Summary:

- Meta Platforms, Inc. stock has surged to a new high, outperforming the S&P 500 with ease.

- It has demonstrated robust AI integration into its core business while opening up exciting new opportunities in AR/VR.

- Meta’s digital advertising business is expected to remain resilient, mitigating its investments in AI and AR/VR to define its computing platform.

- META’s forward valuation multiples suggest it’s no longer assessed as undervalued, but I wouldn’t bet against Mark Zuckerberg and his team.

- I explain why a reasonably valued META remains an exciting proposition with several AI and AR/VR growth optionalities in its thesis.

COM & O

Meta Platforms, Inc. (NASDAQ:META) investors are likely cheering the stock’s stellar performance as META notched a new all-time high. As a result, it has continued its impressive run over the past year, delivering a 1Y total return of nearly 90%, outperforming the S&P 500 (SPX) (SPY). Despite that, its forward valuation multiples remain aligned with its 10Y average, justifying the market’s optimism as the leading social media company returns to robust growth.

In my previous META article in June 2024, I upgraded the stock as I assessed that the time had come to turn bullish. Given its AI integration and robust ad monetization opportunities, I also highlighted my confidence that it is expected to continue its rally. Therefore, dip-buyers have returned with conviction, lifting the stock toward a new high.

Meta investors are likely aware of its recent Meta Connect 2024 live event, at which CEO Mark Zuckerberg unveiled significant updates to his company’s AR/VR strategies. Zuckerberg has lowered the price for its entry-level Quest VR device, aiming to compete more aggressively with Apple (AAPL) Vision Pro’s entry.

In addition, Meta also unveiled its Orion AR glasses, underscoring the company’s wide-ranging approach toward AI integration as it seeks to refine its path toward a “general purpose computing platform.” Furthermore, Meta delivered salient AI model updates through its Llama 3.2 LLMs, improving access to developers looking for more lightweight versions appropriate for edge AI solutions.

Notwithstanding its optimism, its AR/VR strategy isn’t expected to lift Meta’s earnings profile significantly in the near term. Even Apple Vision Pro hasn’t led to a surge in revenue growth for the Cupertino company, underscoring the immense challenges in unhinging Apple’s dominant iOS walled garden. Despite that, Meta’s Q2 earnings release in July 2024 highlighted the resilience of its digital advertising business, benefiting from improved ad monetization attributed to enhanced engagement metrics. Furthermore, Meta can leverage growth prospects in business messaging and AI agents, potentially opening up more opportunities to monetize its AI investments.

Meta is banking on the increasingly widespread use of Meta AI to demonstrate its ability to scale up and compete more effectively against OpenAI’s dominance. However, OpenAI’s ability to deliver more advanced models consistently has also upped the ante against the Menlo Park-headquartered company. Despite that, Meta Platforms is aggressively pursuing mega AI clusters, championing its drive toward open-source AI models while combating OpenAI’s closed-source approach. Despite that, Meta’s speed in incorporating AI into its digital advertising business is a testament to its ability to demonstrate immediate use cases. While the investments in its AR/VR strategy are not expected to lead to near-term earnings accretion, I assess that Meta’s robust free cash flow profitability should mitigate these challenges.

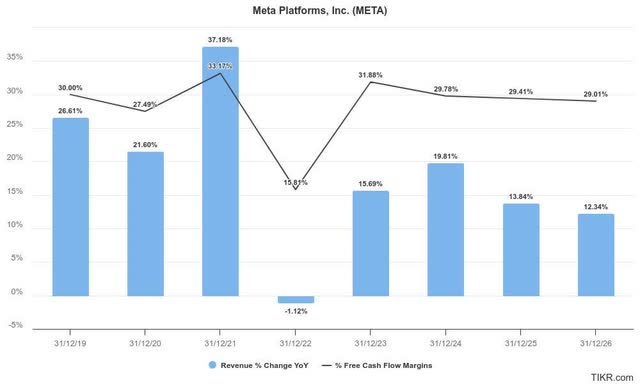

Meta is expected to continue delivering robust FCF profitability through the FY2026 forecast period, underpinned by the recovery in its ad business. The decision by Amazon (AMZN) to work more closely with Meta highlights the scale and growing e-commerce opportunities through its social media platform. In addition, Meta’s unique value proposition to develop AI avatars for its creators could spur broader adoption of its AI studio software.

Hence, I assess that Meta’s ability to produce more exciting use cases to further embed AI into its platform should improve the market’s confidence in its ability to monetize AI over time. While still nascent, Meta’s massive digital advertising business should afford the company the bandwidth to experiment with Generative AI more liberally compared to its smaller peers.

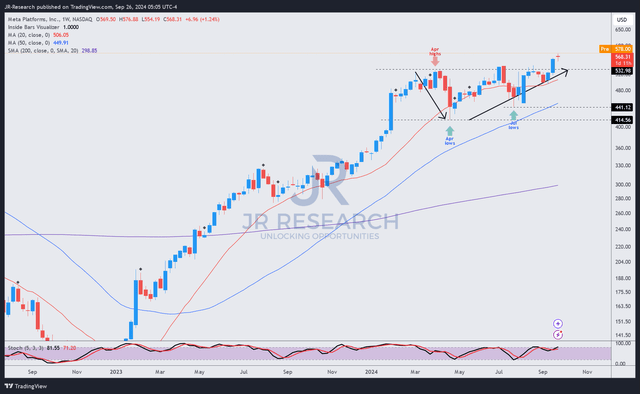

META price chart (weekly, medium-term, adjusted for dividends) (TradingView)

META’s price chart corroborates my bullish conviction, as it likely broke out of its $530 resistance zone. META’s “A” range momentum grade over the past six months underpins the market’s optimism, justified by its fundamentally strong digital advertising business model.

Moreover, its forward adjusted EBITDA multiple of 13.8x is still below its 10Y average of 14.1x. META’s forward adjusted PEG ratio of 1.48 is nearly 15% above its sector median. Hence, while the stock is not assessed to be undervalued, I don’t consider it as significantly overvalued.

Notwithstanding my optimism, investors must still be cautious about the cyclicality of the digital advertising business. Meta’s revenue growth plunge in 2022 is a reminder of overstated expectations linked to the surge in its revenue in 2021 while being impacted by Apple’s IDFA changes then. While Meta has navigated these challenges successfully, it lacks a less cyclical cloud computing business that could help mitigate the more cyclical headwinds inherent in the digital advertising industry.

In addition, regulatory headwinds are expected to intensify, potentially affecting Meta’s execution capabilities. Google’s (GOOGL) (GOOG) legal challenges remind us that Meta’s AI business is expected to remain under intense scrutiny, particularly in the EU. Hence, these headwinds could lower a more aggressive valuation re-rating in META.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!