Summary:

- Thermo Fisher operates worldwide selling medical and science laboratories products, software, and services that benefitted from the pandemic but are not beholden to it for profit and momentum.

- The stock gets low grades for valuation and growth but investors can potentially realize a 20% upside or more in the next 12 months.

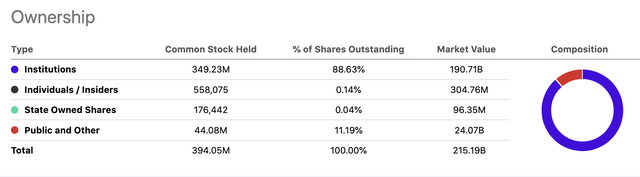

- 88% of the shares are owned by institutions looking to increase their equity and profits. Their diligence will help retail value investors to profit.

JHVEPhoto/iStock Editorial via Getty Images

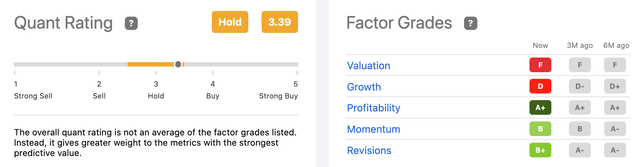

For years, the consensus about Thermo Fisher Scientific Inc (NYSE:TMO) has been to Hold the stock. Its valuation and growth potential get low grades from Seeking Alpha. Meanwhile, the company consistently gets an A+ for profitability, and As and Bs for momentum and EPS revisions.

We turned bullish recently for several reasons. SA’s Quant Rating is now trending to Buy. We expect solid Q4 revenue and earnings when the company reports on February 1, 2023.

Quant Rating & Factor Grades (seekingalpha.com/symbol/TMO/ratings/quant-ratings)

Company Products in Demand

The company’s ~$40B in annual revenue generates from sales of instruments, equipment, software, consumables, and services:

- Thermo Scientific commercializes its Applied Biosystems genomic solutions for cancer diagnostics, human i.d. testing, animal health, and inherited and infectious diseases. Invitrogen protein biology is grounded in cellular and gene editing used by scientists for research and to design new drugs. Fisher Scientific sells lab equipment and chemicals around the world through a company salesforce, catalogs, and e-commerce.

- Unity Lab Services helps labs maximize productivity by improving their efficiencies and effectiveness.

- Thermo’s Patheon operates 65 locations conducting clinical trial services, logistics, and commercial manufacturing in end-to-end drug development.

- PPD provides Thermo customers assistance in gaining regulatory approvals and commercializing medicines, biotech, and medical devices.

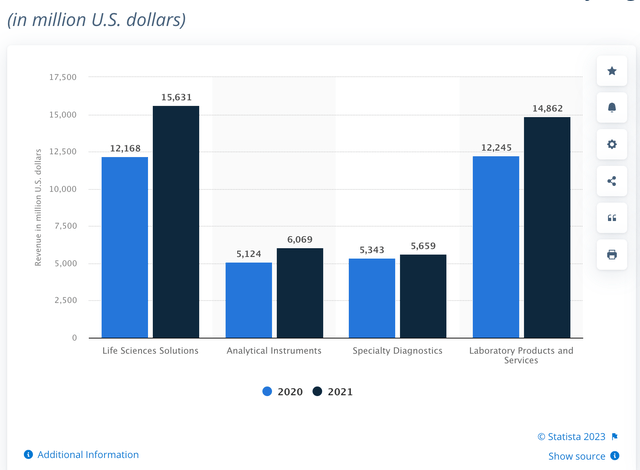

Revenue of Thermo Fisher Scientific by segment 2021

Revenue by segment (statista.com/statistics/1101131/revenue-by-segment-thermo-fisher-scientific/)

Company revenue hit $32.2B in 2020 and $39.2B in 2021. It benefitted from the novel COVID-19 pandemic. We forecast 2022 revenue at about $44B; though the pandemic is not as debilitating, testing in great numbers continues as does the demand for new vaccines and pharmaceuticals.

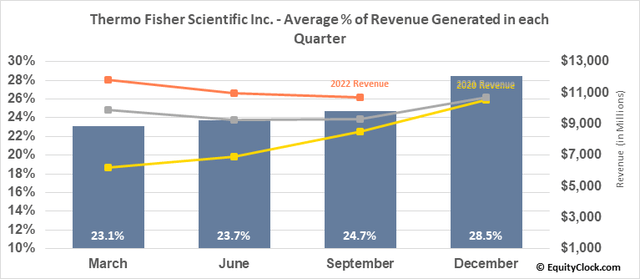

Q3 in 2022 revenue was $10.68B. Core organic growth was reported at 14%. The adjusted EPS was $5.08 beating the consensus estimates of about $4.80. The February ’23 EPS report can potentially be a +20% jump to ~$5.20 per share. Thermo Fisher beat earnings estimates for four consecutive years, sometimes as much as 25%. Company revenue is usually strongest in the fourth quarter, as the chart below suggests, giving gravitas to our forecast for a strong fourth-quarter report.

Average revenue generated (charts.equityclock.com/thermo-fisher-scientific-inc-nysetmo-seasonal-chart)

Bright Future but Uneven Price Climb

Thermo Fisher continues meeting increasing demand with its new and upgraded product and software offerings. For example, the company launched a host of new products last year. Its Orbitrap Ascend Tribrid mass spectrometer quantifies and characterizes proteins. The Thermo Scientific Arctis Cryo-Plasma Focused Ion Beam is an automated microscope that streamlines cryo-electron tomography research providing insights into how proteins and other molecules operate within cells. Its CE-IVD certification of the Oncomine Dx Express Test and Oncomine Reporter Dx software advances precision oncology testing.

Thermo Fisher is a leading force in a compelling growth industry. Worldwide demand is rising for clinical laboratory testing, according to a December ’22 report from ResearchandMarkets.com. The report suggests demand for the clinical lab service market to reach $280.67B by 2030.

The report attributes high demand to the emphasis on early disease detection, the prevalence of chronic diseases, and “supportive government initiatives for improved clinical diagnostic procedure.” In line with these circumstances, the CEP observes that pharmaceutical and biotech comprise 60% of the company’s core business. “It’s our largest end market,” the CEO told a conference audience.

Downwinds

In 2021, Thermo Fisher did $2B in revenue supporting medicines and vaccines. The easing of the pandemic makes it likely that Thermo Fisher will do $1.5B in 2022 in this space. But management expects it will deliver 12% growth in other sectors “to migrate the first $500M to other activities.” The impact on the stock has been to increase its volatility (Beta 0.99).

The company’s share price hit a high of $665 at the end of 2021. Over the last 12 months, the share price fell 12.63% but was only down 1.28% YTD. Its 52-week low was $475.77. Shares hovered recently around $546 each then popped +4% in one day closing at $568 reflecting its volatility. We see few risks to Thermo Fisher shares in the near term; short interest is a nominal 0.77% but the dividend is not attractive.

The company has a $210.82B market cap. Some growth has been by acquiring 67 companies in 16 countries over the years. In 2021, Thermo Fisher made its largest acquisition of pharmaceutical Product Development for $17.4B. 5 companies were acquired in 2021. The debt is substantial but manageable.

The debt totaled $29B at the end of September. Its debt-to-equity ratio is 60%. Management worked to reduce the ratio from 89% over the last 5 years. Equity as of last September was $43.7B. The debt is covered by operating cash flow and the interest payments are covered by EBIT. Cash and equivalents the company holds are about $3B. News sentiment is positive.

Hedge funds sold almost 200K shares in the last quarter. In January ’22, 104 funds owned shares. At the end of Q3, just 92 owned shares. Corporate insiders also sold more shares than purchased in the last quarter.

Takeaway

We forecast an average price target of $615 this year. The price can potentially fluctuate between $505 and $650 if volatility and the inflation rate punch upward. We think the services and product sales of the company are unlikely to be hurt by any recession.

Demand for the company’s products and services will increase in our opinion over time. America’s population is aging, doubling in fact, over the next 40 years. Europe has the largest aging population in the world. Demand for more lab services will increase because of this aging population. Further underpinning the share price forecast is the board’s authorization to repurchase $4B of shares with no expiration date.

Institutional ownership of the stock is higher than normal. The good thing is they demonstrate their faith in the company’s long-term profitability.

Ownership (seekingalpha.com/symbol/TMO)

In our opinion, Thermo Fisher is going to have a good Q4 report. The virus is not done with us; demand for testing and lab services is pretty great despite lockdowns and school closings being passé. Travel is increasing and countries are demanding pre-departure testing and tests on landings.

We think Thermo Fisher will also benefit from the growing market for diagnosis of chronic illnesses, bioprinting, and tissue engineering, the upturn in the development of orphan drugs underwritten by the government, and the push for new medications and gene editing.

In shaky economic times, there are several industries retail value investors ought to be considering. In our opinion, you can always do well sticking to science. Thermo Fisher Scientific is a potential opportunity to invest in science and benefit from its high-quality scientific products and services and good management.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.