Summary:

- Texas Instruments’ strategic expansion through $4.6 billion CHIPS Act funding will enhance production capacity, targeting high-demand sectors like automotive and industrial automation.

- Despite short-term revenue and EPS declines, TXN’s strong cash flow, consistent dividend growth, and capital discipline position it for long-term growth.

- The focus on 300mm wafer technology and internal manufacturing will reduce costs by 40%, providing a competitive edge over peers like Intel and TSMC.

- TXN’s premium valuation is justified by its growth prospects in the semiconductor sector, supported by government backing and advanced manufacturing capabilities.

wellesenterprises

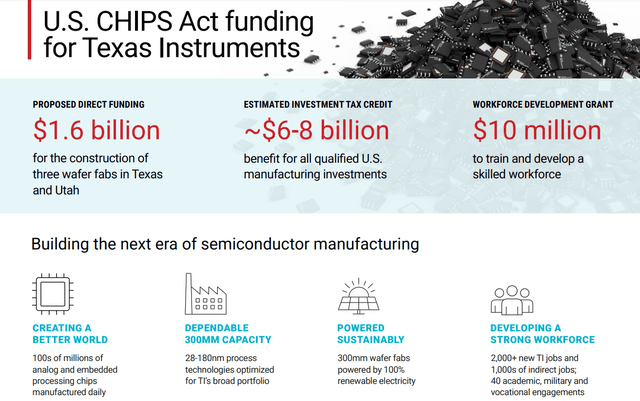

For years Texas Instruments (NASDAQ:TXN) has stood strong in the semiconductor industry thanks to its expertise in analog chips and embedded processors that give it a clear competitive edge. The company received $4.6 billion under CHIPS Act financing from the Federal Government to build three new semiconductor plants, a strategic expansion that could enhance its long term growth prospects.

I believe Texas Instruments presents a compelling investment opportunity, even with some recent short-term challenges. The company’s resilience through disciplined capital allocation and significant government support under the CHIPS Act position it well for long-term growth. I believe Texas Instruments leadership in analog chips and embedded processing markets and its commitment to returning value to shareholders through dividends will drive future gains.

In my opinion, the stock is currently trading at a premium, but the high valuation is justified given the growth opportunities in semiconductors and its increasing focus on internal manufacturing capabilities make it a solid candidate for a long-term horizon.

Expansion through CHIPS Act Funding

Texas Instruments is strategically scaling its semiconductor manufacturing capacity, particularly through the $4.6 billion CHIPS Act financing. This funding is for building three new semiconductor plants or “fabs” in Texas and Utah, which will increase the company’s production capacity significantly. These plants once they are operational are expected to produce over 100 million chips daily targeting high-demand sectors like automotive, industrial automation, and personal electronics. I believe this expansion positions Texas Instruments to capitalize on the increasing global demand for semiconductors, particularly in the rapidly growing sectors of automotive electronics and industrial automation.

U.S. Chip Act Funding For Texas Instruments (Texas Instruments)

Texas Instruments investment in advanced manufacturing technologies such as its focus on 300mm wafer production further strengthens its competitive position. By lowering per chip production costs by 40% the company is not only improving its margins but also ensuring it remains competitive in a cost sensitive sector. I strongly believe that this will be one of the key factors that fuels its long-term growth.

TI’s New 300mm wafer fab Manufacturing (Texas Instruments)

The three new fabs funded by the CHIPS Act Financing is a major expansion of the company’s manufacturing footprint. The first two plants in Sherman, Texas, they’re part of a larger complex that is expected to host as many as four plants meanwhile the third fab in Lehi, Utah, will sit right next to an existing facility. Once these fabs are fully operational which is expected by the end of 2025 Texas Instruments will have significantly boosted its ability to meet the growing demand for semiconductors particularly in automotive and industrial sectors.

This development is not just about increasing production capacity, It also represents a shift towards more sustainable manufacturing. The new fabs are designed with LEED Gold certification in mind and they’ll run entirely on renewable energy. In my opinion this positions Texas Instruments not only as a leader in manufacturing capacity but also in sustainability, which is becoming increasingly important in today’s business environment.

The Sherman, Texas fabs are expected to produce 100 million chips per day once fully operational, a production volume that will notably increase Texas Instruments market share in analog and embedded processing markets. These fabs will also enable the company to reduce its per-chip production costs by approximately 40% providing a clear competitive advantage in terms of both efficiency and scalability.

The fact that Texas Instruments plans to increase internal manufacturing to over 95% by 2030 demonstrates its focus on sustained resilience and supply chain security. This sets the company well against competitors that are more dependent on external manufacturing. I see this as a major factor that will drive stock performance in the coming years.

Financial Performance and Growth Prospects

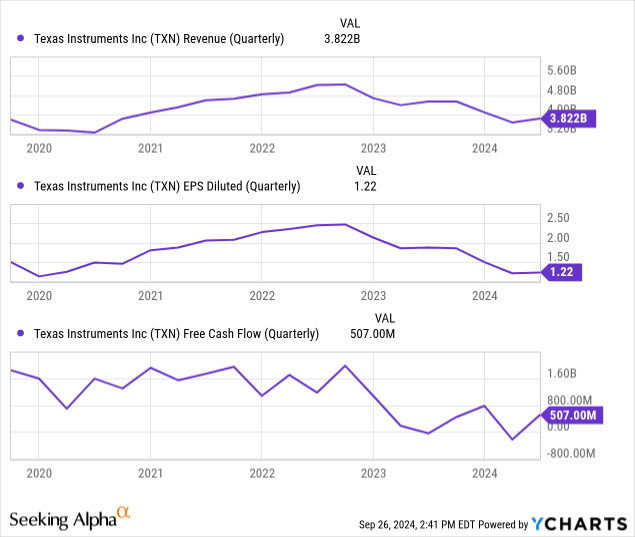

Texas Instruments has faced some Transitory challenges, as reflected in its recent earnings. For Q2 2024 it reported revenue of $3.82 billion, a 16% YoY decline and an EPS of $1.22, down 35% from the prior year. Free cash flow also dropped by 53%, raising some concerns about future shareholder returns.

These numbers are not encouraging, but I believe that the company’s investments in advanced manufacturing particularly in 300mm wafer production will lead to cost efficiencies and margin improvements over the next few years.

Looking at the financials, Texas Instruments continues to maintain robust profitability despite market challenges. In the second quarter of 2024 it reported $1.6 billion in operating cash flow and $507 million in free cash flow. Although this represents a decline from the previous year, they still managed to return over $1.1 billion to shareholders through dividends.

One of the standout factors for Texas Instruments is its ability to consistently generate strong free cash flow, which is a key driver of future growth. Texas Instruments has a strong track record of returning value to shareholders, with a dividend yield of 2.65% and an impressive streak of 21 consecutive years of dividend increases. Texas Instruments’ profitability metrics also remain solid. The gross profit margin stands at 59.36% and its operating margin is 32.55%, which are strong figures in the semiconductor industry. Moreover, its ROE is 32.04% highlighting efficient use of capital.

What stands out to me is the company’s focus on long term resilience, with operating cash flow totaling $6.45 billion over the last twelve months. But free cash flow has seen a decline because of the company’s increased capital expenditures which totaled $5 billion over the past year. These investments are vital to Texas Instruments’ long-term Advancement and align with its goal of reducing per-chip production costs and increasing output.

Comparing Texas Instruments with its Peers

In the highly competitive semiconductor industry, Texas Instruments holds a distinct advantage due to its focus on analog and embedded chips. Competitors like Intel (INTC) and Taiwan Semiconductor (TSM) are more focused on digital semiconductors particularly those used in data centers and PCs whereas Texas Instruments dominates the market for low power analog chips. This strategic focus positions Texas Instruments as a leader in sectors like automotive electronics and industrial automation areas that are expected to see substantial Rise over the next decade.

One of the most significant advantages Texas Instruments has over its peers is its focus on 300mm wafer technology, which reduces per unit manufacturing costs and improves overall production efficiency. Many of its competitors are still investing in 200mm wafer technology, which is less efficient. This technological advantage coupled with the new fabs in Texas and Utah will likely allow Texas Instruments to outperform its competitors in terms of both margins and production capabilities.

Texas Instruments has maintained a consistent track record of dividend growth and capital returns to shareholders, which is not as evident in some of its competitors. This consistency appeals to investors looking for both growth and income, setting the company apart in the crowded semiconductor space.

Valuation Analysis

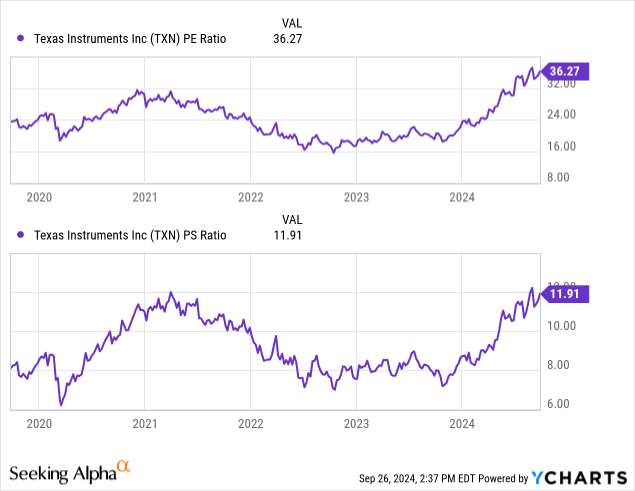

From a valuation perspective, Texas Instruments appears to be trading at a premium with a P/E ratio of 36.12 compared to the industry average of 26.47. But in my opinion, high valuation is justified by its extended growth trajectory in the semiconductor sector. If you had asked me a month ago, I would have said that TXN was overvalued given its P/E ratio of 36.12 which is above the industry average of 22.47. However, the recent developments, particularly the $4.6 billion backing from the U.S. government under the CHIPS Act along with the strategic expansion initiatives have fundamentally changed the valuation narrative.

The capital from the government allows TXN to expand its manufacturing capabilities notably increasing output while lowering production costs by 40%. This not only sets the company to meet the growing demand in high growth sectors like automotive electronics and industrial automation but also enhances its competitive edge in 300mm wafer production. With these developments in mind I now see TXN’s current price as reflective of its future potential, making the premium valuation reasonable.

The PEG ratio of 4.42 also reflects the higher growth expectations, especially as the new fabs become operational. Although the semiconductor industry is cyclical and subject to short-term volatility, TXN’s focus on high-growth markets like automotive electronics and industrial automation will provide a strong tailwind over the next decade.

Additionally, Texas Instruments has a (P/S) ratio of 11.91 which is relatively high compared to historical averages. But the company’s dividend yield of 2.65% and its consistent free cash flow generation support the higher valuation. Investors looking for a stable income stream alongside long term capital appreciation should find the current valuation attractive, despite temporary headwinds.

Risk Assessment

I am bullish on Texas Instruments, but The company is highly exposed to cyclical demand in the semiconductor sector and the current slowdown in the analog chip sector has resulted in a 15.6% YoY decline in quarterly revenue. If this trend carries on it might make it harder for the company to hit its near term financial goals.

Another major risk comes from increased competition in the semiconductor space. Companies like TSMC and Intel are also investing heavily in their manufacturing capabilities, which could erode Texas Instruments’ competitive advantage over time. Additionally, macroeconomic factors such as inflation and potential recessions could negatively impact demand for the products particularly in cyclical sectors like automotive and consumer electronics.

Moreover, Texas Instruments has increased its debt levels to $13.89 billion, which raises concerns about its ability to manage its liabilities during periods of slower revenue growth. Although it has a strong cash position of $9.69 billion, the high level of debt could constrain its flexibility in future downturns.

However, the company’s aggressive R&D investments and capital expenditures indicate a clear focus on sustained growth prospects. I believe Texas Instruments ability to navigate through this period will hinge on how well it executes its manufacturing expansion and keeps innovating in its key markets.

Bottom Line

I believe Texas Instruments represents a compelling long-term investment opportunity despite the short-term challenges in the semiconductor sector. Its $4.6 billion in CHIPS Act financing and focus on 300mm wafer technology will significantly boost production capacity and reduce costs, positioning TXN for sustained growth in critical sectors like automotive electronics and industrial automation.

While revenue and EPS declines in 2024 may raise concerns, TXN’s strong cash flow, consistent dividend growth, and capital discipline offer a solid foundation for future growth. For investors seeking value in the semiconductor industry Texas Instruments is well worth considering. I expect its stock to perform well in the years ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.