Summary:

- Pfizer remains an attractive capital return play with a 10X P/E ratio, despite concerns about post-COVID revenue declines.

- The oncology business shows promising growth, particularly with products like Xtandi and Lobrena, supporting Pfizer’s long-term potential.

- Pfizer’s guidance for FY 2024 EPS has been raised, indicating strong earnings potential and undervaluation by the market.

- Pfizer’s shares pay a healthy 6% yield and the dividend is growing.

Massimo Giachetti

Shares of Pfizer (NYSE:PFE) have gone nowhere this year in large part because investors feared a revenue cliff with regard to the company’s COVID-19 products. Although shares have widely disappointed in 2024, I believe Pfizer remains an attractive capital return play for investors as the company is growing its adjusted top line modestly and is seeing some real momentum in its Oncology business. Pfizer raised its diluted EPS guidance for FY 2024 and is trading only at a 10X P/E ratio which puts Pfizer squarely into value territory, in my opinion.

Seeking Alpha

Previous rating

I rated shares of Pfizer a buy after the pharmaceutical company submitted its fourth-quarter earnings sheet in February and the company guided for $4.0B in cost reductions to improve its profitability and higher investment spend. Since my last coverage, shares of Pfizer have revalued 4% higher and Pfizer has not participated in the broader market rally, chiefly because investors are still pretty much concerned about the company’s top line trajectory in a post-COVID world. While the company’s revenue growth is clearly slowing, I believe the oncology pipeline is promising and Pfizer continues to return a ton of cash to shareholders.

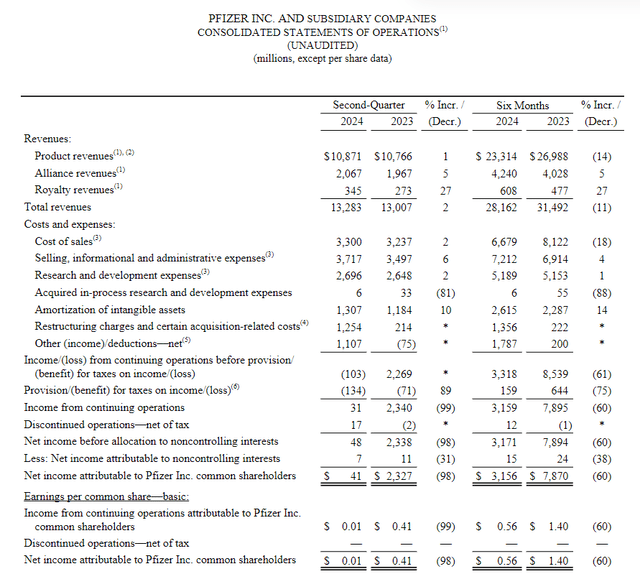

Revenue cliff and capital return potential

Pfizer’s revenues surged during the pandemic which was due mainly to the company’s COVID-19 vaccine, but this top line growth has all but disappeared. In the second-quarter, Pfizer generated $13.3B in revenues, showing only 2% growth year-over-year. With its top line under pressure, Pfizer is focused on realized restructuring gains and repositioning its product portfolio. Unfortunately, Pfizer suffered a significant increase in restructuring expenses in the second-quarter that lowered the company’s profitability quite dramatically. In Q2’24, Pfizer generated only $0.01 per-share in earnings, an almost symbolic amount, compared to $0.41 per-share in the year-earlier period.

Pfizer

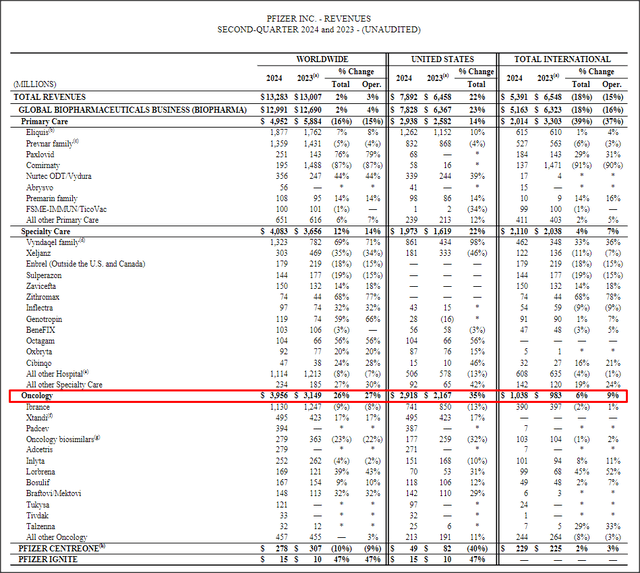

The revenue breakdown of Pfizer’s product portfolio shows that the company is struggling with its primary care division which generated $4.95B in revenue, showing a decline year-over-year of 16%. This product group includes Comirnaty, Pfizer’s mRNA COVID-19 vaccines, which saw a revenue drop-off of $195M (-87% Y/Y). The weakness in primary care products, however, has been offset by growth in one specific segment: oncology.

Oncology revenues amounted to $3.96B, showing 26% year-over-year growth. One of most successful oncology products in Q2’24, in terms of revenue contribution, are Xtandi, a medicine used for the treatment of four types of advanced prostate cancer, and Lobrena, a medicine used to treat adults with non-small cell lung cancer. These products achieved double-digit year-over-year revenue growth and Xtandi is now the second-highest revenue grossing oncology product in Pfizer’s portfolio, after Iberance, a breast cancer drug.

Together with a strict focus on cost controls, investment spending will be key for Pfizer to generate higher top line growth going forward… and potentially create a catalyst for Pfizer’s share price in the process. Investments in new products is paramount and management has guided to put $5.2B this year in R&D in order to boost the company’s pipeline.

Pfizer

Raised guidance for FY 2024

Pfizer guided for $2.45–$2.65 per-share in earnings for the current fiscal year, compared to $2.15–$2.35 per-share in Q1’25 and the pharmaceutical company raised its top line guidance as well, on strong expectations for its oncology products: Pfizer projects $59.5-62.5B in revenues in the current fiscal year, showing a $1.0B raise at both the low-end and the top end of guidance.

Pfizer’s valuation

Pfizer is currently trading at a 10.1X forward price-to-earnings, based off of FY 2025 estimated earnings. Pfizer is trading at a below-average earnings multiplier, likely because investors still need to see a reinvigoration of the company’s top line after the COVID-19 vaccine hit. The industry group I am comparing Pfizer to includes Sanofi (SNY), Bristol-Myers Squibb (BMY) and Astra-Zeneca (AZN). The average pharmaceutical company in this group has a forward price-to-earnings ratio of 11.4X, making Pfizer slightly undervalued: shares of Pfizer trade at an 11% discount to the industry group average P/E ratio.

In the longer term, assuming that Pfizer can reinvigorate its top line growth, expand on revenue gains in the oncology segment and can restructure its portfolio without cutting the dividend, I believe Pfizer could at least trade up to the industry group average P/E of 11.4X which implies a fair value of $32.60 and approximately 13%. Since shares are also currently priced at a 6% yield, investors could potentially realize higher returns. With a P/E ratio of just about 10X, I consider Pfizer to be a value stock as well.

| PFE vs. rivals | Share Price | Market Cap ($B) | FY 2025 Est. Earnings | FY 2025 P/E Ratio |

| Pfizer | $28.77 | $163.94 | $2.86 | 10.1 X |

| Sanofi | $57.03 | $142.91 | $4.95 | 11.5 X |

| Bristol-Myers Squibb | $50.15 | $101.27 | $6.99 | 7.2 X |

| Astra-Zeneca | $78.40 | $238.76 | $4.67 | 16.8 X |

| Average: | 11.4 X |

(Source: Author)

Risks with Pfizer

Pfizer is seeing some real momentum in its oncology business, but the overall revenue trend has not been great, in large part because of the widely discussed post-COVID cliff that is leading to lower product-specific revenues related to Comirnaty. If Pfizer fails to turn this revenue trend around and doesn’t gain control of its costs, then the pharmaceutical company’s shares may continue to languish. What would change mind about Pfizer is if the company were to lose oncology revenue momentum or what announce a dividend reduction in order to aid its restructuring efforts.

Final thoughts

Pfizer is a value stock with a forward P/E ratio of 10X and although the company faces real revenue challenges and cost pressures, I believe the market overall is way too negative and unconstructive about Pfizer. The oncology product portfolio looks promising and Pfizer is seeing some real growth and momentum here. Further, Pfizer is chiefly a capital return play with a 6% dividend yield and a history of growing its dividend. Investors that don’t look for a quick pay-off, have patience and are interested in collecting a growing dividend should take a second look at Pfizer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.