Summary:

- Alibaba’s unique market position and diverse business lines differentiate it from competitors PDD and JD.com, mitigating direct competition concerns.

- Recent political developments suggest reduced pressure on Alibaba, with Beijing allowing more growth opportunities, particularly internationally.

- Despite a weak Chinese economy, Alibaba maintains strong profitability and stable revenue, positioning it as a competitive player.

- Valuation remains attractive compared to U.S. stocks, leading to an upgraded rating to Buy.

Andrew Braun

Introduction

Alibaba (NYSE:BABA) helps the merchants, PDD (PDD) serves the underprivileged, and JD.com (JD) serves the rich.

This distinction in customer focus highlights the varying market strategies among these e-commerce giants and sets the stage for a deeper analysis of Alibaba’s unique position within the competitive landscape.

We used to be concerned about the intense competition in China’s e-commerce market, especially since we preferred PDD, a peer company, because of its very effective team and business plan. But after observing Alibaba for a few quarters, we’ve concluded that it doesn’t face direct competition from these peers. Additionally, we recently saw a few indicators that could indicate Beijing is putting less political pressure on Alibaba. The weak China economy is not a major concern for us, and we will address all of the aforementioned points in the sections that follow.

Competition Analysis

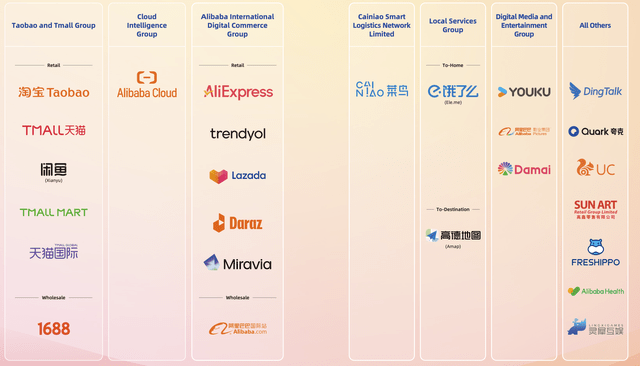

“Make it easy to do business wherever” is Alibaba’s tagline. Alibaba participates in the e-commerce industry from a different angle than PDD, which recently changed its focus from merchant to consumer-orientated, and JD.com, which focuses on services. The fact that Alibaba operates across a more diverse range of business lines compared to PDD and JD.com, which focus solely on e-commerce, speaks volumes. Through its domestic and international e-commerce platforms, Alibaba offers merchants access to global markets. Additionally, by utilizing its cloud services and entertainment platforms, Alibaba equips merchants with tools and data to optimize their advertising spend.

Alibaba’s business lines (BABA)

PDD began by differentiating itself from other e-commerce platforms through a team purchase model and its exclusive access to mass consumers via a partnership with WeChat.

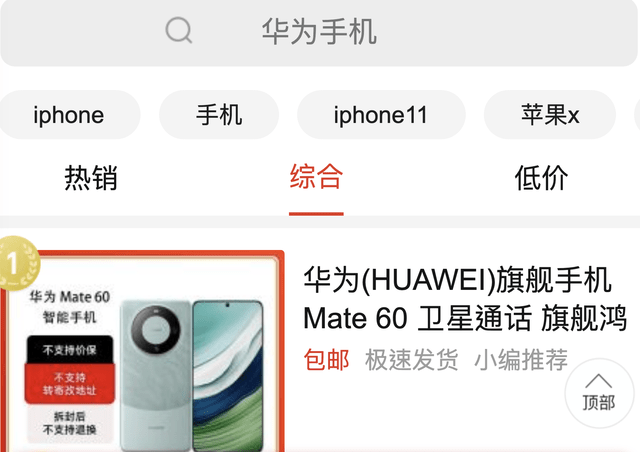

Initially, the focus was on connecting white-label factories to consumers, with a strategic emphasis on agriculture, allowing the company to grow from a small startup into a major player. In recent years, PDD has successfully expanded its reach to large brands like Huawei and Xiaomi in China—a development many investors might overlook, as Temu continues to focus primarily on white labels.

Huawei on Pindoudou (Pindoudou)

PDD has undergone several business model shifts, evolving from merchant-centric to consumer-focused, and from being advertising-driven to a full-service platform. While these moves were initially seen as risky by investors, PDD’s management team has executed them exceptionally well.

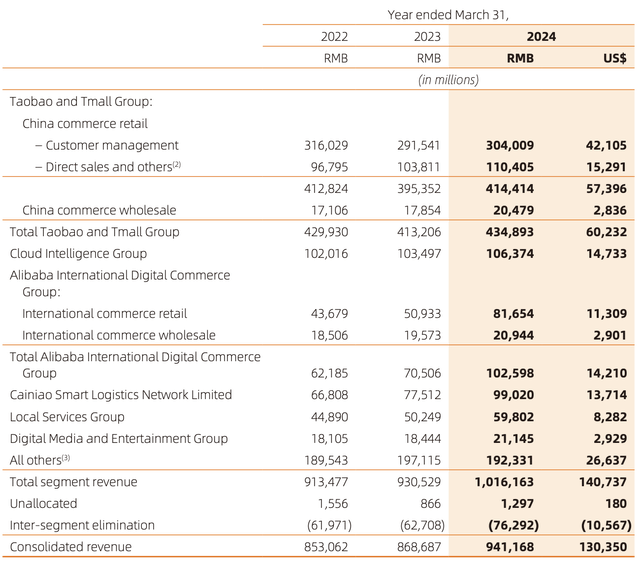

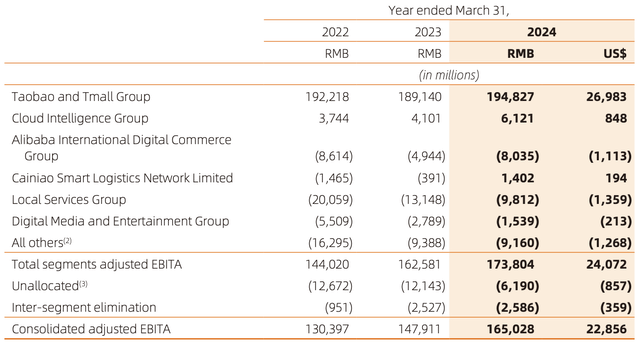

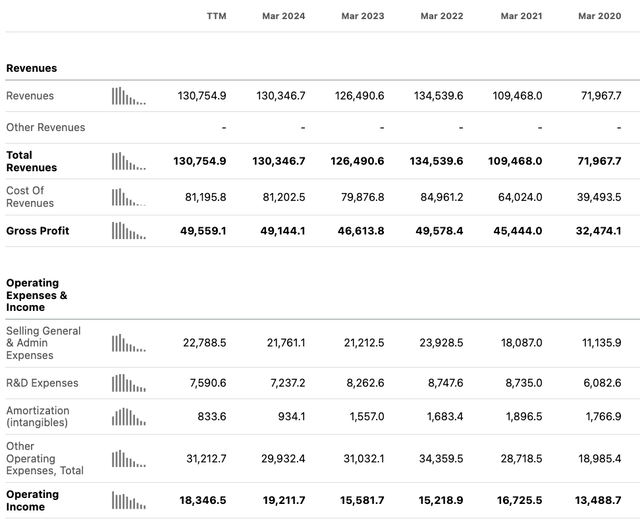

Through our observations, we found that many merchants sell on both Alibaba and PDD but view Pindoudou (domestic)/Temu (international) more as channels for inventory liquidation rather than a full-price platforms. Merchants often achieve higher profitability on Alibaba while using PDD to quickly offload excess inventory. In this sense, in our opinion, PDD operates more like an online version of TJ Maxx (TJX), whereas Alibaba functions more like Amazon (AMZN) in China. This explains why consumers may not always find the same items from the same merchants consistently available on PDD’s platform. By maintaining this model, PDD can keep prices low without significantly impacting Alibaba. This can be observed that despite PDD’s rapid growth, Alibaba’s e-commerce revenue has remained flat, sustaining a stable 45% EBITDA margin (as calculated from the chart below).

Alibaba’s financials (BABA) Alibaba’s financials (BABA)

JD.com, on the other hand, focuses on holding its inventory, operating more like a traditional retailer. Its emphasis on delivery speed and customer service has earned it greater trust among affluent consumers, as we discussed in a previous article. Although JD has recently launched its e-commerce marketplace, its focus on electronics makes it more comparable to Best Buy (BBY) than Amazon. As a result, JD.com is likely to remain in its niche market without posing a significant threat to Alibaba. This is probably also the result of the parties’ negotiations, as the Chinese government has stated openly that it opposes excessive competition in the market.

Political Landscape and Competition

Collaboration with Tencent

Alibaba recently began allowing Tencent’s WeChat Pay to be used on Taobao, marking a significant development. AliPay and WeChat Pay have long dominated China’s digital payment landscape as duopolies, so this move signals a subtle shift in response to the fierce competition within the Chinese market.

ByteDance, the company that owns TikTok and Douyin, has posed new challenges to both Tencent and Alibaba. Investors frequently consider how ByteDance competes with Google (GOOG) and Meta (META) mostly in the US, but they are typically unaware of the fierce competition that also exists in China.

ByteDance’s portfolio (Maimai)

ByteDance has developed its own large language model (LLM) and, through a diverse range of service platforms—such as the media platform TouTiao and AI-powered video editing tool CapCut—has grown into a major conglomerate in China. ByteDance boasts 1 billion monthly active users and more than 60,000 employees, and it has recently emerged as a significant competitor to Alibaba at the group level. With stronger ties to Beijing compared to Alibaba, ByteDance’s rising prominence has turned U.S. opposition into a broader geopolitical struggle between Washington and Beijing. The recent collaboration between senior leaders from Alibaba and Tencent suggests that the rivalry between these two giants may pause, at least for the time being. It appears that ByteDance has become their primary target.

In addition, Beijing also gave the go-ahead for Alibaba’s growth, particularly internationally, by ending Ant Group’s (the company that owns Alipay) regulatory overhaul.

As a result, we interpret the sequence of events as most likely involving the political aspects of competition amongst Chinese political parties. And it seems like Jack Ma manages it rather well because, after going silent for nearly 4 years, he recently made a comeback. Alibaba is now progressively regaining its position as China’s political outsider.

Economic Context

China’s economy has been notably weak, with many economists believing that Beijing is intentionally refraining from increasing stimulus measures until the Federal Reserve lowers interest rates. The Chinese government is concerned about potential capital flight resulting from the weak economy. If the Chinese government were to implement stimulus measures before the Fed’s rate cut, it could send a desperate signal to Wall Street, likely leading to a rapid depreciation of the RMB. This may explain why the Chinese government has held back its actions, ultimately announcing a rate cut yesterday and indicating that more easing policies are forthcoming.

We believe that the Fed’s decision to loosen its monetary policy in September and to signal that more rate cuts are imminent not only signals that inflation is no longer the main concern but also that geopolitical tensions will likely lessen going forward. Fed’s high interest rates have increased the pressure on emerging nations to devalue their currencies. Therefore, we may assume that more capital will flow to emerging countries and as well as value stocks such as Alibaba.

Valuation and Conclusion

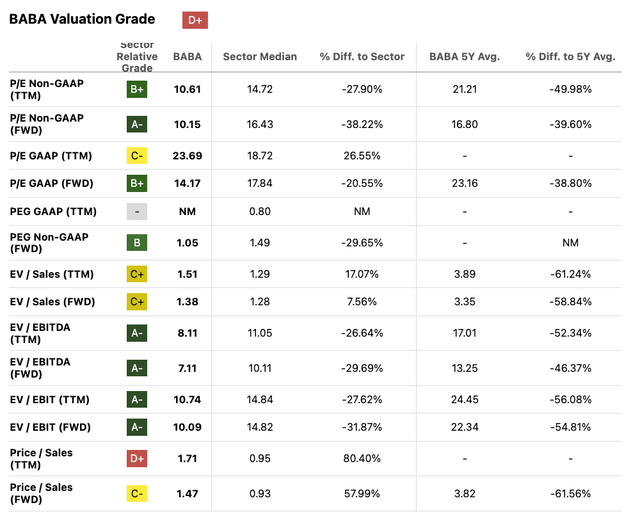

Alibaba’s valuation is not considered expensive by any measure when compared to U.S. stocks.

Valuation multiple (Seeking Alpha)

While Alibaba is reliant on a weak Chinese economy and faces intense competition in its sector, this also positions it as a competitive player on paper. Its revenue has remained flat while maintaining strong profitability for the past 3 years.

Alibaba’s financials (Seeking Alpha)

More importantly, we believe that Alibaba does not directly compete with PDD and JD.com for the reasons mentioned earlier. Therefore, we are confident that Alibaba remains a strong contender in the market. As a result, we are upgrading our rating to Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.