Summary:

- Netflix’s strong business model, economies of scale, and differentiated content library are overlooked by many investors.

- Netflix’s margin expansion potential and operational leverage are significant, with costs declining as a percentage of sales and no additional cost for incremental users.

- Advertising is an underappreciated growth driver, with Netflix building its own ad stack and already seeing substantial revenue from this segment.

- I reiterate a ‘Buy’ rating, seeing Netflix as a wide moat high growth company.

Riska/E+ via Getty Images

Netflix (NASDAQ:NFLX), one of the most popular brands in the world, is also one of the strongest businesses I’ve analysed.

This is the place where economies of scale, process power, and counter-positioning, all come to life to deliver market-beating profitable growth, and accordingly, market-beating returns for shareholders.

Despite being so popular, Netflix is often overlooked by investors. Let’s try to find out why that is, and show that there’s still a lot of meat left on this bone.

Why Is Netflix Overlooked By Investors?

Before we answer that question, we have to first explain what we mean by overlooked, as to make sure we’re not tackling a “strawman” here. So, I encourage you to take a quick look in the Dataroma Superinvestors list. There, you’ll find that only three firms have Netflix overweight, ranking in the 91 spot, compared to its 23rd place in the S&P 500.

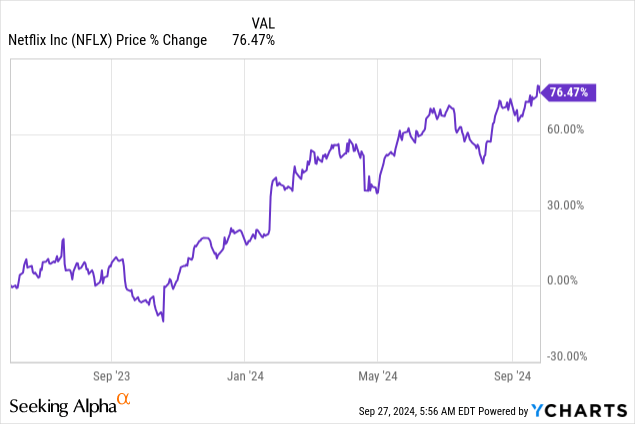

I started covering Netflix on Seeking Alpha back in June 2023, when the stock was already going through its recovery following the great ‘Netflix selloff’.

At the time, I said it wasn’t too late to buy, as the market was far from pricing in the company’s growth acceleration story, margin expansion potential, and free cash flow scalability.

Well, the stock is up over 76% since, so it turns out we were correct so far. Still, many investors question Netflix’s moat and long-term prospects.

The bears argue that Netflix doesn’t have meaningful competitive advantages, with an abundance of streamers, legacy media, and new entertainment formats fighting for people’s attention.

In my view, they fail to grasp just how deeply Netflix is entrenched in people’s lives, the convenience it offers, and its unparalleled library of content. None of Netflix’s competitors have this level of global production capabilities, and none of them are close when it comes to their technology platforms.

Another huge point the bears miss is Netflix’s margin expansion potential. We’ve already seen how lucrative a media business can get, with the benefit of zero marginal costs. As long as Netflix is growing, and it does, there’s no reason operating margins won’t continue to rise faster.

In my view, Netflix’s long-term story has a lot more runway, and despite its outperformance, investors should still consider a position.

With that, let’s take a deep dive into engagement numbers, and address the midterm growth opportunities.

Netflix’s Share Of Viewing Continues To Rise

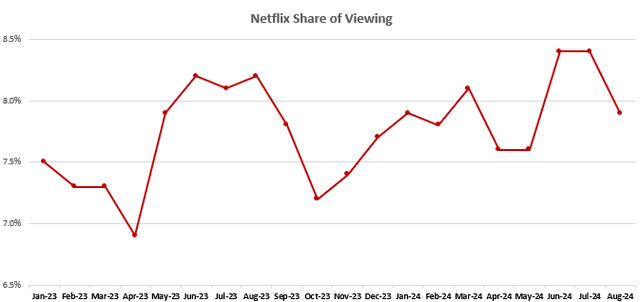

In the two months prior to the Olympics, Netflix maintained an 8.4% share of viewing, which is an all-time record for the company.

The Olympics are twisting the numbers a little bit in August, and it’ll be very interesting to see how Netflix shapes up in September, especially against Peacock, which carried the Olympics in hopes for a lasting effect after it ends.

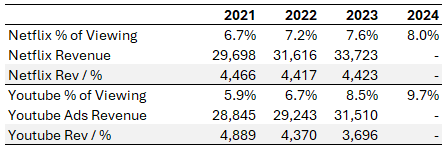

Created by the author based on Nielsen data.

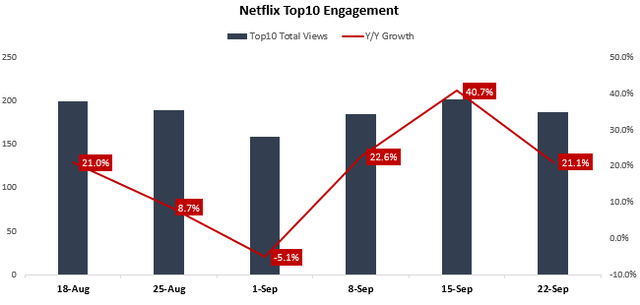

Based on my proprietary engagement dataset, which is based on the company’s weekly Top 10 disclosures, Netflix is on pace for an amazing quarter ending, with total views significantly up since mid-August (the Olympics ended on August 11th).

Created by the author based on Netflix Top10 data.

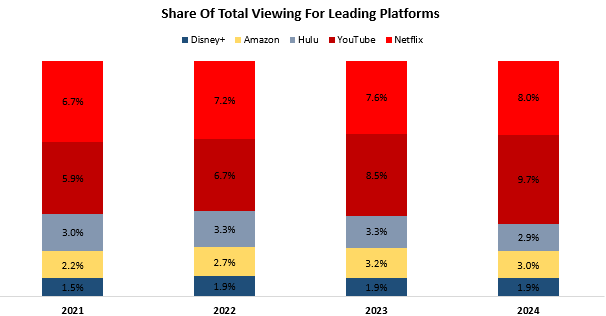

Aside from YouTube, Netflix is the only streaming player that’s gaining consistent share, even though it’s already the second-largest, and by far the largest among paid platforms.

Created by the author based on Nielsen data.

Importantly, Netflix is a leader not only in share of viewing, second only to YouTube, but it’s a leader in monetization as well, evidenced by the revenues it generates per share of viewing, resulting in higher ARPUs compared to other streamers, even higher than YouTube’s.

Created and calculated by the author using data from Alphabet and Netflix reports.

So, the engagement numbers paint quite a clear picture. Netflix continues to gain time share, and it’s number one in terms of monetizing that time share. Advertising should be a big driver for acceleration on both metrics.

Netflix’s Advertising Prospects Are Underappreciated

Just like investors were sleeping on Netflix and its core subscription model, I believe they are doing the same when it comes to its advertising efforts.

Veteran industry analysts like Ben Thompson, Eric Seufert, and multiple Wall Street firms are saying that Netflix’s advertising efforts should be viewed as a way to more freely raise prices of the ad-free tiers, and they’re not seeing the ad-tier as a meaningful business for Netflix in the future.

Their argument is that if Netflix is charging a base-price even for the ad-tier, it shows that the company cares more about keeping its ad-free subscribers than building a large advertising business (an advertising business should seek as many users as possible, which contradicts charging for it). This, to them, means that Netflix doesn’t view its advertising as a large stand-alone arm.

I couldn’t disagree more.

Netflix is only in the early innings of building an ad stack, which is set to launch in Canada in November and globally in 2025. Digital advertising is a complex business, and building this capability from scratch is difficult.

The fact that Netflix decided to build its own stack, by itself, tells me that they’re seeing a huge opportunity in this space. And why shouldn’t they? Traditional TV advertising is a $150 billion market, and there’s no reason Netflix won’t be able to take a huge piece of that going forward.

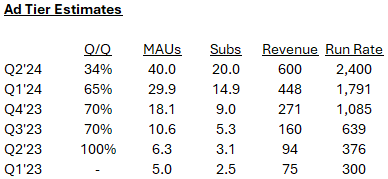

Also, early signs suggest Netflix is doing quite well there, with 40 million global users as of last May, growing rapidly. In fact, I estimate that advertising revenue is already above a $2 billion run-rate, and will surpass $500 million revenues next quarter:

Created and calculated by the author based on Netflix’s commentary and author’s estimates.

The unique co-CEO structure combined with Netflix’s strong corporate culture is driving execution at an industry-leading pace, and I see them reaching scale much faster than most people seem to believe.

I expect Netflix will go through a similar process as Meta (META) went through with Reels. The new advertising offering will dilute monetization initially, but will become a huge driver for growth later on.

Operational Leverage Opportunity

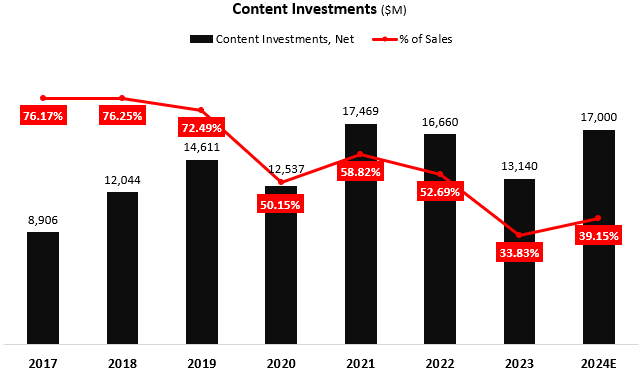

Understanding the scale advantages of Netflix’s business model is key, and quite simple. Netflix has no additional cost for the incremental user. Unlike YouTube, which pays a fixed amount of its revenues back to creators, Netflix is carrying all the risk for its content, but all the upside as well.

What this means is that the more users watch a show, the higher the gross margin of that project for Netflix. More accurately, the more members that remain subscribed to Netflix, the higher the gross margin of all the shows.

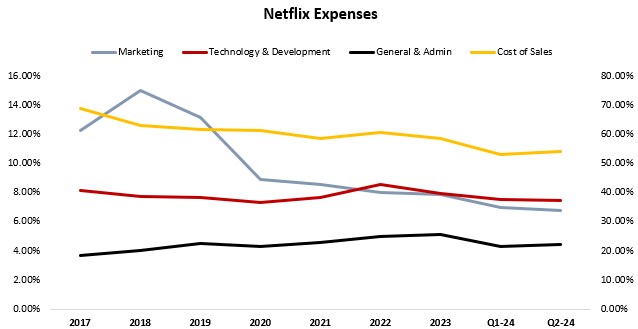

Below the gross margin line, all the costs are overhead, meaning that they aren’t directly related to revenue growth. (In the chart below: Cost of Sales uses right axis, all others use left axis)

Created by the author using data from Netflix reports.

You can see that over time, all the main expense lines are declining as a percentage of sales, reflecting Netflix’s operational leverage. The same applies to Netflix’s cash expenses.

Created by the author using data from Netflix reports.

Again, nothing suggests this should stop or hit a wall in the foreseeable future, as long as Netflix continues to grow.

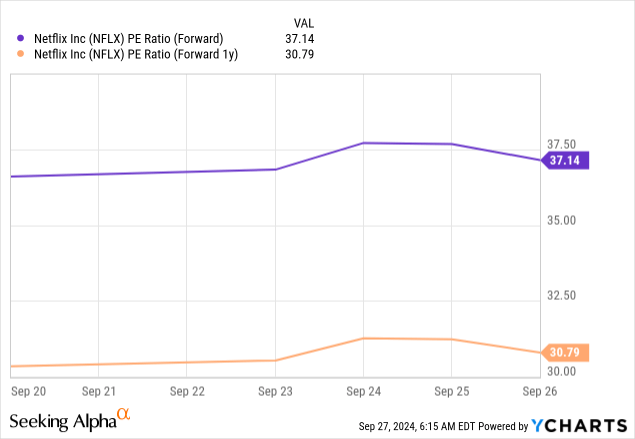

Valuation Remains Attractive

I see Netflix growing revenues at a low-double-digit pace for a long time, driven by subscriber adds, price increases, as well as advertising penetration and consistently improving monetization.

All four of those pillars have clear near-term tailwinds, including differentiated content additions in WWE and NFL; Price increases and less content from struggling competitors and; Technology developments, scale, and availability in more geographies.

Combined with the operational leverage opportunity we discussed, I see Netflix as a mid-to-high teens EPS growth story for the rest of this decade.

Considering all of the above, I see anything below a 32x multiple on 2025 estimates as an attractive buying opportunity.

Furthermore, I’m highly confident Netflix will beat estimates quite handily. At $43.4 billion in revenues and $23.1 in EPS, estimates reflect too significant of a growth deceleration, and too low of a margin expansion. I expect Netflix to do $44 billion next year, and ~$23.5 in EPS.

Conclusion

Even after its amazing results over the past two years, and with the stock more than quadrupling from their lows, I still believe Netflix is somewhat underappreciated.

I think the company’s margin expansion opportunity is so big, that even its leaders are reluctant to say it out loud (although they hinted at 40%+ margins in one call last year).

In addition, the growth story remains strong, with core subscriptions still at a low percentage of TAM, and advertising at early innings.

I see Netflix as a wide moat high-growth company, and estimate the fair multiple at 32x, reflecting a near-term price target of $740 a share.

Therefore, I reiterate a ‘Buy’ rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.