Summary:

- Palantir is cementing its position as a leading force in the AI and data analytics space.

- Commercial momentum is fueled by strong growth in its U.S. commercial and government divisions, widening margins, and strategic.

- The company is on track to achieve $1.2 billion in operating profits by 2026.

- Additionally, the recent inclusion of Palantir in the S&P 500 is expected to trigger immediate buying interest from index funds and ETFs.

- However, Palantir’s current stock price reflects a significant overvaluation, making it difficult to justify an investment at these levels.

hapabapa

Palantir (NYSE:PLTR) is showing strong commercial momentum on the backdrop of robust growth in its U.S. commercial and government segments, expanding margins, and strategic positioning within critical markets and growth vectors. With this, Palantir is expected to generate $1.2 billion of operating profits by 2026 (according to consensus estimated collected by Refinitiv). On top of this, Palantir’s stock is poised to see immediate buying pressure from index funds and ETFs that track the index, on the backdrop of the stock’s index inclusion in the S&P 500.

Unfortunately, Palantir stock reflects extreme overvaluation, making it (for me) impossible to argue for an investment based on current valuation levels. Investors should consider that if we use the projected $1.2 billion in operating profits by 2026 as a reference point, Palantir is currently trading at an EV/EBIT ratio of around 60 times. This represents a 300% premium compared to where its peers in the information technology sector are trading today.

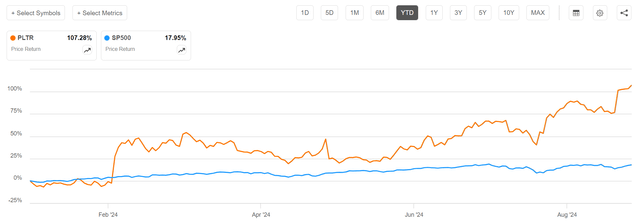

To provide some context, Palantir stock has notably outperformed the broader equity market in 2024, with shares rising 107% YTD, compared to a 18% gain for the S&P 500 (SP500).

Seeking Alpha

Accelerating Growth in Core Markets

Palantir’s recent quarterly performance demonstrates its momentum across both commercial and government sectors. The company delivered a substantial revenue beat in Q2 2024, exceeding its guidance by $27 million or 4.2%. The revenue growth, which stood at 27% YoY, marks an acceleration from the 21% growth reported in the first quarter, underscoring the company’s ability to capitalize on its unique product offerings in a competitive market.

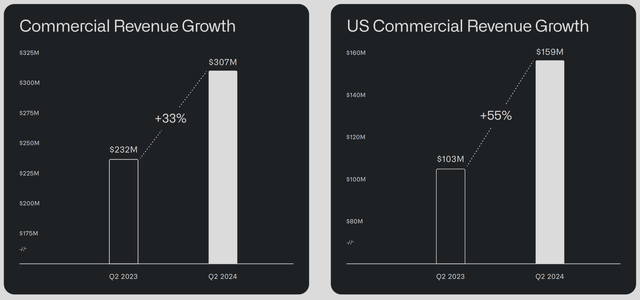

Notably, Palantir’s U.S. commercial revenue surged by 55% YoY and 6% QoQ, to$307 million for the period, a significant acceleration driven by the success of its Artificial Intelligence Platform. The AIP has proven effective in attracting new customers and expanding existing relationships, as evidenced by over 1,025 boot camps conducted to date. Customer count jumped an impressive 83% YoY and 13% QoQ. In my view, this growth is particularly impressive given the current macroeconomic headwinds that have restrained IT spending across many industries.

Palantir Q2 2024 reporting

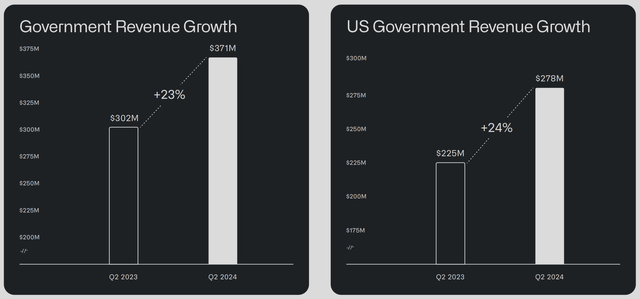

On the government front, Palantir continues to expand its footprint with key contracts such as the Chief Digital and Artificial Intelligence Office’s (CDAO) Open DAGIR project, aimed at scaling AI capabilities across the Department of Defense. Revenue for the segment grew 23% YoY, to $371 million.

Palantir Q2 2024 reporting

Margin Expansion and Financial Strength

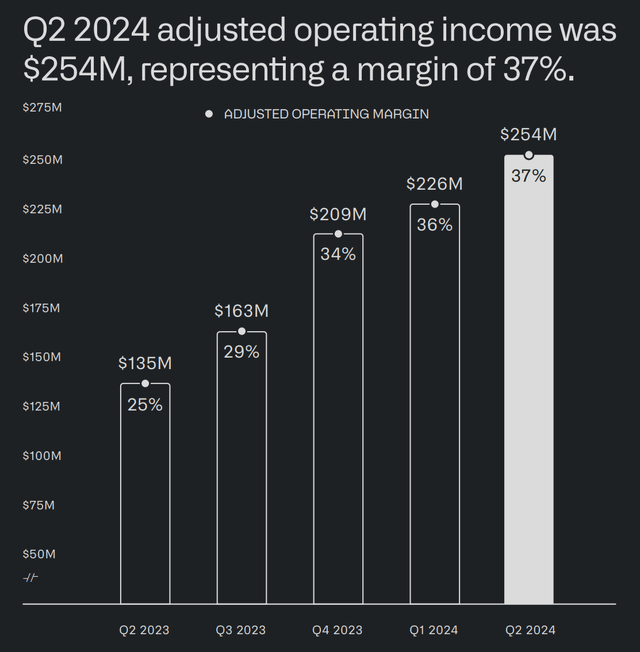

Palantir’s focus on operational efficiency is paying off, as demonstrated by its expanding margins.

Palantir Q2 2024 reporting

The company reported a non-GAAP operating margin of 37% for Q2 2024, well above the Street’s estimate of 32%, and has subsequently raised its full-year guidance to 35%. This margin expansion is driven by improved cost management and a favorable revenue mix skewed toward higher-margin government contracts In dollar-value, operating income was $254 million for Q2, almost double the profits recorded for the same period one year prior.

Despite a free cash flow miss in the second quarter, Palantir’s management remains confident in achieving its FCF guidance of $800 million to $1 billion for the full year. Indeed, the Q2 miss is likely attributed to timing mismatches in government and commercial collections, with expectations for a stronger cash flow generation in the latter half of the year. Notably, Palantir’s balance sheet remains strong, with zero debt and significant cash reserves. This financial flexibility provides the company with ample room to invest in growth opportunities, including potential acquisitions and continued product development.

Positioning in AI and Data Analytics …

Palantir’s approach to leveraging and developing AI is multifaceted, combining its proprietary platforms, Foundry and Gotham, with a robust strategy to drive AI adoption across commercial and government sectors. The company’s AI Platform (AIP) serves as the foundation for its AI-driven capabilities, allowing organizations to analyze vast datasets and generate actionable insights in real-time. Specifically, Palantir’s AIP is designed to enhance operational efficiency, reduce costs, and accelerate decision-making processes, making it particularly attractive in sectors with large-scale data integration needs, such as defense, intelligence, healthcare, and finance.

In the commercial sector, Palantir is capitalizing on its unique AIP boot camp initiative, which provides a hands-on experience for over 1,000 companies, showcasing the platform’s capabilities in a practical, intimate setting. This approach has been instrumental in driving customer conversion and expanding Palantir’s market footprint. Strategically, highlight that the boot camps not only serve as a direct sales tool but also as a method to demonstrate the platform’s adaptability to various industries, ranging from logistics and supply chain management to industrial manufacturing, where the new “Warp-Speed” product aims to digitally transform and reindustrialize American businesses.

On the government front, Palantir’s AI strategy aligns closely with U.S. defense priorities, particularly through its involvement in high-profile initiatives like the Department of Defense’s Open Data and Applications Government-owned Interoperable Repositories (Open DAGIR) project. Open DAGIR, developed in collaboration with the Chief Digital and Artificial Intelligence Office (CDAO), focuses on scaling AI capabilities across the Department of Defense and integrating Joint All-Domain Command and Control (JADC2) functions across space, cyber, electronic warfare, and logistics domains. This program positions Palantir as a crucial player in the U.S. government’s push to modernize military operations through AI, enhancing both data interoperability and real-time decision-making capabilities.

… Driving Upside In EBIT

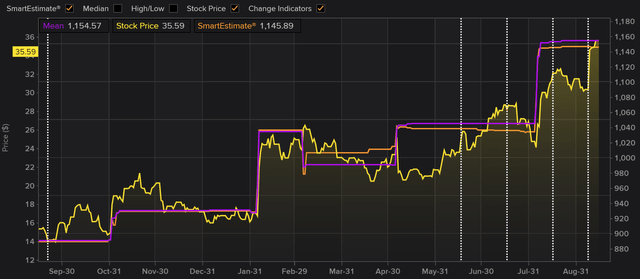

Palantir’s strong commercial momentum can not be ignored. And accordingly, Wall Street analysts are taking note: Over the past 12 months, consensus estimates for Palantir’s EBIT outlook in 2026 have notably increased, jumping from about $900 million in September 2023 to almost $1.2 billion as of September 2024, according to data collected by Refinitv, reflecting higher topline growth expectations as well as stronger margin assumptions.

Refinitiv

One More Win – S&P 500 Inclusion

Palantir has been included in the S&P 500. The inclusion took effect on September 23, 2024, before the market opened. Palantir’s addition to the S&P 500 followed its consistent financial performance, including profitable results for the past seven consecutive quarters. The company’s entry into the S&P 500 came as part of a quarterly rebalancing by S&P Global.

Palantir’s inclusion in the S&P 500 is bullish because it triggers increased demand for its shares from index funds and ETFs that track the index, leading to immediate buying pressure and potentially higher stock prices. Moreover, the inclusion enhances the company’s visibility and credibility, likely leading to a broader investor base and increasing analyst coverage, which should ultimately boost also retail investor confidence.

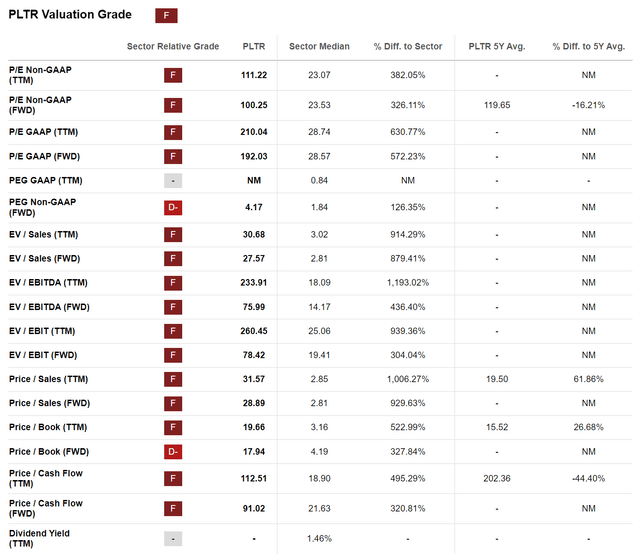

Valuation

Based on the valuation metrics collected by Seeking Alpha, Palantir exhibits a valuation significantly above sector medians across nearly all key metrics. For example, its Price-to-Earnings Non-GAAP ratio is 111x, which is 382% higher than the sector median, and its Price-to-Sales ratio is 32x, over 1,000% higher than the sector average. Similarly, PLTR’s Enterprise Value to EBITDA ratio is 234, a staggering 1,193% above the sector median. Needless to say, all these figures reflect extreme overvaluation compared to its peers, making it (for me) impossible to argue for an investment based on current valuation levels.

Even accounting for growth, Palantir stock looks grossly overvalued: Taking the consensus estimate of $1.2 billion operating profits by 2026 as the anchor, Palantir is trading at a EV/EBIT of close to 60x, which would be a 300% premium to where peers in the information technology sector are trading today.

Seeking Alpha

Investor Takeaway

Palantir is cementing its position as a leading force in the AI and data analytics space, fueled by strong growth in its U.S. commercial and government divisions, widening margins, and strategic footholds in critical markets and growth areas. The company is on track to achieve $1.2 billion in operating profits by 2026. Additionally, the recent inclusion of Palantir in the S&P 500 is expected to trigger immediate buying interest from index funds and ETFs. However, Palantir’s current stock price reflects a significant overvaluation, making it difficult to justify an investment at these levels. Even with the anticipated $1.2 billion in operating profits by 2026, the stock is trading at an EV/EBIT ratio of approximately 60 times, which is a 300% premium compared to its peers in the information technology sector. In my view, Palantir stock is grossly overvalued; and accordingly, I remain “Sell” rated until the risk reward improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.