Summary:

- I am upgrading Plug Power to a sell due to a slightly improved market outlook and technical analysis indicating an oversold position.

- Despite recent positive developments, Plug Power’s financial performance remains weak with significant cash burn and declining revenues, making it a risky investment.

- The company’s future prospects hinge on long-term green hydrogen adoption and achieving profitability, which is not expected until at least 2030.

onurdongel

Investment Thesis

I am “upgrading” Plug Power (NASDAQ:PLUG) as a sell. In May 2024, I published an analysis with a strong sell rating. The company’s stock performed as expected based on increased cash burn from rapid expansion with minimal results, and its share price dropped more than 20% ever since.

Now, in this analysis, I updated the fundamental analysis with recent developments and enhance it with a technical analysis, which proves why the stock is currently consolidating at an oversold point and implying a short-term bullish, although a long-term underperformance in business. The company has not yet achieved full results from its diversified investment to meet is full potential and profitability, owing to slow adoption of green hydrogen. My analysis on the company’s overall financial performance indicates its effort and commitment to recovery, but this will take time.

Macro development in hydrogen fuelling PLUG’s momentum

The world is highly investing in renewable energy sources. This consistently driven Plug Power towards investing into the future through infrastructure. The recent $10 million grant to fund its pants reveals government intention to make clean energy investments a success to power the future. The company has started to gain a strong footing from the rapid expansion, with over 60,000 fuel cells systems deployments. Additionally, Plug Power projects to increase its green hydrogen to 2,000 tonnes per day by 2030.

Plug Power fuel station receives DOE decarbonization fund

Green hydrogen is still at the infant stage, and it is yet to attain full competitiveness with the grey hydrogen. However, with the recent recognition of green hydrogen potential in response to climate change crisis, it fuels Plug Power investors. The Department of Energy (DOE) in the $62 million funding for 62 projects aimed at decarbonization efforts, has issued Plug Power with $10 million grants for its hydrogen refuelling facility. The 250 high-performance refuelling stations under Plug Power positions the company uniquely to lead the green hydrogen sector.

Strategic partnerships: Bags H2DRIVEN Portugal-based contract.

In the latest news, 13th Sept 2024, Plug Power signed an agreement with H2DRIVEN to develop a green hydrogen project that supports 25 megawatts (MW) using its Proton Exchange Membrane (PEM) Electrolyzers. This is a first contract with H2DRIVEN aimed at producing 80,000 tons of green methanol yearly through its water electrolysis synthesis technology powered by solar energy. An investor looking into the future of sustainable energy, methanol has huge application in heavy industry and mobility in the future of clean energy.

Plug Power CEO Andy March states that the company is well positioned to deliver advanced project and provide technical support with its world’s largest Proton Exchnage Membrane (PEM) and experience.

Going forward, Plug Power projects reduce emissions by 105 kilotons of CO2 yearly in Portugal by 2027 when it starts to operate in 2026. The 2026 operational target will be a medium-term revenue generation potential, spurring the company’s growth momentum in the clean energy sector.

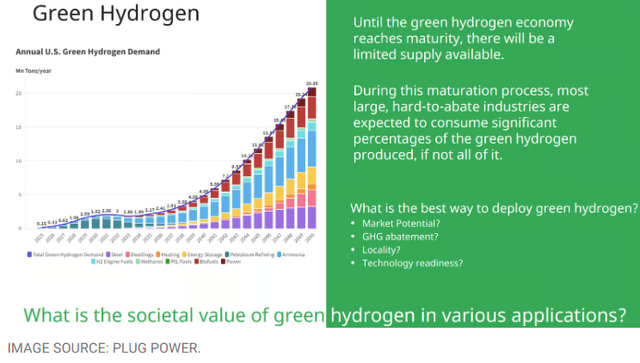

Hydrogen boom comes faster than expected

Hydrogen optimism is still well-founded. For example, the $70 million deployments of electrolyzer systems in the second quarter 2024 represents a gain in the hydrogen energy. BY the end of the year, Plug Power forecasts to install 100 MW electrolyzers, which solidifies its leadership position in hydrogen sector.

These installations come at a time when BMW Group and Toyota Motor Corporation collaborate to make the next-level fuel cell electric vehicle (FCEV) passenger cars. In support of hydrogen infrastructure, BMW is set to start its first-ever FCEV in 2028. Overall, the with almost zero demand currently to over 20 million tons per day demand by 2050, the Plug’s business model is set to expand in the recent future.

It is important to note that Plug’s huge investment in green hydrogen infrastructure currently at $2.3 billion market cap, investors are yet to see that value reflection in its stock. The stock has plummeted to 2019 low to current price at $2.1. Indeed, the company is below its initial public offer (IPO) price at $15. Looking at the future of green hydrogen and its current uptake,

However, business fundamentals still present depressed facts

Plug Power faces hard time to convince investors about its growth prospect, basing it on sales, electrolyzers, cutting costs and reduced cash burns in Q3’2024. The enthusiasm created by the company through its profitability, Plug Power investor do not have it following a record net loss of $262.3 million in Q2’24. The company bases the loss by changing market dynamics, strategic investments and a non-cash charges. However, the second quarter was an 11% increase YoY.

The company expects to generate between $825 million and $925 million in 2024. With 2023 projected revenue falling hugely than expected from between $1.2 billion to $1.4 billion to a recording $825 million, the company is likely to miss the revenue projection in 2024. The failure in projection follows Q2’24 reduced revenue from $269.182 million to $143.350 million QoQ reflecting a 45% decline YoY.

Even with a significant reduction of Research and Development (R&D) from $29.251 million to $18.940 million QoQ in Q2’24, the company recorded an increased operating loss.

Operating loss increased in the second quarter from $233.842 million to $244.673 million, reflecting the company’s strain into profitability.

Plug power shareholders continues to incur dearly, the cost of losses as shares down by 75% over a year. This is gut-wrenching, showing the loss is nearly over 97% of their value since the company was listed in the public stocks 20 years ago.

The losses and sale of outstanding shares explains why further decline of the stock happened in bid to fund company operations. I am convinced that the company is ready for takeoff after huge infrastructural investment, but this will take some fairly to say by 2030. The management projects that the company will achieve $20 billion in revenues by 2030 and 35% gross margin, with 13%of revenues being operating cost.

My overall thought

When I retrospect on my previous article on rapid development with minimal results, I am optimistic about the company’s rapid investments results taking shape. My previous strong sell was well-driven by company decisions on more cash burn and investments.

The management’s commitment to advance hydrogen economy is substantiated in recent achievements showing its readiness to deliver a sustainable future energy solution that will drive value to its shareholders. However, I reiterate that this is a long-term perspective. The second quarter, 2024 QoQ was depressing, but I believe the company is best positioned to take on the future opportunities in green hydrogen demand. With adoption of green hydrogen set to soar gradually, the company has slowed cash burn and capital expenditure to which is expected to raise revenues.

Valuation and Technical Analysis

As iterated in my last article on Plug, it is difficult to rate a company at this very early stage of refining its product offering and deep in negative profit margin and cash flow – only when there is meaningful profit being made and reduced cash flow, the share price can be less volatile.

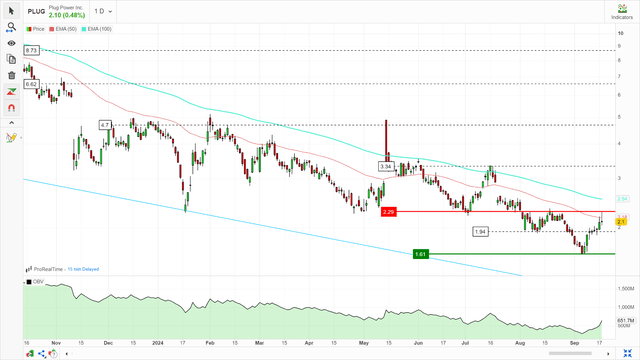

My last article listed out 4 key events that will lead to a significant drop in share price, one of which has happened – the equity raise announced in July this year has brought the share price down from $3.3 to almost $1.5 at the trough. With cash and equivalents at around $260 million, while the operation cash outflow at an average of $200 million per quarter, I expect that another financing action will be needed towards Q1 next year. Therefore, even though the short-term trading pattern (as analyzed in the session below) has shown some good sign, long-term it is still a sell. But for traders out there, here is an analysis.

Technical analysis

From a technical perspective, my rating upgrade is well-founded. The company is at an oversold position, with 50-day exponential moving average (EMA) below 100-day EMA. As such, the stock oversold position annexed with the developments gaining momentum in electrolytes installations discussed above, it is bound to consolidate between $2 and $3. We expect a golden cross when 50-day EMA crosses above 100-day EMA to confirm a bullish trend.

Image created by the author with technical analysis

Despite the slightly improved outlook, the company intent to raise cash through sale of 78,740,157 shares at $2.54 per share saw a slight uptrend. I am still on sell but not hold because the company is still grappling with how to scale its cash position. At the moment the Plug stock remains very speculative as it hasn’t turned profitable, gets its gross margin positive and its hydrogen plants starts to make good returns. It is not a good idea to buy at the current dip.

Investment risks

- Limited cash – While my anticipation based on current state of affairs of the company shows its efforts to spur its growth, it is still facing limited cash contributing to the sale of its shares. The company poses a risk to its shareholders as dilution increases, which could lead to low shareholders value.

- Dwindling revenues – Due to low uptake of green hydrogen against the investment, there will be slow growth on Plug. The company is still making net losses, which poses a risk on the future of shareholders dividend earnings.

- Dependence on government support – Green hydrogen is currently relying on government policies. Power Plug is still relying on $10 million to develop its plants from DOE. This is a significant risk in case the government is unable to issue the promised funds in support of decarbonization.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.