Summary:

- Medtronic is a Dividend Aristocrat with 47 consecutive years of payout growth.

- The MedTech company exceeded the analyst consensus for revenue and non-GAAP EPS in its fiscal first quarter.

- Medtronic’s interest coverage and debt-to-capital ratios are both healthy.

- Shares could be priced at a 10% discount to fair value.

- Medtronic looks to be poised to produce 12% annual total returns through fiscal year 2027.

A surgical team works in the operating room.

Morsa Images

When I’m investing in a business, one thing that I love to see is a company culture that can consistently reward its shareholders. This can be done in a variety of ways, including a steadily growing dividend, share repurchases, and investments in the business.

A company can only do these things over the long haul if it is doing right by its customers and its shareholders. Dividend Aristocrats are S&P 500 index (SP500) components that have upped their payouts for at least 25 consecutive years. These are businesses with extensive experience in executing at a high level for shareholders.

Medtronic (NYSE:MDT) is one such example of a Dividend Aristocrat. When I last covered it with a buy rating in June, I appreciated its excellent product portfolio and recent product launches. The company’s A-rated balance sheet was another plus. Lastly, shares were materially undervalued.

After releasing its financial results for the fiscal first quarter last month, I’m reiterating my buy rating. Medtronic’s recently launched products demonstrated momentum in the quarter, with the company surpassing the analyst consensus for both revenue and non-GAAP EPS. The company’s financial health remains solid. Finally, Medtronic’s valuation remains moderately discounted.

Innovation Is Restoring Medtronic’s Growth

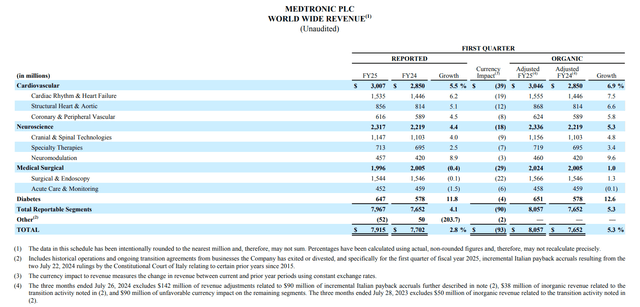

Medtronic Q1 2025 Financial Statements

Medtronic’s second quarter offered more evidence that growth is returning to the company. Its total revenue edged 2.8% higher over the year-ago period to $7.9 billion in the fiscal first quarter ended July 26th. This came in at $100 million more than the analyst consensus for the quarter.

Digging deeper, the topline growth is even more impressive. That’s because, accounting for $93 million of unfavorable foreign currency translation, organic revenue increased by 5.3% during the fiscal first quarter.

What was behind this uptick in growth in the fiscal first quarter? Predictably, it was strength in each of its core businesses.

Medtronic’s Cardiovascular segment was the biggest contributor to this topline growth in absolute dollars. The segment’s total revenue rose by 5.5% year-over-year to $3 billion for the fiscal first quarter. That was driven by vigorous performance from Pulsed Field Ablation, TAVR, Cardiac Surgery, and Coronary products.

The company’s Neuroscience segment posted $2.3 billion in total revenue during the fiscal first quarter. This was a 4.4% growth rate over the year-ago period. That was fueled by growth from Neuromodulation, Spine and Biologics, and Hemorrhagic Stroke products.

Medtronic’s Diabetes segment recorded $647 million in total revenue in the fiscal first quarter, which was an 11.8% year-over-year growth rate. Increased uptake of Simplera Sync and improved adoption of the MiniMed 780G insulin pump system were to credit for this topline growth.

The Medical Surgical segment was the only segment to not record reported revenue growth. Reported revenue decreased by 0.4% over the year-ago period to $2 billion for the fiscal first quarter. But adjusting for unfavorable foreign currency translation, organic growth was 1% during the quarter. Growth in Hernia, Wound Management, and Endoscopy and Perioperative Complications was canceled out by net sales declines in the Advanced Surgical Technologies and Respiratory Compromise product categories.

Medtronic’s non-GAAP EPS increased by 2.5% year-over-year to $1.23 in the fiscal first quarter. This topped the analyst consensus by $0.03 for the quarter. Backing out $0.06 of unfavorable foreign currency translation, currency-neutral non-GAAP EPS climbed by 7.5% over the year-ago period during the quarter.

Constant currency adjusted operating margin expansion helped currency-neutral non-GAAP EPS rise faster than total revenue in the fiscal first quarter. According to interim CFO Gary Corona’s opening remarks during the Q1 2025 Earnings Call, constant currency adjusted operating margin improved by 60 basis points to 24.4% for the quarter.

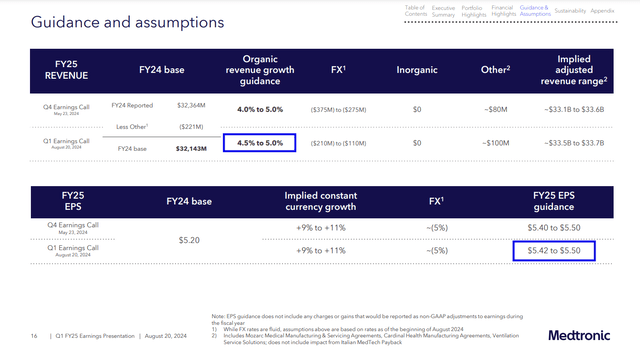

Medtronic Q1 2025 Earnings Presentation

As a result of these expectation-defying results, Medtronic upped its guidance for FY 2025. The company increased its midpoint organic revenue growth rate from 4.5% (4% to 5%) to 4.75% (4.5% to 5%).

Currency-neutral non-GAAP EPS was raised from a midpoint of $5.45 ($5.40 to $5.50) to $5.46 ($5.42 to $5.50). Off the $5.20 base for FY 2024, the latter would be a 5% growth rate. The FAST Graphs analyst consensus of $5.46 in currency-neutral non-GAAP EPS for FY 2025 is in line with management’s midpoint.

Per Corona, Medtronic believes that currency headwinds will lessen as the fiscal year unfolds. In the back half of the fiscal year, high single-digit EPS growth is anticipated.

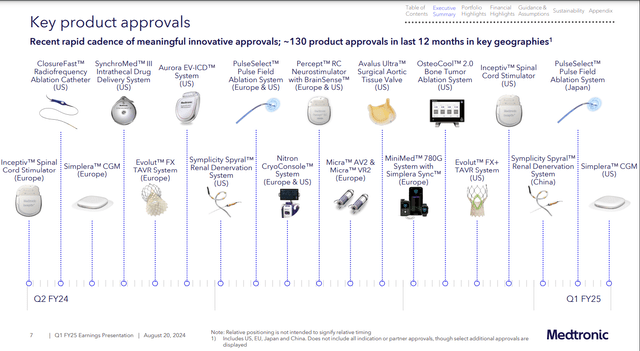

Medtronic Q1 2025 Earnings Presentation

Medtronic has its product approvals and momentum from recently launched products to thank for its turnaround. In the past 12 months, the company has secured approximately 130 product approvals in key markets. These include the Simplera CGM in the U.S., the PulseSelect Pulse Field Ablation System in Japan, and the Inceptiv Spinal Cord Stimulator in the U.S.

Products like the MiniMed 780G insulin pump system and Symplicity Spyral Renal Denervation System should only pick up more steam as the quarters progress.

That’s why the FAST Graphs analyst consensus is that currency-neutral non-GAAP EPS is expected to rise by 7.2% in FY 2026 to $5.85. Another 8.2% increase in currency-neutral non-GAAP EPS to $6.33 is expected for FY 2027.

In closing, no conversation about Medtronic would be complete without emphasizing the strength of its balance sheet. The company’s debt-to-capital ratio in the mid-30% range is below the 40% that rating agencies like to see from the industry per The Dividend Kings’ Zen Research Terminal.

Medtronic’s interest coverage ratio of 8.6 in the fiscal first quarter was also respectable. This is why the company enjoys an A credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to Medtronic’s Q1 2025 Earnings Press Release, Medtronic’s Q1 2025 Financial Statements, Medtronic’s Q1 2025 Earnings Presentation, and Medtronic’s Q1 2025 10-Q Filing).

Fair Value Has Reached $100 A Share

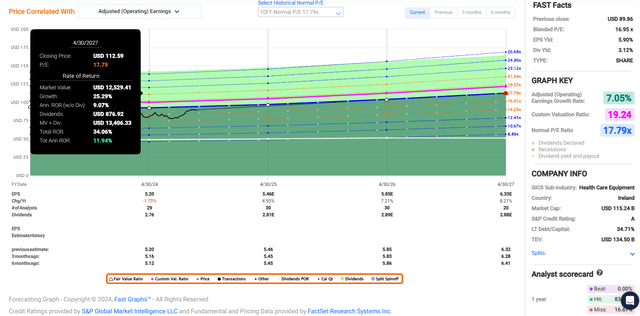

FAST Graphs, FactSet

In the three months since my previous article, shares of Medtronic have gained 11%. This is meaningfully ahead of the S&P 500 index’s 6% appreciation over that time.

Yet, I would contend that there’s still room for shares of Medtronic to ride higher in the coming months and years. This is supported by a current-year P/E ratio of 16.4, which is modestly less than the 10-year normal P/E ratio of 17.8 per FAST Graphs.

In the years ahead, I believe that the fair value multiple is right around 17.8. That’s because Medtronic’s forward annual currency-neutral non-GAAP EPS growth consensus of 7% is above the 10-year average of 3.7%. This suggests that the company could be worthy of a multiple in the high teens upon proving its worth with a few more strong quarters.

Currently, Medtronic’s FY 2025 is about 41% complete. That leaves another 59% of FY 2025 and 41% of FY 2026 still to come in the next 12 months. This is how I arrive at a forward 12-month currency-neutral non-GAAP EPS input of $5.62.

Applying a 17.8 multiple to the shares of Medtronic, I compute a fair value of $100 a share. From the current $90 share price (as of September 24th, 2024), this equates to a 10% discount to fair value. If the company meets the growth consensus and reverts to fair value, a 34% upside could be in store come the end of FY 2027.

More Payout Growth Ahead

The Dividend Kings’ Zen Research Terminal

Medtronic’s 3.1% forward dividend yield registers at double the healthcare sector’s median forward dividend yield of 1.4%. That’s sufficient for Seeking Alpha’s Quant System to award an A- grade for forward dividend yield and a B+ grade for overall dividend yield.

Medtronic also comes with a remarkable reputation for dividend growth. The company has upped its dividends paid to shareholders for 47 consecutive years. For perspective, that’s much greater than the sector median of 2 years per the Quant System.

The company’s appeal as a dividend payer doesn’t end there, either. Medtronic has a viable runway to keep growing its payout for the foreseeable future. The company’s EPS payout ratio is on track to be in the low 50% range in FY 2025. That’s less than the 60% EPS payout ratio that rating agencies like to see from the industry per The Dividend Kings’ Zen Research Terminal.

Thus, I believe that Medtronic will return to at least mid-single-digit annual dividend growth once its growth story is reasserted by the next fiscal year (FY 2026).

Risks To Consider

Medtronic’s efforts to revive growth appear to be yielding results but there are still risks to the investment thesis.

One risk to the company is the potential for a cyber breach. Medtronic’s tens of thousands of patents and other proprietary information make it a frequent target of attempted cyber breaches. If any are successful, the company’s proprietary information could be compromised. That could damage the investment thesis.

Another risk to the company is that it operates in a half-trillion-dollar and growing global industry. This massive market features no shortage of competition from eager upstarts looking to be disruptors to industry juggernauts like Medtronic.

If the company’s research and development spending doesn’t continue to produce breakthrough products, it could lose market share over time. That could result in diminished growth prospects.

The size and profitability of the global medical devices industry also make it vulnerable to regulatory risks. If any major markets enact unconstructive legislation, that could crimp Medtronic’s profit margins.

One final risk to the company is that it could fall victim to a global pandemic. If a major pandemic happens again, this could disrupt Medtronic’s operations via supply chain chaos and hospitals deferring the elective procedures in which its products are used. Research and development could also be delayed and that could push back product launches needed to keep the growth going.

Summary: A Dividend Aristocrat With Double-Digit Total Return Potential

Medtronic is a world-class business in just about every aspect. The company’s currency-neutral non-GAAP EPS growth is set to accelerate. Medtronic’s balance sheet is rock-solid. The dividend is well-covered by currency-neutral non-GAAP EPS. Clinching the buy case is the moderate undervaluation of Medtronic’s shares. This positions the stock well to put up double-digit annual total returns in the next two and a half years. That’s why I’m reaffirming my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.