Summary:

- Airbnb’s asset-light model allows for rapid scaling without owning physical properties supported by strong network effects.

- Stagnant booking growth, regulatory challenges in major cities, and vulnerability to economic downturns could limit Airbnb’s future revenue and profitability.

- Despite a $215 target price, Airbnb’s growth concerns and market risks make it too risky for investment at this time.

Klaus Vedfelt

Context

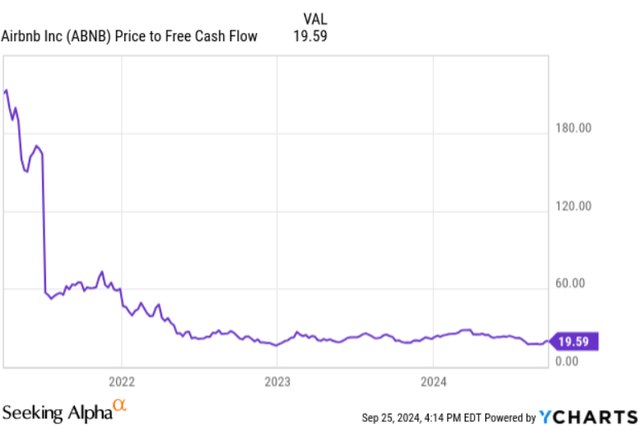

Airbnb (NASDAQ:ABNB) underperformed the S&P500 last year, as shown in Figure 1. Even when its results were reasonably good, the company kept growing and with high margins. However, I have some concerns about the current situation. Growth has been lower than expected, there are some regulatory concerns in key cities, and macroeconomic headwinds would significantly impact the company.

Even my most probable scenario values the company at $215 per share, a 65% premium over its current stock price; I estimate the risk outweighs this return, and I recommend holding until we uncover more information to see if those risks are reduced.

Figure 1: Seeking Alpha

A compelling competitive position

Airbnb is a two-sided network whose value grows as more hosts and guests join the platform. As more guests want to enter the network, it becomes more attractive for hosts because there is more demand and a greater probability of having more occupancy ratios. As more hosts are on the platform, more diverse properties are more attractive to guests. This network effect gives Airbnb a clear competitive advantage, which makes it hard for competitors like Vrbo and Booking Holdings to replicate a network like Airbnb’s.

Besides this, as the platform grows, the company benefits from more economies of scale as its net revenue margin outweighs platform development costs. Some data illustrate the size of Airbnb’s network. In Q2 2024, It had more than 8 million active listings; it booked 125.1 million nights and experiences, a 9% increase year over year.

Another characteristic I like about Airbnb is that it is an asset-light model. That means that unlike hotels and more traditional competitors, Airbnb hasn’t had to invest in properties, allowing it to scale without huge investments. CAPEX is almost insignificant.

The last part of its business strategy involves diversifying its offerings with Airbnb Luxe and expanding into experiences that allow it to access high-net-worth clients, such as traditional hotel clients. This will also allow it to grow in revenue. Markets like Latin America are a growth driver for the company and diversify its revenue stream geographically.

Financial Performance

Airbnb reported $2.75 billion in revenue in Q2 2024, an 11% year-over-year growth rate. Gross booking value increased 11% to $21.2 billion, and the average daily rate increased slightly. So, growth is driven mainly by volume, especially in Latin America, with a growth rate of 13.5%. This revenue growth is one of the lowest in the last few years, signaling that it is becoming more challenging for the company to grow.

Gross margin has been 81.6%, down from 82.6% in Q2 2023. The main reason is higher merchant fees, which means hosts have more power and influence over the company, which is another headwind. Operating income margin has lowered from 21% of revenue in Q2 2023 to 18% last quarter. This margin decrease is due to higher marketing spending, which increased 18% to $573 million last quarter. The company has spent much more because of ongoing campaigns and search marketing. Customer acquisition costs are rising with more demanding customers that are harder to convince.

The company is generating cash at a good pace, with free cash flow at $1 billion, accumulating $4.3 billion in the trailing twelve months, a margin of 41%, and a growth rate of 16% year over year. The company also returned capital to shareholders by repurchasing $749 million in shares during the quarter, with $5.25 billion remaining in the authorized program. The company holds $11.3 billion in cash and cash equivalents and has $10.3 billion in funds on behalf of guests.

These results indicate an increasingly challenging environment for the company even when it is still growing, and its free cash flow margins align with those of traditional hotel chains like Marriott International.

Valuation

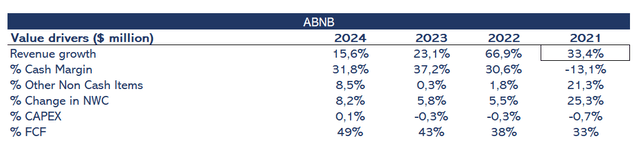

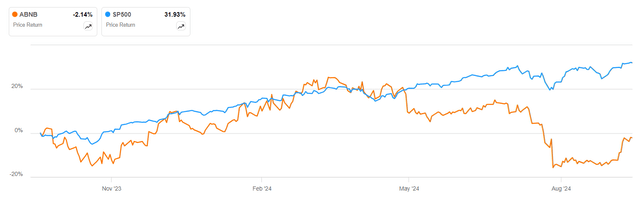

Figure 2 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

I estimate revenue growth will decrease by two percentage points due to the industry cycle’s downturn. In a conservative view, I project a further reduction in the revenue growth rate until it reaches 10% in ten years. Margins will decrease from 30% to 25% in ten years. As I have stated, increasing marketing spend is due to a more challenging competitive and regulatory environment.

Cash flows will be discounted at a 7.8% WACC because the beta is 1.17 and risk-free at 3.8%. Given the company’s low leverage of 22% of total capital debt, WACC is weighted towards the cost of equity. The terminal growth rate is set at 3%.

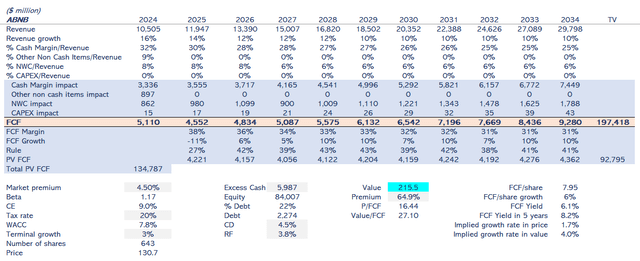

As shown in Figure 3, my value estimate is $215.5 per share, a 65% premium over its current stock price. My valuation implies a Price to Free Cash Flow of 27, which is modest compared to the historical series, as shown in Figure 4.

Risks

As I stated in the financial performance section, Airbnb’s revenue has been the lowest in the last few years, and its guidance of 8%—10% reaffirms its difficulty in growing, especially in North America, where revenue growth rates are 9.7%. This indicates that Airbnb’s core business could be maturing, potentially limiting future returns.

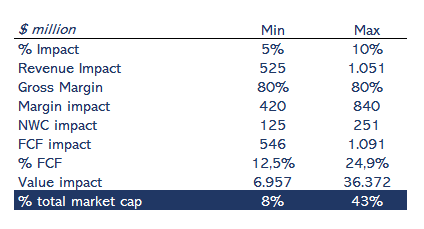

Additionally, Airbnb faces increasing regulatory problems in key cities like New York, Paris, and Barcelona. For example, new regulations in New York have reduced Airbnb listings by 75%, and the markets where Airbnb operates are increasingly challenging regulatory environments. These may lead to 5-10% drops in revenue in certain regions, posing risks to Airbnb’s overall growth and potentially putting downward pressure on the stock price. This decrease in revenue generates a wide range of variations in the stock value, from 8% to 43% if the five biggest cities have regulatory problems (Figure 5).

Figure 5: Author

Airbnb is very sensitive to macroeconomic factors such as inflation, recessions, and interest rates. Economic downturns lead to reduced discretionary spending, such as travel, which could affect Airbnb bookings. If a recession occurs, consumers will likely cut back on travel, resulting in fewer bookings and impacting Airbnb’s revenue.

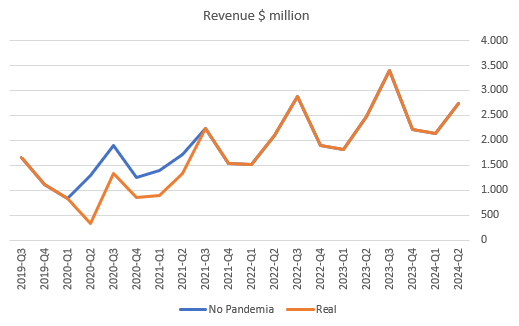

Given its reliance on travel spending, a 10-20% drop in bookings during a downturn could significantly reduce profitability and value. In a more severe scenario, for instance, the pandemic (Figure 6), revenue decreased 23% annually, resulting in a $1.8 billion loss in benefits. Additionally, income from bookings earned but not yet recognized could be reduced by $240 million, further pressuring Airbnb’s financial performance. Its potential stock price loss would be 31.4%. The stock wasn’t public at that time.

Figure 6: Author

In a scenario where there is a recession in 2026 with a decrease in revenue of 20%, another 14% downfall in 2027, and a flat in 2028, the valuation model will give us a fall of 26% in stock market value. Considering the risks described and its negative impact, it is easy to reach a price of $97 per share. My conclusion is that the ratio risk-return is not worth it. Even when the stock has a low multiple, it is too risky for me to invest in the company.

Conclusion

Airbnb offers an attractive opportunity driven by its strong competitive position. Its profitable, asset-light model has strong network effects. The company’s expansion into luxury segments and growth in regions like Asia and Latin America provide promising long-term potential. However, growth in North America has slowed, the company has higher customer acquisition costs, hosts are demanding higher prices, and the company faces regulatory and macroeconomic risks.

Despite solid financial performance, with $2.75 billion in revenue in Q2 2024 and strong cash flow, challenges pressures could limit future returns. And even when my target price is $215 per share, a 65% premium, Airbnb offers too much risk for investing in the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.