Summary:

- Starbucks has reached maturity, with declining per-store metrics since 2014, and the recent CEO change may take years to show results.

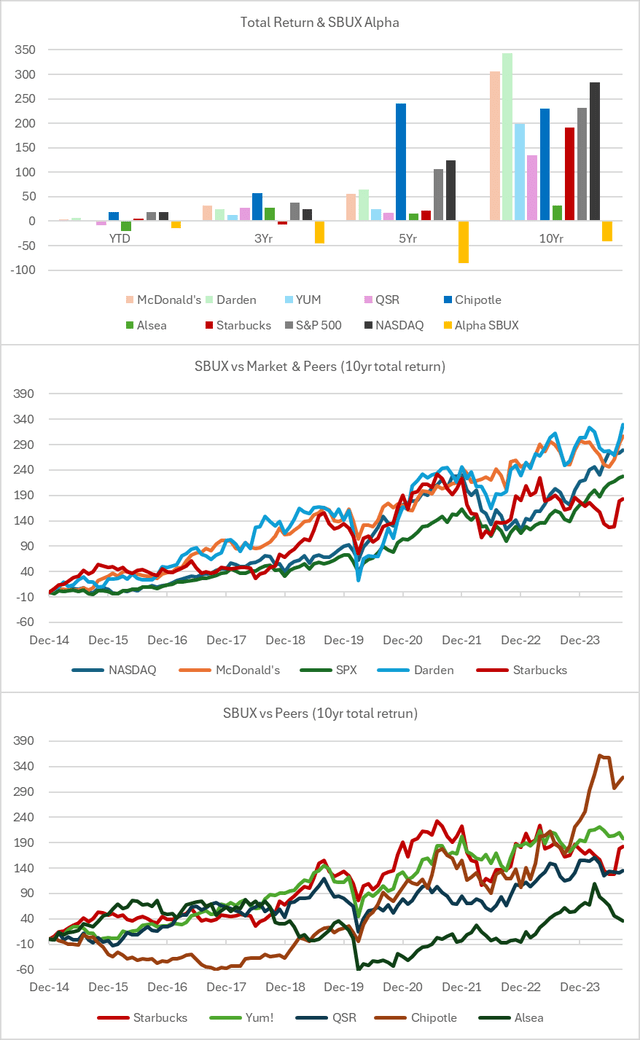

- Stock performance has stagnated since 2016, underperforming the S&P 500 and Nasdaq, highlighting poor relative returns.

- Consensus estimates seem overly optimistic without a solid brand revitalization or store restructuring plan, making current valuations unappealing.

- I rate SBUX a Sell due to execution risks in revitalizing demand and the lack of compelling upside in stock valuation.

martinrlee

Introduction

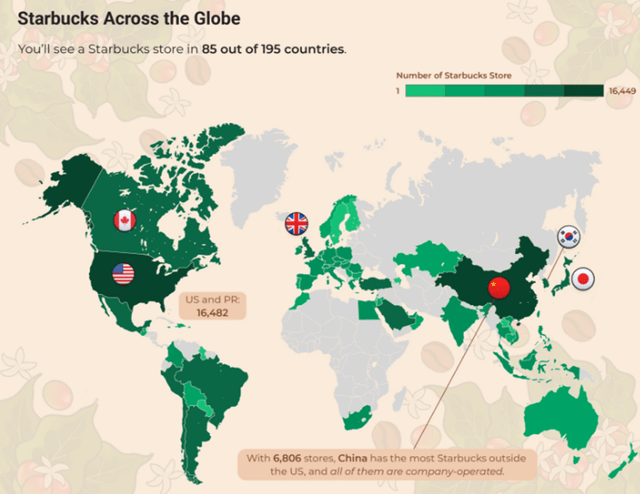

In the last thirty years, Starbucks (NASDAQ:SBUX) has become a symbol of American consumer culture, much like McDonald’s (MCD) and Levi (LEVI). The company posted consistently high growth as it built a network of stores in what seemed to be on every corner of every city in the US and internationally. However, the company hit maturity around 2014 and has been in an operating decline, with per-store metrics stagnating or falling; it could be cannibalization, saturation, or changing consumer habits that the company has not been able to revert. The recent CEO change, raiding Brian Niccol from Chipotle Mexican Grill (CMG), can lead to a revitalization of the brand and the company. However, this will be a show-me story that can take several years to materialize.

Stock Performance

From its IPO in 1995, the stock has been up 270x but stagnated from 2016 to 2018 and has been very volatile in the US$75-110 range since 2018. I compared the stock’s total return (with dividends) vs. the S&P 500 and Nasdaq, as well as several consumer peers, which highlighted the stock’s poor relative performance. The SBUX Alpha bar is Starbucks’ total returns less the SPX, which, across all time frames, shows sharp underperformance.

Created by author with data from Capital IQ

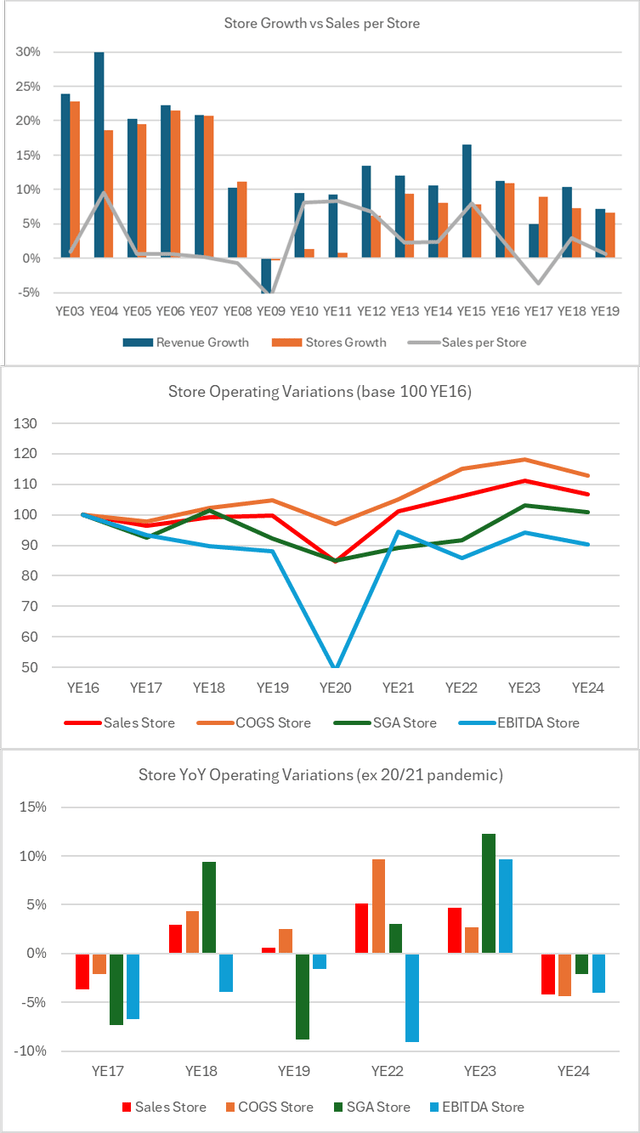

Store Metrics Under Pressure

The Starbucks business model has been built on significant new store growth with a rapid maturation time frame; that is, new stores reach sales/margin levels of the existing base in a short time frame and thus generate positive ROIC (return on invested capital). The model depends on satisfying and creating demand and not cannibalizing older store sales. This worked very well for most of SBUX´s history until it seemed the market reached saturation around 2016, and sales per-store and same-store sales (SSS) declined, leading to lower margins and a decline in EBITDA per unit as new and older stores saw increased costs (leases, wages, coffee, milk, etc.). The turnaround most likely requires a reduction in store growth and, more importantly, a revitalization of demand, driving more customer traffic and higher average tickets. This is not a quick fix and is fraught with execution risk.

Created by author with data from Capital IQ & Bloomberg Cafely.com

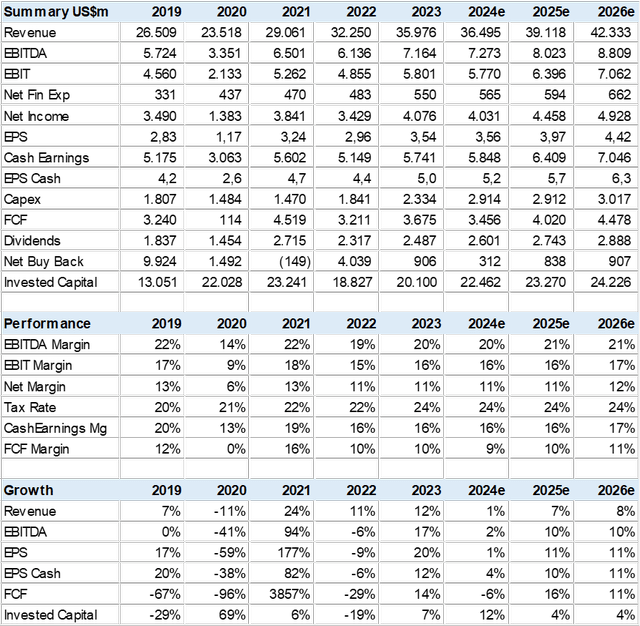

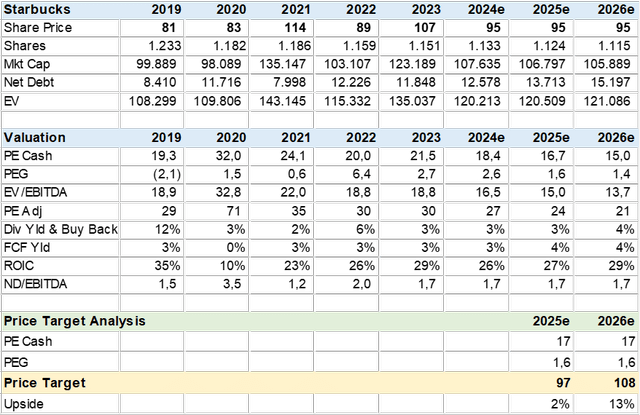

Consensus Estimates Seem Optimistic

I gathered consensus estimates from 29 analysts, and it seems the market is relatively positive, with revenue growth rebounding to 7% in 2025 (fiscal year starts in November 2024) with a modest pickup in margin but still high capex. This suggests that analysts are assuming the company’s same business model of high store growth can drive sales, while an SSS of 3% and some cost-cutting can lead to 10% EPS growth. In my view, this seems optimistic without a brand revitalization program or store restructuring plan by the new CEO. I sense complacency and hope in consensus estimates.

Created by author with data from Capital IQ

Valuation Is Not Compelling

Using consensus forecasts and the current 12-month price target, one can see that the market sees SBUX at fair value and incorporates a decent dose of optimism in estimates, as discussed above. The US$97 price target backs into an implied PE (cash) of 17x or 1.6x PEG, which is in line with the market. This does not produce a relevant upside, and the execution risk under a new CEO has not been factored in. I applied the exact multiple to 2026 estimates that produced a US$108 price target or 13% upside that does not seem compelling.

The company may need to post same-store sales above 3% to drive EPS growth and potential vacation increase. However, Starbucks is a relatively mature company, and in my view, multiples may not expand without a shift to higher dividends, buybacks, or some transformative M&A.

Created by author with data from Capital IQ

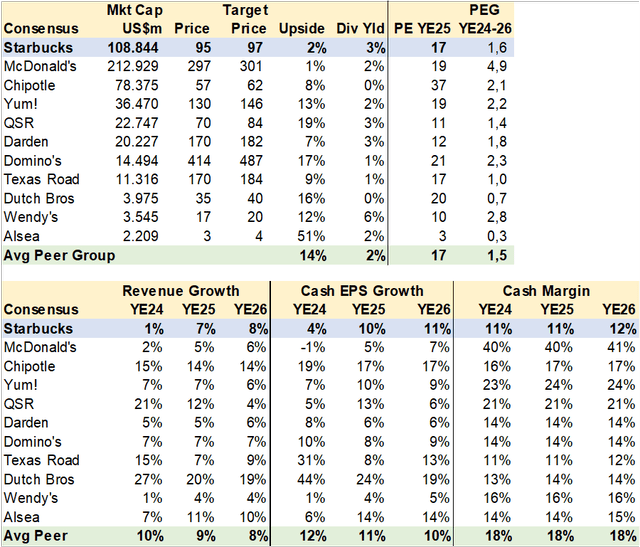

Peer Comps Under Impress

There are few comparables to Starbucks, perhaps Dutch Bros (BROS) or Alsea (OTCPK:ALSSF), the Latam Starbucks master franchise. At the same time, Chipotle seems to be the large-cap peer to beat. The consensus data suggest this sector is more mature, with solid, if not fantastic, cash margins and market SPX-like upside potential. Starbucks does not stand out as a value or growth stock.

Created by author with data from Capital IQ

Risk

The risk to a sell rating is that the company develops and executes a brand/demand revitalization strategy or embarks on a full transformation to utilize its store footprint, for which the market pays forward.

Conclusion

I rate SBUX a Sell. The company’s growth model based on store expansion may have reached its zenith, and the shift to increasing same-store sales or demand can take longer and is fraught with execution risk. At the same time, the stock valuation and forecasts are not compelling enough to take this turnaround risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.