Summary:

- Tesla’s stock has rebounded strongly from April to July 2024 but faces resistance at $271, leading to a downgraded “hold” rating.

- Q2 2024 earnings missed expectations due to a 7% drop in auto sales and a 45% decline in net income.

- Positive revenue growth in energy storage and carbon emission incentives are positives, but EV sales lag competitors, necessitating stabilization before a “buy” rating.

- The upcoming Cybercab Robotaxi event could impact stock, but near-term resistance levels suggest maintaining a “hold” rating for now.

Monty Rakusen

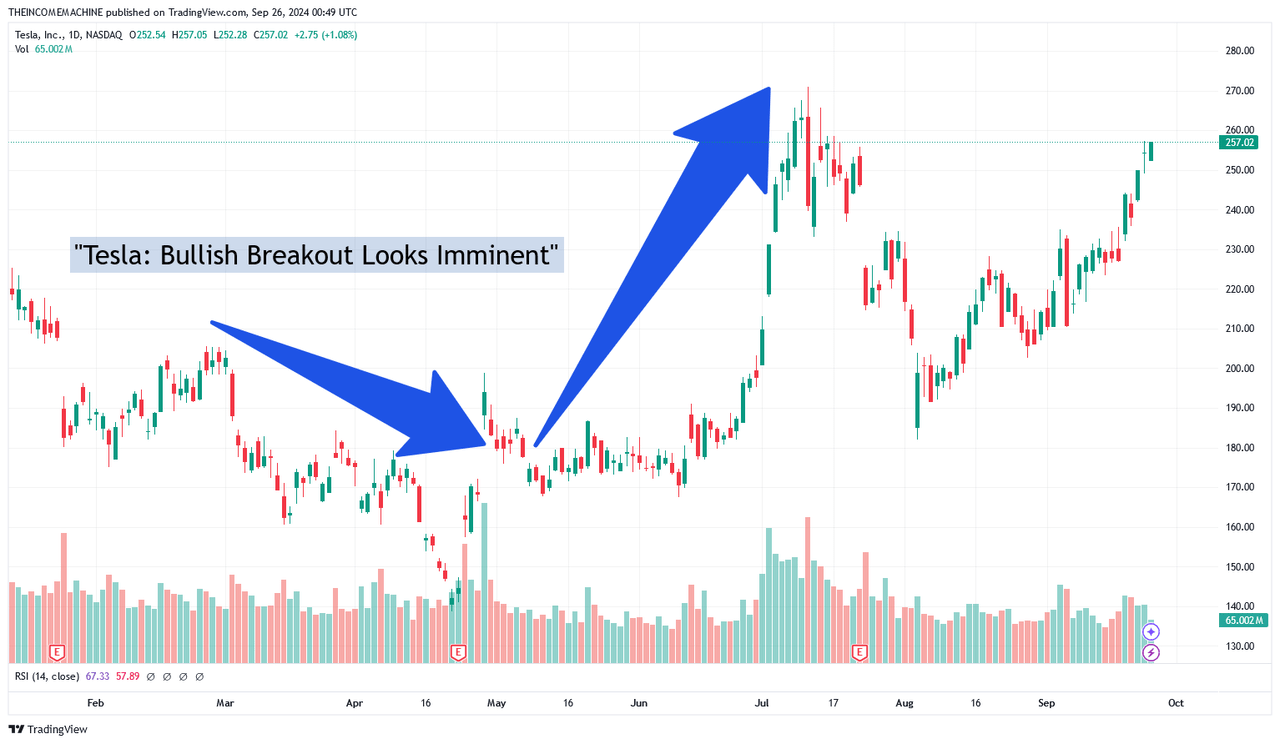

When I last covered Tesla, Inc. (NASDAQ:TSLA) with “Tesla Stock: Bullish Breakout Looks Imminent” on April 30th, 2024, the stock was caught within the midst of a massive downtrend that had actually seen losses of over -66.5% during the prior 17 months. Under these heavily bearish circumstances, offering the suggestion that Tesla was likely on the verge of a significant bullish break risked being met with a healthy dose of skepticism in the comment section of the article (which did, in fact, occur). However, share prices quickly managed to stabilize in the upper $160s and the stock soon rallied to highs above $270 per share (ultimately, generating gains of over 48.2%) by July 11th, 2024. At the time of writing, Tesla shares are currently showing returns of 38.73% while the S&P 500 (SP500) is still trailing far behind with returns of just 13.85%.

TSLA: Daily Price Chart (Income Generator via TradingView)

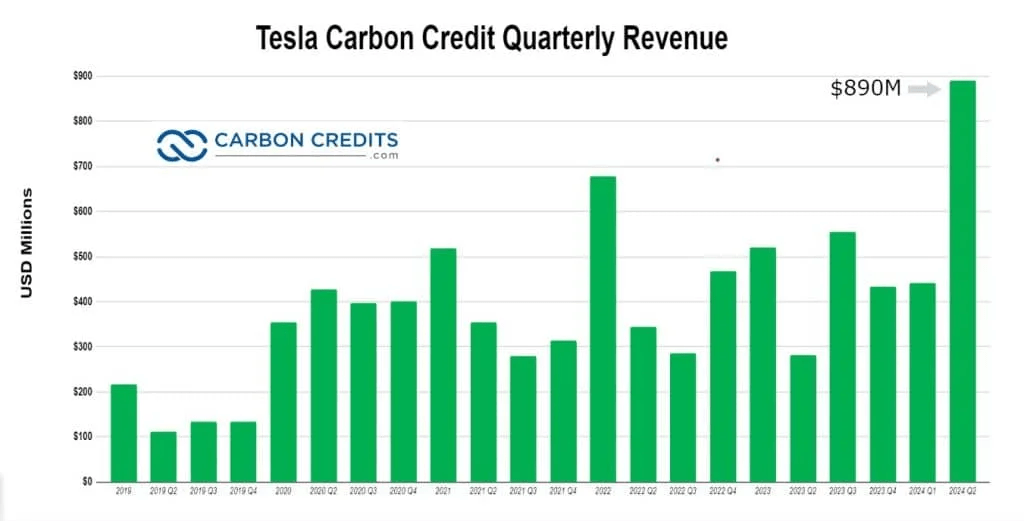

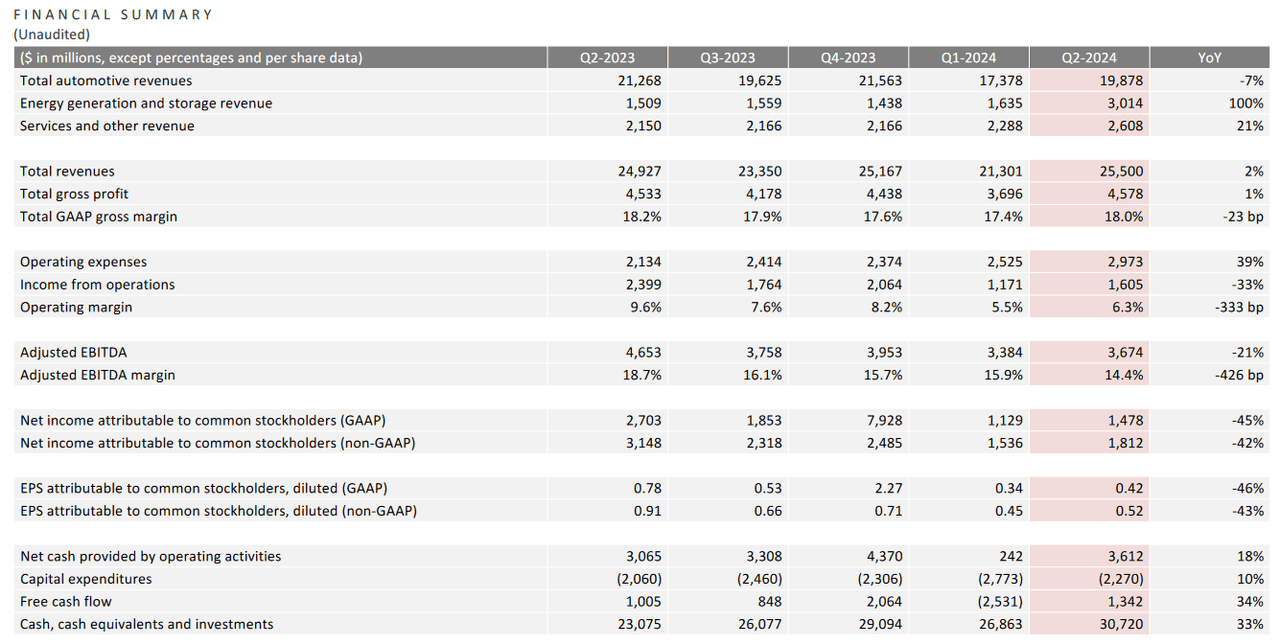

Since I last covered the company, Tesla has released earnings figures for the second quarter period in 2024 and my assessment of this development has been quite mixed. On the negative side, we can see that auto sales continued to drop (maintaining the new trend that began during the prior quarter) and this was a major driver in Tesla’s inability to match consensus earnings expectations. Specifically, auto sales posted declines of -7% (at $19.9 billion versus $21.27 billion recorded during the same period in 2023). But it should also be noted that Tesla’s auto sales revenue was supported by a record $890 million in regulatory credits, which was more than three times the amount seen in 2023.

Tesla Carbon Credit Quarterly Revenue (Carbon Credits)

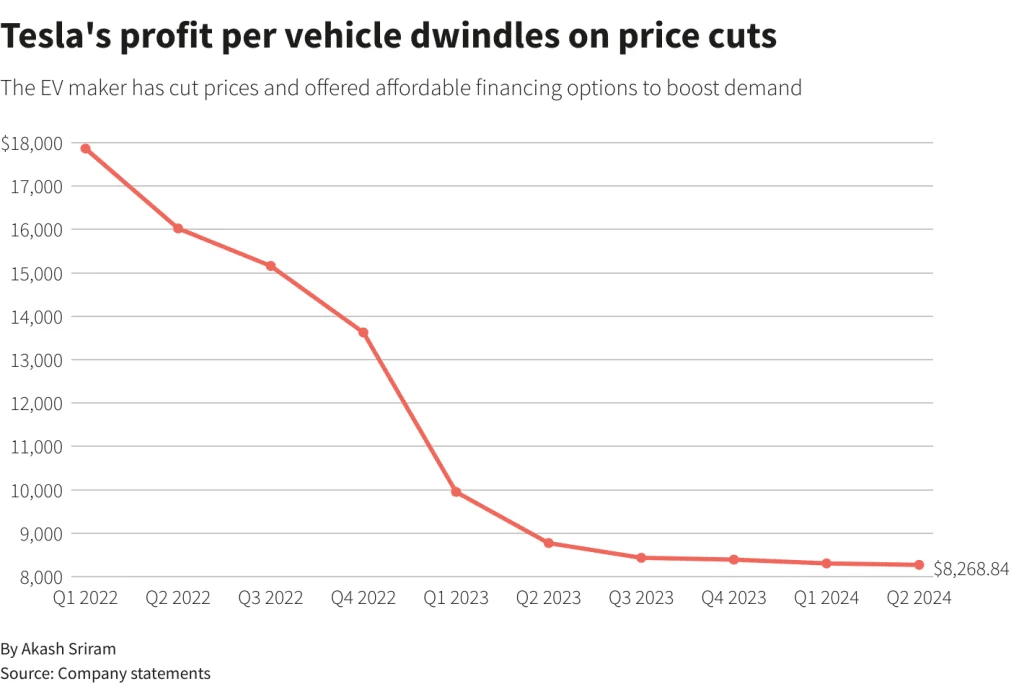

Ultimately, general weakness in auto sales placed pressure on Tesla’s quarterly earnings performances, with the company recording adjusted per-share earnings of $0.52 (falling well short of the average estimates calling for $0.62 per share). Significant declines were also seen in Tesla’s net income figures, which were lower by -45% relative to the 2023 figure of $2.7 billion (coming at $1.48 billion). In part, this weaker performance was impacted by subsidized financing arrangements and other discounts that were made available both in the United States and China to reinvigorate consumer demand. As a result, earnings margins (adjusted) saw sizable declines from the 18.7% figure recorded in Q2 2023 (coming in at 14.4%).

Tesla’s Profit Per Vehicle (Reuters)

On the positive side, Tesla’s total revenue figure did see gains of 2% (at $25.5 billion) and this did help the company surpass market expectations calling for $24.77 billion in total revenues. Of course, it should also be noted that Tesla continues to competitively outperform within the industry as a whole in terms of the company’s ability to meet carbon emission requirements (ultimately resulting in that attractive $890 million incentive).

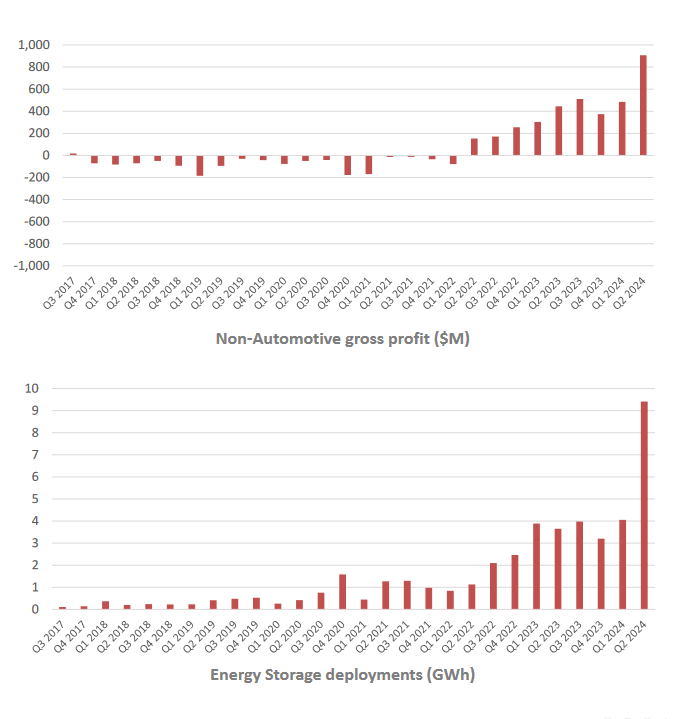

Additionally, revenues from the energy storage/generation segment surpassed the $3 billion mark for the quarter. This is nearly two times the figure that was recorded in Q2 2023, and this makes it apparent that Tesla’s Powerwall and Megapack products are really starting to generate positive momentum in demand from both residential and commercial customers.

Tesla Energy Storage Deployments (Tesla Quarterly Earnings Presentation)

Despite the positive aspects we’ve seen in Tesla’s most recent quarterly report, markets have failed to respond in a bullish manner, with the stock trading higher by just 3.46% on a YTD basis. Unfortunately, this underperformance pales in comparison to the attractive 22.46% return that has been generated by the NASDAQ Composite Index during the same period of time. Of course, a well-placed trading call has the power to surpass the returns under all of these circumstances. However, the stock’s recent inability to overcome near-term resistance suggests that TSLA shares could encounter difficulties in an attempt to overcome a major resistance zone that currently rests at $271 per share.

Tesla Second Quarter Earnings Figures (Tesla Quarterly Earnings Presentation)

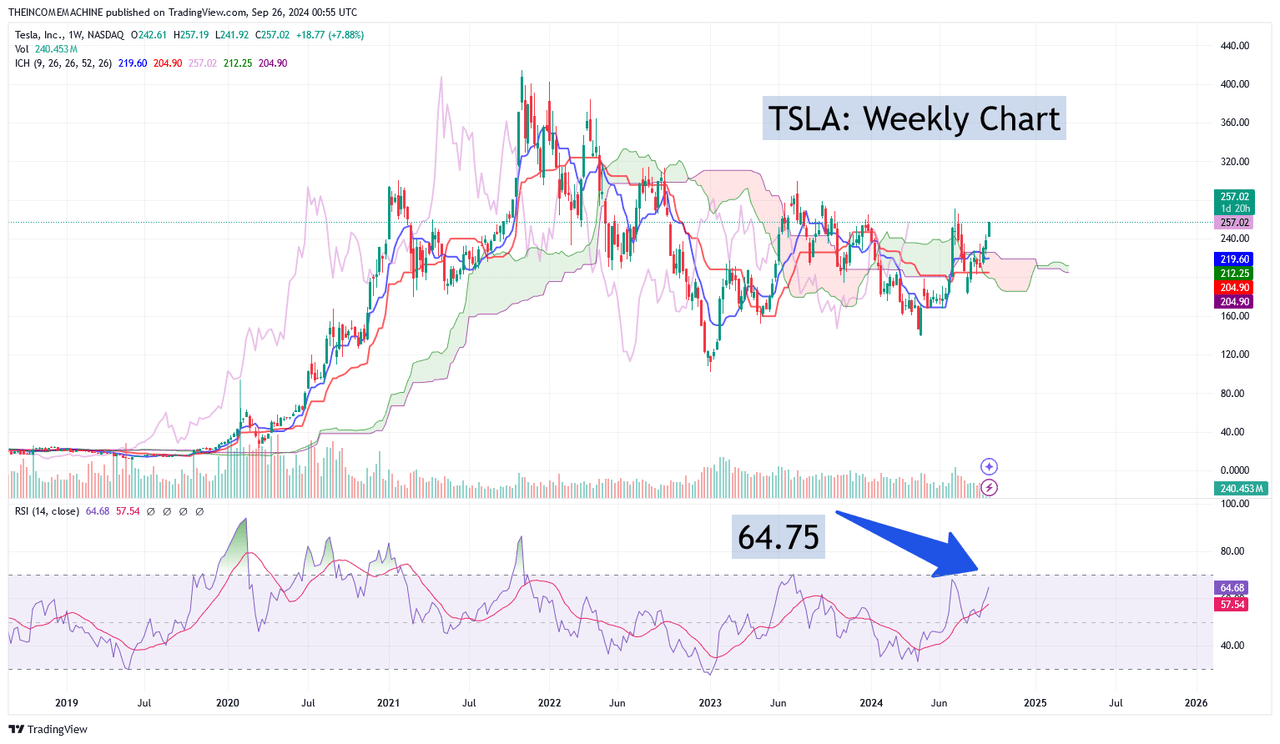

Currently, momentum readings on both the daily and weekly time frames have started to improve with bullish conditions holding in place and the relative strength index (on both of these time frames) is now resting above its exponential moving average. However, readings in the relative strength index on the weekly price charts currently rest near 64.75 which suggests that share prices might not have much room to extend to the topside before becoming overbought. Furthermore, chart readings in this indicator are even more extreme when viewing the stock from the perspective of the daily time frame.

TSLA: Weekly Price Chart (Income Generator via TradingView)

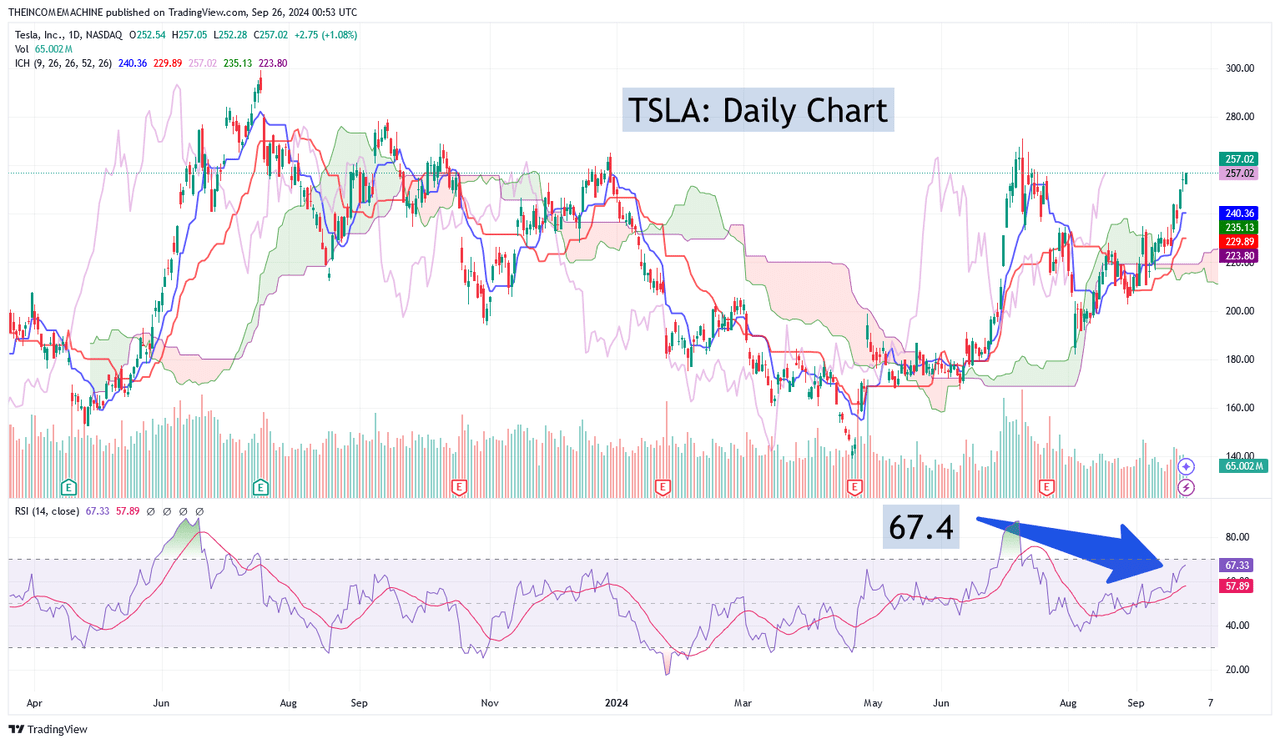

Specifically, daily readings in the relative strength index currently rest at 67.4. This indicates that markets would only need to see a small move to the topside to receive technical signals suggesting that the current uptrend is becoming overextended. Remember, any reading over the 70 level in the relative strength index will start to send “overbought” signal readings on a specific time frame. So, when we assess these combined indicator readings (on both the daily chart and weekly chart) with the fact that share prices are currently trading less than 5.2% below the stock’s next major resistance level (July 11th, 2024 highs of $271), it becomes much more difficult to maintain a “buy” rating for this stock near term.

TSLA: Daily Price Chart (Income Generator via TradingView)

Another factor that should be considered is the positive sales trend that Tesla’s key competitors like Ford, Cadillac, and Kia have been able to generate during the first half of 2024. Specifically, EVs sold by Tesla competitors have seen sales surge by 33% during this six-month period, and this presents a stark contrast with the Tesla performances that have been seen during this same period. During the first six months of 2024, Tesla saw comparable EV sales decline by -9.6%.

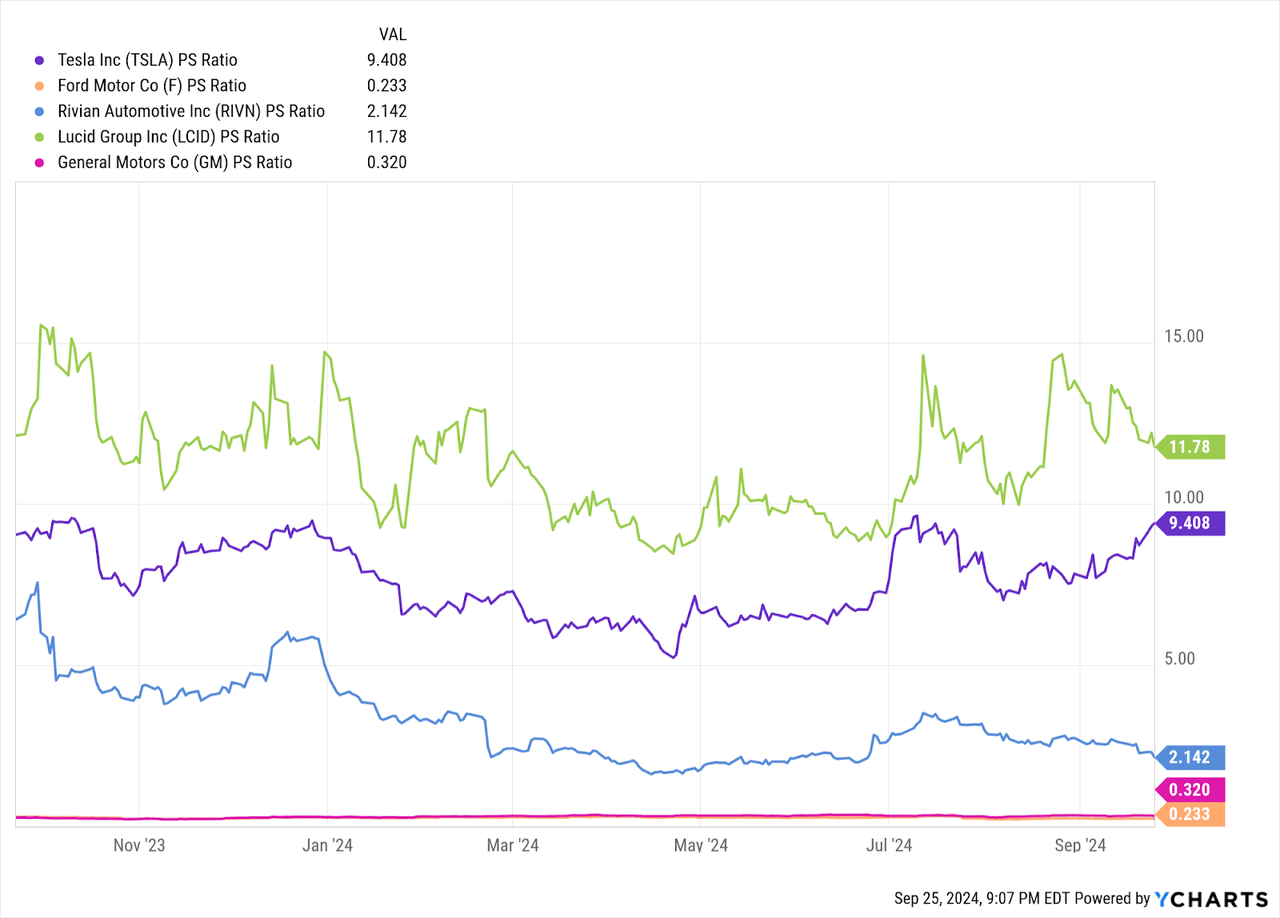

I will need to see some stabilization within this worrisome trend before I can once again raise my analysis rating on Tesla, Inc. stock back into the “buy” category. Currently, Tesla’s price-sales ratio is holding well above Ford (F), Rivian (RIVN), and General Motors (GM), and we would have to actually look to Lucid (LCID) to find a comparable stock that is currently trading with a higher P/S metric. So, when we combine all of these factors, I think it makes the most sense to downgrade by analysis rating from “buy” to “hold” for this stock.

Comparative Price to Sales Valuations (YCharts)

Of course, CEO Elon Musk is arguably the most creative visionary on the planet – and there is always the possibility that something as simple as one of his comments can send share prices moving rapidly (in either direction). One event that has the potential to change this diminishing performance outlook for Tesla might be found in the Cybercab Robotaxi event that currently is scheduled for October 10th, 2024.

If investors walk away from the event with the sense that their investments will be rewarded with new (and significant) growth opportunities, we could see share prices continue moving higher. However, given the stock’s current proximity to near-term resistance zones, I do not recommend buying this stock heading into this event risk and will instead maintain my “hold” rating for TSLA. On the price charts themselves, an upside break through the next major resistance zone (at $271 per share) would alleviate portions of this cautious stance because a technical event like this could lead to an acceleration of upside momentum (as stop losses from short positions will likely be tripped). If this occurs, I will revisit my current stance and update readers with a new outlook for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.