Summary:

- It goes without saying that the “lush [compensation] package” for SBUX’s new CEO comes with great expectations, with it uncertain how Brian Niccol may deliver outsized results.

- Investors should monitor the new CEO’s strategies and upcoming FQ4’24 earnings call for potential restructuring/ capex/ operating expense impacts.

- While SBUX has previously highlighted that “China is expected to be our fastest growing market in terms of percentage growth,” things are no longer the same as local competition intensifies.

- This is on top of the deteriorating balance sheet and the management’s previously lowered FY2024 guidance, with any headwinds potentially moderating much of the stock’s recent gains.

- Combined with SBUX’s expensive FWD PEG non-GAAP valuations of 2.57x, we believe that it may be better to be prudent and observe the new management’s execution.

mikkelwilliam

SBUX’s Reversal Remains Speculative Despite The New CEO

We previously covered Starbucks (NASDAQ:SBUX) in November 2022, discussing why we had rated the stock as a Hold then – attributed to its premium valuations and the minimal margin of safety.

This was despite the robust comparable sales growth in North America and the potential tailwinds from China upon the loosening of the Zero Covid Policy, along with the rich shareholder returns of up to $20B between dividend payouts and share buybacks over the next three years.

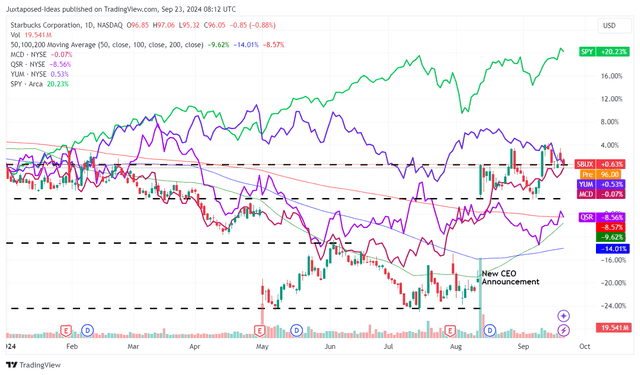

SBUX YTD Stock Price

Since then, SBUX has already retraced by -27.6% at its worst, attributed to the drastically lowered FY2024 guidance in the FQ2’24 earnings call – with the recent rally only attributed to the arguably exuberant market sentiments surrounding the new CEO.

For reference, the coffee company had managed to nab Brian Niccol, the previous CEO of Chipotle Mexican Grill (NYSE:CMG) to replace the departing CEO Laxman Narasimhan (2023-2024), whom took over from the three times ex-CEO, Howard Schultz (1986-2000) (2008-2017) (2022-2023), effective September 2024 onwards.

This development has been highly unexpected indeed, as observed in the SBUX stock’s extreme vertical rally by +28.8% in the days after the announcement.

Even so, we believe that the optimism has been overly done, since the new CEO is likely to commence on numerous management shake ups to deliver renewed growth – and we believe these may trigger numerous restructuring costs in the upcoming quarter.

This is on top of SBUX’s intensified focus on “Third Place” and the market analysts’ expected increases in “targeted [employee] benefits,” with it potentially triggering additional capex/ operating expenses in the intermediate term and consequently, impacted profit margins.

As a result, investors may want to pay attention to the management’s commentaries in the upcoming FQ4’24 earnings call sometime in October/ November 2024 – with any bottom-line headwinds potentially moderating much of the stock’s recent gains.

At the same time, it goes without saying that the “lush [compensation] package” for SBUX’s new CEO comes with great expectations, with it remaining to be seen how Brian Niccol may deliver outsized results with a remote work strategy.

The latter is an odd decision indeed, given that most Big Tech companies have advocated for employees to return to office, attributed to the “the benefits of working in person.“

It is uncertain to us how the new CEO may actually deliver the coffee chain company’s original mission to “inspire and nurture the human spirit – one person one cup and one neighborhood at a time” through his virtual presence.

While Niccol may have been instrumental in delivering CMG’s robust top/ bottom-line growth at a CAGR of +15.2%/ +37.7% during his tenure between FY2018 and FY2023, respectively, it is unclear if he will be able to replicate his previous execution here in our opinion.

Lastly, while SBUX has previously highlighted that “China is expected to be our fastest growing market in terms of percentage growth, our second largest market overall and 100% company-owned,” it appears that things are no longer the same as international competition intensifies as its growth also slows in the US.

This development has been observed in China’s painful comparable store sales decline by -14% YoY by FQ3’24 (-7% YoY in transaction volume), along with North America comparable store sales by -2% YoY (-6% YoY in transaction volume).

These numbers well reverse SBUX’s robust growth observed at +2% YoY in China (+4% YoY in transaction volume) and +9% YoY in North America in FY2023 (+3% YoY in transaction volume), along with those observed in FY2021 at +17% YoY in China (+19% YoY) and +22% YoY in North America (+7% YoY), respectively.

Given that these two regions comprise 61% of the coffee company’s global portfolio and 42.2% of its overall revenues by the latest quarter, we believe that investors may want to closely monitor its near-term performance.

This is especially since SBUX has previously lowered their FY2024 guidance – one which previously wiped out -18% or the equivalent $18.1B of its market cap in May 2024.

This is on top of the deteriorating balance sheet, with a growing net debt of $12.17B (+3.4% YoY/ +43.5% from FY2019 levels of $8.48B) and higher net-debt-to-EBITDA ratio of 2.10x (compared to 1.99x in FQ3’24 and 1.54x in FY2019).

In addition, a Chinese company, Luckin Coffee, has already overtaken SBUX as the largest coffee chain in the country – attributed to “its deep understanding of the Chinese market and consumer preferences.”

At the same time, the Starbucks consumer experience has been touted to be overly expensive with long wait times, with the price hikes partly attributed to the elevated inflation.

As a result of these headwinds, we believe that readers may want to temper their near-term expectations, with the SBUX stock likely to trade sideways at current levels before the new (and in our opinion, rather expensive) CEO delivers any positive results.

So, Is SBUX Stock A Buy, Sell, or Hold?

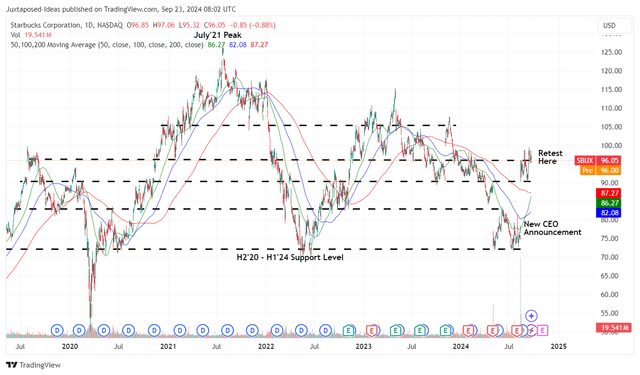

SBUX 5Y Stock Price

For now, the recent development has already triggered the SBUX stock’s immense recovery, with it running away from its 50/ 100/ 200 day moving averages while retesting the resistance levels of $96s.

Based on its FWD P/E non-GAAP valuations of 26.98x and the LTM adj EPS of $3.57 ending FQ3’24 (+8.1% sequentially), it may appear that the stock is trading near to our fair value estimates of $96.30.

Based on the consensus FY2026 adj EPS estimates of $4.50, there seems to be an excellent upside potential of +26% to our long-term price target of $121.40 as well.

Based on SBUX’s historical trend, we are likely to see another dividend raise from the annualized sum of $2.28 last declared in June 2024 while building upon the robust 3Y dividend growth rate by +8.2%. Assuming a similar raise by the last hike of +7.5%, the speculative annual dividends of $2.451 also imply a decent forward yields of 2.55%.

While it is nothing to shout about, compared to other high dividend yielding stocks or the US Treasury Yields at between 3.49% – 4.64%, we believe that long-term investors may continue subscribing to their DRIP program while accumulating additional shares on a quarterly basis.

Despite so, we are reiterating our Hold (Neutral) rating here.

This is why.

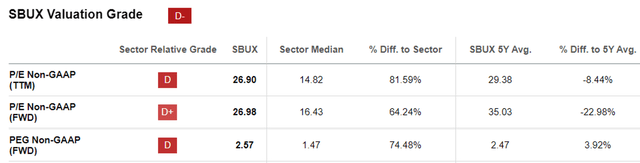

SBUX Valuations

SBUX remains expensive at FWD P/E non-GAAP valuations of 26.98x, despite the moderation from its 5Y average of 35.03x while nearing the pre-pandemic mean of 25.42x.

Our uncertainty arises from the elevated FWD PEG non-GAAP valuations of 2.57x, compared to its 5Y mean of 2.47x and pre-pandemic mean of 1.81x.

Even when compared to the sector median of 1.47x and its direct quick service/ coffee shop peers, such as Tim Hortons under Restaurant Brands (QSR) at 2.09x and Yum! Brands (YUM) at 1.90x, it is undeniable that SBUX is overpriced at current levels, aside from McDonald’s (MCD) at 4.25x – with the decelerating growth trend offering interested investors with a minimal margin of safety.

For now, it goes without saying that we have missed the boat on its attractive trading levels of between $70s and $80s in Q2’24, as the stock gains over $20B in its market cap in recent weeks.

However, given SBUX’s relatively expensive FWD PEG non-GAAP valuations of 2.57x and the uncertain reversal in its intermediate term growth prospects, we urge readers to wait for a moderate retracement before adding, preferably at its previous April 2024 support levels of $85s for an improved margin of safety.

For now, we believe that it is wiser to be prudent and observe the new management’s execution.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.