Summary:

- Chinese monetary stimulus is a strong re-rating catalyst. Dovish surprises and continued rate cuts and measures to encourage stock pledges and buybacks can support BABA stock and other Chinese equities.

- There are signs of a paradigm shift in market sentiment. Alibaba investor David Tepper is ‘buying everything’ China-related. The last time he said this was in 2010 for US equities.

- BABA stock valuation is still heavily discounted and attractive and is no longer in a value trap. There is a catalyst for a material re-rating.

- Relative technicals vs the S&P 500 is bullish, with further room for upside and hence outperformance.

- A rebound in Chinese retail sales data is something that I expect going forward. I am also watching the US Fed’s policy decisions for clues on Chinese rate decisions.

Lintao Zhang/Getty Images News

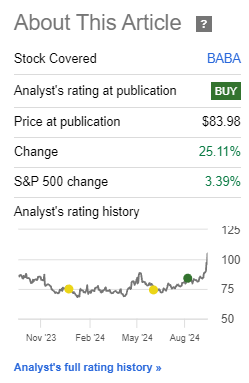

Performance Assessment

My timing on Alibaba (NYSE:BABA) (OTCPK:BABAF) has been quite good as I have held back on rating it a ‘Buy’ when it was arguably still in a slowly declining value-trap mode, but switched to a bullish stance to capture the first major leg of outperformance vs the S&P 500 (SPY) (SPX):

Performance since Author’s Last Article on Alibaba (Seeking Alpha, Author’s Last Article on Ali Baba)

Thesis

A major Chinese monetary policy update this week has finally given rise to a genuine re-rating catalyst for Chinese stocks such as Alibaba. I believe this lifts them off ‘value-trap’ conditions:

- Incoming Chinese monetary stimulus is a strong re-rating catalyst

- There are signs of a paradigm shift in market sentiment

- Valuation is attractive and no longer in a value trap

- Technicals show further room for upside

- A rebound in Chinese retail sales data would provide further confirmation, but it’s not worth waiting for

Incoming Chinese monetary stimulus is a strong re-rating catalyst

Governor of the People’s Bank of China (PBOC) Pan Gongsheng had acknowledged the challenges in the Chinese economy and the need for accommodative policy in a speech he gave in June 2024:

Chinese economy is still confronted with some challenges, mainly in that the effective demand is still insufficient; there are blockages to domestic economic circulation, and the complexity, severity, and uncertainty of the external environment have risen significantly. Adhering to an accommodative monetary policy stance, we will strengthen counter-cyclical and inter-temporal adjustments, help consolidate and add momentum to the economic recovery, and create a favorable monetary and financial environment for economic and social development.

– Governor of People’s Bank of China (PBOC) Pan Gongsheng in June 2024

At the State Council Information Office (SCIO) press conference on September 24, 2024, Gongsheng outlined a host of stimulative measures to boost the Chinese economy and stock markets. Of particular direct relevance for Alibaba is the interest rate cuts in the economy. For example, the 7-day reverse repo rate was cut from 1.7% to 1.5%, which exceeded expectations:

Markets had been leaning toward expecting multiple 10bp rate cuts, so a 20bp cut represents a slightly stronger than expected move

– Lynn Song, chief economist for greater China ING

This is a tailwind for all Chinese assets including Alibaba stock since the opportunity cost of capital is lowered. Most importantly, further interest rate cuts are expected over the upcoming quarters, providing even more support for asset price appreciation.

Also of direct relevance for Alibaba and the broader Chinese stock market (MCHI) is the fact that for the first time, the PBOC is utilizing monetary policy to support the Chinese capital market as they intend to:

establish a swap facility for securities, fund and insurance companies to support eligible institutions in obtaining liquidity from the central bank by pledging their assets. This facility will significantly enhance these institutions’ ability to raise funds and increase stock holdings. The other is to launch a special central bank lending to guide banks to provide loans to listed companies and their major shareholders for buying back shares and increasing stock holdings.

– Governor of People’s Bank of China (PBOC) Pan Gongsheng in the SCIO Press Conference

By encouraging pledges of stock and company buybacks, the PBOC intends to increase liquidity flow into Chinese capital markets.

There are signs of a paradigm shift in market sentiment

These policy stances have spurred a shift in market sentiment by investors. Of special attention is David Tepper’s “uber bullish” stance on China, who noted that the PBOC’s messaging was unusually accomodative:

They exceeded expectations, and [People’s Bank of China governor Pan Gongsheng] promised to do more and more and more, and that’s very strange language, especially for any central banker, but especially over there.

– David Tepper of Appaloosa Management sharing his view on China’s policy changes

In response to this development, David Tepper is now saying he’s ‘buying everything’ China-related. And Alibaba is his largest position with a weighting of 12.24%.

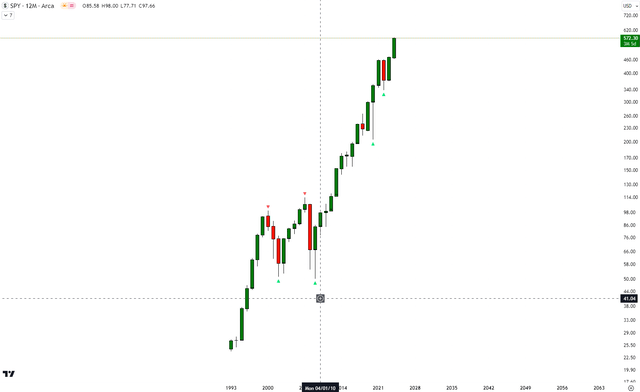

How significant are these comments by the hedge fund manager? For context, the last time David Tepper said ‘buy everything’ was for US equities back in 2010. The result is well-known, as the markets have broken out from a decade-long consolidation period from 2000 – 2010 to embark on a massive 14-years-long-and-running bull run:

SPY’s bull trend since 2010 (TradingView)

Valuation is attractive and no longer in a value trap

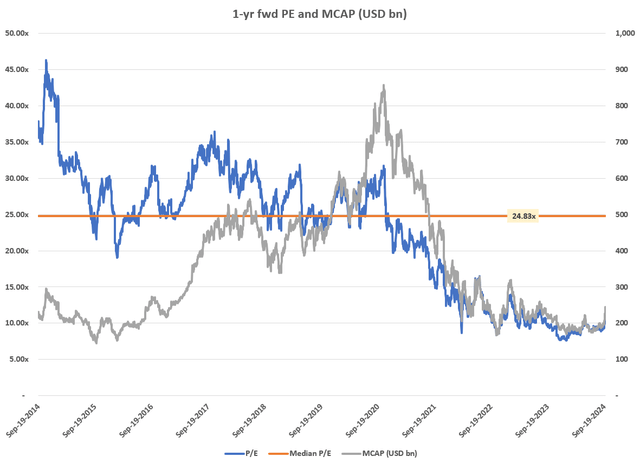

1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

At 11.5x, BABA stock is trading at a 54% discount to its longer-term median 1-yr fwd PEs of 24.8x. I’ve previously been unenthused by these large discounts due to a lack of a strong catalyst. But I believe this time is different, as I view the PBOC’s stimulative measures as a key paradigm shift that can lift BABA and other Chinese stocks out of value trap territory.

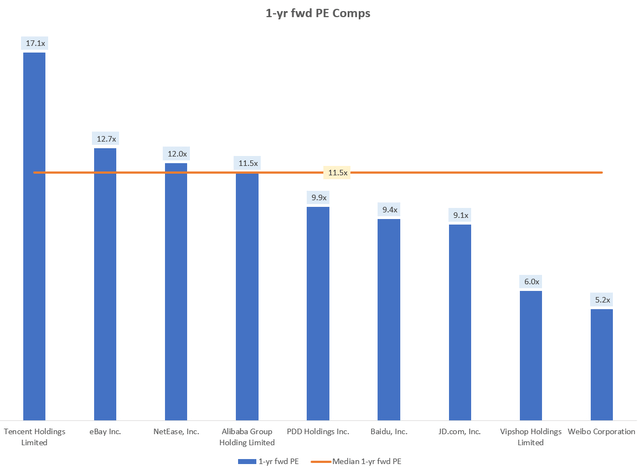

Now, relative to other Chinese internet stocks, BABA is trading bang on at the median 1-yr fwd PE levels of 11.5x, which I find perfectly acceptable:

1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Technicals show further room for upside

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

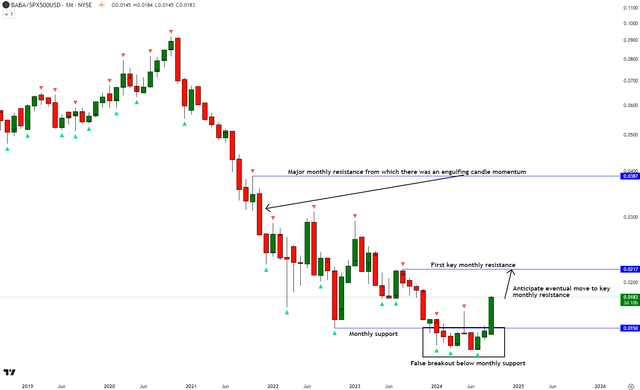

Relative Read of BABA vs SPX 500

BABA vs SPX 500 Technical Analysis (TradingView, Author’s Analysis)

Looking at BABA vs SPX 500, the ratio prices have formed a nice bottom and are showing a strong upthrust from the lows. I anticipate further upside ahead till at least the first key monthly resistance marked, and potentially beyond.

Chinese retail sales data and US Fed Policy are key monitorables

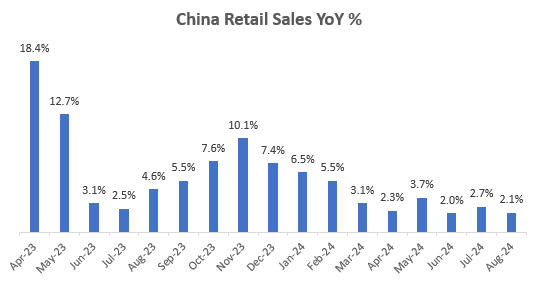

As a dominant ecommerce player in China with more than 40% market share, Alibaba’s performance is affected by macroeconomic trends in Chinese Retail Sales, making this variable a key monitorable:

China Retail Sales YoY % (Trading Economics, Author’s Analysis)

So far, there is no evidence of a meaningful rebound. However, I anticipate that this would change as stimulative policies reignite the struggling Chinese economy.

Another key monitorable for me is the US Fed’s monetary policy. If the US Fed continues its dovish rates path, then I would be more confident of the PBOC’s proclivity to favor stimulus. However, any hiccup in US rates may cause the PBOC to hold back as well lest they endanger their ability to:

keep the RMB exchange rate basically stable at an adaptive and equilibrium level

– Governor of People’s Bank of China (PBOC) Pan Gongsheng in response to a question on FX Rates impact at the SCIO

Takeaway & Positioning

In August 2024, I had turned bullish on Alibaba before, mostly due to an optimistic outlook on fundamental growth and margins, and a positive technical analysis read. This has worked out well, as the stock has outperformed the S&P 500 since then.

Now, I have increased confidence in the longevity of the rally in Alibaba since China’s central bank messaging has turned very accomodative to support not only the broader economy via interest rate cuts, but also the stock market by encouraging stock-pledges and company’s share buyback program. I believe this marks a paradigm shift wherein Alibaba and much of the broader Chinese stock market moves away from ‘value-trap’ territory. This provides a strong catalyst for valuation multiples to re-rate from their currently heavily discounted levels.

Indeed, this has gotten major investors such as David Tepper of Appaloosa Management very bullish as he is ‘buying everything’ related to China, with Alibaba being his largest 12.24% stake position as of the latest 13-F filings. I view this as a positive and trustworthy signal since the last time Tepper said ‘buy everything’ was for US stocks in 2010; a call which has worked out wonderfully since the SPY has initiated a massive 14-years-and-counting rally after a decade (2000-2010) of flattish performance.

From a technical analysis perspective too, the charts point bullish signs with further upside potential ahead. As key monitorables, I am watching for a rebound in China Retail Sales growth and also keeping an eye on US Fed policy since hiccups in the dovish stance here can flow over to China as the PBOC may be forced to prioritize the RMB’s FX stability goals.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.