Summary:

- Occidental Petroleum is a well-managed energy firm with significant production upside, strong free cash flow, and a recent acquisition boosting its Permian Basin output.

- The company is using excess cash flow for debt repayment, enhancing its balance sheet, and offering a 2% dividend yield, making it an attractive buy.

- Warren Buffett’s 30% ownership and the accretive CrownRock acquisition should provide additional comfort. Investors today get a 15% discount on Buffett’s June buys of OXY.

- Valued at a P/E ratio of 11X, Occidental Petroleum has a fair value potential of $61-66, implying up to 29% revaluation upside.

ugurhan

Occidental Petroleum (NYSE:OXY) is a well-run energy company with considerable organic and acquisition-driven production upside. The energy firm is growing its operational footprint and using excess cash flow to repay its debt, leading to a leaner balance sheet and more upside for Occidental Petroleum’s shareholders in the longer term. Occidental Petroleum also gave investors a 22% dividend raise in the second-quarter, and shares currently yield 2%. In my opinion, the consolidation represents a buying opportunity and Occidental Petroleum’s shares have a risk profile that is skewed to the upside.

Previous rating

I rated Occidental Petroleum a buy in November 2023 after OPEC+ members provided pricing support for petroleum markets through voluntary supply cuts: OPEC+ Supply Cuts And Earnings Upside. Shares have since decreased 15% and even repeated buys by Warren Buffett around $60/share have not had a positive impact on OXY so far, likely due to falling energy prices. Occidental Petroleum’s production base is growing, however, in part due to acquisitions and the company generates a ton of free cash flow that is available either for debt repayments and/or for accelerating capital returns.

Growing operating portfolio, strong free cash flow

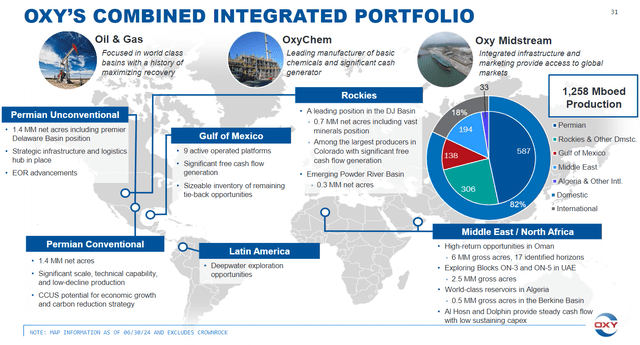

Occidental Petroleum owns a diversified portfolio of energy assets, including oil & gas, chemical, midstream and low-carbon energy investments that help smooth out earnings and free cash flow volatility. While Occidental Petroleum has energy assets both in the U.S. and offshore (mainly in North Africa and the Middle East), the Permian is by far the most significant geographic location for the E&P company from a production perspective.

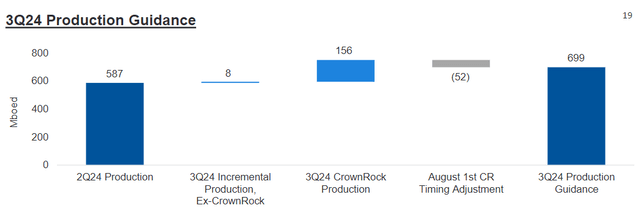

Occidental Petroleum announced the acquisition of CrownRock at the end of FY 2023 — a Midland-based oil and gas producer — for approximately $12.0B, paid in a stock and cash. As per guidance, CrownRock was expected to add approximately 170 thousand barrels of oil equivalent per day to OXY’s production. The acquisition was conducted mainly because of CrownRock’s assets in the Midland basin were complimentary to Occidental Petroleum’s heavy Permian focus and promised to be free cash flow accretive. The transaction was completed at the beginning of August, and the outlook for production growth for OXY is very favorable.

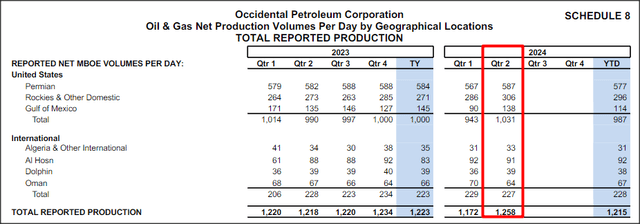

According to Occidental Petroleum’s production break-down, the Permian Basin was responsible for 587 MBOED in the second-quarter, showing 4% quarter-over-quarter growth. The Permian is by far the biggest source of production, representing about 47% of total production.

Occidental Petroleum’s acquisition of CrownRock in 2024 is expected to make a quite significant production impact on the firm’s total production base in the near term. According to the company’s Q3’24 outlook, OXY’s production in the Permian is expected to grow 19% quarter-over-quarter. Due to the acquisition of CrownRock, Occidental Petroleum also raised its full-year Permian production outlook from 569-599 MBOED to 637-663 MBOED.

Occidental Petroleum is a very free cash flow-profitable oil and gas enterprise, and the company has achieved positive free cash flows in each quarter in the last year. In the most recent quarter, Q2’24, Occidental Petroleum generated $1.3B in free cash flow (+83% Q/Q, +31% Y/Y) of which the company returns a considerable amount to shareholders. Theoretically, free cash flows can be used to retire debt, pay dividends and buy back stock… and Occidental Petroleum does all of those things.

|

$millions |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Y/Y Growth |

|

Product Net Sales |

$6,731 |

$7,400 |

$7,529 |

$6,010 |

$6,879 |

2.2% |

|

Net cash provided by operating activities |

$3,070 |

$3,129 |

$3,239 |

$2,007 |

$2,394 |

-22.0% |

|

Plus: Working Capital/Other |

($419) |

$210 |

($734) |

$439 |

$650 |

– |

|

Less: Purchases of Property and Equipment |

($1,646) |

($1,619) |

($1,446) |

($1,726) |

($1,729) |

5.0% |

|

Free cash flow |

$1,005 |

$1,720 |

$1,059 |

$720 |

$1,315 |

-22.3% |

|

Free cash flow margin |

14.9% |

23.2% |

14.1% |

12.0% |

19.1% |

+ 4.2 PP |

(Source: Author)

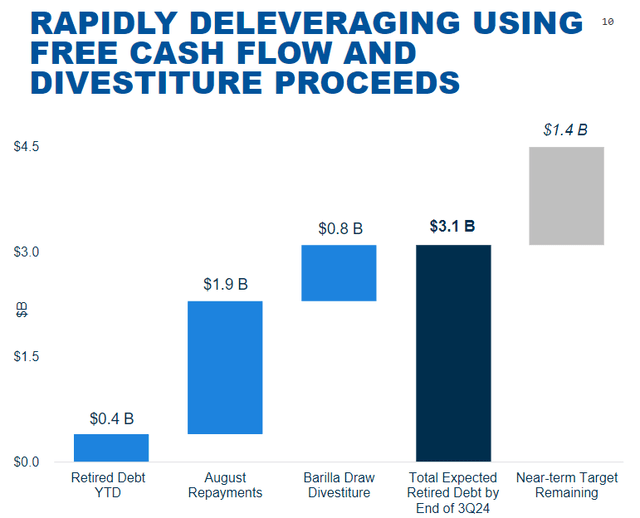

A large portion of Occidental Petroleum’s goes to debt repayments and the company has guided for $1.9B for incremental debt reductions in the month of August, following the close of the CrownRock acquisition. At the end of the June quarter, Occidental Petroleum had approximately $18.4B in total long-term debt. In the last year, the total long-term debt balance has been reduced by approximately $1.3B. With production increases and strong FCF, I expect the company to prioritize further debt repayments in the short term.

Occidental Petroleum’s valuation vs. rivals

Occidental Petroleum is currently valued at a price-to-earnings ratio, based off of FY 2025 earnings, of 10.9X, which is above the industry group average P/E ratio. The industry group includes Eni (E), Suncor Energy (SU) and Imperial Oil (IMO) and the average P/E ratio is 10.5X, meaning Occidental Petroleum is slightly more expensive than the average rival.

However, Occidental Petroleum is growing quickly and has a huge advantage over other energy companies: Warren Buffett is a near-30% shareholder in the company, which represents a vote of confidence. I believe Occidental Petroleum, given its growing production footprint, ‘Buffett’ seal of approval and soaring free cash flow, could re-price to a 13-14X price-to-earnings ratio which implies, based off of a consensus forecast of $4.71 per-share, a fair value in a range of $61 to $66. With shares currently trading at $51, I see an upside revaluation case, over a twelve-month period, of up to 29%. Since Warren Buffett bought at ~$60 per-share in June, investors can get a 15% lower price than he did.

| OXY vs. rivals | Share Price | Market Cap ($B) | FY 2025 Est. Earnings | FY 2025 P/E Ratio |

| Occidental Petroleum | $51.12 | $47.81 | $4.71 | 10.9 X |

| ENI S.p.A. | $30.91 | $49.43 | $3.23 | 9.6 X |

| Suncor Energy | $37.42 | $47.55 | $3.61 | 10.4 X |

| Imperial Oil | $70.32 | $37.19 | $6.20 | 11.3 X |

| Average: | 10.5 X |

(Source: Author)

Risks with Occidental Petroleum

The biggest risk for Occidental Petroleum is a potential down-turn in petroleum prices and a less vigorous defense of prices by OPEC+ members going forward. Occidental Petroleum is also mainly focused on the Permian Basin which makes the company quite concentrated. What would change my mind about Occidental Petroleum is if the company were to see slowing production growth in the vital Permian Basin or a drop-off in free cash flow in relation to weakening petroleum prices.

Final thoughts

If you are looking to invest alongside Warren Buffett, Occidental Petroleum is your chance: the energy company is growing its production footprint and investors can now buy OXY at a lower price than Buffett got. Investors are set to see incremental production gains in the third-quarter due to the inclusion of CrownRock’s assets in the Permian Basin. Occidental Petroleum is generating solid free cash flows (and margins) and is prioritizing the repayment of its long-term debt, which should lead to a healthier balance sheet and ultimately more upside potential for the company’s shares in the future. I believe the consolidation of Occidental Petroleum opens up an engagement opportunity, and investors can now get an even better deal than Warren Buffett got during the summer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.