Summary:

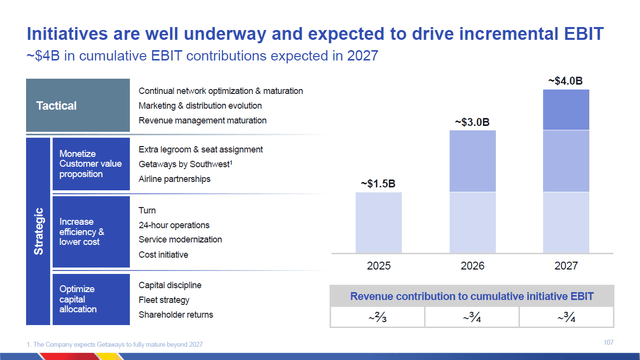

- Southwest Airlines aims for $4 billion EBIT by 2027 through low CapEx initiatives, focusing on asset utilization and cabin product enhancements.

- Elliott Investment Management’s criticism highlights Southwest’s lag in industry trends but lacks concrete solutions for boosting profits.

- Despite revenue and cost optimization efforts, Southwest’s stock remains a hold due to historical underperformance and modest growth projections.

- LUV’s initiatives, like priority boarding and seat selection fees, are standard industry practices, underscoring its need to catch up.

Boarding1Now

Southwest Airlines (NYSE:LUV) hosted its investor day on the 26th of September and the company had a lot to announce in terms of driving revenues and profits, targeting an EBIT of $4 billion by 2027. While there is a lot that Southwest Airlines discussed, I will only touch upon the main items, which already will be a lot to unpack and connect to the investment case for Southwest Airlines.

Elliott And Southwest Airlines Clash

The investor day took place at a time when things are getting heated between Elliott and Southwest Airlines. Elliott Investment Management disclosed a stake in Southwest Airlines in June and has been seeking to replace the CEO Robert Jordan and Executive Chairman Gary Kelly while it also looked to nominate 10 people to the board. While Elliott has not been unsuccessful in driving share prices up in companies in which it takes an activist shareholder position, I am not quite impressed with what they provide in terms of solutions for Southwest Airlines.

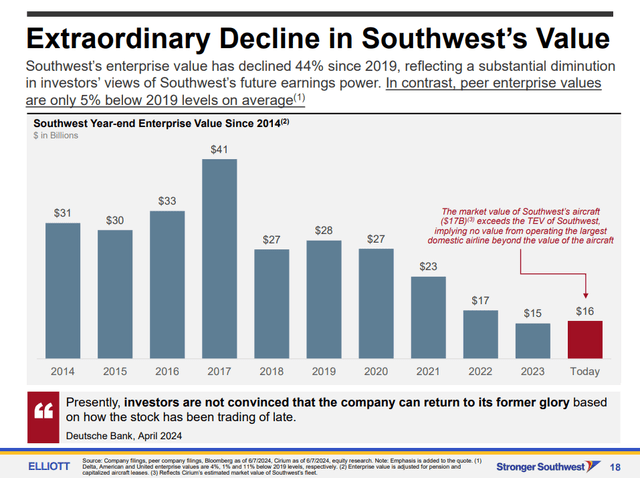

The company argues that the enterprise value of Southwest Airlines reflects the value of the airline’s airplanes, thereby suggesting that the airline does not generate any value. A calculation using current market values in high and low-case scenarios shows that the airplanes are worth between $12.5 billion and $26.8 billion and $19.6 billion at the midpoint. However, that is when we really take the average value among all the models. The way Elliott does the math is not entirely clear and calculating airplane values is a science by itself, but if we take the average value of the Boeing 737-800/MAX8 fleet and the low end of the value for the Boeing 737-700, we would get to $16.8 billion which is close to what Elliott portrays as the value of the fleet. I would argue that the Boeing 737-800/MAX8 are in high demand, and one should be using the high end of the fleet value which brings the value to $21 billion. So, that would even enforce Elliott’s view were it not that comparing the enterprise value with the value of the aircraft actually tells the story of investors not even valuing the business that the company derives from its aircraft. There would be a $1 billion underappreciation of the business by shareholders or even $5 billion according to my calculations just to value the airplanes and that does not value the business derived from the airline operations. It does not mean that Southwest Airlines does not generate value, it means investors have not incorporated it in the stock price. Those are two different things.

Furthermore, in a presentation of 50 slides, Elliott provides a lot of material to imply that the company does not deliver. However, it does so without recognizing the simple fact that the operational environment has significantly changed for many airlines and that whatever technology investments the company did not make before the operational meltdown in December 2022 had to be made in 2023 and 2024 at inflated levels while revenue initiatives had to be delayed to get the technology backbone up to the standard to support the value that the airline wants to create. Essentially, Elliott provided no solutions for Southwest Airlines to boost profits.

Southwest Airlines Looks To Optimize Its Assets Utilization And Cabin Product

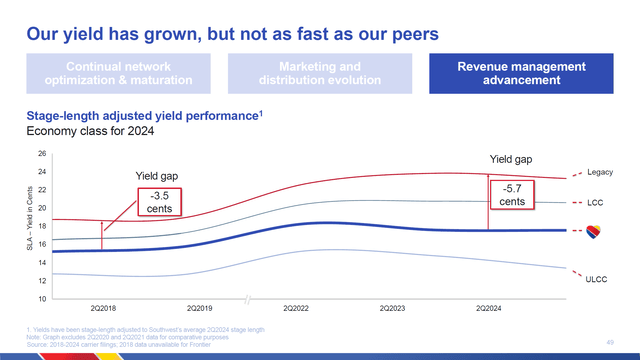

If there is one thing that Eliott might be right about, it is the fact that relative to peers Southwest Airlines has not performed well. The yield get was 3.5 cents four years ago, and it has widened to 5.7 cents. There are a variety of reasons for that such as delays of new Boeing 737 MAX deliveries to the airline, which is not unique to Southwest Airlines, but Southwest Airlines operates an all-Boeing fleet and problems at Boeing bite them back a bit harder. Furthermore, the investments in technology that Southwest did not make in 2018, they definitely had to make them after the December 2022 operational meltdown.

Furthermore, we see that the airline has a yield that is between LCCs and ULCCs. Improving revenue management and revenue initiatives here is a big thing. Among all low-cost carriers, it is almost standard practice that you pay for every extra added piece of service you desire. However, Southwest Airlines for instance still does not charge for bags and it will not. The company has looked into the impact and while it would increase bag fees by $1 billion to 1.5 billion, it would lose $1.80 billion in revenues. So, the company looked at other options.

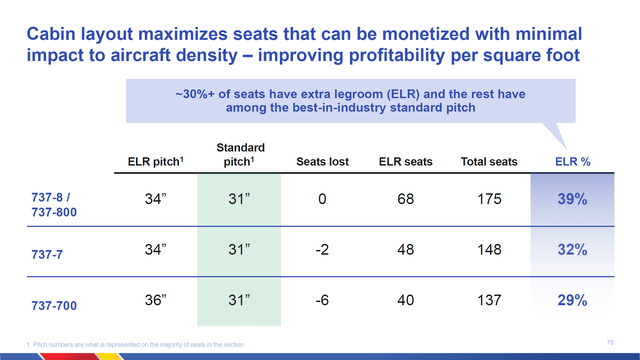

The revenue initiative starts outside of the airplane. Obviously, when you book a flight, that is revenue management already full in play. However, what I mean is that from the moment you board and perhaps check in your bags that is the moment at which Southwest Airlines already can sell you the premium experience. It is all about taking existing pieces of service and charging for it where it makes sense. So, boarding priority can be bundled into a fare product. Another option is seat selection. Even at the legacy carriers that I fly in Europe, I have to pay for seat selection. Legacy carriers also have done a great job with cabin segmentation following a trend of dividing economy into economy and premium economy, and that is where Southwest definitely has fallen behind. The company now is optimizing the value of its cabin space by implementing extra legroom seating at little to no cost to the capacity of the cabin. The company is also rolling out modernized cabins. Starting Q1 2025, the company aims to start rolling out the ELR-configured airplanes at a rate of 50 to 100 airplanes per month. That means that in 8 to 16 months all airplanes should be retrofitted. This should result in $1.5 billion higher EBIT by 2027 at little to no additional costs.

So, the cabin initiatives are mostly about introducing a cabin standard and putting a fare system in places that harvests more revenues from passengers already carried. The second set of low investment cost initiatives is the introduction of 24-hour operations with the so-called redeye flights. Those are not new, we heard about that plan in the past, but it is highly likely that the company had not introduced it as it addressed the technological shortfalls of its systems.

With the redeye flights, the company hopes to provide solutions to connect passengers for morning flights and the company does not require additional aircraft for it. By carrying out redeye flights, the company will add capacity equivalent to 18 airplanes in 2025 and 28 by 2027 without actually adding those aircraft. It’s pure asset utilization-based capacity growth. Furthermore, the company aims to increase its turn times, which should increase capacity to an equivalent of 16 airplanes by November 2025. So, by 2027 Southwest Airlines will increase its capacity by the equivalent of 44 airplanes without actually having to spend money to add extra airplanes. All of that feathers into a capacity expansion plan of 1 to 2 percent per year towards 2027 with minimal CapEx.

Southwest Airlines Aims For $4 Billion EBIT By 2027

It is important to keep in mind that what Southwest Airlines has in the works to increase EBIT is not rocket science, it is the low-hanging fruit. The pressure from Elliott likely has increased Southwest Airlines’ effort to implement these changes. Obviously, we have to see whether Southwest Airlines will be able to deliver on these EBIT targets but from what I can see, the initiatives themselves are fairly easy to implement with a low CapEx requirement. Over time, one of the bigger cost savers could become the shift to the MAX 7/8 planned by 2031. With 15% in fuel burn savings, that should really make a difference on the expenses.

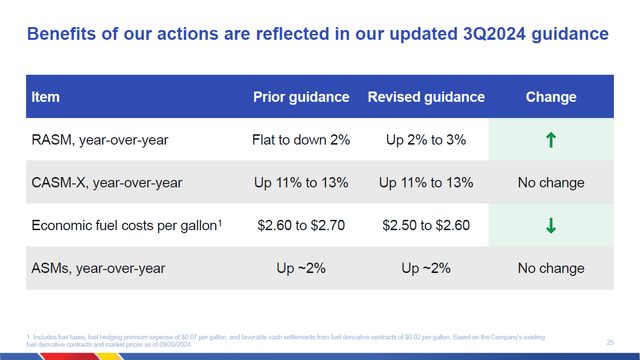

For the third quarter, the company expects unit revenues to be up 2 to 3 percent instead of down 2 percent to flat. On unit cost, the guidance remained unchanged but fuel cost estimates have come down. So, the third quarter is expected to be stronger than initially anticipated and perhaps the shortage of Boeing deliveries has helped Southwest Airlines to modestly grow the unit revenues. The company also announced a $2.5 billion share repurchase authorization.

Southwest Airlines Stock Is Still A Hold

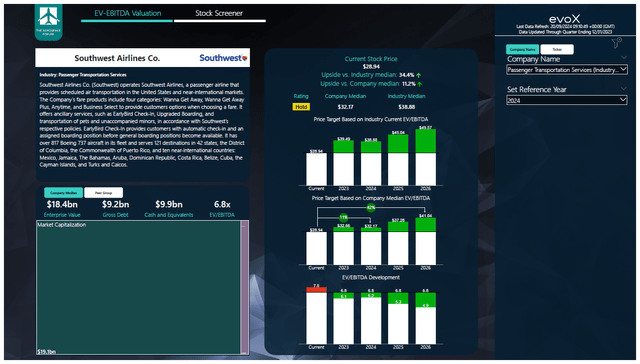

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows, and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog, I have detailed our analysis methodology.

While the shareholder returns, cost optimization, asset utilization optimization, and revenue initiatives look like a big deal. The reality is that it doesn’t really make Southwest Airlines stock a buy. The most recent estimates that are currently available show 6.6% growth per annum between 2024 and 2026 while free cash flow will remain negative. Based on these projections and the balance sheet and share repurchases mapped at $500 million per year, we get to an 11% upside for this year and a 42% upside for 2026. This doesn’t get us much further than a hold rating. While the upside is compelling, the historical underperformance against the market makes it questionable whether the fundamental upside I see will also materialize.

Conclusion: Southwest Airlines Picks The Low-Hanging Fruit

Investor Days are always nice because, for a change, we see a focus on medium-term goals and initiatives and the initiatives that Southwest Airlines presented should definitely boost value generation. It does not impress me much. In essence, what the company aims for is low-CapEx enhancements that focus mostly on extracting more value from the cabin and higher asset utilization. That’s really all that there is to it, and in some way, Elliott was right that Southwest Airlines has been falling behind in industry trends because the initiatives that Southwest Airlines presented such as priority boarding, paying for seat selection, and more legroom are well-established industry practices. So, while it is good that Southwest Airlines does implement these things to drive value, they are barely something to be impressed with. I am maintaining my hold rating for the stock, and that is driven by the historical underperformance. Southwest Airlines looks like a great company in the sense that it has an investment grade credit rating and is in a net cash position, but we see little translation of that to the share price value, and in fact, the share repurchases and dividends that the company plans in the year ahead are nothing more and nothing less than the company returning to normalized cash levels of around $3 billion. In some way, we are still not seeing the business deliver sustained value that is driven by the business itself. Perhaps Elliott was right after all.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.