Summary:

- Dell’s increasing penetration of AI server opportunities have overshadowed the tepid recovery outlook in its core PC sales, and underpinned the stock’s continued upsurge this year.

- DELL’s expanding operating margins, despite the increasing mix of less profitable AI server sales, also differentiates from bottom line compression observed at key rivals Super Micro and HPE.

- The impending transition to DLC servers with the upcoming deployment of Nvidia Blackwell systems will be an incremental growth catalyst for Dell in the AI transformation cycle.

- In light of SMCI’s recent accounting woes, Dell’s capability in deploying DLC solutions at scale also allows it to gain additional AI server revenue share by absorbing potential supply shortfalls.

ictor/iStock Unreleased via Getty Images

The Dell stock (NYSE:DELL) has been a strong gainer amid the AI rally. Its value has more than tripled since the debut of OpenAI’s ChatGPT in late 2022 unleashed mass market interest in generative AI solutions.

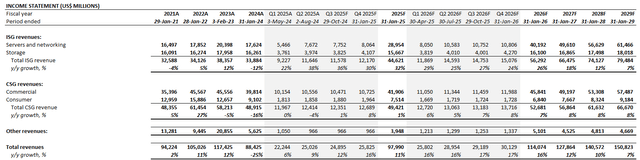

Known primarily for its leadership in the PC market, Dell’s lesser-acknowledged server business has actually emerged as a top revenue share gainer amid the rapid build-out of AI infrastructure. Specifically, the company’s latest fiscal 2Q financial outperformance had overshadowed its 1Q shortfall from earlier this year, as its AI server deployments remain resilient.

An industry leading bright spot was Dell’s ability in improving margins despite the increasing mix shift towards less profitable AI server sales to cater the technological revolution. This largely contrasts from its key rivals – namely, SMCI (SMCI) and Hewlett Packard (HPE) – who have continued to struggle from compressing margins given the profit-dilutive nature of Nvidia’s (NVDA) pricey processors within AI servers.

The combination of increasing AI server market share and improving profit margins at Dell provides validation to its differentiated go-to-market strategy. While industry peers like SMCI and HPE have largely focused on serving large CSPs, Dell has instead focused on AI server opportunities across government agencies and enterprise end-markets. The strategy has essentially given Dell greater pricing power as it continues to ramp up AI server volumes and gain market share.

More importantly, we view Dell as a key contender for growth opportunities stemming from the need for direct liquid cooling (“DLC”) solutions in next-generation data centers. Despite the limited airtime on Dell’s DLC capabilities, the company is currently a key provider of the solution. In light of key rival SMCI’s recent accounting debacle, and the potential implications on its ability to provide DLC solutions, Dell is well-positioned to absorb related supply shortfalls. Additional DLC demand would be incrementally margin accretive for Dell’s less profitable AI server sales by enabling greater operating leverage improvements. This will essentially unlock further earnings growth for the company, which remains underappreciated at the stock’s current levels.

Dell’s Expanding AI Server Revenue Share

Dell’s AI server sales continue to exhibit relentless growth, reaching $3.2 billion during F2Q. This was key to taking its infrastructure solutions group (“ISG”) revenue to a quarterly record of $11.6 billion during the period. Meanwhile, forward-looking AI server prospects for Dell also remain promising. The AI server backlog was maintained at $3.8 billion exiting F2Q, with management confirming a deals pipeline that is “several multiples” of that, realizable over the next five quarters.

A Differentiated, Yet Effective, Go-to-Market Strategy

While competitors have reported margin compression, Dell showed an improvement in earnings as AI server sales continued to scale. Specifically, the company grew ISG operating margins by three percentage points q/q to 11% during F2Q despite an increasing mix shift towards less profitable AI server sales. This differs from SMCI, which recently reported continued margin pressure due to its utilization of a competitive pricing strategy on AI server sales aimed at growing hyperscaler market share. HPE has also reported margin erosion due to the increasing mix shift towards less profitable AI server revenue.

Dell is expecting further margin expansion through F2H25, as incremental scale from the ongoing ramp of AI server shipments complements results from ongoing disciplined spend management. Dell’s AI server earnings outperformance is likely also attributable to its differentiated go-to-market strategy. As discussed in the earlier section, Dell currently prioritizes AI server opportunities in enterprise end-markets and government agencies, as well as smaller tier-2 CSPs. This has likely allowed the company to sell at better unit economics compared to peers that have been prioritizing larger hyperscaler customer, which typically exhibit greater pricing power.

Deploying DLC Solutions at Scale

Looking ahead, Dell is anticipating greater penetration into sovereign and larger CSP opportunities with the upcoming Blackwell-powered PowerEdge XE9680L DLC servers. This is expected to add to existing enterprise demand and drive further scale to aid sustained margin expansion for Dell.

Specifically, we expect Dell’s continued ramp of DLC deployments, starting with the upcoming Blackwell systems, to be a looming catalyst for the stock. The upcoming Nvidia Blackwell platform will be one of the first to require 1,000W of power. Its successor, based on the Rubin platform in 2026, will likely require 1,500W of power. And traditional air-cooled solutions just won’t cut it in optimizing the energy consumption and compute performance of these next-generation chips.

This creates a vast emergence of DLC opportunities ahead, given the solution’s crucial role in optimizing next-generation data centers fitted with increasingly power-hungry chips. The International Energy Agency is currently estimating global data center electricity consumption levels to double between 2022 and 2026, given the increasing volume of compute-hungry AI training and inferencing workloads. And DLC solutions will be critical in complementing increasingly high performance and power-hungry chips in optimizing data center power consumption without compromising on performance. This is further corroborated by Nvidia’s advocation for liquid cooled servers in recent years, citing it as the “solution that is maturing in the age of AI”.

Although Dell’s DLC solutions have received limited airtime in recent quarterly earnings calls, its technology has been publicly endorsed by Nvidia. Specifically, the AI darling has recognized Dell as an “essential partner” in the build-out of “AI factories”, lauding the server maker’s ability in providing all-encompassing storage, networking and computing solutions for wide-ranging customers. This essentially validates the competitiveness of Dell’s DLC solution, making it a top contender for emerging opportunities in the transition to accelerated computing.

Both Nvidia and Dell have jointly unveiled the Dell PowerEdge XE9680L liquid-cooled servers, fitted with eight next-generation Blackwell GPUs, in May. The newest system is optimized for AI workloads by enabling greater “GPU density per rack”. By leveraging DLC technology, the XE9680L will also improve scalability by optimizing thermal and compute power efficiency, especially in facilitating AI training and inferencing workloads. Dell has also designed the XE9680L with an “efficient deployment process” in mind. The newest systems offer seamless integration with partner components to enable rapid time-to-deployment and time-to-value for customers.

The combination of optimized GPU density per rack, improved scalability and rapid time-to-deployment essentially translates to competitive TCO for customers. This essentially reinforces the appeal of Dell’s DLC solutions to its target enterprise customer cohort, and bodes favourably for the company’s increasing penetration into sovereign and CSP opportunities.

Dell is a Key Beneficiary of SMCI’s Woes

In the latest development, Dell’s key server rival and industry-leading DLC provider, SMCI, has been dealt with accounting troubles. The company has delayed its 10K filing for FY 2024 due to issues with its assessment of internal controls. This has caused us to circle back on our previously bullish outlook for SMCI, as the latest development is not a good look for the stock. The risk of financial reporting shortfalls could potentially impact SMCI’s operational outlook and, inadvertently, fundamentals underpinning its valuation prospects.

What makes the situation worse is that this is not SMCI’s first rodeo involving accounting and disclosure deficiencies. The company was fined $17.5 million by the SEC in 2020 for “prematurely recognizing revenue and understating expenses from at least fiscal year (“FY”) 2015 through FY 2017”.

As a brief overview on the assessment of internal controls, the audit procedure typically spans throughout the year. The testing of internal control design is performed earlier in the year following the risk assessment stage. Meanwhile, samples are further scrutinized throughout the remainder of the year to ensure effectiveness of said internal controls over financial reporting.

In SMCI’s “Notification of Late Filing” notice, the company has specified issues regarding the assessment of control effectiveness. SMCI management has also filed a follow-up notice to reaffirm that the recent events have not affected the company’s day-to-day operations, and they do not anticipate any material changes to financial information disclosed during SMCI’s FY 2024 earnings press release. The company has disclosed shipments of “approximately 2,000 DLC liquid-cooled AI racks to customers” in the current calendar year. This translates to an estimated 75% share of the total DLC market according to SMCI’s disclosure.

Although management does not expect any material misstatements in SMCI’s financial statements, nor adverse implications to SMCI’s day-to-day operations, the recent events cast doubt to the company’s demand outlook, in our opinion. Even if without impact to its day-to-day operations, SMCI’s recent troubles are likely to drive its customers and partners into considering further diversification of server supply based on due diligence considerations. We believe this will inevitably lead to some extent of adverse implications to SMCI’s near-term fundamental outlook. And Dell’s ability in providing DLC solutions at scale makes it well-suited for absorbing SMCI’s prospective shortfall.

Dell’s increasing penetration of CSP opportunities also aligns favourably with SMCI’s hyperscaler-focused customer base. And while SMCI has maintained a competitive pricing strategy to gain AI server market share, risks of its sudden shortfall could favour Dell’s pricing dynamics in the industry as well, given the limited number of server makers in the industry that can deliver DLC solutions at scale. Taken together, Dell is well-positioned for incremental AI server demand and ensuing margin accretion because of SMCI’s recent accounting, and, potentially, operational woes.

Fundamental Considerations

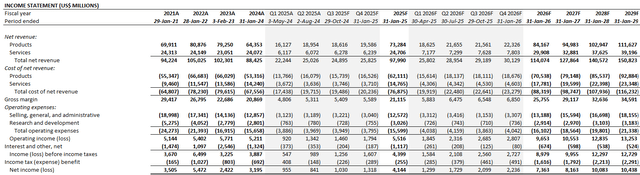

Updating our forecast for Dell’s F2Q25 results and forward outlook, we estimate current year revenue growth at 11% y/y to $98.0 billion. This is consistent with management’s guidance for total FY 2025 revenue in the range of $95.5 billion to $98.5 billion.

Our assumption is driven primarily by expectations of accelerating AI server demand with the emergence of DLC deployments, and incremental penetration into CSP opportunities. This is corroborated by Dell’s maintained AI server order backlog of $3.8 billion. Dell’s forward AI server deals pipeline, which is multiple folds of the order backlog, effectively reinforces visibility into its longer-term revenue share gains as well. A potential operational shortfall at SMCI could also be an additive tailwind for Dell’s AI server revenue share.

Meanwhile, the emerging PC recovery, though modest, is expected to be an additive growth factor to Dell’s ongoing AI server strength, nonetheless. Our estimates project a more evident improvement in PC sales in FY 2026, as the AI-driven refresh cycle is expected to gain momentum on increasing use cases, especially from commercial end-markets.

Author

On the cost front, we expect Dell’s continued cost-savings initiatives and disciplined spend management to complement operating leverage improvements realized through incremental scale of AI server deployments. This is corroborated by Dell’s reiterated commitment to headcount reductions this year to unlock greater operational efficiency.

Author

Valuation Considerations

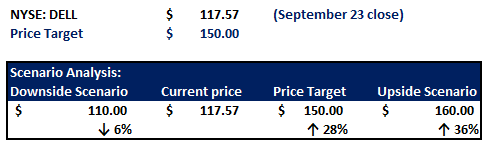

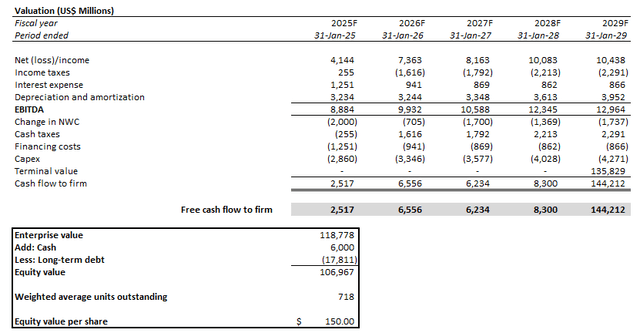

Based on the foregoing analysis, we are setting a base case price target for Dell at $150 apiece.

Author

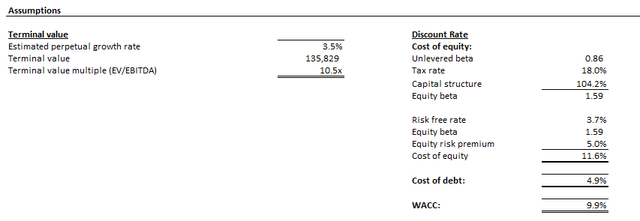

The price target is derived from the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken in conjunction with Dell’s fundamental forecast discussed in the earlier section. The DCF analysis considers a 9.9% WACC in line with Dell’s capital structure and risk profile. An implied perpetual growth rate of 3.5% is also considered in the analysis to determine Dell’s terminal value. The assumption applied is consistent with the upper range of the estimated pace of economic expansion across Dell’s core operating regions to reflect its competitive advantage in addressing imminent AI growth opportunities.

Author

Author

Upside Scenario Considerations

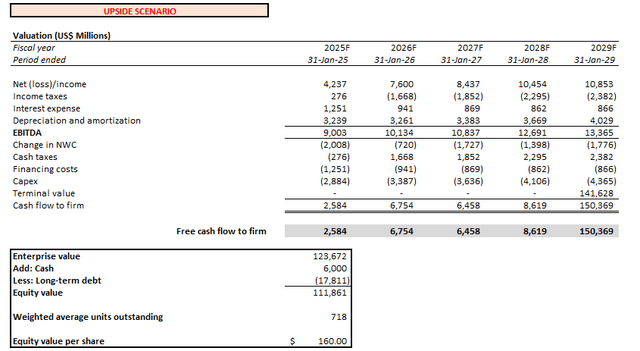

In the upside scenario, we have considered prospects of incremental revenue share gains for Dell in AI server opportunities. This could come in the form of improved supplies to address resilient demand across its key enterprise, government and CSP customer base; and/or incremental opportunities stemming from a potential rival shortfall as discussed in the earlier section. Greater than expected AI server volumes could be incrementally margin accretive for Dell given additional scale and ensuing operating leverage improvements.

By applying upside scenario cash flows to the valuation analysis, while keeping all other key assumptions (i.e. 9.9% WACC; 3.5% perpetual growth rate) unchanged from the base case scenario, Dell exhibits an estimated intrinsic value of $160 apiece. This would represent upside potential of 36% from its currently traded price of $117.77 (September 19 close).

Author

Conclusion

Despite being a key beneficiary of the AI transformation cycle, Dell is not free from operational risks. The company’s elevated exposure to cyclical end-markets make it inherently prone to recessionary headwinds, which have recently re-emerged as a market concern due to weakening labour data.

But Dell’s market leading margins amid an increasing mix shift towards AI server sales is a positive compensatory factor. We believe Dell is well-positioned for an earnings growth uplift from incremental AI server opportunities ahead. This will be sustained by Dell’s competitive advantage in addressing the longer-term transition to DLC servers, which remains underappreciated at the stock’s current market value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.