Summary:

- S&P500 inclusion benefits PLTR as the stock benefits from a decadal trend of growth in passive investment strategies and S&P500 ETF inflows.

- I believe PLTR’s multiple expansion is acceptable given the long-term growth potential to be as big as Microsoft, rates cut tailwind and improving business quality.

- Much of the rally in the stock is backed by strong earnings growth, which is a good sign for long term stock performance.

- Relative technicals vs the S&P500 remain bullish; despite reaching a key 4-monthly resistance level, the approach is strong on the monthly, so it would be premature to exit bullish views.

- Operating performance in revenues and margin performance is the key thesis-changing monitorable and so far, Palantir is meeting and exceeding expectations here.

floridastock

Performance Assessment

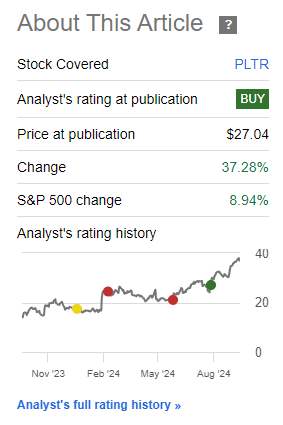

Palantir (NYSE:PLTR) has outperformed the S&P500 (SPY) (SPX) since my last bullish update on the stock:

Performance Since Author’s Last Article on Palantir (Seeking Alpha, Author’s Last Article on Palantir)

Sentiment Review and Thesis Update

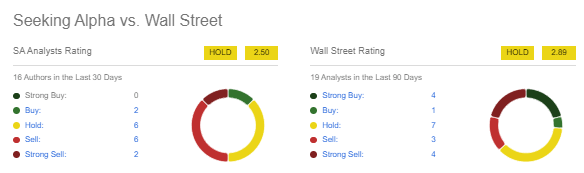

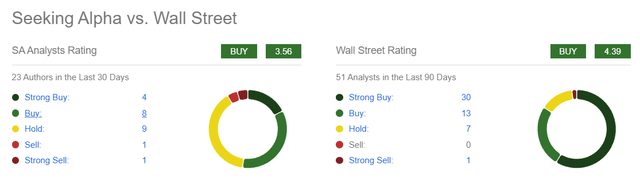

It looks like Seeking Alpha and Wall St Analysts’ sentiment on Palantir has turned more bearish:

Palantir’s Ratings by Seeking Alpha and Wall St Analysts (Seeking Alpha – Palantir’s Page)

For example, compare the high incidence of ‘Sell’ views now compared to when I published my last update on the stock in early August.

Frankly, I am very surprised by the sharp turn of sentiment from bullish to bearish. It looks like this change in stance is mainly driven by valuation concerns and a higher incidence of insider sales.

Previously, I have also shared these reasons for being a Palantir bear. But as the stock defied my expectations, I concluded that overweighting these factors against flawless revenue growth and margin expansion is a recipe for missing out on Palantir’s genuine growth story. For more details on these learnings, I encourage readers to read my last note on the stock, where I admitted my mistake and changed course.

Today, I remain bullish on Palantir as in addition to the fundamental revenue and margins growth, I recognize the following drivers:

- S&P500 inclusion benefits PLTR from structural passive flows

- Multiple expansion is acceptable given long-term growth vision, rates cut tailwind and improving business quality

- Much of the rally in the stock is backed by strong earnings growth

- Relative technicals remain bullish

- Operating performance of revenues and margins is the key thesis-changing monitorable

S&P500 inclusion benefits PLTR from structural passive flows

In a long-anticipated move, Palantir finally joined the esteemed club of S&P500 constituents this week on Monday 23rd September 2024. The stock has a 0.15% weight in the S&P500 (SPY) (SPX), which gives it a standing as the 133rd largest position in the S&P500.

Now, I have been skeptical of the S&P500 inclusion as a stock-moving event catalyst for upside since December 2023 as the index-inclusion effect has been waning in today’s markets. However, this effect focuses on the stock price reactions before and a few days after the S&P500 inclusion event. What I believe is more structural and material is the structurally resilient flows experienced by constituents of passive ETFs such as the S&P500. Here’s why:

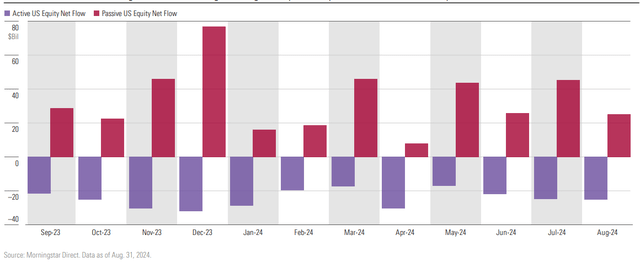

Firstly, net flows in passive US equity have consistently been positive, taking away share from active US equity net flows, which have shrunk every month for the past year:

Active US Equity vs Passive US Equity Net Flows (Morningstar)

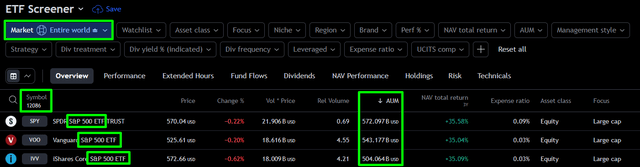

This is part of a broader decadal trend wherein the growth and scale of passive investment strategies is overtaking that of active management. For example, in 2024, for the first time ever, the amount of money in passive investment strategies exceeded that of active management. According to the S&P Annual Survey of Assets, there was $11 trillion indexed to the S&P500 last year in 2023. Indeed, the most recent data shows that S&P500 ETFs managed by Vanguard (VOO), SPDR (SPY) and iShares (IVV) have more than $1.6 trillion in AUM:

Largest ETFs in the world (TradingView)

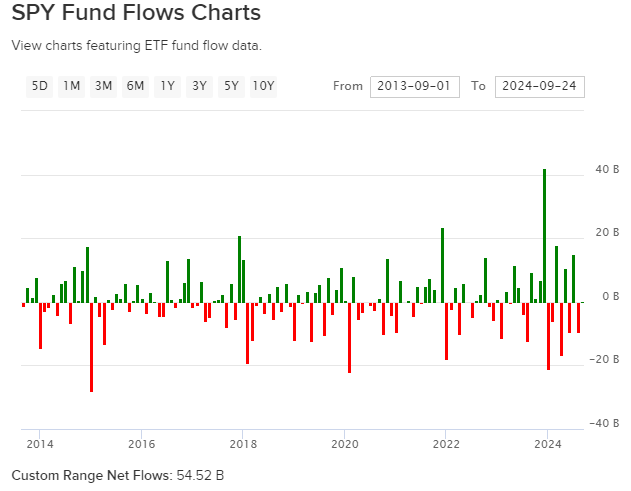

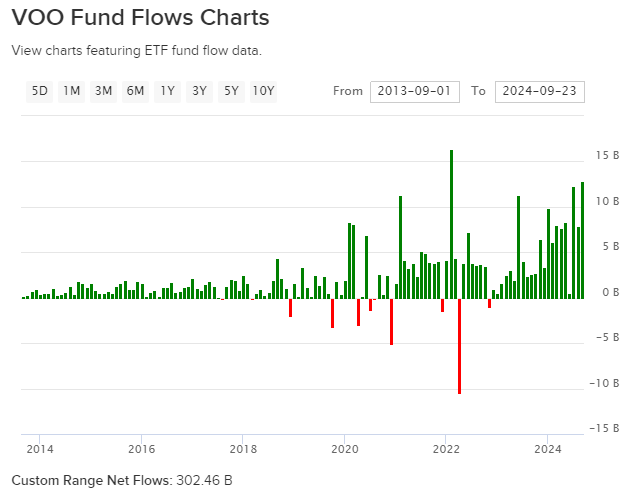

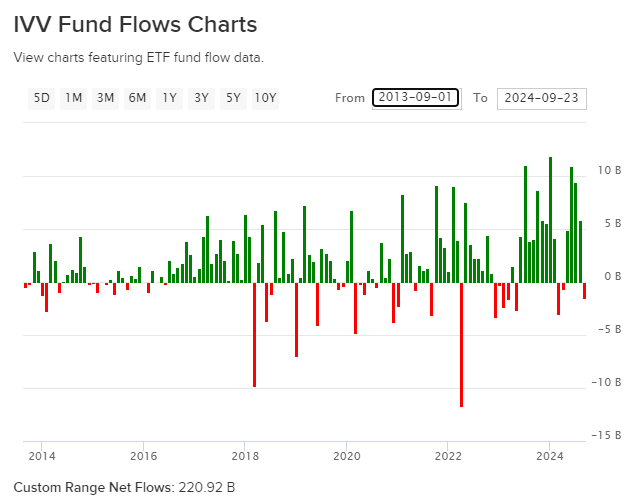

Evidence that the passive indexing growth phenomenon is present in the SPY, VOO and IVV S&P500 ETFs is clear when we look at the net fund flows that show a very clear structural increase of $578 billion in total over the last 10 years:

SPY Fund Flows (ETFDB) VOO Fund Flows (ETFDB) IVV Fund Flows (ETFDB)

The largest buyers of passive investing ETFs include large mutual funds, pension funds, sovereign wealth funds, endowment funds and insurance companies; these players are structural buyers of equities, rain or shine.

Given all these factors, I believe that as a constituent of the S&P500, PLTR is a beneficiary of massive structural inflows, providing a fresh source of support for the stock’s price that was not there before.

Multiple expansion is acceptable given long-term growth vision, rates cut tailwind and improving business quality

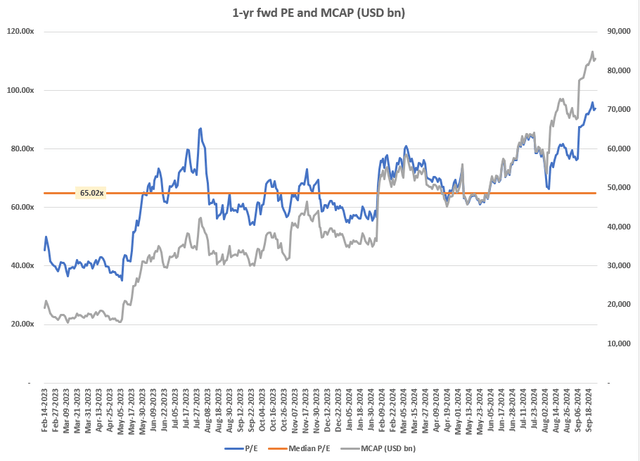

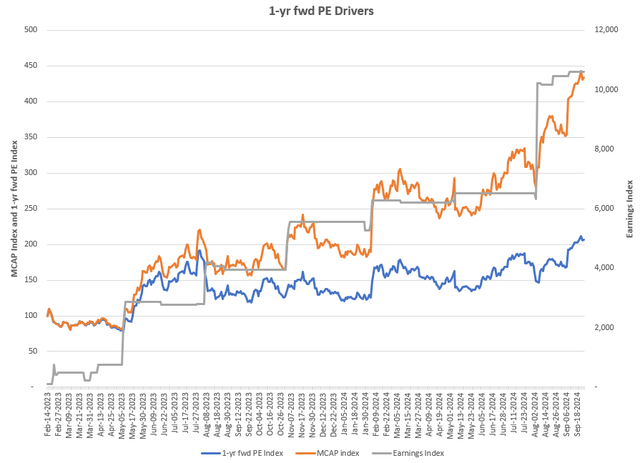

Palantir’s 1-yr fwd PEs now stand at 94x as recent multiple expansion has caused the stock to divert away from the longer term median of 65x:

1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

Although this seems crazy since the S&P500’s 1-yr fwd PE is much lower at 23x, I believe looking at this valuation multiple in isolation is a mistake:

First of all, Palantir’s growth vision is huge as it has the opportunity to become the largest AI company in the world according to some investors such as Cathie Wood.

Although many of the ARK Invest funds (ARKK), (ARKG), (ARKW), (ARKF), (ARKQ), (ARKX), (ARKB) have fallen from grace, I believe the firm does good, differentiated research that outlines the longer term prospects of innovating companies, which I believe is a valued contribution that departs from the typical QoQ focused tone of Wall St and yes, admittedly, my style of analysis as well.

One long term visionary investment thesis for Palantir is that as the firm accumulates knowledge from working with an increasingly broad scope of customers from both the commercial and government sector, it would be one of the best positioned sources of “useful compute” as it would be armed with a deep level of data and insights specific for each vertical. Monetization of this can make Palantir a virtual necessity for every company in the Western world (as essential as email or a spreadsheet program such as Microsoft’s (MSFT) Excel or Google’s (GOOGL) worksheets) as the useful information here would be critical for the next-generation era of business decision making. This vision highlights the scope for Palantir to be as big as Microsoft or even bigger. Microsoft’s market capitalization is currently almost $3.19 trillion, almost 39x bigger than Palantir’s $83 billion currently.

For high potential growth stocks such as Palantir, I believe thinking along these lines of the potential addressable market and ability to become as big as current industry giants is often a much more useful framework than the traditional lens of looking at mere 1-yr fwd earnings multiples.

At the same time, I would like to emphasize that relying purely on grandiose growth visions to justify a virtual perma-bull outlook is also wrong. I have done committed this kind of mistake before with Tesla stock earlier, with key learnings that whilst high traditional valuation multiples to reflect grandiose visions is acceptable, it is critical to pair that with strong execution of operating growth. The good news is that for Palantir, operational momentum has been flawless (discussed in depth in my last article and also later in the thesis-monitorable section below).

Secondly, as a long-duration (much of the value is in cash flows further out into the future), equity growth stock, I expect PLTR to be one the bigger beneficiaries of a rates-easing environment:

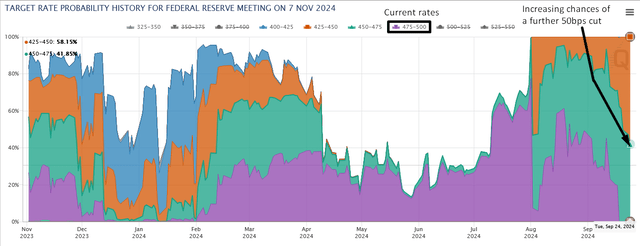

Fed Target Rate Probabilities for the Nov 2024 Meeting (CME FedWatch, Author’s Annotations)

The chances of a further 50bps cut in the Fed’s November 2024 meeting has increased in September, which I view as a tailwind for PLTR. This would help justify some of the stock’s multiple re-rating.

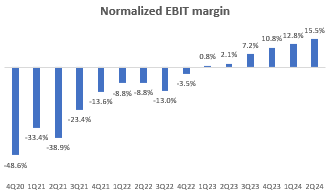

Thirdly and lastly, I will reiterate the case for steady margin expansion due to an improving revenue and margins expansion profile:

Overall, I believe the stickier nature of revenues and structural increase in margins make for a credible case for multiple expansion in the stock to reflect the increased chances of business longevity.

– Author’s case for multiple expansion in the stock, expressed in the last update

Normalized EBIT Margin (Company Filings, Author’s Analysis)

The chart above shows Palantir’s structural margin expansion. I am confident of further margin growth ahead since incremental YoY normalized EBIT margins (which is a rough proxy of long-term stable margins potential) is much higher at 65%. To better appreciate the impressive nature of this statistic, consider that the typical operating margins for a systems software company is only 20%. As another example highlighting Palantir’s superiority, Crowdstrike (CRWD) is currently a growth darling with a much more bullish sentiment by both Seeking Alpha and Wall St:

Recent Seeking Alpha Analysts’ Sentiment on Palantir (Seeking Alpha – Palantir’s Analysis Page)

Yet, CRWD’s incremental YoY EBIT margins are far weaker at a mere 12.5%.

Much of the rally in the stock is backed by strong earnings growth

The recent rally in PLTR’s stock price and market capitalization has largely been driven by earnings growth expectations instead of multiple re-ratings:

1-yr fwd PE Drivers (Company Filings, Author’s Analysis)

I view this as a positive sign since earnings growth is a strong long term driver of stock performance.

Relative technicals remain bullish

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

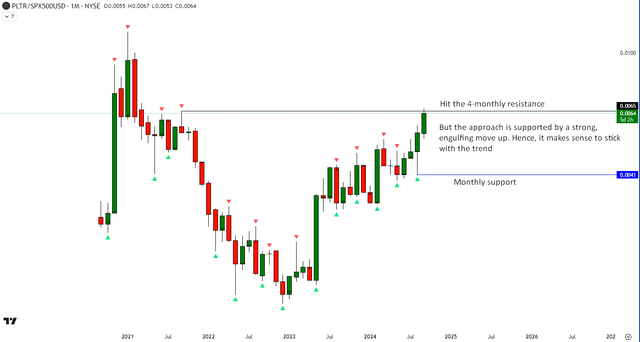

Relative Read of PLTR vs SPX500

PLTR vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the SPX500, PLTR has reached a key 4-monthly resistance area currently. However, the approach to this level is supported by a strong engulfing move up on the monthly. Hence, given the fundamental and valuations-driven considerations, I believe it is prudent to stick with the current uptrend.

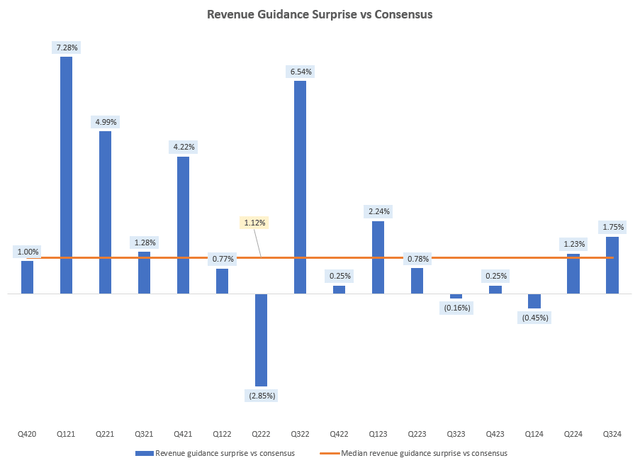

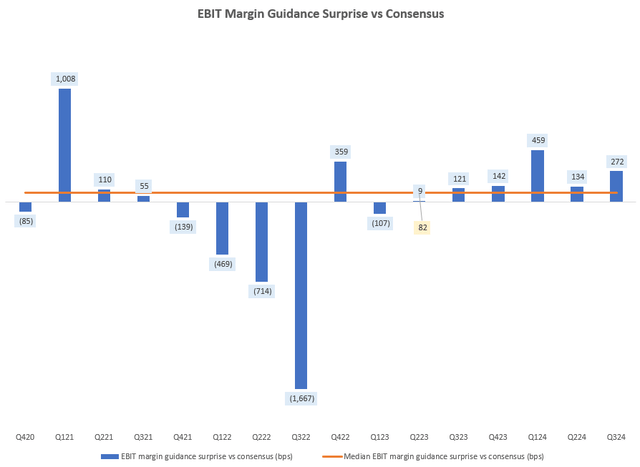

Operating performance of revenues and margins is the key thesis – changing monitorable

One of the most valuable learnings in my investing journey has been to virtually always require fundamental operating momentum to align with my valuation view. I have noticed that in instances wherein the high/low valuations do not align with bearish/bullish fundamental drivers, the stock tends to move in accordance with the nature of the fundamental outlook and technical analysis trends instead of a lone valuation signal.

Hence, the key thesis-changing monitorable for my bullish view on Palantir would be a slowdown in its revenues or margins outlook. And so far, there seems to be no problem here as evidenced by a mostly healthy record of beats:

Revenue Guidance Surprise vs Consensus (Company Filings, Author’s Analysis) EBIT Margin Guidance Surprise vs Consensus (Company Filings, Author’s Analysis)

Takeaway & Positioning

Palantir has outperformed the S&P500 since my last bullish update on the stock. However, Wall St and Seeking Alpha Analysts’ sentiment seem to have turned more bearish over the past couple of months, citing valuation and insider selling concerns. I do not find these arguments to be compelling.

I am still bullish on Palantir since in addition to executing well, I believe its addition into the S&P500 provides a fresh source of support to the stock’s price, driven by a strong industry-wide trend of growth in passive investment flows.

Palantir’s 1-yr fwd PE valuation multiples have expanded since last time to 94x. I am not as fazed by this since I think a valuation assessment framework that focuses more on assessing the total addressable market potential and ability to grow as big as current industry giants such as Microsoft is more useful. This is so long as quarterly operational growth momentum remains strong and healthy and this is true for Palantir today. Moreover, I believe a rates-easing environment and improving business quality also help justify some of the re-rating in the stock’s valuation multiples. In any case, it is pleasing to note that PLTR stock’s recent run up has been driven mostly by earnings growth anyway, which is a better indicator of long-term stock performance.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.