Summary:

- I’ve doubled down on Rivian amid the recent dip, and I am awaiting positive near-term catalysts in the second half of FY24.

- The company has announced that its second-gen R1 vehicles will have a 20% cheaper production cost, helping the company toward its goal of gross margin profits by Q4.

- A new $5 billion investment from Volkswagen will additionally help the company hit its R2 and R3 milestones, with R2 slated to begin production in 1H’26.

- R2 and R3 will position Rivian for the mass market, much in the way that Tesla’s Model 3 supercharged the EV leader’s growth rates.

hapabapa

With the S&P 500 sitting richly above 5,700, one mantra has guided my investment philosophy since the Fed rate cuts were announced: go against the grain and invest in stocks that others are dumping.

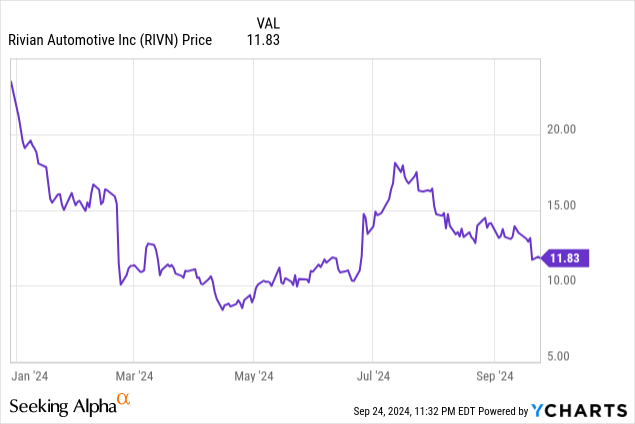

Rivian (NASDAQ:RIVN) is having a bit of a bad moment in the stock markets, with shares of the electric SUV maker down over 40% year to date. The stock is down over 20% in the past month alone, after investors panned the company’s Q2 earnings release. Still: there are a number of upcoming catalysts that have the potential to swing the narrative on this company.

I last wrote a bullish note on Rivian in early June immediately after the company announced its ambitions to release the R2 and R3 lineup, with production slated to begin in early 2026. As a reminder for investors newer to the Rivian story, R2 is expected to be the company’s first foray into mass-market vehicles, with this smaller crossover vehicle expected to start at $45,000; the R3 vehicle that follows it is expected to sell at an even lower price.

But we don’t have to wait as far out as 2026 for positive catalysts to take hold for Rivian. Since my last article on the company, two major near-term catalysts have emerged:

- The company has quantified cost savings from its recent manufacturing transition. It expects that the second generation R1 vehicles will have a 20% cheaper bill of materials, which is expected to help Rivian hit gross profit breakeven by Q4.

- Investment by Volkswagen. Like Tesla (TSLA) in its earlier days, a lot of the Rivian bull case hinges on its ability to survive long enough to develop the technology for its mass-market models. A deal from Volkswagen (worth up to $5 billion) greatly extends the company’s viability.

Stay long here and buy the dip.

Second-gen R2 to deliver 20% savings

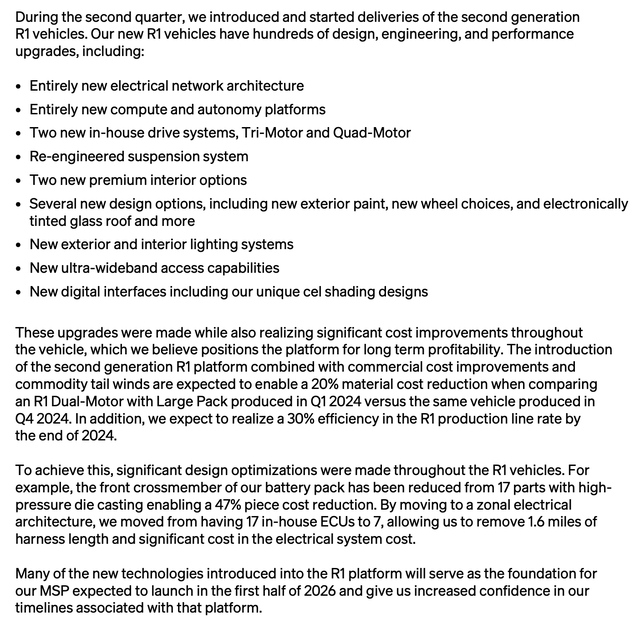

The first near-term catalyst to cheer for Rivian: the company has just started deliveries of its next-gen R1 vehicles. The second generation comes with the host of upgrades, including new drive systems and a new suspension. A fuller description is shown in the snapshot below:

Rivian second-gen R1 updates (Rivian Q2 shareholder letter)

The best part, from an investment perspective, is that the new model is expected to deliver substantial production cost savings, roughly estimated at 20% (specifically comparing the R1 Dual Motor Large Pack variant, pre- and post-manufacturing transition). The cost improvements are driven both by new designs as well as better negotiations on parts from suppliers. Writing on the possibility for further cost improvements in the Q2 shareholder letter, Rivian management noted:

The second generation R1 incorporates engineering design changes, commercial cost improvements, and raw material savings that improve profitability and confidence in our positive fourth quarter gross profit target. Beyond 2024, we are planning for further profit improvement driven by reducing material costs, leveraging our fixed cost due to anticipated R2 volumes, and scaling our revenues per delivered unit through product mix and pricing, software and services, and other revenues.”

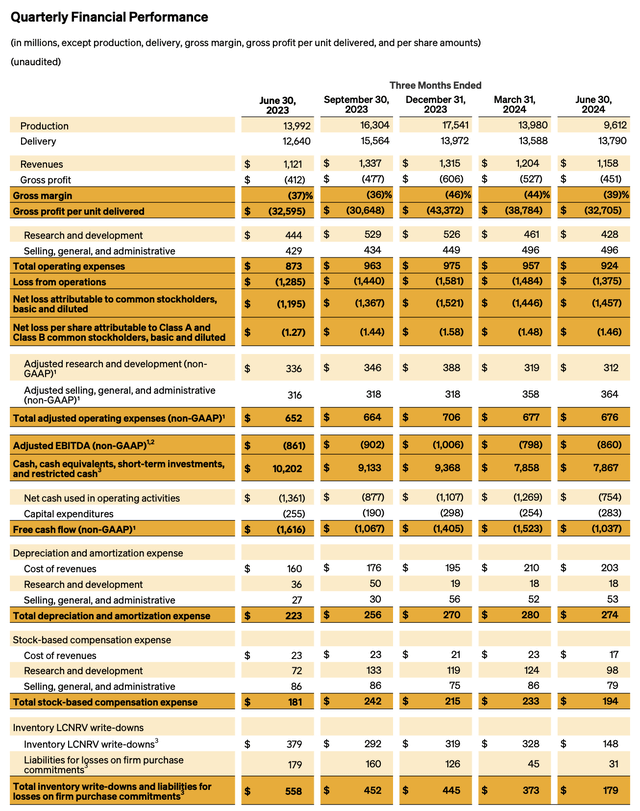

In Q2, Rivian’s deliveries (13.8k units) exceeded production (9.6k units), which was slowed down as the company executed its planned manufacturing re-tooling to prepare for the second-generation R1 (which also lays the groundwork for the eventual R2 model). The additional implication of this is that the company is draining its held inventory of the higher-cost first-gen R1 units.

Rivian Q2 results (Rivian Q2 shareholder letter)

Already in Q2, Rivian’s gross margin losses improved sequentially from -44% in Q1, to -39% in Q2. Note that reported gross margins are based on units sold (delivered), not produced. The company expects second-gen units to ramp in sales in Q3 and Q4, and continues to expect a “modest gross profit” (implying above breakeven gross margins, a huge upward swing from -39% in Q2) by Q4.

Volkswagen investment bolsters Rivian’s balance sheet

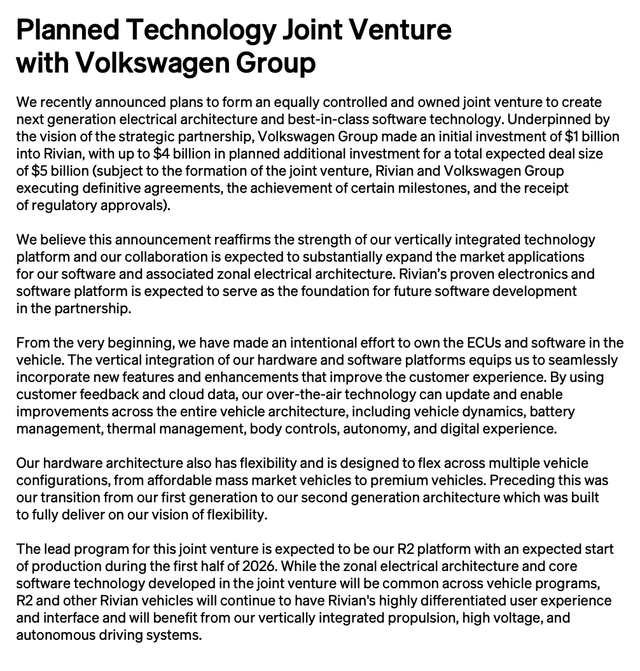

In mid-June, the German automotive giant Volkswagen announced a huge expansion of its relationship with Rivian. Volkswagen already invested $1 billion into Rivian, with the potential for up to $5 billion across the partnership.

The investment in the joint venture is mostly centered around the upcoming R2 model. The JV will have ownership in the model’s electrical architecture and core software. More details are in the snapshot below, taken from the company’s Q2 shareholder letter:

Rivian-Volkswagen deal (Rivian Q2 shareholder letter)

Importantly for investors, this deal greatly expands Rivian’s lifespan and gives it the liquidity it needs to survive through 2026, when R2 is expected to begin production.

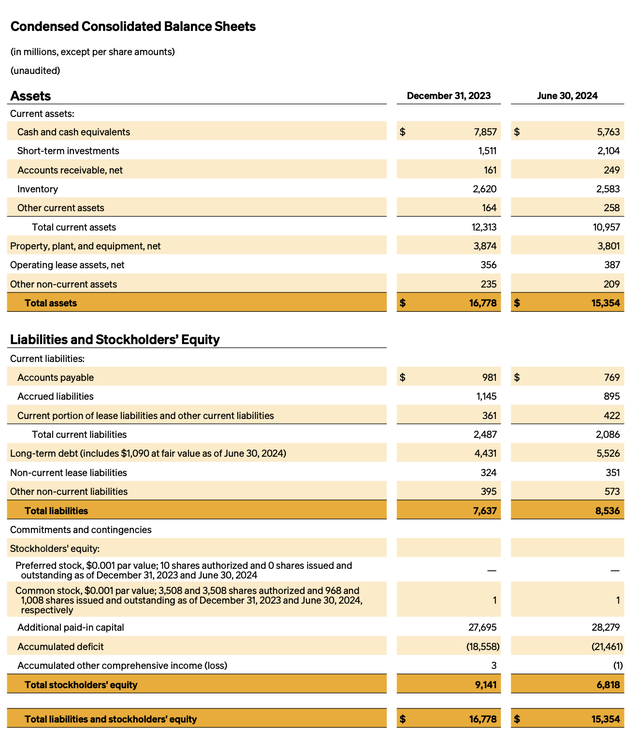

Rivian balance sheet (Rivian Q2 shareholder letter)

As shown in the company’s most recent balance sheet, above, Rivian had $7.88 billion of cash left on its books as of the end of Q2, alongside $5.53 billion of debt (or a $2.35 billion net cash position).

FCF burn in the first half of FY24, meanwhile, was -$2.56 billion: but this included heavy capex to transition the company’s manufacturing operations. Adjusted EBITDA losses in the first half were smaller, at -$1.66 billion. For the full year, though Rivian hasn’t guided to FCF, it has maintained a full-year adjusted EBITDA loss projection at -$2.70 billion, indicating that 2H losses on an adjusted EBITDA basis will be -$1.04 billion: a 33% improvement over the first half, driven by the cost savings from the second-gen R1.

With this in mind, Rivian’s existing cash position plus the additional investments from Volkswagen (which should help to defray the significant R&D costs to bring R2 to market) should give the company a long enough runway through 2026 and beyond.

Risks and key takeaways

The sharp fall in Rivian shares over the past few months has created a great buying opportunity. Still, we shouldn’t be blind to the risks that Rivian faces. In particular, the company’s second-gen R1 model hasn’t yet translated into price savings for consumers. Ahead of a potential U.S. recession, consumers may balk at spending ~$70k on a vehicle.

Rivian reports production and delivery, but not vehicle bookings: so we can’t see whether the company is merely exhausting backlog and not booking enough new units at the same pace it’s delivering them. If bookings do fall, the company may lose the production economies of scale that are expected to deliver its gross margin gains – or it may choose to cut price prematurely ahead of the R2 launch in order to not lose volume. In either scenario, Rivian’s plan to improve its profitability is certainly far from guaranteed, and heavily reliant on customer demand.

Still, we can’t forget that Rivian still has its flashy delivery van partnership with Amazon (AMZN) to support orders. And in my view, the stock’s fall over the past few months already prices in a good deal of risk. Stay long here and use the dip as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.