Summary:

- Alibaba is up +60% from my January bottom call, on rising optimism about China’s economy for 2025.

- However, the stock quote is getting extremely overbought, and could witness 2-3 months of retracement action, before another push higher appears.

- I am reducing my 12-month outlook to Hold/Neutral, with an expected trading range of $85 to $120 going forward.

OJO Images/OJO Images via Getty Images

With Alibaba Group Holding Ltd. (NYSE:BABA) announcing some cutting-edge open AI tools last week, followed by recently announced People’s Bank of China credit easing (the largest since the 2020 pandemic) alongside promises for stimulus efforts yesterday (September 26th, 2024) by China’s Politburo, short covering and investor interest in this leading Asian powerhouse have rushed forward. The net result has been a spike in Alibaba’s share quote, with the ADR now above US$100 per share.

For regular readers, I reversed my long-held rating of the company from a neutral to bearish stance into a Buy view for the first time ever in January of this year, days from its 52-week low trade. Shareholders have not been disappointed for performance since then. Over the past eight months, BABA, including dividends, has generated a total return of +60%, easily beating both the S&P 500 index and nearly every Big Tech name in America for investor performance.

Seeking Alpha – Paul Franke, Alibaba Article, January 22nd, 2024

The reasons for optimism included a new dividend payout with large ongoing share buybacks, an unusually strong Accumulation/Distribution Line, near universal pessimism on the stock for overbaked sentiment, an extremely low valuation vs. peer businesses around the world, and the decent odds China’s economy would not implode.

Yet, the easy money has already been made in BABA into late September. It is becoming quite clear the company has a brighter future than most retail investors and analysts imagined possible during early summer. From my perspective, the rational course of action is to expect a breather/rest period in upside price movement, perhaps even a flat line for investor gains over the next 6-12 months.

As a consequence of less bullish momentum patterns, and a view selling this “rip” higher in price may prove the prudent course of action for short-term traders/investors, I am downgrading my official view of the stock from Buy to Hold. I am now forecasting a range for price trading between $85 and $120 into next summer.

Underlying Momentum Indicators

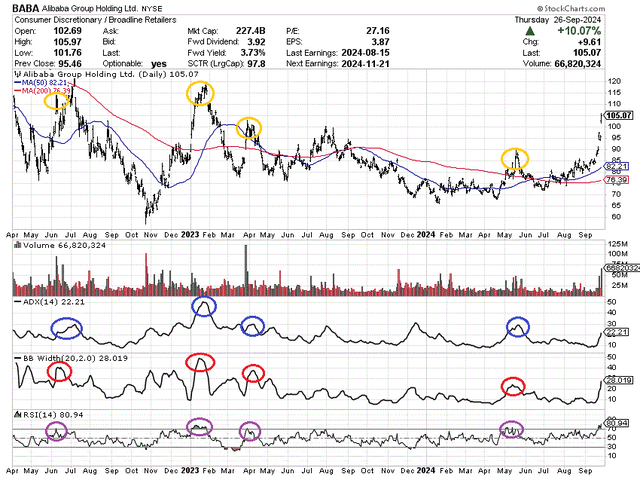

Perhaps the most critical short-term investment puzzle piece that has me backing away from Alibaba is the technical chart has becoming completely “overbought” on the latest rapid ascent in price.

My overbought setup idea is drawn below. I have circled extremely stretched readings in several useful volatility and price change indicators, similar to today. The list of signal-callers includes the 14-day Average Directional Index, Bollinger Band Width (20,2) calculation, and 14-day Relative Strength Index. When they reach high levels in unison, the stock quote generally peaks for at least a month or two.

StockCharts.com – Alibaba, 30 Months of Price & Volume Changes, Author Reference Points

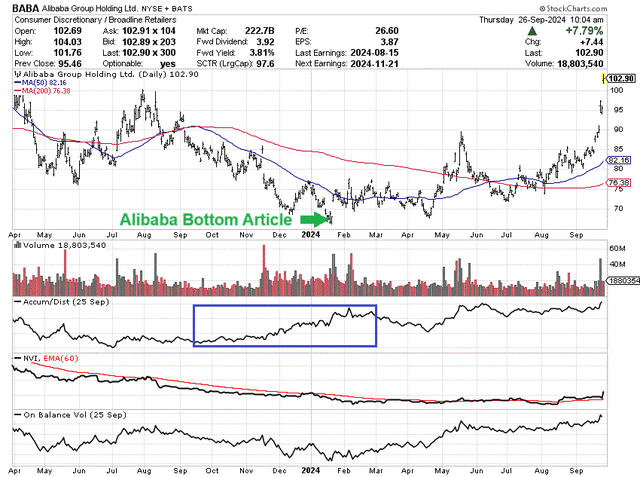

In addition, numerous general momentum indicators I track are not quite screaming Buy Me, like they were earlier in the year. The majority of indicators are higher than a few months ago, but not in the amazing fashion you would expect to match super-strong price action.

In particular, the uniquely robust Accumulation/Distribution Line pattern between June 2023 and February 2024 (boxed in blue below) has faded. To confirm additional price gains are approaching, I would’ve liked the ADL, Negative Volume Index, and On Balance Volume readings to show up a little better.

StockCharts.com – Alibaba, 18 Months of Price & Volume Changes, Author Reference Points

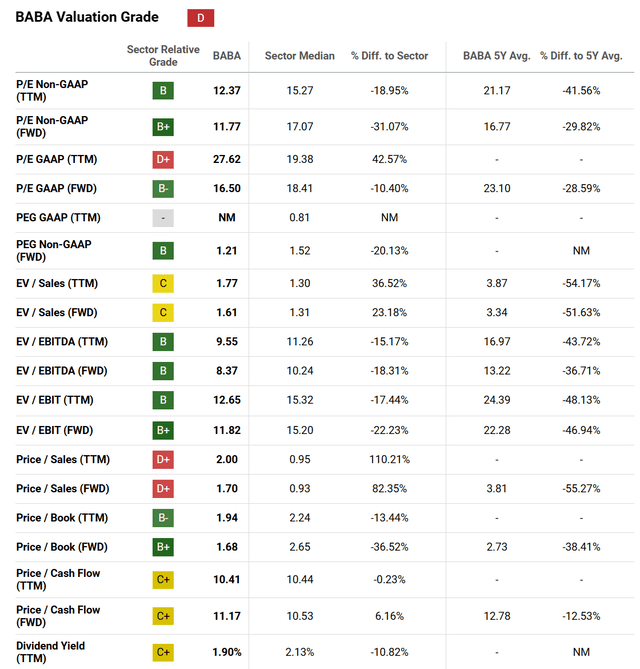

Valuation Normalizing

Alibaba has fallen from an overall “B” Quant Valuation Grade in January to a “D” currently on its September price spike. Given most individual components remain in the “B” to “C” range, I think an overall rating of “C” fits in line with my thinking.

Seeking Alpha Table – Alibaba, Quant Valuation Grades, September 26th, 2024

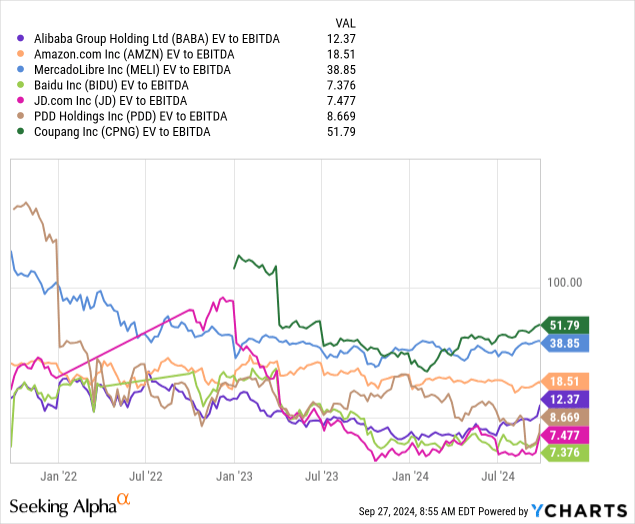

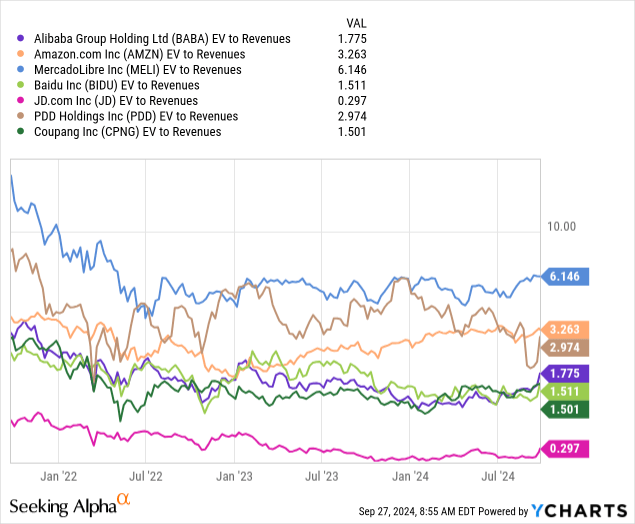

While its valuation does remain in the middle to cheaper end of the spectrum vs. peers and competitors (especially those operating inside China), the overall underlying nominal range is now the same as late 2022 and the first half of 2023. So, the level of undervaluation on metrics like enterprise value (including equity worth plus total debt minus cash) to EBITDA or sales is not a standout buy proposition for this Asian blue-chip name.

YCharts – Alibaba vs. Online Retailers & Peers, EV to EBITDA, 3 Years YCharts – Alibaba vs. Online Retailers & Peers, EV to Sales, 3 Years

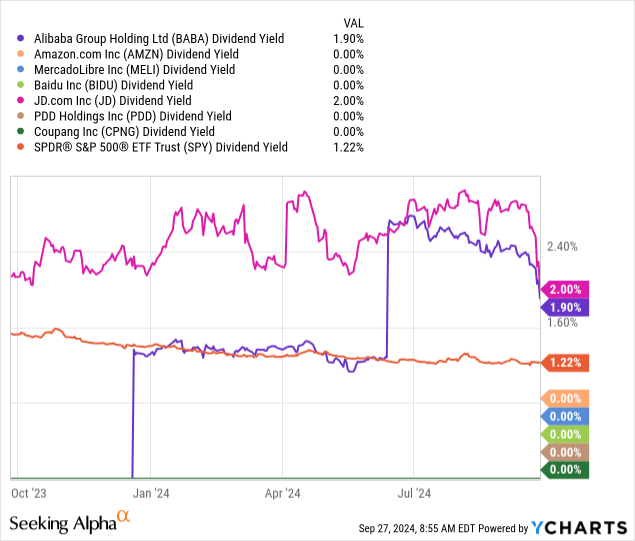

Again, one persuasive bullish argument to continue ownership is the new dividend. The roughly 2% in cash distributions available annually is running at nearly double the S&P 500 rate of 1.2%.

YCharts – Alibaba vs. Online Retailers & Peers, Trailing Dividend Yield, 1 Year

Final Thoughts

Do I consider Alibaba a stock to avoid? Not really. If you can purchase a stake on weakness, perhaps back to $90 or below, this security is a smart way to diversify your wealth away from U.S. markets. It’s focus on sales in mainland China, Hong Kong, and other parts of Asia is worthy of your attention. If the Chinese economy can rebound from feeble 2024 economic growth during 2025, shareholders should earn a steady return, with a 2% dividend yield and share buybacks supporting you.

What are the risks? The overriding risk revolves around Chinese government decision-making, including regulations on capital outflows to the rest of the world, alongside questionable signals about attracting/keeping foreign manufacturers (many are moving operations to nearby Asian nations).

You could also wake up one morning and find it difficult to actually sell your shares on the American market as a delisting action/reaction to military escalations over Taiwan. Fortunately, shares are listed in Hong Kong, which may provide an option for trading if you can switch your share ownership to a brokerage outside of the U.S.

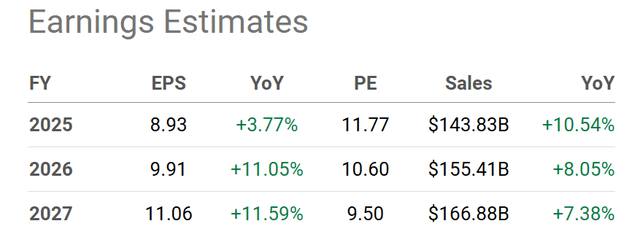

Otherwise, changing economic fortunes in Asia (growth/recession) will drive the Alibaba quote, sitting at a fair valuation setup today. For sure, with a P/E under 12x and price to sales hovering around 2x projections for the current fiscal year (ending March 2025), investors do retain some headline value holding ADR shares around $100.

Seeking Alpha Table – Alibaba, Analyst Estimates for 2024-26, Made September 26th, 2024

My summary view is a period of retracement and digestion back to the $90s seems likely for months. After that is finished, a resumption of nice gains could reappear in 2025. For the time being I am downgrading Alibaba to Hold/Neutral, for a 12-month outlook. There is still no guarantee a global recession can be avoided over the next year. If we do experience one, BABA may still be trading under $100 next summer. At this point, if you own a position, selling covered calls may prove an excellent strategy to capture some income (and/or hedge the latest sharp gain) while we wait.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.