Summary:

- AT&T shares rebounded impressively, generating 28.68% YTD returns, outperforming the S&P 500’s 11.2% gains, prompting an upgrade to a “buy” rating.

- Strong Q2 results with 419,000 new wireless subscribers and a 0.7% churn rate, alongside a 9% increase in free cash flow, support this upgrade.

- Despite an 8% decline in mobility equipment revenue, AT&T’s valuation remains attractive, trading at 9.14x 2026 earnings and 7.4x free cash flow.

- Recent pullback from $22.34 offers a buying opportunity, with strong momentum and support levels suggesting limited downside risk for this high-dividend payer.

jetcityimage

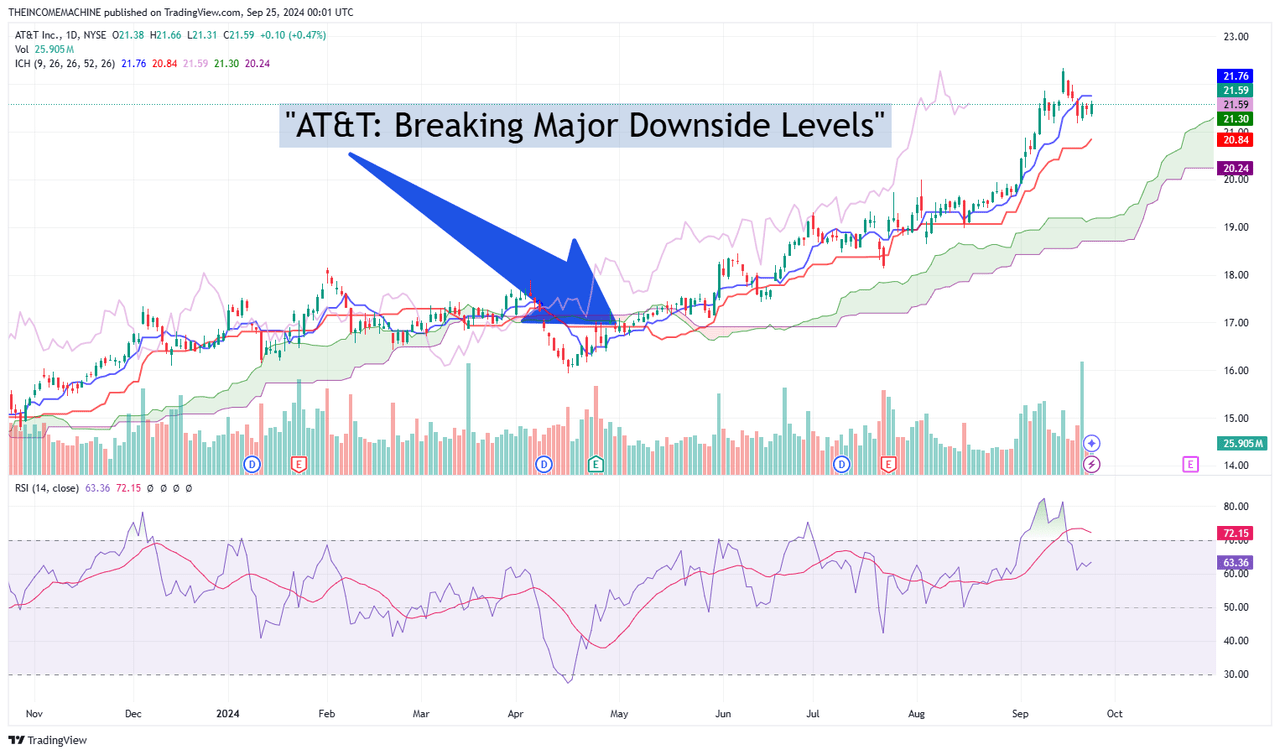

When I last covered AT&T Inc. (NYSE:T) with “AT&T: Breaking Major Downside Levels” on May 6th, 2024, share prices were experiencing an increased level of downside price volatility while trading below the $17 mark, and the stock was in the process of falling sharply from the prior highs that were posted during the early parts of April. At the time, I felt as though the potential for upcoming gains still outweighed the risk of further losses and I opted to “hold” my position through this period of rising short-term turmoil that was experienced by many dividend-seeking investors. Since then, share prices have shown an impressive rebound with rallies to the topside, and T shares have generated total returns of 28.68% while upward changes in the S&P 500 have trailed far behind (at just 11.2%) and recent developments have now given me the confidence to upgrade my stance to a “buy” for this classic high-dividend yielder.

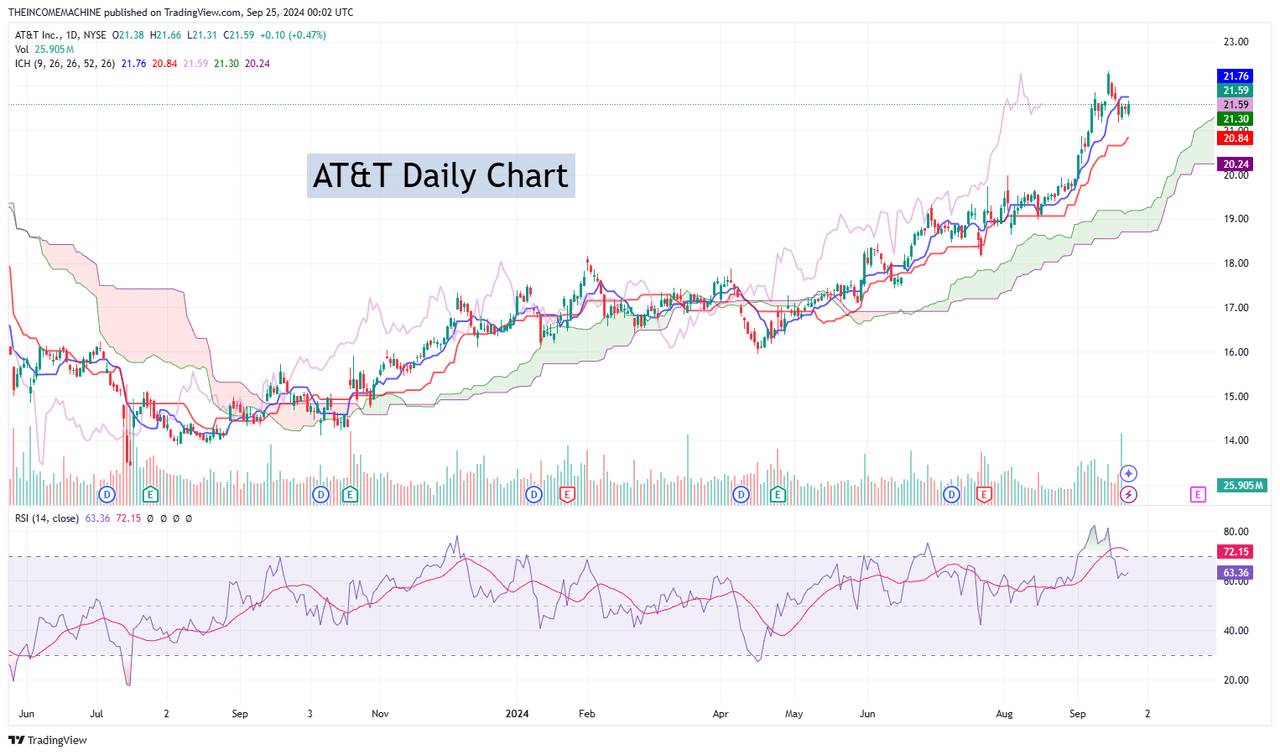

AT&T: Historical Stock Price Chart (Income Generator via Trading View)

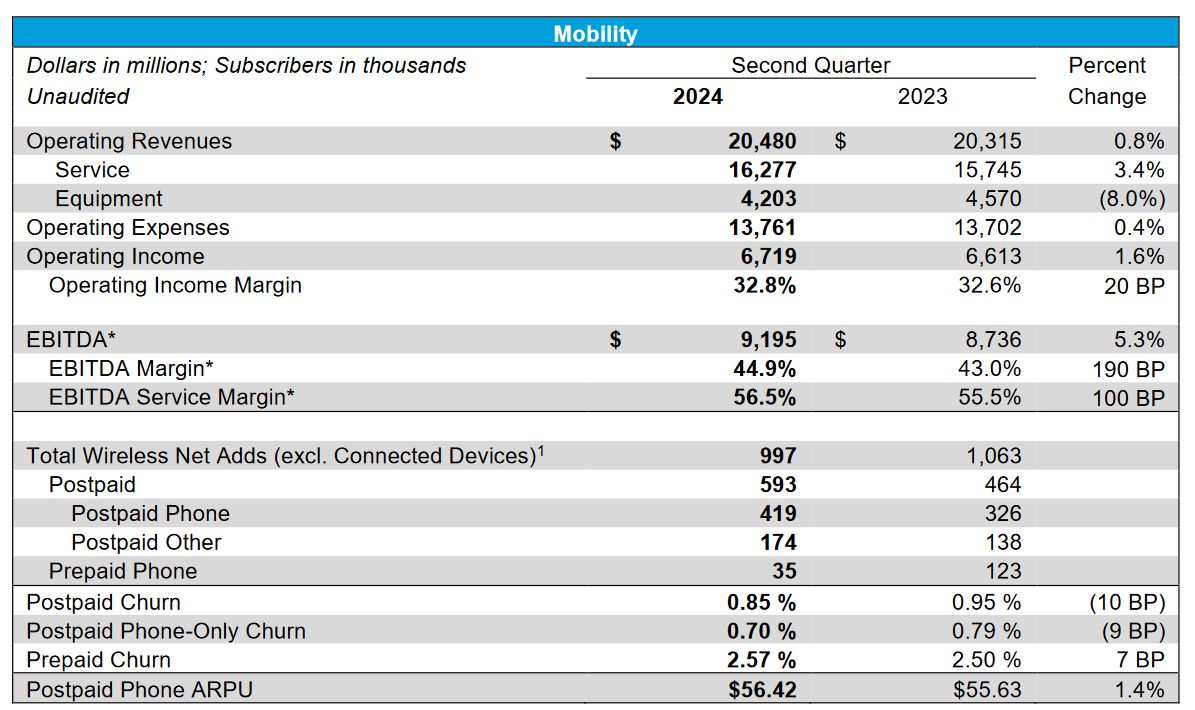

Since my last analysis was published, AT&T’s second-quarter earnings report showed that the company surpassed analyst estimates with 419,000 new wireless phone subscriber additions for the period (beating by a wide margin the consensus estimates calling for 284,800 wireless subscriber additions) and these results indicate broad strength within the premium tier of AT&T’s wireless phone plan offerings. Moreover, this strength made it easier for the company to retain postpaid subscribers (when compared to AT&T’s industry rivals).

Specifically, AT&T’s churn rate posted at 0.7% for the period (which is the second-best performance seen during any Q2 period in the company’s history). In addition to this, AT&T’s free cash flow figures experienced gains of 9% for the period (coming in at $4.6 billion and soundly beating analyst estimates calling for a print of $4.22 billion). Of course, this metric is critical in terms of assessing AT&T’s ability to reliably pay its elevated dividend over time and I believe all of these performances meet the mark in terms of achieving my requirements to revise my stock rating higher into the “buy” category.

AT&T: Second Quarter Earnings Figures (AT&T Earnings Presentation)

However, on the negative side, we did see evidence of weakness in mobile upgrade purchases at AT&T (which is actually indicative of a more widespread issue within the telecom industry as a whole because we have recently seen similar evidence of weakness from competitors like Verizon). Specifically, the company’s revenue from its mobility equipment segment experienced losses of -8% and this contributed to AT&T’s misses in its overall revenue figure (which came in at $29.8 billion, while falling short of expectations calling for $29.92 billion in total revenues).

AT&T: Second Quarter Earnings Figures (AT&T: Earnings Presentation)

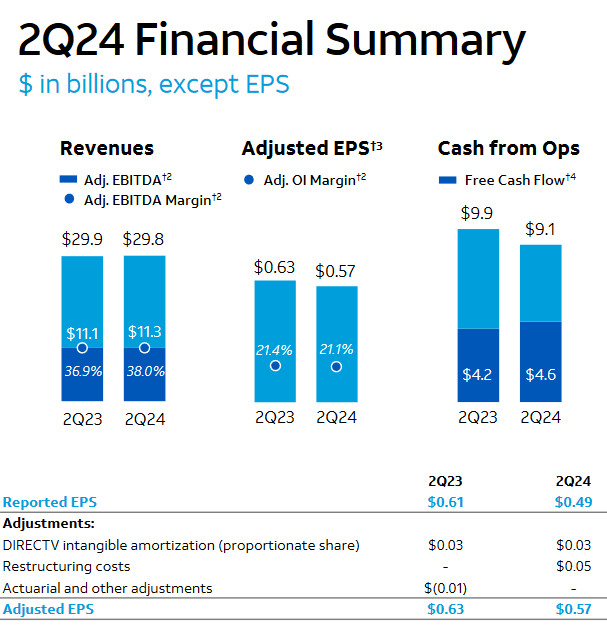

Now that the U.S. Federal Reserve has finally made it clear that they are ready to start an extended phase to reduce interest rates, stocks like T will continue to play an important role for income investors looking for attractive dividend yields. So when we take all of this into consideration along with the relatively strong operational performances shown in AT&T’s quarterly earnings figures, it becomes easier to see why this stock’s share prices have seen impressive movements in the bullish direction. On a YTD basis, T shares have already risen by nearly 24.6% even though the S&P 500 has seen gains of less than 20.6% during the same period of time.

Currently, AT&T’s forward dividend yield of 5.15% rests far above the averages seen in important telecom industry rivals (for example, Verizon and T-Mobile) but this also must be balanced against the fact that the stock’s payout ratio is more elevated, as well. Fortunately, AT&T has managed to hold this key metric comfortably below the 75% threshold that is typically considered to be unsustainable (or a precursor to future reductions in dividend payouts). Additionally, these recent rallies in AT&T share prices still haven’t done much to change the argument that the stock’s price-earnings ratio is still undervalued (not only in relation to its industry peer group but also to the broader market, as well).

AT&T: Comparative Price-Earnings Ratios (YCharts)

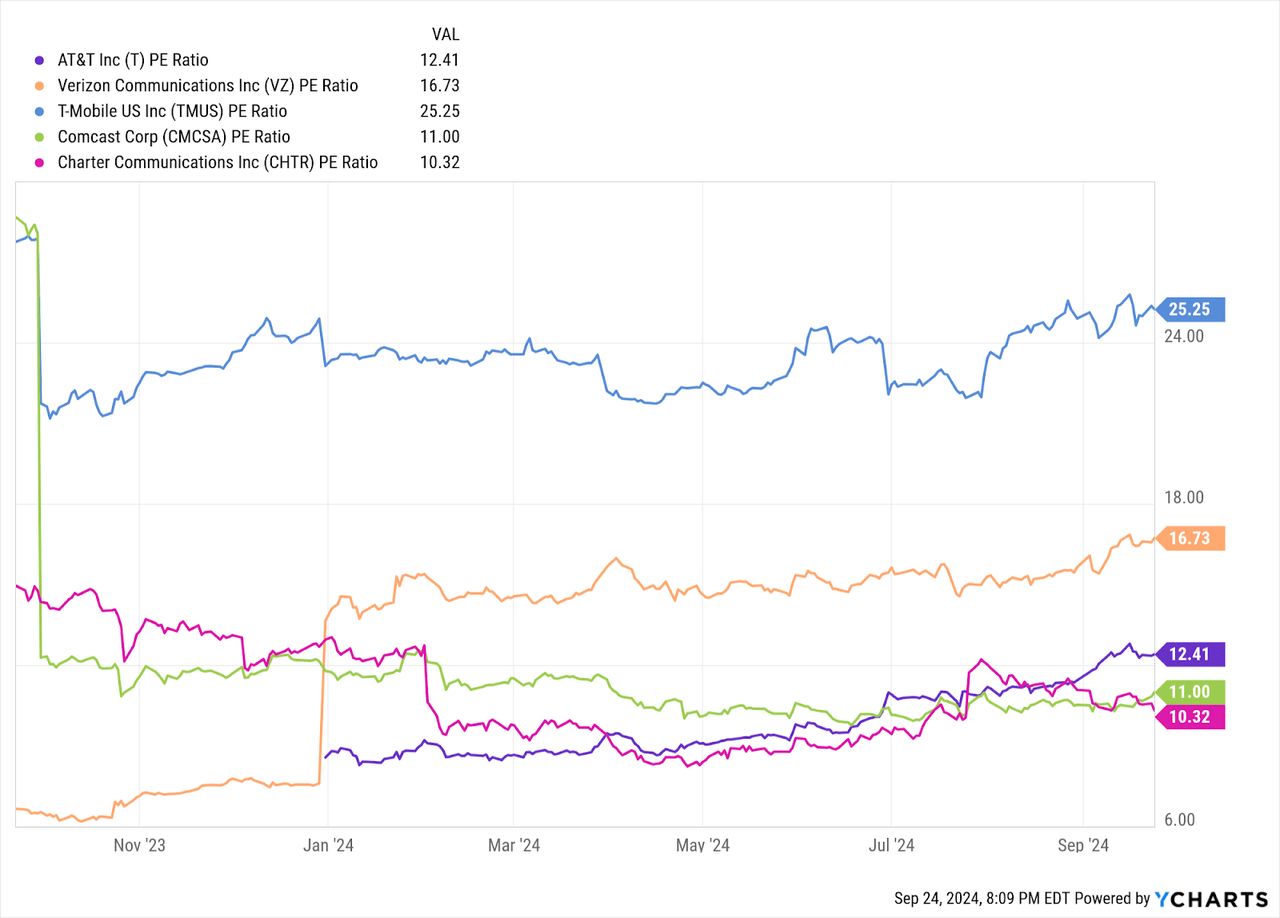

Currently, the stock is trading near 9.14x projected earnings for 2026, which is far below the 17x earnings expected for the S&P 500 during the same period of time. But perhaps the most surprising comparative valuation metric (in my view) can be found in AT&T’s price to free cash flow figures, which actually show somewhat severe undervaluation when compared to key counterparts within its peer group:

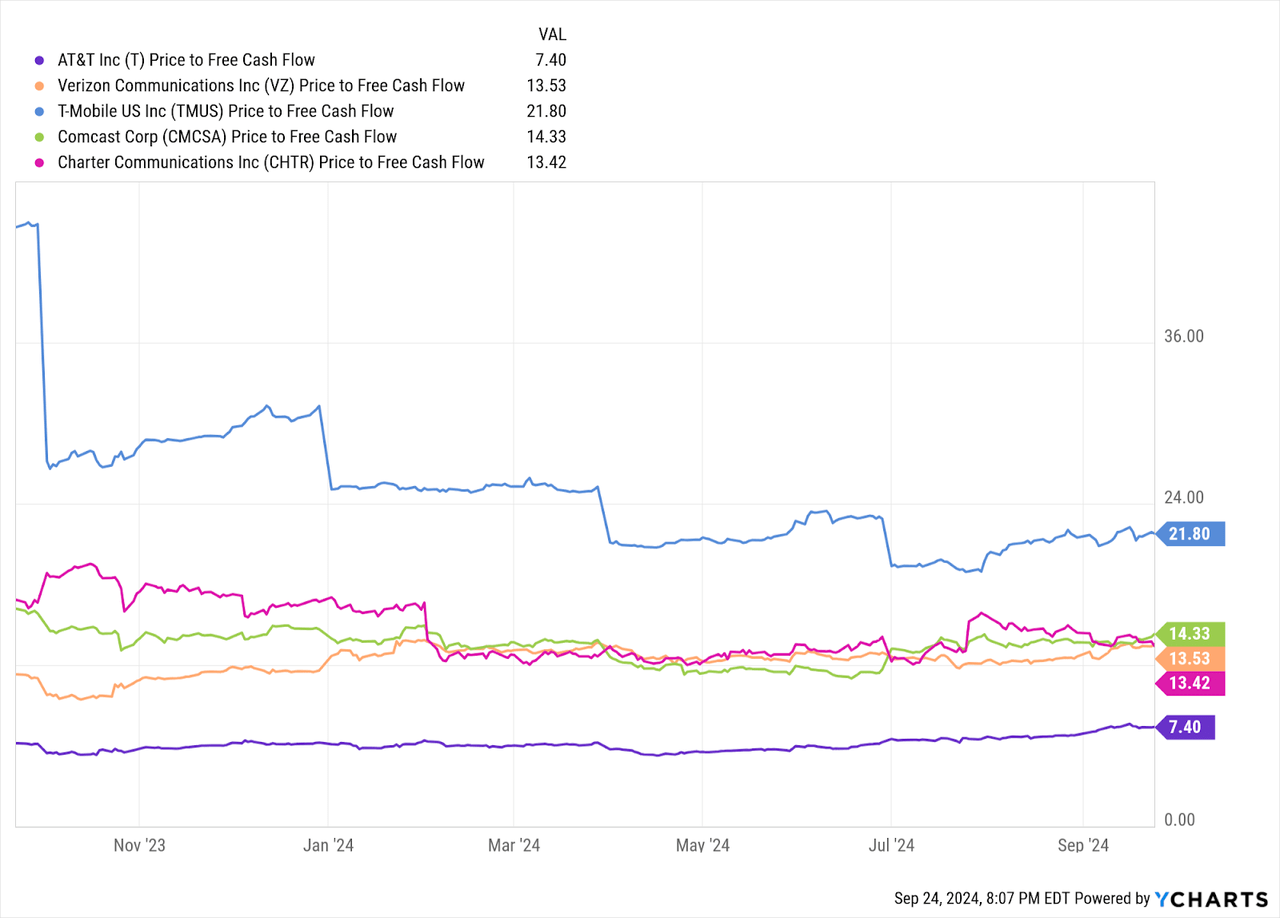

AT&T: Comparative Price to Free Cash Flow Ratios (YCharts)

Here, we can see that AT&T is trading at just 7.4x free cash flow and this is far below every other company within the telecom industry peer group. As an illustrated example, T-Mobile is currently trading at a valuation equal to 21.8x free cash flow, while Verizon is trading at levels that are a bit lower but still quite elevated on a comparative basis at 13.5x). For many, these figures might be quite surprising given the fact that T shares have displayed extremely strong upward price rallies since the middle of April when the stock was still trading at lows below $16 per share. However, AT&T’s recent rallies above $22.30 have done little to erode the positive outlook because the stock is still trading at valuation levels that are still looking much more attractive when compared to other major alternatives in the telecom space.

AT&T: Historical Stock Price Chart (Income Generator via Trading View)

After rising to near-term highs of $22.34 on September 16th, the stock has experienced a bit of a pullback and this downside retreat is starting to look like a suitable entry point (given the longer-term strength of the stock’s emerging uptrend). Momentum readings in the relative strength index suggest that the upward trend in share price momentum has actually remained intact since the middle of July in 2023 – and this is an impressive feat given that this is a positive condition that has managed to remain in place for more than a full year. As a point of caution, readings in this indicator are currently trading in overbought territory on the weekly time frames but near-term support zones resting slightly above the $20.30 level might be enough to contain downside selling pressure from the bearish side of the market over the next few weeks.

As a result, I will continue to side with the argument that AT&T currently maintains its long-held position as one of the market’s classic dividend payers. Ultimately, I feel validated in my prior decision to hold this stock even while T share prices were facing a tremendous amount of selling pressure from the bearish side of the market toward the final portions of 2023. As we can see, this positive outlook has been largely supported by undervalued share price metrics and strong operational results during the second-quarter reporting period. For all of these reasons, I am upwardly revising my stance on this stock to reflect my “buy” rating for AT&T and I believe that near-term downside retracements should be relatively subdued as the market continues to view outsized declines as new buying opportunities for this attractive dividend payer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.