Summary:

- I remain bullish on Accenture plc stock due to their strong AI and cloud capabilities, with a one-year target price of $410 per share.

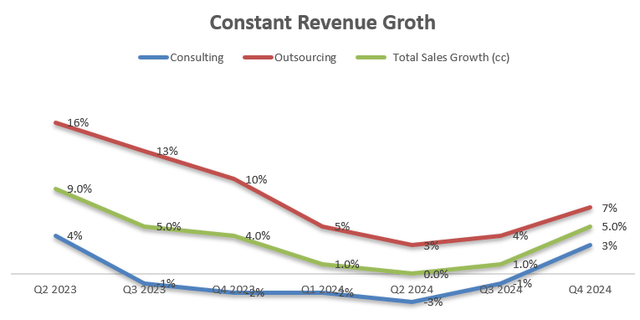

- Accenture’s Consulting business shows early recovery signs, with 3% constant revenue growth, benefiting from potential interest rate cuts and increased AI demand.

- Accenture’s restructuring towards AI and cloud computing is crucial for long-term growth, despite near-term margin compression from headcount increases in data and AI areas.

- I project Accenture’s revenue to grow 7% annually, driven by digitalization, cloud computing, AI implementations, and M&A, supporting a ‘Strong Buy’ rating.

JHVEPhoto

I expressed my bullish view on Accenture plc (NYSE:ACN) in my initiation report published in June 2023, highlighting their long-term growth potential in generative AI and the continuing strength in cloud transformation. They released Q4 FY24 results on September 25th before the market open, reporting 5% constant revenue growth and 3% adjusted EPS growth. I remain bullish on Accenture’s AI and cloud computing capabilities. Accenture’s Consulting business has demonstrated some early signs of recovery during the quarter. I reiterate a “Strong Buy” rating with a one-year target price of $410 per share.

Booking Recovery in Consulting Business

As depicted in the chart below, Accenture delivered 3% constant revenue growth in their Consulting business, marking the first positive growth in the past six quarters.

Amid the high-interest rate environment, corporate customers have cut some discretionary IT spending as part of cost reduction and reorganization efforts. As a result, the IT consulting business is particularly vulnerable in such a challenging macro environment. When the Fed began to cut the interest rate, I anticipated the consulting business would start to recover for the following reasons:

- Accenture provides comprehensive IT consulting services covering marketing, advisory, and planning, implementation across entire technology stacks, operational excellence, and simplification, as communicated over the earnings call. These IT consulting services are mission-critical for enterprise customers looking to reduce costs, optimize operations, and improve productivity.

- A lower interest rate environment could alleviate financial burdens for enterprise customers, allowing them to prioritize IT consulting for their digital transformation, cloud migration, and AI implementations, which would benefit Accenture’s growth.

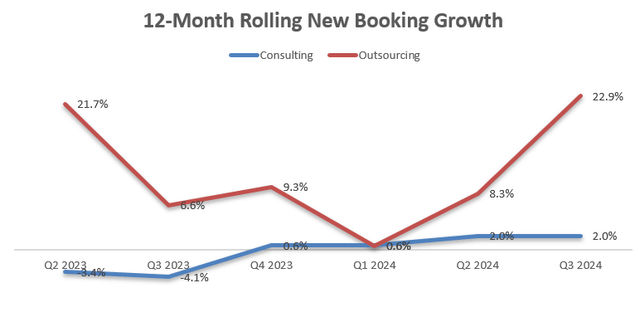

- When AI technology shifts from the training to inference phase, I anticipate enterprise customers and the public sector will increase their edge AI computing workloads and require more business consulting for the AI inference and user-interface edge platforms. Over the past couple of years, Accenture has increased their AI investments in talents, platforms, and technology knowledge base. As discussed in my previous article, Accenture will be relevant in the AI era, in my opinion. For the full year, the company generated $3 billion in AI-related bookings.

Business Restructuring and Delay in Promotions

Accenture incurred $438 million in restructuring expenses in FY24, aiming to reallocate resources from the traditional on-premises market to AI-related areas. I think the whole restructure makes total sense, as their future growth will rely on their capabilities in AI technology, across their consulting and implementation services.

As reported by Bloomberg, Accenture is planning to push back the bulk of its staff promotions by six months. I don’t think the delay in promotions would indicate any structural issues within Accenture. In fact, the Big Four accounting firms all reshaped their consulting workforce at the beginning of 2024, according to the media.

Accenture’s management has emphasized that the company will continue to adjust its divisions and related positions, with a focus on key growth areas such as digitalization, 5G, AI, and cloud computing. I think for the long term, the ongoing restructuring is crucial for an IT consulting business to stay aligned with the latest technology advancements.

Outlook and DCF Projections

Accenture is guiding for 3%-6% constant revenue growth and 5%-8% adj. EPS growth for FY25, which is quite conservative and does not reflect any substantial recovery in their Consulting business in my view.

For the normalized business growth, I am relying on the following assumptions:

- As new booking growth fluctuates every quarter, it is better to calculate a 12-month rolling growth rate, as shown in the chart below. It is evident that new bookings growth in Consulting has shown some early signs of recovery, with strong booking growth in outsourcing businesses. As the Fed began to cut interest rates, I anticipate the recovery will continue in FY25.

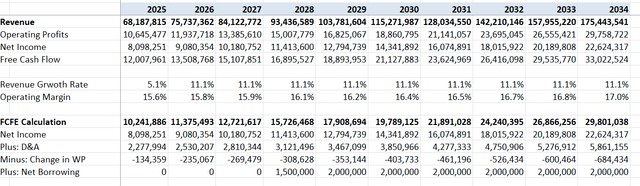

- Virtue Market Research predicts that the global IT consulting market will grow at a CAGR of 4.5% from 2023 to 2030, driven by digitalization, cloud computing, and AI implementations. As a global leader, Accenture has outpaced the market growth recently, generating around 7% organic revenue growth on average over the past decade. I anticipate the company will continue growing faster than the overall market, increasing its revenue by 7% annually.

- M&A has been a key growth driver for Accenture. I anticipate the company will spend 5% of total revenue on M&A, contributing an additional 2% to the topline growth.

- I model 20bps margin expansion for Accenture, driven by 10bps from gross margin improvement due to pricing; 20bps from SG&A optimization, and -10bps impact from ongoing restructuring initiatives.

- I estimate the cost of equity to be 10.9% assuming: a risk-free rate 3.6%; beta 1.13; equity risk premium 6.5%.

With these parameters, the discounted cash flow (“DCF”) and free cash flow from equity (FCFE) can be summarized as follows:

Discounting all the FCFE, the one-year target price is calculated to be $410 per share.

Key Risk

Accenture has been adding more headcounts in data analytics and AI areas. As indicated over the earnings call, the management anticipates increasing their data and AI workforce from 40,000 to 80,000 by the end of FY26. The significant headcount increase will cause some near-term margin compression, as it typically takes 3-6 months for a new consultant to complete related trainings and start contributing to productivity.

End Note

I favor Accenture plc’s strategic positions in AI technology, and I expect enterprise demand for AI-related consulting to increase in the future. I reiterate a “Strong Buy” rating with a one-year target price of $410 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.