Summary:

- Starbucks appears overvalued and is struggling to profitably grow its international business.

- Despite brand power and scale advantages, contracting margins and increased competition raise doubts about Starbucks’ ability to sustain growth and justify its current valuation.

- the author estimates that Starbucks must grow free cash flow at a 10.5% CAGR over the next decade to justify its current stock price, which seems unlikely given recent trends.

- I consider Starbucks a stock to sell unless it trades below $70 per share, as it risks becoming a low-growth, capital returns-focused company that trades like a growth stock.

martinrlee

Investment Thesis

Starbucks (NASDAQ:SBUX) appears to be significantly overvalued, given its struggles to grow its international business profitably. I project that the company needs to nearly double its free cash flow growth rate from 2015-2023 in order to justify the current stock price. Additionally, the company is in a state of identity crisis as it transitions from its traditional model of being the “third place” into a place for people to grab-and-go and get out quickly.

The third place was what made Starbucks special. It differentiated the company from everyone else. You knew you could pop into a Starbucks, get passable coffee, and linger. If it was your local spot near work or along your morning walk, you got to know the employees and the regulars. The third place is gone, and Starbucks is stuck somewhere in the middle, attempting to strike a balance between the lingering and the online ordering. I’m not sure what to make of the company as an investment case. It appears to be a stock in the decline phase.

After the recent run up in price on speculation that new CEO Brian Niccol can turn the company around, I rate the stock a sell. However, I think the case can be made to hold on and see if the company can execute on its growth strategy. If it can, it may be a good value today.

In this article I’m going to try to tease out a potential investment case and dive into all aspects of the business.

Introduction

The market has been hot this year, and some of my favorite stocks are looking a little expensive, the ones that I hold the highest conviction in are already too largely weighted in my portfolio for me to add more, so I’m on the hunt for new ideas. Starbucks has seen a lot of action lately, with the addition of Brian Niccol, former CEO of Chipotle (CMG), and the stock has rallied. I decided to take a look at the company and see if it belongs in my portfolio or on my radar list. Prior to the run-up in share price, I was keeping an eye on Starbucks, and do not own shares.

Background of Company

Formed in 1985, Starbucks describes itself in its 10-K as, “the premier roaster, marketer and retailer of specialty coffee in the world, operating in 86 markets.” Starbucks purchases and roasts coffees, along with handcrafted tea and other beverages. It also sells a variety of food items through company-operated stores. The company also sells a variety of coffee and tea products through other channels, such as licensed stores, grocery stores, and food service locations. SBUX has a Global Coffee Alliance with Nestlé S.A. (OTCPK:NSRGF). SBUX also sells company-licensed goods and services under the following brands: Teavana, Ethos , Starbucks Reserve, and Princi.

Starbucks mainly generates revenue from company-owned stores. This is a core part of its strategy, allowing SBUX to maintain high standards for store design, customer experience, and product quality. SBUX locations are generally found in high-traffic locations globally. The company does have licensed stores across the globe, generating licensing fees and royalties, as well as sales of its merchandise to the operators.

Starbucks operates in three reportable segments: North America (74% of revenue in 2023), International (21% of revenue), and Channel Development (5%). Starbucks had 38,038 company-operated stores and licensed locations as of its most recent fiscal 2023 10-K.

Does Starbucks Have A Moat?

Starbucks appears to hold the basic structure of a moat. It has brand power, an intangible asset that can be a true advantage in a marketplace. It also has premium pricing power from its brand recognition and the perception of high-quality products. I’m going to do my best to check my coffee snobbery at the door and recognize that Starbucks is just about as reliable a product as there is, even though I find the coffee mediocre, personally.

Its brand is widely recognized across the world. Going back to my introduction and investment thesis, the company used to be a place where I could show up at any location and reasonably expect to get a minimum level of service, decent coffee products, and a snack if needed and have a place to use the restroom and take a break if required. Though this is mostly true today, the experience at Starbucks has been disrupted, so I think the brand, though still very relevant, appears to be less relevant for some today. The third place concept seems to be what made Starbucks special, and what catapulted the company to impressive growth and its current standing. However, that model has been disrupted, and I’m not sure Starbucks can maintain its edge enough to be a solid investment.

Scale advantages are a source of a moat for Starbucks by providing low-cost production through a more efficient supply chain and the ability to buy massive amounts of coffee and tea from its suppliers at reduced cost. Integrating technology into the business is a competitive advantage.

Low-cost production is an advantage for Starbucks. The company operates at such a great scale that it can procure its ingredients and materials at lower prices than its competitors. This is a huge advantage in a marketplace, particularly when customers are looking to cut back on expenses. However, the company doesn’t exactly pass all its cost savings onto its customers, it charges a hefty premium compared to competitors. An investigative article from 2022 found that Starbucks charges between a 12% and 22% premium to its competitors. Combined with the ability to raise prices without losing customers, Starbucks’ biggest ongoing advantage may be the combination of low-cost production and pricing power.

SBUX has built a reliable and well-used technology platform into its business. Starbucks has 32.8 million active rewards members and an online mobile ordering app, that allows customers to order ahead and pickup their drinks at the counter, skipping the line. This is something that much of its competition cannot match. Starbucks’ technology is innovative and difficult or impossible to replicate for smaller competitors.

It appears that Starbucks has a moat that will allow the company to remain the dominant player in its industry. However, having a moat may sustain the business, but it does not guarantee great shareholder returns. The company must be able to grow cash flows in order to reward shareholders.

Let’s see where the company stands today.

Demand For Coffee

Global coffee consumption demand continues to grow. Coffee culture is expanding in other markets, fueling demand in emerging markets like Asia and Latin America. Starbucks has capitalized on this by aggressively expanding internationally, especially in China, where it sees significant long-term growth potential. This may be the most critical aspect of any investment thesis in the company. Can Starbucks replicate its North American success in China or India?

The global coffee market is projected to increase at a CAGR of 4.8% between 2024 and 2030. Some of the trends observed in the industry are younger drinkers of coffee, with Gen Zers beginning around the age of 15 versus Millennials who started drinking coffee around 18-20 years old.

Relevance Of The Coffee Market

As the global coffee market grows, it’s important to understand what is fueling this growth. The product itself is addictive. Caffeine has mildly addictive properties, and the cultural act of drinking coffee and tea cannot be understated as a critical reason for the relevance of the industry being sustainable.

Relevance Of Starbucks

I’ve discussed how I think the differentiator of Starbucks stores is waning, the third place is dying and being disrupted by the very thing coffee is intended for, efficiency. At Starbucks you can place an order online and walk right up to the counter, where dozens of other drinks are waiting to be picked up by other mobile customers.

This presents both a solution and a problem for the company. The lines that used to form in stores acted as a buffer for the baristas to regulate throughput. Because a customer had to wait in line, the customers ahead could have their drinks made first, meaning the spread between the order and the delivery was also regulated. Now, some Starbucks stores turn into absolutely chaotic scenes, with long lines waiting for baristas rushing to make online orders, only to pile them up on the counter.

If the magic of Starbucks has been disrupted, it may diminish the incentive for people to buy coffee there.

Financial Analysis

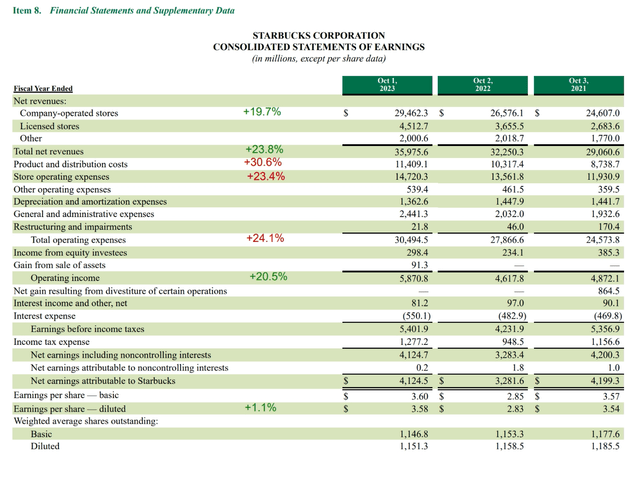

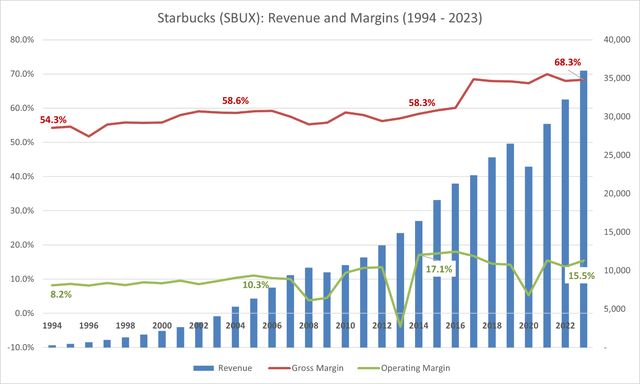

SBUX has steadily grown revenue, expanding its gross margin signifcantly. Normally, an expanding gross margin comes with expanding operating margins, but this isn’t the case for Starbucks. Operating margin expanded until 2014, before contracting until today. The company is grappling with increased SG&A expenses and other operational challenges.

Author-generated with data from SEC Filings

The chart below shows a significant increase in operating costs over the last three fiscal years, with expenses outpacing revenue growth.

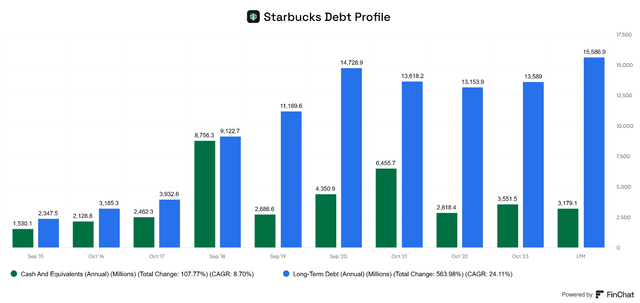

Starbucks has grown its debt levels in recent years and has about $12.3 billion in net debt on its balance sheet. Giving it a TTM Net Debt to EBITDA ratio of about 1.8x, which is pretty healthy. The debt is only a concern if this ratio keeps growing.

Cash Flows

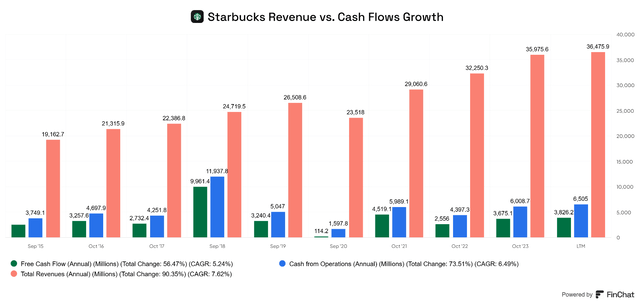

Considering the solid top-line growth of 7.6% annually from 2015 until the TTM period, FCF growth has been unimpressive, growing at just a 5.2% CAGR. Furthermore, it’s not just a product of increased Capex for store growth. OCF has only grown at a CAGR of 6.5%.

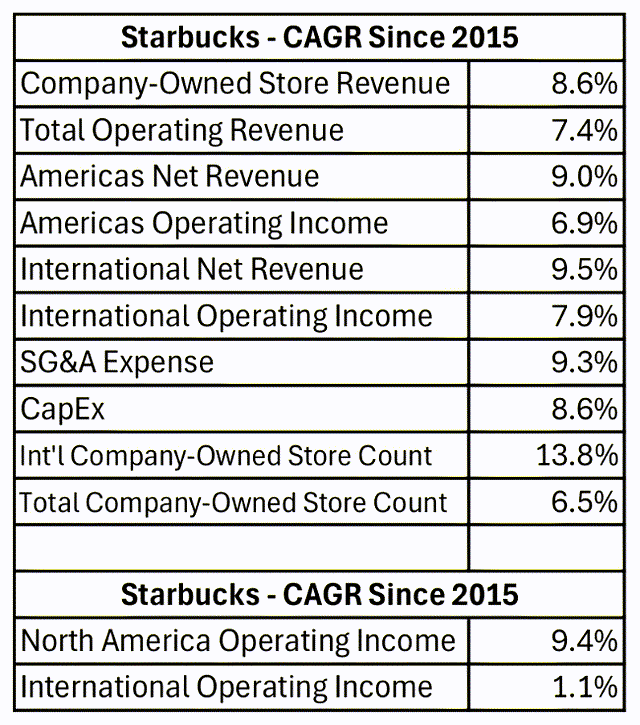

Digging deeper, we can see the CAGR of various figures between 2015 and 2023. SBUX grew revenue of company-owned stores at 8.6%, and total operating revenue at 7.6%. However, SG&A expense grew at 9.3% during the period and Capex at 8.6%. The company is investing in growth, but operating income has grown slower than revenue, just 6.9% for Americas and 7.9% for International.

SBUX has grown its international store count by 13.8% annually and total stores by 6.5% annually. These investments have to begin paying off at some point.

Author-generated from SEC Filing Data

When we look at the growth rates since 2018, we see that International operating income has only grown at a CAGR of 1.1%. This is a troubling sign for SBUX.

Valuation

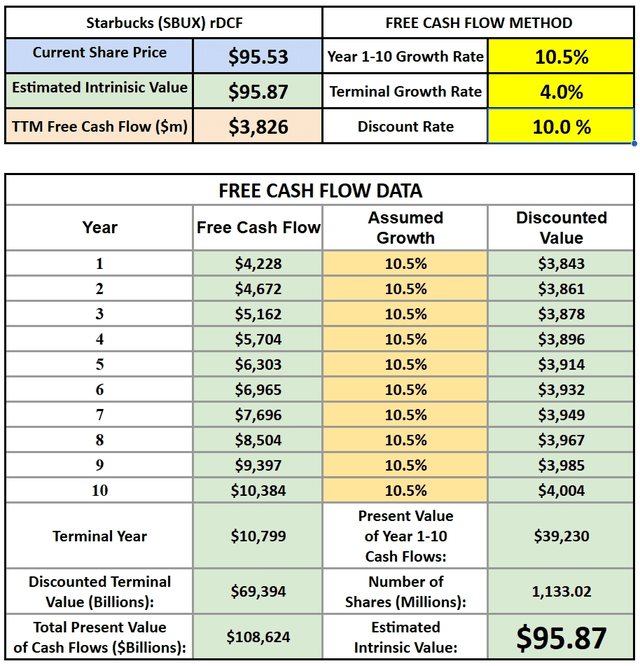

To estimate the required returns for Starbucks, given the current price, I ran a reverse DCF model using SBUX’s TTM free cash flow of $3.826 billion as a base. I set the discount rate to 10%, which would deliver adequate returns, and falls roughly in-line if not higher than S&P 500 returns. For the terminal growth rate, I’m using 4.0%, which might be the expected growth rate of the global coffee market.

Author-generated Reverse DCF Model

Under these assumptions, SBUX must grow free cash flow at 10.5% CAGR over the next ten years to justify the current share price form an intrinsic valuation perspective. I am not adjusting this model for the debt that Starbucks has on the balance sheet, so there is some added risk to this model.

SBUX has grown FCF at a 5% CAGR since 2015, and OCF at a 6.3% CAGR. If my model is anywhere close to accurate, it needs to grow FCF at a CAGR of 10.5% for the next ten years before reaching a terminal rate of 4%. With margins contracting I have my doubts about SBUX’s ability to do this.

Given Starbucks’ contracting margins, loss of the cultural identity that made it successful, increased competition, and a premium valuation, I see the company stuck between stage 5 and stage 6 of the business growth cycle. It’s trying to grow out of the early stages of decline rather than leaning into the capital returns stage. The hiring of Brian Niccol is a welcomed change, but the enthusiasm that has driven up the stock price has made me think Starbucks could be dead money for investors who buy today.

Risks

Thesis Risk

If Starbucks is able to expand successfully across China and through Asia, then my thesis and sell rating will be challenged. The opposite of my stance on SBUX is my buy thesis, which I cannot support now: that SBUX can pull off the long-tailed growth it is attempting to do.

An additional risk to my thesis is that SBUX pulls the plug on expansion, and the stock does not suffer because investors believe in the new CEO, Brian Niccol. Then, the company successfully refocuses its current store base, becomes more efficient, and increases its FCF margin. In this case, it likely becomes a huge dividend grower and share repurchaser.

Business Risk

The company faces challengers, big and small, from large competitors in China, like Luckin Coffee (OTCPK:LKNCY) and Dunkin Donuts, to independent coffee shops that have sprung up everywhere. International growth comes with cultural challenges as well as regulatory challenges. Starbucks needs to execute on its growth strategy or it is likely significantly overvalued.

Business Growth Stage Risk

SBUX may be a company in the early stage of decline. The company’s operating margin has been contracting, and if its expansion efforts don’t pay off, it will be wasting an opportunity to reward shareholders with the healthy cash flows it could be generating if it weren’t pouring it into growth.

China Risk

SBUX is attempting to grow rapidly in China, but I have my doubts about this strategy. On the one hand, there is an increasing demand for coffee in China; on the other hand, China is much different from the markets in which SBUX is already well-established in, particularly The United States. Luckin Coffee (OTCPK:LKNCY) is a formidable foe in the Chinese market, with significantly lower prices than SBUX. Can SBUX command premium pricing in China? That’s a very important question investors must ask themselves.

Conclusion and KPIs

I want to see Starbucks accelerate its International operating income growth. This is essential for the company as it’s investing a lot of money into expansion. The stock trades at a premium, and growing its way into that premium is what will deliver shareholder returns; anything less will make SBUX a value trap.

I want to see margins expand, operating margin has been deteriorating in recent years, which is a troubling sign and a potential indicator that SBUX is a company in the early stages of decline or at least fighting the inevitability of becoming a low-growth, capital returns type of company that should be focusing on reducing capital expenditures and expansion efforts, increasing its dividend and buying back shares when the stock is cheap enough.

From what I see, Starbucks appears to be fighting off its decline through expansion, which is a risky proposition for shareholders. I would only consider the stock a buy if the price fell low enough to support healthy shareholder returns with a lower required free cash flow growth rate. For me, I’d be more interest if the stock were trading below $70 per share. I consider Starbucks a stock to sell, but I am curious about what others think and want to hear your takes. Do you disagree? Please comment below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.