Summary:

- Caesars Entertainment, Inc. is tackling significant debt while showing strong performance in Vegas and digital sectors, but valuation concerns and lack of dividends warrant cautious optimism.

- The company’s history of ambition and expansion has led to a heavy debt load, which it is actively working to reduce through strategic initiatives.

- Despite impressive growth in digital and Vegas markets, the high P/E ratio and debt-to-capital ratio suggest Caesars Entertainment stock is overvalued.

- I rate CZR as a ‘Hold’ due to debt concerns, no dividends, and valuation issues, despite potential for future growth and operational improvements.

Nancy C. Ross/iStock Unreleased via Getty Images

Thesis

My analysis argues that although a key part of the Caesars Entertainment, Inc. (NASDAQ:CZR) story is a history of hubris and a litany of triumphs, today’s reality is more complex. Vegas and the digital world are going gangbusters, but a shadow hangs over the company—a mountain of debt and a sticky valuation for which there appears to be no reasonable justification. The company is positioning for the future, trimming the debt load, and chasing the very high-margin businesses like parlays. Until that dust clears, however, it’s cautious optimism all the way.

About Caesars Entertainment, Inc.

Caesars Entertainment, Inc. is one of the world’s big players in gaming and hospitality, and it’s all because of Bill Harrah. Born in 1911, Harrah is considered the godfather of modern gaming. He started off in 1937 with a humble bingo joint in Reno, Nevada, went on to open spots in Lake Tahoe and Las Vegas, and built a major casino empire along the way.

Harrah’s was the first casino to go public in 1971, a move that showed Bill’s commitment to running a legit and above-board operation to steer the public perception away from the sinister gangster operations common at the time. He also played a key role in setting up the Nevada Gaming Control Board, cleaning up the state’s casino scene and shaping what we know as the modern gaming industry.

It owns properties—icons, really—that operate under the brands of Caesars Palace, Harrah’s, Horseshoe, and Tropicana, among others. Following its 2005 merger with Harrah’s Entertainment (Harrah’s bought Caesars for $1.87 billion in cash and $3.27 billion in stock, while also assuming $3.86 billion of Caesars’ debt), the company expanded across the country, and in 2020, Eldorado Resorts saw the potential (with an $8.5 billion price tag), took the reins, and adopted the Caesars name, cementing its status as synonymous with global gaming dominance.

CZR’s Performance

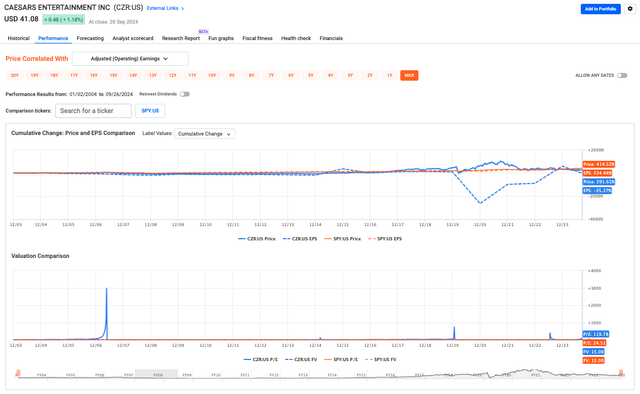

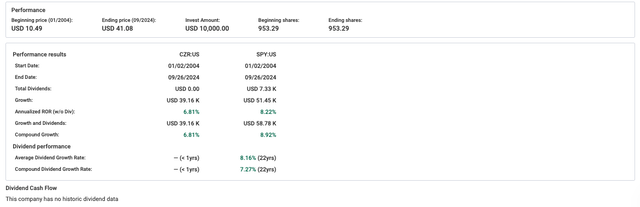

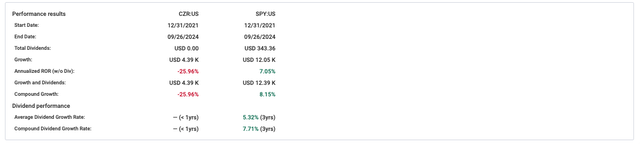

CZR isn’t a stock for income-focused investors: it hasn’t paid dividends, unlike the broader market (SPY), which has not only been consistent with payouts but has also grown them by over 13% annually in the past 20 years. So if you’re after steady income, CZR’s lack of yield is a dealbreaker.

From a price appreciation standpoint, CZR has delivered decent returns — since 2007, it’s had an annualized return of 7.38%, but that still lags SPY’s 8.24%. When factoring in dividends, the gap widens: a $10K investment in CZR has grown to $35.32K, but SPY has delivered over $46K with dividends included, which is why, for conservative long-term holders, dividends matter for long-term growth.

However, newer investors in the post-COVID recovery era have had much worse luck, with the stock suffering a 26% annual loss compared to the broader market.

Halfway through the month, CZR’s short interest was 7.87%, suggesting a fair amount of doubt about the stock, but I don’t think it’s as worrisome as, for instance, Super Micro (SMCI), American Airlines (AAL), and Etsy (ETSY) — all with higher short interest.

Financial Performance

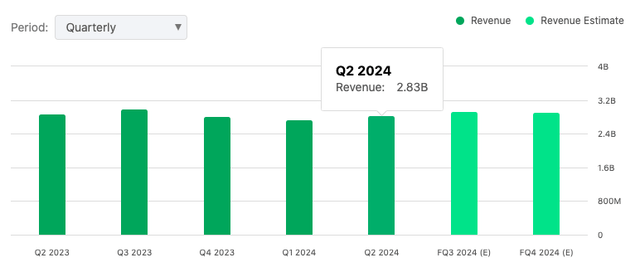

Given these issues, the company’s financials probably explain its challenges better than anything else. Company-wide revenue hit $2.8 billion, and adjusted EBITDAR was $1 billion, essentially flat year over year. The regional segment was soft, with adjusted EBITDAR declining 8% to $469 million. Increased competition (new properties coming into markets like Reno and Terre Haute), disruption caused by ongoing construction at its rebranded local property, Caesars New Orleans, which is part of a $430 million investment project, and difficult comps drove the segment’s decline, which also led to a 100-basis-point decrease in regional EBITDA margins. Overall, these losses amounted to $25 million, and management indicated that they will continue to affect Q3 results, signaling potential further declines.

Future Growth Prospects

On the flip side, when construction in New Orleans is all wrapped up, gaming revenue is projected to rise by $80 million. A new property in Virginia will open later this year, spurring the rise to better growth.

Though Las Vegas faced headwinds, including higher union contract costs and delays in bringing some restaurants that were still under construction last year up to speed, the quarter was decent, with Caesars increasing revenue. Overall, hotel renovations have been particularly productive, especially at the Versailles Tower, where room rates were up 60%. The outlook for the rest of the year is strong, with continued growth expected for both Las Vegas and the company overall into 2025.

Debt Reduction Progress

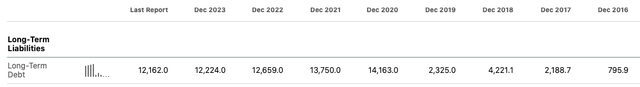

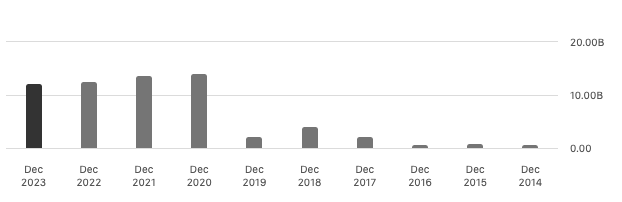

Long-term debt winding down from 2020 highs (Seeking Alpha)

Caesars is a name built on ambition, on expansion. But ambition comes with a price, and right now, that price is an enormous debt load of around $12.162 billion, which it is trying to reduce. More than $100 million was paid off during the quarter, and the company continues to work to further reduce its debt burden.

Debt slowly coming down. (Seeking Alpha)

With the heavy lifting in the capital expenditure (CAPEX) cycle winding down after its 2020 merger and following several major projects, capital investments are expected to decline by over $500 million. The completion of the Virginia property is also expected to give some much-needed breathing room, boosting free cash flow, aiding in further debt reduction, lowering leverage, and possibly enabling stock buybacks as part of the company’s broader financial strategy.

With debt coming down, leverage shrinking, maybe, just maybe, there’s enough room to think about stock buybacks. Although Caesars has not officially committed to a buyback program (they said they’ll buy back stock if the current market undervalues the shares) its improved operations—particularly in the Las Vegas market and digital sectors—could signal the possibility, which, in turn, raises more questions about the pace of leverage reduction.

Marketing and Promotion Savings

At the same time, Caesars might find itself making savings in marketing optimization or through drives to reduce its wasteful promotion spending. This is a strategy that Eric Hession — President, Caesars Sports and Online Gaming called a “peanut butter spread approach” which should help boost both margin and EBITDA growth, especially in the digital space.

Meanwhile, while Caesars is fighting to climb out from under a mountain of debt, Illinois comes along and slaps on a new progressive tax on sports betting. The state’s new progressive tax on sports betting revenues hits operators like Caesars hard, with rates up to 40% for top earners. This could bleed Caesars around $5 million a year, squeezing its margins. Moreover, digital sports betting volumes haven’t budged; they’re flat as a poker table, raising questions about long-term growth.

Focus on High-Margin Products

Even so, Caesars is pushing to boost profits by improving its products and focusing on higher-margin bets like parlays, which have been on the rise. Parlays are a hit because they offer bigger payouts by bundling multiple bets into one. They’re harder to win, but sportsbooks love them because they boost their profits and help cover other costs.

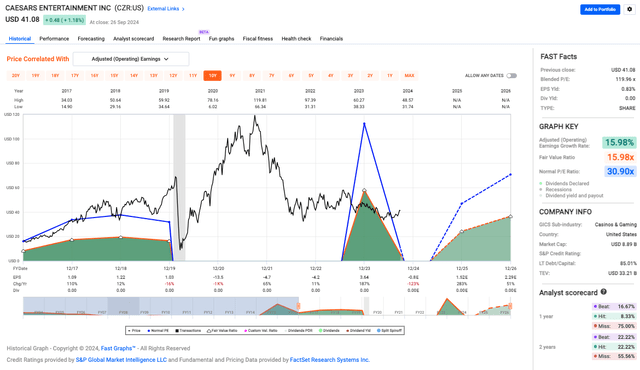

CZR’s Valuation

CZR’s blended P/E ratio is 119.96x, way above normal and higher than the market. Usually, a P/E this high means investors expect big future growth. But with an EPS yield of just 0.83%, there’s a gap. Investors are paying a premium for a product that isn’t quite there yet. This disconnect tells me one thing: investors expect big things, but the valuation looks overhyped.

Another issue, worth driving home again, is that the long-term debt-to-capital ratio is 85.01%. On the plus side, the company’s adjusted operating earnings growth rate is 15.98%. That’s where the optimism creeps in, and maybe some of that premium is justified.

But here’s the bottom line: when comparing the fair value ratio of 15.98x to the normal P/E of 30.90x, the market’s current valuation isn’t grounded in reality yet.

Financial Highlights

Caesars Entertainment pulled in $1.1 billion in net revenue from its Las Vegas segment in Q2 2023. Adjusted EBITDAR grew 1.2% year-over-year to $514 million. Vegas margins hit 47%, beating industry expectations and showing off their pricing power in rooms, restaurants, ATM fees, and pool cabanas.

Despite $76 million in headwinds, Caesars kept growth steady. Normally, big casino operators like Caesars and MGM see margins in the mid-to-high 40% range. Caesars’ 47% margin was above the norm, especially compared to MGM’s 36.3% margin on the Vegas Strip.

Additionally, the company’s digital segment saw strong growth, with net revenues up 28% year-over-year to $276 million. Adjusted EBITDA for Caesars Digital hit a quarterly record of $40 million, a big jump from $11 million the previous year.

iGaming revenues were impressive, growing 50% for the second quarter in a row. Sports betting revenues increased 19%, driven by higher customer engagement and an 80-basis-point improvement in hold. iCasino operations are expected to grow revenue by 30%, with about half flowing through to EBITDA, positioning them to reach around $200 million in EBITDAR this year, with potential to hit $500 million.

And the outlook for Vegas? As noted, occupancy and pricing there are still on the upswing, keeping the city’s lights bright. Future bookings for 2025 show mid-single-digit growth over this year — if the stars align, there’s a shot at nudging that growth into the mid-teens.

CZR Rating

I would rate CZR as a “Hold.” The company has trimmed some debt, got hot in Vegas and started to see some success in the digital space. I’d like to be bullish, but I’m still wary. The company is still sitting on a mountain of debt, there’s no dividend and valuation concerns me. There’s potential, and I believe in the story — I’d just wait for some better clarity before I come to the table to put my chips down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.