da-kuk

The Chinese electric vehicle sector is being closely watched as the battle for market share in the nation plays out. It has been an eventful week already, with NIO (NYSE:NIO) reporting Q2 earnings and XPeng (NYSE:XPEV) in a deal-making mode.

XPeng (XPEV) rallied for the second straight day, with a 1.95% gain in Tuesday morning action. The Chinese electric vehicle maker attracted positive comments from analysts on its strategic partnership with DiDi Global (OTCPK:DIDIY) aimed at accelerating the adoption of Smart EV and technologies in the mass market segment. The highlight of the collaboration is that the Chinese electric vehicle upstart aims to launch an A-class Smart EV model in Q3 of 2024 under a new brand called Mona.

Deutsche Bank reiterated its Buy rating on XPeng (XPEV) after pointing to upside from the DiDi partnership. Analyst Edison Yu Key said the key point deal is that XPeng (XPEV) gains greater volume and scale by getting access to DiDi’s vast network of 19M drivers in China. “This should funnel in many more mobility/fleet customers and deepen XPeng’s reach into the lower end of consumer mass market with a structurally more attractive offering,” he noted. “Combined with VW, we are very encouraged by management’s ability to cultivate marquee agreements that expand the reach of its tech and increase scale,” he added. Deutsche Bank has a price target of $21 on XPEV.

Bank of America also backed its Buy rating on XPeng (XPEV). Analyst Ming Hsun Lee said the Mona brand strategically targets the A-class electric vehicle market with price range of RMB100K to RMB 200K, with more focus on cost control. while the XPeng brand will target the RMB200K to RMB300k Smart EV market, with a focus on leading tech. ” Currently, SEPA2.0 models and Mona share 40% of the supply chain, and both parties are likely to cooperate to further reduce Mona’s cost by lowering procurement cost (by way of larger scale),” updated Lee. BofA assigned a price objective of $22 to XPEV.

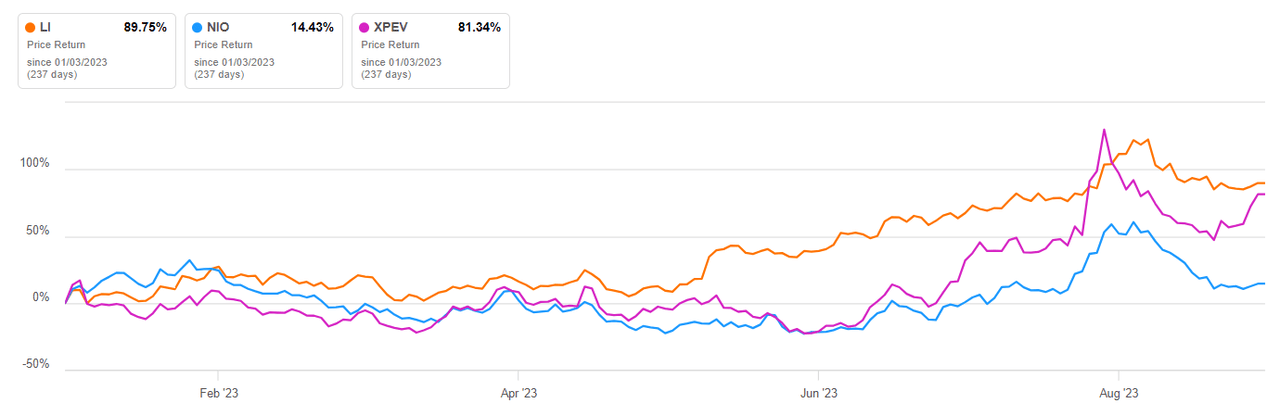

Shares of XPeng (XPEV) were up 2.06% at 10:35 a.m. Elsewhere in the Chinese EV sector, Li Auto (NASDAQ:LI) was up 7.67% and NIO (NIO) down 6.58% after its earnings report highlighted profit pressures on the company. Li Auto (LI) is also the year-to-date leader with a gain of more than 85%.

More on Chinese EV stocks

- NIO Q2 2023 Quick Takes: 1 Step Forward, 2 Steps Back

- XPeng: Deteriorating Margin Trend Is A Concern (Rating Downgrade)

- Li: The Best Chinese EV Startup

- Li Auto: A Buy-The-Dip Situation

- NIO And XPeng: Attracting High-Profile Strategic Investors

- Compare financial and valuation metrics on LI, NIO, and XPEV