Summary:

- Alphabet Inc./Google’s recent share price weakness is due to non-fundamental factors, and the company’s strong fundamentals support a bullish outlook.

- Google’s cloud business is outpacing competitors, and its robust financial position allows for aggressive investment in innovation, particularly in cloud and AI.

- The stock is attractively valued with a forward FY2025 P/E ratio below 20, and a DCF analysis suggests a fair value target price of $245 per share.

JHVEPhoto

Introduction

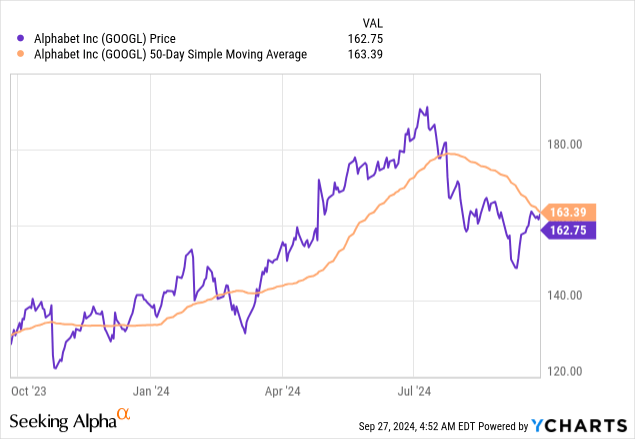

I had a “Strong Buy” thesis on Alphabet Inc. aka Google (NASDAQ:GOOG) on June 6. Over the next month after my thesis, the stock demonstrated a massive rally and peaked at slightly above $$190 in July. After these, there were several adverse developments for the technological sector, which included the global outage of Microsoft’s (MSFT) services and increased recession fears. As a result, today, the stock trades around 8% lower compared to its price as of June 6.

My outlook for Google remains bullish because all these adverse developments were not company-specific, meaning that the recent share price weakness is explained by non-fundamental factors. If we look only at the company’s fundamentals, the picture looks good. Despite Google’s vast scale, recent trends in profitability metrics suggest that the company still has strong potential to improve operating leverage.

The company’s cloud business significantly outpaced its main competitors in terms of revenue growth during the latest reportable quarter, meaning that Google is winning market share from its rivals. Google’s massive financial position compared to rivals’ positions it well to invest more in innovation than its competitors. Google’s strong potential in cloud and AI is also evident from recent promising partnership with other giants. Developments around Waymo are also bullish.

The stock currently attractively valued with a solid upside potential, and the blend of catalysts looks robust enough to help the stock in breaking the resistance level, which is the 50-day simple moving average. Due to all these favorable factors, I reiterate a “Strong buy” recommendation for GOOGL.

Fundamental analysis

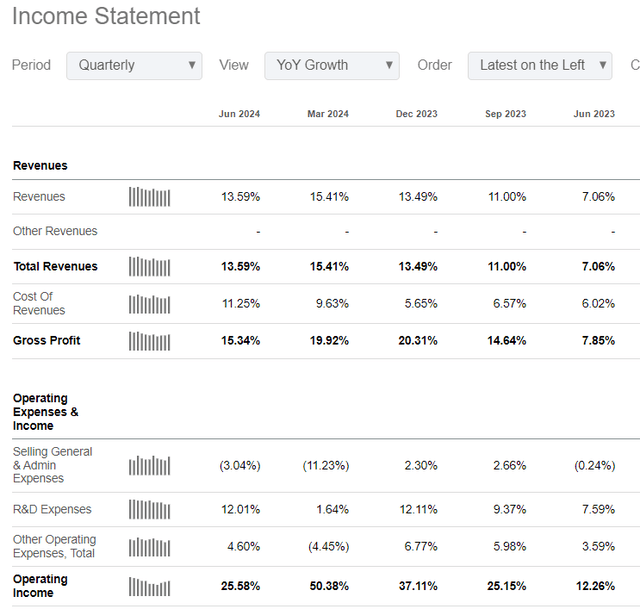

I prefer to invest in profitable and growing companies. Therefore, let me start my fundamental analysis update by reviewing the company’s latest trends in financial performance. Google’s revenue grew by 13.6% YoY in Q2, which was slower compared to Q1. On the other hand, the Q2 2024 revenue growth was much stronger compared to the same quarter last year.

Moreover, Google’s operating income grew notably faster compared to revenue growth. The SG&A expenses line demonstrated a decline in the second consecutive quarter, which is quite impressive. The management drives profitability by optimizing auxiliary administrative activities without sacrificing the R&D budget. I praise the management for such a stringent cost discipline.

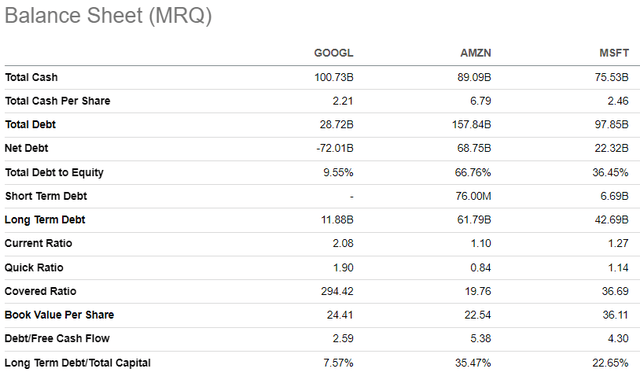

Strong P&L performance ensures Google’s robust cash flows, which contributes to the company’s financial position. The company is in a massive $72 billion net cash position, and the book value per share keeps accumulating. Google’s balance sheet is an absolute fortress, which makes it look much stronger financially than its major rivals in the cloud business, Microsoft (MSFT) and Amazon (AMZN).

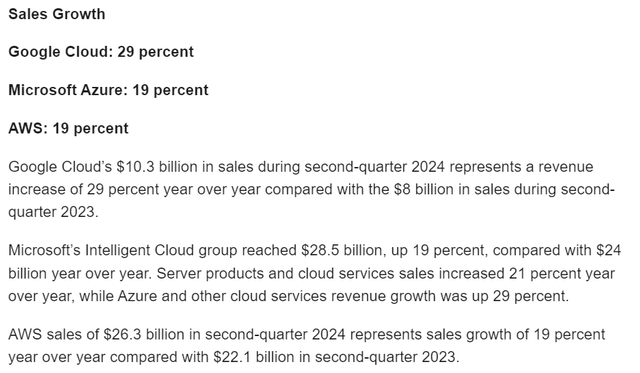

Google’s rivals lack the financial flexibility that Google possesses, which serves as a crucial strength. Consistent investment in innovation is key to excelling in competition, particularly in rapidly growing industries like cloud computing and AI. Therefore, I expect Google to continue investing aggressively both in innovation and expanding its cloud infrastructure. For example, the company recently announced that it invests another $3.3 billion in new data centers. Google’s competitive edge in cloud is evident from the revenue growth dynamic compared to main rivals in Q2 2024. According to CRN, Google’s cloud grew much faster than Azure and AWS during the quarter. This suggests that Google is gaining market share at the expense of its rivals.

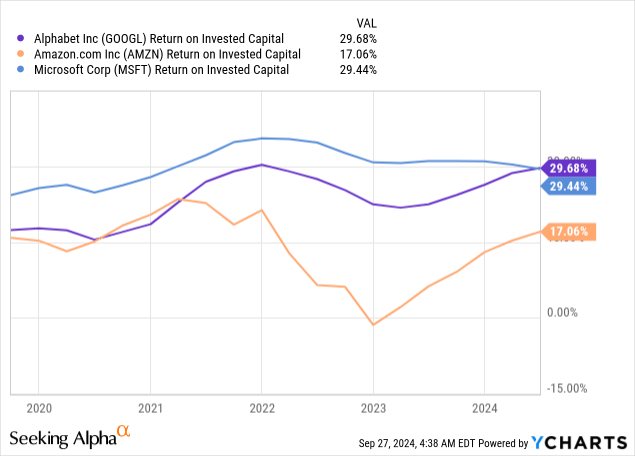

I have a high conviction that Google will be able to create value by allocating its spare financial resources to new projects because its historical ROIC is stellar and is now leading among the three cloud giants. The fascinating fact is Google has been notably trailing behind Microsoft over the last five years but has closed the gap since the AI trend emerged.

Thus, the optimism from Wedbush’s Scott Devitt is absolutely fair. According to Mr. Devitt, Google is technologically well positioned to drive expansion of generative AI tools thanks to its unmatched breadth of data to develop and train AI algorithms. Google continues rolling out new AI features, which are also crucial to improve users’ experience. For example, the company recently announced that its Gemini AI features are available for Workspace users. According to the release, a survey of clients found Gemini saves users an average of 105 minutes per week. Boosting efficiency of users is a cornerstone that will help in forming Google’s image as a cutting-edge AI tools provider, which is crucial.

Google’s strength in AI is recognized by other prominent technological companies. For example, the world’s leading CRM company, Salesforce, partners with Google and Nvidia (NVDA) to enhance its Agentforce AI agents. Recognition from the leading company in its industry is a solid sign that Google’s AI offerings are compelling for the most technologically advanced businesses.

In my previous thesis, I have highlighted that I see strong potential in Google’s autonomous taxi project called Waymo. Therefore, I also want to highlight a couple of important developments here as well. In August, Waymo expanded destinations for San Francisco and Los Angeles users. A couple of weeks ago, Waymo announced that it expanded a partnership with Uber (UBER) to bring autonomous ride-hailing to Austin and Atlanta. Finally, Waymo and South Korean giant Hyundai (OTCPK:HYMTF) are reportedly in talks to outsource manufacturing of its self-driving vehicles. This information suggests that the management expects Waymo to be a large-scale business because Hyundai is one of the world’s largest automakers, with 4.2 million vehicles sold in 2023. Moreover, Hyundai’s flagship EV model IONIQ 5 is gaining solid momentum in the U.S.

This section of my analysis is titled “Fundamental Analysis,” but I also want to highlight the positive insights from the technical analysis. The current share price is ready to break the 50-day simple moving average, which is quite a bullish setup. With such a solid bunch of catalysts and positive news, I think that the stock is well-positioned to break through this resistance level.

Valuation analysis

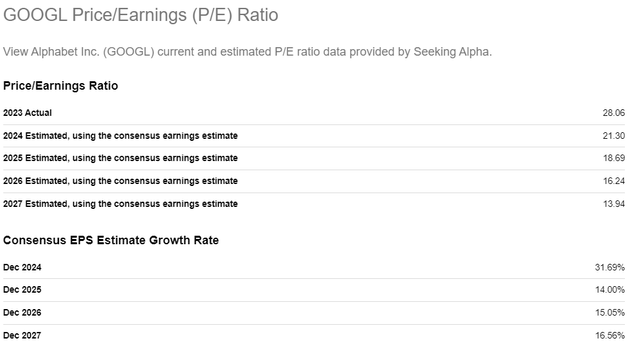

Google’s forward FY2025 P/E ratio is below 20, which is a clear indication that this technological behemoth is attractively valued. A further notable P/E contraction is projected by consensus by FY2027.

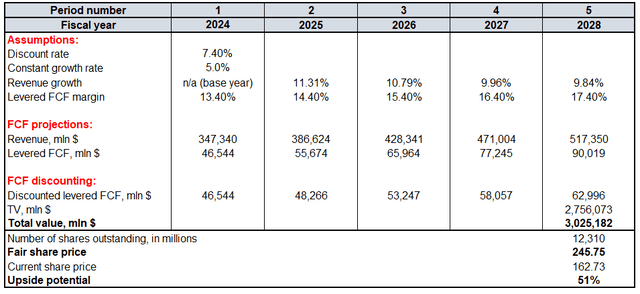

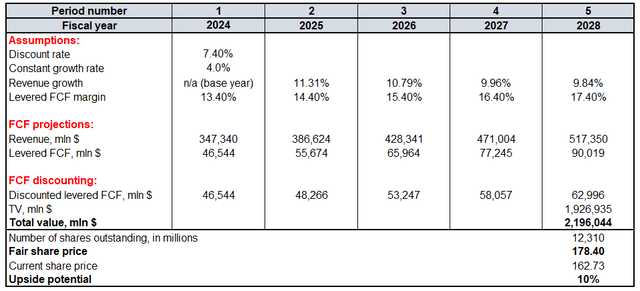

To cross-check the forward P/E ratio analysis, the discount cash flow model (“DCF”) must be simulated. Google’s cost of equity is 7.3%, which is the discount rate for the DCF. Consensus project an 11.31% revenue growth for FY 2025 with further slight deceleration, which is reasonable enough for my DCF. Due to Google’s improving fundamentals, I reiterate an ambitious 5% constant growth rate for the terminal value (“TV”) calculation.

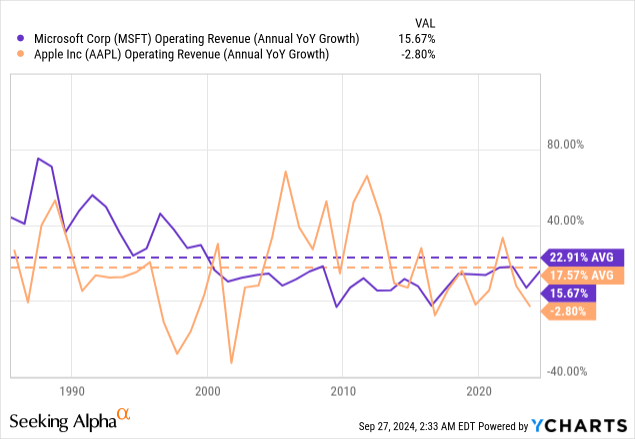

The above data from YCharts suggests that a 5% constant growth rate is absolutely conservative. Powerhouses like Microsoft and Apple (AAPL) delivered a notably above 15% revenue CAGR over almost forty years. Google is younger, but I think no one will argue that it is also a powerhouse and as iconic as AAPL and MSFT are. Therefore, I consider a 5% constant growth rate as absolutely fair and reasonable.

Google’s levered FCF margin is 13.4%, and there is a strong historical correlation between revenue growth and profitability improvements. Therefore, I implement a 100 bps FCF margin expansion for each year. According to Seeking Alpha, there are 12.31 billion shares outstanding.

Google’s fair value is $3 trillion, which equals to a $245 target price per share. This is 51% higher than the last close, meaning that the stock is extremely attractively valued. The margin of safety is in place as the stock is still undervalued even with a modest 4% constant growth rate.

Mitigating factors

As a company that dominates in the digital advertising industry, Google is subject to intense scrutiny from antitrust bodies across the world. This factor increases risks of financial damage due to fines and penalties. For example, the company recently has lost an appeal in an antitrust case in the E.U. against the $2.7 billion penalty. Apart from financial charges, I believe that these antitrust penalties are also harmful to the company’s reputation.

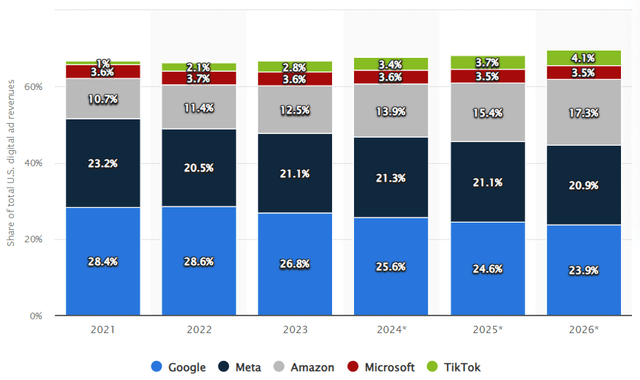

The competition in digital advertising is intensifying. Fierce competition is likely the primary reason why Statista expects Google’s market share to decline in 2025 and 2026. As we see above, Amazon’s market share in digital advertising is expanding aggressively. Due to Amazon’s dominance in e-commerce and cloud industries, it is highly likely that this giant is also a dangerous competitor in digital advertising. New social media like TikTok is also expected to expand its market share. Other large players are also entering this domain. For example, PayPal (PYPL) has also joined the race in 2024.

Conclusion

Recent developments around Google represent a robust set of bullish catalysts, which will highly likely help to close the massive gap between the current share price and the fair value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.