Summary:

- Backlog indicators as seen in the remaining performance obligations are shrinking and high-growth products such as AI-servers are expected to see QoQ revenue declines next quarter, with a flat backlog.

- Competitive intensity is increasing, and industry data shows that Dell is losing share in global PC shipments and mainstream servers.

- A revenue mix shift toward lower-margin AI-servers and pricing pressures are headwinds to gross margins going ahead.

- Dell is trading at a slight premium to sectoral peers, which I think reduces the margin of safety for buys given a tough competitive environment.

- Relative technicals show a monthly bullish trend, which is a silver lining. However, there are weekly obstacles ahead that, I think, will inhibit upside vs the S&P 500.

Richard Drury

Thesis

I’m not a bull on Dell Technologies (NYSE:DELL) due to the following:

- Backlog indicators are shrinking

- Competitive intensity is increasing

- Mix shift and pricing pressures weigh down on margins

- Dell is trading at a slight premium to sectoral peers

- Relative technicals show a monthly bullish trend facing weekly obstacles

- Pipeline to backlog conversion and AI server pricing levers are key upside risks

Backlog indicators are shrinking

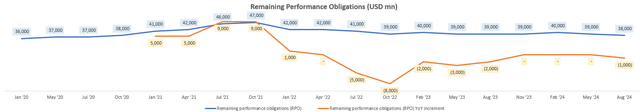

Remaining performance obligations (RPO) are an indicator of backlog, representing the “value of unfulfilled manufacturing orders“. For Dell, this leading indicator of future revenues has been showing YoY declines for more than 2 years:

Remaining Performance Obligations (USD mn) (Company Filings, Author’s Analysis)

Management’ outlook commentary from the latest earnings call also indicates that supposedly high-growth products such as AI servers are showing at least a temporary slowdown since sequential declines are expected in Q3 FY25 with a flat backlog. I noticed that management’s narrative tried to put the focus on the company’s pipeline, which is supposedly 5x the size of the current backlog. However, in my experience, definitions of pipeline vary, and it is not a tangible leading revenue indicator, unlike RPOs which represent contracted work that is yet to be fulfilled. Hence, I view management’s attempts to paint a bullish picture of top-line growth potential by talking about pipelines as a risk signal that there may be disappointments in revenue execution ahead.

Competitive intensity is increasing

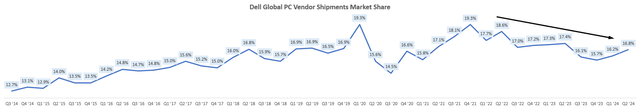

The numbers also show Dell’s stagnant to declining share of shipments in the global PC vendor market:

Dell Global PC Vendor Shipments Market Share (Statista, Gartner, IDC, Canalys, Author’s Analysis)

This affects the performance of Dell’s Client Solutions Group (CSG), which makes up 53% of TTM revenues mix as of Q2 FY25.

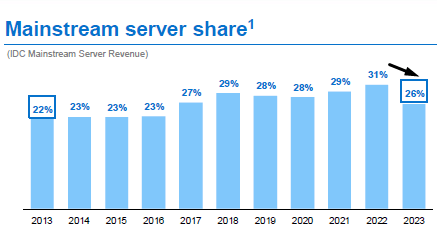

On the servers side too, Dell seems to be feeling the heat as its share has dropped 500bps in FY23, which is an unusually large YoY delta:

Mainstream Server Share (Dell’s Q2 FY25 Presentation, Author’s Annotations)

I could not find free or reasonably priced data for 2024’s quarters, but I do not suspect a reversal of market share as management has admitted that there are competitive pressures, which are impacting margins as well:

Mix shift and pricing pressures weigh down on margins

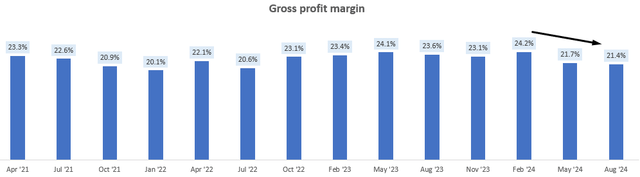

Overall, company gross profit margins have started to decline over the past 2 Qs by almost 300bps:

Gross Profit Margin (Company Filings, Author’s Analysis)

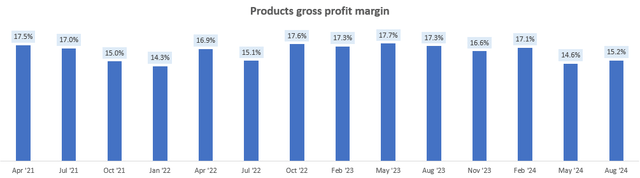

This is mostly due to a deterioration in product gross margins, which makes up 51.5% of the total gross profit mix:

Products Gross Profit Margin (Company Filings, Author’s Analysis)

Now, I do recognize that the latest quarter has seen a +60bps improvement. This is mainly due to improvements in AI servers’ pricing, which I don’t think is a benefit that will continue accumulating in the next few quarters.

Management has attributed the decline in gross margins over the past year to a mix-shift effect (AI-servers have lower gross margins than traditional servers) and a more competitive pricing environment (which means prices have gone down):

[Gross margin] is down 230 [YoY] basis points due to an increase in our AI-optimized server mix and a more competitive pricing environment.

– CFO Yvonne McGill in the Q2 FY25 earnings call

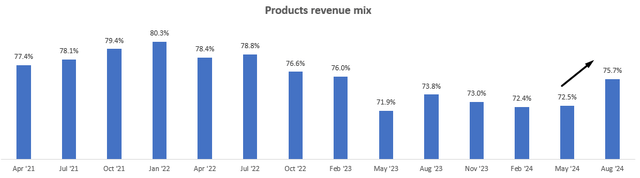

The mix of product revenue has seen a jump last quarter:

Products Revenue Mix (Company Filings, Author’s Analysis)

And I anticipate this to continue as Dell has indicated increased uptake of traditional and potentially AI server orders in the latest earnings call. Overall, this revenue mix-shift can weigh down on gross margins further. Indeed, the CFO is also guiding for a further 180bps guided:

We expect our gross margin rate to decline roughly 180 basis points due to inflationary input costs, the competitive environment and a higher mix of AI-optimized servers.

– CFO Yvonne McGill in the Q2 FY25 earnings call

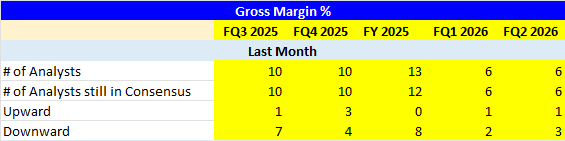

A look at the gross margin downgrades by Wall St analysts shows that consensus is pricing in gross margin downgrades for the next 4 quarters ahead:

Consensus Gross Margin Revisions (Capital IQ, Author’s Analysis)

Dell is trading at a slight premium to sectoral peers

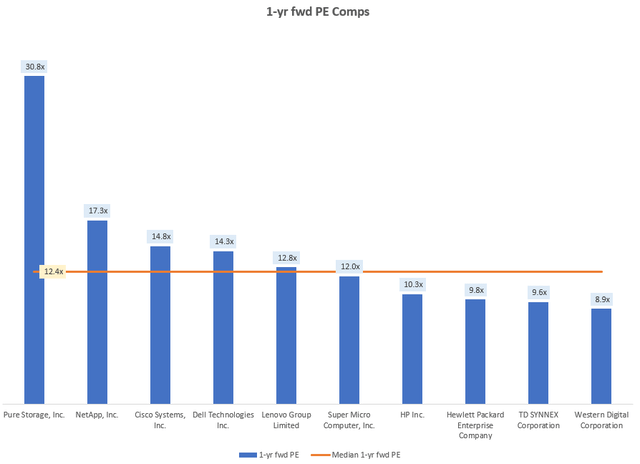

Dell is trading at a 1-yr fwd PE of 14.3x, which corresponds to a 15.5% premium over the sectoral median PE of 12.4x:

1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Given the signs of Dell’s weakening competitive positioning vs peers, I doubt the premium is acceptable to justify buys.

Relative technicals show a monthly bullish trend facing weekly obstacles

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of DELL vs. SPX500

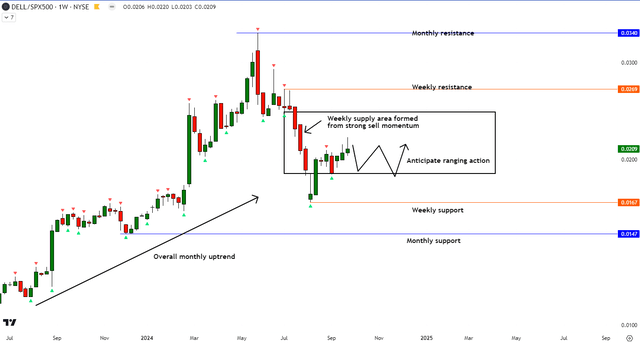

DELL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

The relative technical analysis of DELL vs SPX500 (SPY) (SPX) (VOO) (IVV) shows that the ratio prices are facing resistances at a weekly supply area, despite being in an overall monthly uptrend. Given this setup, I anticipate some ranging action ahead, which would correspond to performance more or less in-line with the broader market.

Pipeline to backlog conversion and AI server pricing levers are key upside risks

As management has noted that its “5-quarter pipeline is multiples of the backlog” in the Q2 FY25 earnings call, conversion of this into backlog is a key source of upside risk on revenues. Hence, RPO numbers are a key quarterly monitorable to track.

On the gross margins side, management has been able to extract value (higher prices) in the last quarter:

AI server margins… we were able to extract value out of our offer. We were able to extract the value out of our AI offer by expanding our — again, our value proposition to our customers beyond the box to the rack level.

– COO Jeffrey Clarke in the Q2 FY25 earnings call

If Dell is able to continue pricing increases here, that can reduce the erosion in gross margins going forward. That said, I don’t expect this scenario to play out, as I’m skeptical about the scope for price increases amid high competition.

Takeaway & Positioning

I see revenue headwinds for Dell via a shrinking backlog and increasing competitive intensity that is leading to pressures on market share. On the gross margins side as well, I expect a revenue mix-shift toward lower-margin products and pricing cuts to lead to further erosion in the upcoming quarters ahead. On the valuations side, Dell is trading at a modest premium vs its peers, which I think reduces the margin of safety for buys amid a tough competitive environment. Technically, relative to the S&P 500, the picture looks a little bit better as the ratio prices are in a monthly uptrend. But here too, there are weekly obstacles ahead, which is why I think the stock will perform mostly in-line with the broader market index.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.