see table below), my estimates indicate that revenue growth will also be lower, at 13.9% YoY in Q3 2024.

However, the profit margins are set to see a significant upside. With adjusted EBITDA guidance of $2.66 billion, along with the revenue forecasts, the indicated margin is at 34.1%. Similarly, with adjusted net income slated to come in at $1.58 billion, the margin will expand to 20.2%.

Guidance, Q3 2024 (Source: Carnival Corporation)

Market multiples aren’t bad

For the purpose of assessing how much upside there’s to the stock, the full year’s projections need to be considered, however. Despite the price increase, the stock’s forward non-GAAP price-to-earnings (P/E) ratio is at 15.7x, lower than the 16.4x the last time I checked, which is a positive.

At this level, it’s also slightly below the 16.4x level for the consumer discretionary sector. Also, it’s not significantly higher than that for its cruise peer Royal Caribbean Cruises (RCL) at 15.25x. In June, there was a fair gap between the two, since RCL was at 13.7x. It does remain higher than the forward P/E for Norwegian Cruise Line Holdings (NCLH), however, at 13.37x, which was at 12.1x in June.

Based on the comparison with both the sector and the peers, there’s not a convincing enough increase, if at all, indicated for CCL. However, at this point, it’s also a good idea to consider the projections for its financial year 2025, considering that it’s close to the end of the current one. Analyst estimates on Seeking Alpha put the forward P/E for the year at 11.88x. This, incidentally, is lower than 13.13x figure for RCL, and it’s close to that for NCLH at 10.84x. But even this doesn’t reflect a definite upside to CCL.

There could still be a case for CCL if it had historically traded at higher ratios. That’s not the case either. The chart below shows its trailing twelve-month [TTM] GAAP P/E, which is running higher than the numbers in the years prior to the pandemic and before the company fell into inevitable losses.

P/E, GAAP, TTM (Source: Seeking Alpha)

What next?

As such, it’s hard to make a buy case for CCL even now, despite its better than expected performance and upgraded financials. It’s possible that the stock sees another uptick following the Q3 2024 results next week, with earnings forecast to see a jump and exceptional margin exception anticipated.

The only way I see sustained further upside to the stock is if the company upgrades the forecast yet again. This is possible, going by the experience so far in 2024. Specifically, a better than expected revenue growth could open the door for bigger profits. This, too, is possible, considering that the EPS expected for 2024 is nowhere near the company’s pre-pandemic figures. Relatedly, the stock is trading at less than 40% of its pre-pandemic highs, too.

For now, though, I’m erring on the side of caution and retaining a Hold rating on CCL.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.