Summary:

- Algonquin is transitioning to a pure-play regulated utility, exiting merchant power activities to reduce debt and simplify its business, creating significant shareholder value.

- The utility sector is currently thriving due to rising power demand, declining rates and rising regulated revenues, making it an attractive investment.

- Algonquin is trading at a significant discount to peers, with the potential for its equity value to double as it adds assets to its rate base.

- Despite past mismanagement and high leverage, activist fund Starboard Value’s involvement and recent strategic moves position Algonquin for substantial appreciation.

D-Keine

Algonquin (NYSE:AQN) is a newly streamlined pure-play regulated utility group.

The company has recently announced the disposal of its Renewable Energy Group, exiting almost all merchant power activities and re-focusing on regulated utilities.

Algonquin had previously grown rapidly through acquisitions, some of which were sub-par. The company is now disposing of the risky assets.

Stable utilities do not go on sale very often, but Algonquin now presents a unique opportunity to purchase a low-risk regulated utility at an attractive price.

The transaction will de-risk and simplify the business and will also help to clean up the balance sheet. A significant shareholder value will be created.

We estimate that under the best-case scenario, the price of Algonquin could double.

Starboard Value activist fund is involved with this stock and seems to be steering the business in the right direction.

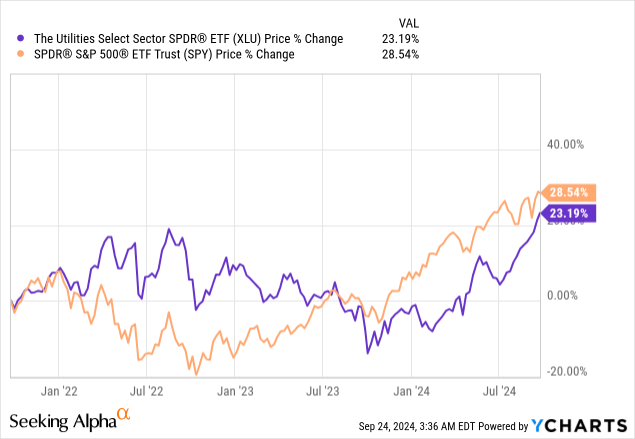

Utilities are the sector to be invested in right now

Economic uncertainty continues to persist, but falling interest rates are lowering financing costs for capital-intensive utilities that rely on leverage. Additionally, regulated revenues are increasing as previous cost hikes are being passed on to consumers.

The sector (XLU) has been one of the top-performing areas in the stock market this year. These resilient utilities have gained from sector rotation as concerns about the U.S. economy have intensified. Meanwhile, the rise in power demand driven by AI and the passage of the Inflation Reduction Act have further fueled growth in the sector.

During the year prior, utilities have underperformed as growing interest rates had put pressure on the earnings of the leveraged companies in the sector. Inflation has also put pressure on utility earnings in the U.S. as rate cases had to be filed before higher costs could be passed on.

The sector seems to be in a Goldilocks period now as the interest rates have started going down again while rate cases are being approved and revenues grow.

Despite the appreciation this year the sector still holds growth potential, driven by surging power demand as well as more accommodative support mechanisms for renewable generation.

Algonquin is our top pick in the utilities sector

Algonquin is a diversified utilities group, selling at a significant discount to regulated peers.

Regulated Utilities are quite stable and predictable enterprises and are mostly preferred by investors seeking a recession-proof yield.

We are however capital appreciation-focused investors and seek to generate index-beating returns with all of our picks. Algonquin might just be the one that offers market-beating returns potential.

Utilities are mostly investing in low-risk projects that usually generate 9% to 12% returns on equity. Returns on investments in local power or gas networks are protected and capped by regulators whereas merchant renewable power projects are often derisked via long-term Power Purchase Agreements.

Algonquin operates a collection of regulated power, gas and water utilities with a combined regulated asset base of ~$7.2 billion. The company has been investing to de-carbonise its regulated generation fleet and will negotiate with regulators to add ~$1 billion of assets it has already built to its regulatory base. In 2-3 years the regulated asset base will grow to ~$8.2 billion most likely.

Algonquin currently sells for an enterprise value of ~$14.3 billion but is in the process of disposing of its merchant renewable power businesses which will likely generate ~$2.8 billion of net proceeds and reduce the indebtedness of Algonquin considerably.

Indebtedness will be reduced by $3.9 billion

The enterprise value of Algonquin is currently ~$14 billion which consists of $4.3 billion of common equity, $8.2 billion of Net Debt and $1.5 billion of non-controlling interests.

Algonquin is also yet to receive proceeds from the sales of interest in Atlantica as well as its fully-owned renewable power business. The cash proceeds from both of these transactions could approximate $2.8 billion, though some uncertainty still exists about charges to be incurred. Most of the proceeds will be used to reduce net debt.

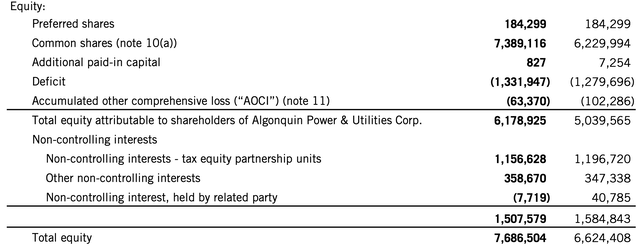

On top of this, non-controlling interests will also go down. These relate primarily to tax equity partnership units which entitle investors to the share of profits (tax benefits) from the company’s U.S. wind power and solar power generating facilities.

Non-controlling interest (Algonquin)

With the disposal of the renewable operations, these non-controlling interests will move along and will disappear from the company’s balance sheet.

| Enterprise Value (starting) | $14.3 |

| – tax equity partnership units | $1.1 |

| – Sale of renewable assets | $2.8 |

| Enterprise Value (ending) | $10.4 |

financials and our estimates

Once the transactions are settled, the company will use proceeds to reduce debt and the Enterprise Value of Algonquin will decline to ~$10.4 billion.

The Equity Value of Algonquin is set to double

After the separation of merchant renewable power activities, Algonquin will become a pure-play regulated utility with $7.2 of rate-based assets. An additional ~$1 billion of assets is expected to be added to the rate base from the assets that are already built over the next few years.

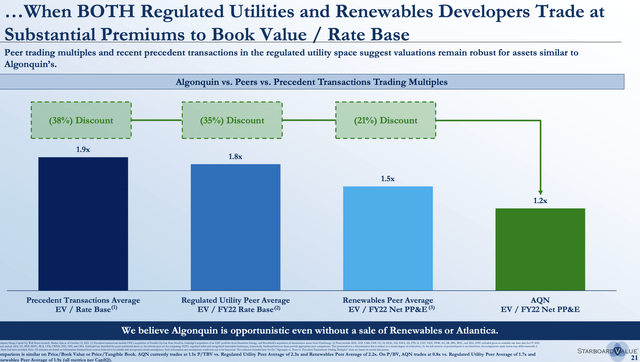

Most of the regulated utility peers are trading at around 1.8X rate base and therefore the Enterprise Value of pure-play Algonquin should range from $13 billion to $14.8 billion.

Utilities Valuations (Starboard)

Algonquin is currently trading at a considerable discount to peers. The company has an adjusted Enterprise Value of $10.4 billion, but it is worth at least $13 billion. As the company renegotiates new rate cases and additional assets are added to its rate base, the value will grow further to ~$14.8 billion, when valued in line with industry peers.

The equity upside is even greater. After disposal transactions settle, we would expect Algonquin to be worth about ~$7 billion, 60% more than the market cap. today.

After the further expected additions to the rate base, the equity value is likely to rise to $9 billion, roughly 2x the market cap. today.

|

Algonquin value, $ billlion |

Now |

Expected (YR1) |

Expected (YR3-4) |

|

Enterprise Value |

14.2 |

13 |

14.8 |

|

Minority interest |

1.5 |

0.4 |

0.4 |

|

Net Debt |

8.2 |

5.4 |

5.4 |

|

Equity Value |

4.5 |

7.2 |

9 |

financials and our estimates

The risks

Starboard Value, a famed activist fund has a significant position and is actively engaged in the company. We are happy to be invested alongside them.

On the other hand, this fund usually engages with poorly managed quality companies. It would be fair to say that Algonquin has been mismanaged in the past.

The company has been growing aggressively through acquisitions and accumulated a lot of leverage. Businesses like that are known to get a helping hand from creative accounting.

While the underlying businesses are regulated utilities and we worry little about their profitability. The financing arrangements at the corporate level are somewhat esoteric, however.

The expected proceeds from the recent renewables division disposal are also considerably lower than the stated sales value and the company plans a considerable writedown.

Going forward we will have more certainty as renewables now have been priced and going forward the business will operate only regulated assets.

Conclusion

Utilities have been a top-performing sector this year due to favourable growth prospects as well as its safe haven status.

We have shied away from the sector due to its limited return potential, on the other hand, we see Algonquin as a potential exception.

The separation of somewhat risky renewable power operations has simplified the business and helped to clean up its balance sheet. This has unlocked considerable shareholder value.

Algonquin now trades at a considerable discount to pure-play regulated utility peers and is likely to appreciate considerably.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.