Summary:

- We believe that Apple’s AI upside is overblown.

- Our valuation model shows that Apple’s shares are greatly overvalued after the latest rally.

- Apple’s stock is a SELL for us.

Anson_iStock

The meteoric rise of Apple’s (NASDAQ:AAPL) stock to its all-time high levels this summer was possible primarily thanks to the announcement that the company is entering the generative AI business with the upcoming launch of Apple Intelligence, which reignited investors’ confidence. This is certainly a positive development for Apple, which did not have any major AI-related products before in comparison to its Big Tech peers like Microsoft (MSFT) and Google (GOOG)(GOOGL), which have been actively involved in the development of their own generative AI tools and platforms for over a year already.

The problem for Apple and its investors is that due to the certain regulatory rules Apple Intelligence is not expected to be launched in the European Union and China, which are major markets for the company. This could mean that the AI upside is overblown since there are not enough reasons to believe that Apple’s AI-related products will be able to offset the underperformance of some of the company’s other businesses and justify the current market price. This is why we believe that the momentum from the recent rally is likely to be short-lived since the downside to Apple’s shares right now is significant in our opinion.

AI Won’t Save The Day

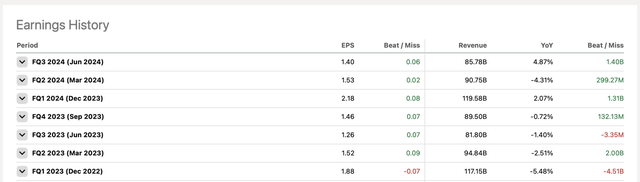

For a while, Apple struggled to revive growth and create shareholder value. In five of the last seven quarters, Apple reported a Y/Y decline in revenues, which indicated a lack of growth for the business and prevented its shares from appreciating above the technical resistance level of $200 per share.

Apple’s Latest Earnings (Seeking Alpha)

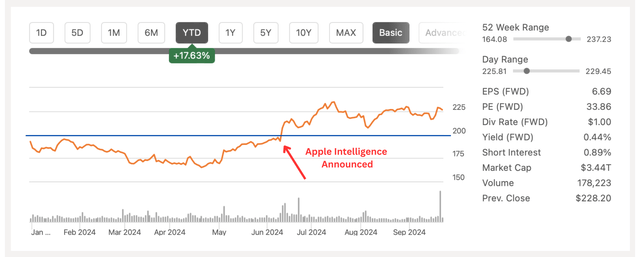

The situation with the underperforming share price has been partially resolved in early June. Back then Apple announced that it planned to enter the generative AI industry by launching Apple Intelligence, which is an AI assistant that can do various tasks across the user’s device similar to Microsoft’s Copilot AI assistant. Thanks to this announcement, the shares have finally broken the $200 resistance level and currently trade above that level.

Apple’s stock performance (Seeking Alpha)

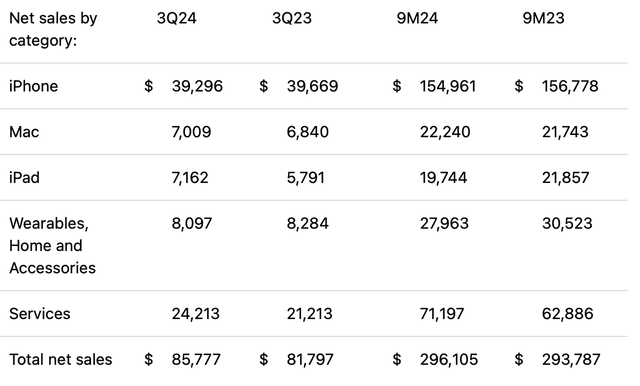

Despite the appreciation of shares, the issues with the growth of the underlying business remain. In August, Apple released its earnings report for Q3 which covers the period from April to June. That report showed that while the overall revenues increased by 4.9% Y/Y to $85.8 billion, Apple’s biggest iPhone business experienced a decline in sales due to the rising challenges in China that will be discussed later in this article.

While Mac and iPad revenues were up Y/Y in Q3, the growth came primarily from the releases of new laptops and tablets that came out in March and May, respectively, and gave an overall boost to sales. It’s possible that in Q4 and beyond the Mac and iPad sales might slow down or even decline Y/Y like it happened with Apple’s Wearables segment, which underperformed in Q3 even though the company’s Vision Pro headset came out in February, as the demand subsided a few months after the launch. At this point, the services business is likely the only business that has the opportunity to perform well in the future. However, it still doesn’t justify a major appreciation of Apple’s shares in recent months, especially since nobody really knows how much additional revenue Apple Intelligence will bring over the coming quarters.

Apple’s Performance in Q3 (Seeking Alpha)

Apple Intelligence itself is expected to launch only in October and only as a beta version, so the appreciation of the company’s shares by a significant percentage doesn’t make a lot of sense to us.

What is more important is that Apple Intelligence is not expected to be available either in the European Union or in China. In Q3, Apple was able to generate 25.5% and 17.2% of sales from the European Union and Greater China, respectively. Without launching Apple Intelligence in those two markets, there’s a risk that the upside from the company’s generative AI platform will be insignificant.

The reason behind the inability to launch Apple’s intelligence in the European Union is due to tougher antitrust regulations. This makes it harder for the firm to launch its innovative products there, especially after the company was designated as a gatekeeper by the European Commission. At the same time, Apple recently lost an appeal in the European Court of Justice, where it fought against the tax ruling of the European Commission that was imposed against the company, and now must pay $14.4 billion in back taxes. Considering such a regulatory environment in Europe, there’s a possibility that we won’t see the launch of Apple Intelligence in Europe anytime soon.

When it comes to the Chinese market, Apple is still looking for a partner, which could help it bring Apple Intelligence to China. Beijing currently requires businesses to get approval from the state before launching their own AI assistants and chatbots. Considering the strained Sino-American relations, there’s a possibility that Apple Intelligence will also not be available in China in the foreseeable future.

However, even if Apple manages to find a partner to launch Apple Intelligence in China, there’s a risk that the upside from such a launch will be insignificant. In recent quarters, Apple has started to lose its dominant position in the Chinese market. While the smartphone market in China has grown 10% Y/Y in the recent quarter, the five biggest phone manufacturers were local brands such as Xiaomi, Huawei, and others. The overall decline in iPhone sales in Q3 was primarily caused by the weakness in China. At the same time, Apple’s latest iPhone 16 already sells at a discount in China, which might signal trouble for the company in the Chinese market.

One of the advantages of local brands over Apple is that their generative AI tools are already available to Chinese customers. Since the United States plans to further curb China’s access to AI software and recently proposed new restrictions, it’s hard to see how Apple will be able to quickly find a way to launch Apple Intelligence in one of the biggest consumer markets in the world.

As a result, the momentum that Apple’s shares gained after the announcement of Apple Intelligence could be short-lived, as the upside for the underlying business could be insignificant given that the AI assistant won’t be available in Europe and China anytime soon.

Risk to Our Bearish Thesis

There are a number of risks to our bearish thesis. To this day, the United States is still the single biggest market for Apple, which generated 43.9% of total sales in Q3. Even if Apple Intelligence won’t be available in Europe and China, the company will still be able to benefit from the upgrade cycle in the United States since its new AI tools will be available only to the newest iPhones and laptops from the M series.

The initial sales of iPhone 16 indicate that the current upgrade cycle will be significant and could even offset the loss of potential revenues in other regions where Apple intelligence is not available for now.

Apple’s service business is also going to continue to perform well and could also offset the potential losses of other businesses. In the latest conference call, Apple’s management said the company already has over 1 billion paid subscriptions across its devices, and the service revenues are expected to grow at double digits.

Finally, the US economy remains resilient and could receive an additional boost from the recent interest rate cuts that will make the cost of borrowing cheaper for businesses and consumers.

All of this could fully or partially undermine our bearish thesis.

The Fair Value of Apple

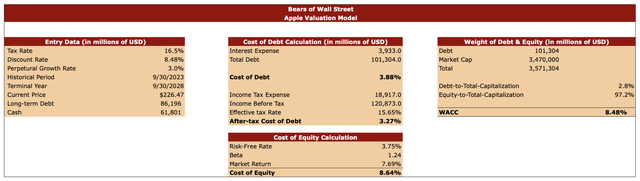

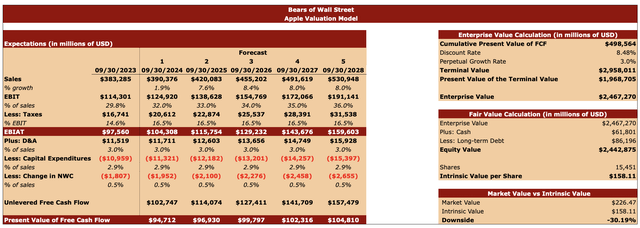

Our valuation model intends to figure out what is Apple’s intrinsic value considering all the risks and opportunities. The tax rate in our model is 16.5%, which is what the company’s management guided in the recent conference call. The discount rate in the model is 8.48%. To calculate it, we figured out Apple’s after-tax cost of debt and the cost of equity. To find out the cost of debt, we used Apple’s TTM data. For the cost of equity, we used a risk-free rate of 3.75%, which is the yield of the 10-year Treasury note at the time of this writing; a beta of 1.24; and the market return rate of 7.69%.

The perpetual growth rate is 3%, which aligns with the historical GDP rate. Apple’s market price at the time of creating the model was $226.47 per share. The long-term debt and cash data is used from the latest earnings report.

Apple’s Valuation Model (Bears of Wall Street)

The sales growth rate in our model is close to the street’s consensus. We will likely see a boost in sales in FY25 that starts in October of 2024 thanks to the growth of the service business, a boost from iPhone 16 sales, and the upside from Apple Intelligence in the United States. The momentum could last until FY26, after which the growth rate will likely start to normalize as growth catalysts could subside and major risks begin to outweigh growth opportunities.

The EBIT rate in the forecast is the same as in recent quarters. The tax rate is 16.5%, and the assumptions for other metrics are the same as in the previous year.

Our forecast helped us figure out Apple’s enterprise value, which is $2.47 trillion. After adding cash and subtracting long-term debt, we figured out Apple’s equity value, which is $2.44 trillion. This helped us figure out Apple’s fair value, which is $158.11 per share. As such, Apple’s shares after the latest rally are overvalued by 30%.

Apple’s Valuation Model (Bears of Wall Street)

Overall, while Apple has growth catalysts and will be growing, the upside from Apple Intelligence is likely to be limited and the recent rally could be short-lived.

Final Thoughts

We believe that while Apple has enough growth opportunities that it can monetize in the future, the upside from Apple Intelligence could be overblown due to the inability of the company to launch it in the European Union and China anytime soon. In addition, the loss of market share in China could also undermine the company’s ability to aggressively scale its business. Given this, we believe that Apple is overvalued at the current price and its stock is a SELL for us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.