Summary:

- Shares have performed well this year, reflecting the solid progress made in the underlying business.

- I see recurring revenue growth above 25% for the next two years following significant customer wins.

- Assuming steady state adjusted EBITDA margins of 25%, shares are trading at an EV/adjusted EBITDA multiple of 42.

- I find the current valuation too rich, and therefore assign a Hold rating.

hxyume/E+ via Getty Images

Investment thesis

Agilysys (NASDAQ:AGYS) is a high-quality business that has consistently achieved high double-digit growth in recurring revenues while maintaining profitability through strong operating leverage. The company has a large market opportunity ahead of it given the increasing adoption of software solutions in the hospitality sector. With a broad range of product offerings, Agilysys can effectively leverage its large existing client base. Looking ahead, I see recurring revenue growing above 25% for this year and next, as a result of recent customer wins. However, the competitive landscape poses a substantial threat to the long-term outlook. Shares are currently richly valued, reflecting market expectations for strong revenue growth and improving margins ahead. Assuming steady adjusted EBITDA margins of 25%, I calculate an EV/adjusted EBITDA multiple of 42, which I consider is too high. As a result, I am assigning AGYS shares a Hold rating.

Why Agilysys is a great business

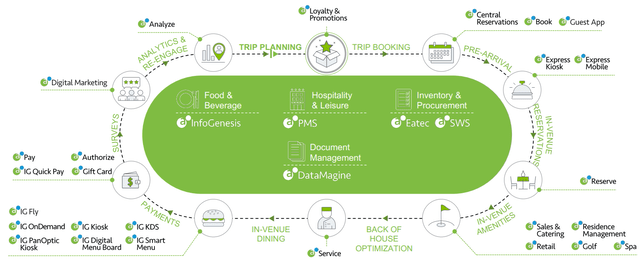

The company has industry-leading software solutions for Point-of-Sale (POS), Property Management Systems (PMS) and inventory procurement. These core products can be integrated along with multiple other software modules, thereby creating an ecosystem as illustrated above. As their cloud-native solution works on-premise as well, it gives Agilysys a distinct competitive advantage. In addition to its competitive product offering, the company has access to a large and growing market opportunity for hotel management software, into which it can sell its ecosystem system of products. Its other target verticals include resorts, casinos, and restaurants, both in the U.S. and internationally.

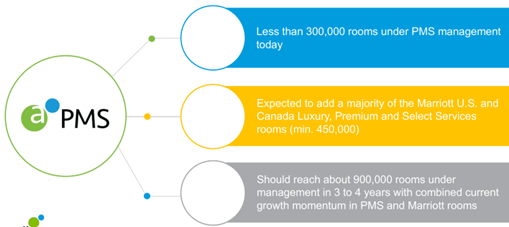

The signing of Marriott (MAR) as a customer has brought credibility to its story, as Marriott was initially onboarded as a PMS customer, but has now also become a POS and Golf solution customer. While the company has significant upsell potential, it has also historically maintained retention rates above 95%. A majority of its revenue is recurring in nature, with gross margins exceeding 75%. Additionally, the company benefits from lower operating expenses, with close to 70% of its employee base located in India.

Looking ahead: What investors can expect

In its latest quarter, recurring revenue grew 19% year over year to $38 million. Notably, the subscription portion increased 32% year over year. However, total revenue growth for the company was 13%, as it was impacted by declining hardware related sales. Adjusted EBITDA, which is a good indicator of FCF given the business model’s low capex needs, came in at $12.1 million, at a margin of 19%. Management maintained their guidance for full year FY25 of $280 million in revenue and an adjusted EBITDA margin of approximately 16%.

According to my analysis, recurring revenue is the key metric that investors should track. This is because the gross margins associated with it are above 75%, compared to the professional services and hardware segments, which have substantially lower gross margins. Though management does not break down guidance further, I estimate the recurring revenue portion at $180 million for FY25. I arrive at this figure by deducting $65 million in expected sales from professional services and $40 million in hardware related sales. I have also accounted for the revenue contribution from last month’s acquisition of Book4Time for $150 million. Though Agilysys has not shared the financials of the company, some sources estimate Book4Time’s annual revenue at approximately $24 million. Book4Time has been recognized as a leader for Spa software, and will be highly complimentary to Agilysys’s existing Spa offering, while also providing a customer base that Agilysys can tap into.

Latest Investor presentation

I estimate Annual Recurring Revenue (ARR) of $185 million when exiting FY25, which should then grow to $235 million when exiting the following year. The main driver behind this 25% year-over-year growth is the contribution from the Marriott deal, shown above. The addition of around 450,000 to 500,000 rooms as part of this deal, should more than double the revenue from the PMG segment, which represented 19% of total revenue last year. Additionally, revenue from the POS win with Marriott can also be expected to contribute significantly. Furthermore, with the number of sales personnel 30% higher than last year, I expect the company to bring in a lot of new customers as well.

Thoughts on valuation

At the current share price of $107, the company has a market cap of $2.94 billion, with its enterprise value roughly the same following the $150 million cash outflow related to the Book4Time acquisition. Based on my ARR estimates exiting this year and next, shares are valued at EV/ARR multiples of 15.9 and 12.5 respectively. Peers in the POS space such as PAR Technology (PAR) and Toast (TOST), which are demonstrating comparable growth rates are valued at EV/ARR multiples well below 10. Therefore, it is evident that the market is offering a premium valuation due to the opportunity it sees ahead.

Taking my valuation a step further, I find shares trading at an EV/Adjusted EBITDA multiple of 65, which appears expensive. However, since the company is prioritizing growth over profitability at this stage, I believe it is more relevant to value the business based on steady state margins, which I think the business can achieve in the future. For Agilysys, I see the business reaching adjusted EBITDA margins of 25%, looking out a few years. Applying this margin to this year’s revenue estimate yields an adjusted EBITDA of $70 million, which translates to an EV/adjusted EBITDA multiple of 42. It is clear that the valuation looks more reasonable when looking ahead, as earnings are set to grow from higher revenue generation as well as improving margins, driven by operating leverage. However, at this valuation, expectations remain elevated, leaving little room for a margin of safety for new investors considering a position in the company.

Risks to consider

Competition

Agilysys navigates a highly competitive landscape, specializing in software solutions tailored specifically for the hospitality industry. For major players like Oracle (ORCL), Sabre (SABR) and Amadeus (OTCPK:AMADF), hospitality software is just one facet of their extensive product offerings. In contrast, newer entrants like Mews focus exclusively on hospitality management software, similar to Agilysys. Rather than competing on price, Agilysys emphasizes on its high customization, functionality and seamless integrations. By selling multiple modules, its products also become stickier, making it harder for even its larger customers to opt for an in-house solution.

Declining hardware sales

Customers are increasingly opting for consumer-grade mobile devices, such as iPads, instead of the company’s hardware POS terminals. This shift has contributed to a decline in hardware-related revenue. While this trend is a headwind to overall top-line growth, it is unlikely to significantly impact profitability, as hardware sales typically have low margins.

Sensitivity to travel demand

Weaker consumer travel demand likely stemming from economic weakness would have a negative impact on the hospitality sector, which could potentially hamper the company’s growth outlook. Given that a significant portion of its revenue is recurring in nature, with an only smaller portion being transaction-based, I expect the business to remain resilient even in a challenging operating environment.

Conclusion

While I am impressed by Agilysys’s overall business performance and promising outlook, I believe the current valuation is too rich to recommend initiating a long position. Therefore, I am assigning a Hold rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.