Summary:

- Vale’s shares have dropped 25% this year due to governance issues and iron ore price volatility, but the long-term investment thesis remains compelling.

- Despite political risks and Chinese economic challenges, Vale’s low-cost production and dividend potential make it an attractive buy at current valuations.

- The company’s diversification into energy transition metals like copper and nickel is promising, though iron ore remains the primary revenue driver.

- Vale’s shares are undervalued compared to historical averages, presenting the potential for high dividends and buybacks, even if iron ore prices remain at current levels.

temizyurek

As a long-term Vale (NYSE:VALE) bull, I’ve seen shares of one of the world’s largest iron ore producers plummet by around 20% until the beginning of September when I wrote my last article on the company six months ago, but recently the share price has corrected a little since then.

At the time, I reinforced my bullish thesis on the company based on the investment thesis based on Vale’s ability to enjoy an operational advantage as a low-cost iron ore producer, which allows the company to remain profitable even during periods when the commodity is low.

In this way, Vale would continue to execute its strategy of generating returns to its shareholders through dividends and buybacks in a robust manner.

However, an excerpt from my last article highlights what has afflicted the company throughout this year, mainly linked to the fact that Vale has a significant stake in the Brazilian government and the iron ore price volatility:

“However, despite being a corporation with limited government involvement in its governance, Vale is exposed to political risks. Recent speculation about potential political interventions, which would be inappropriate given the current shareholder composition, has led to a decline in the company’s share value this year. This, coupled with fluctuations in commodity prices due to the complex situation in the Chinese economy, has contributed to the downward trend.”

And that’s exactly what has hurt Vale’s shares so far. But these are not reasons for despair. Quite the opposite.

Now trading at even more attractive valuations, the long-term investment thesis for Vale is still very compelling, especially considering the dividend potential that the company should pay out even with iron ore prices at their current levels. I believe that times like these when investors have weighed up short-term to medium-term implications for pricing Vale, offer the best opportunities to buy this cash cow at the most derisory prices.

Throughout this article, I’ll go into why, even with all the risks and bearishness of the market on Vale, I see the current occasion as a golden buy opportunity for the long-haul.

Reasons Behind Vale’s Underperformance

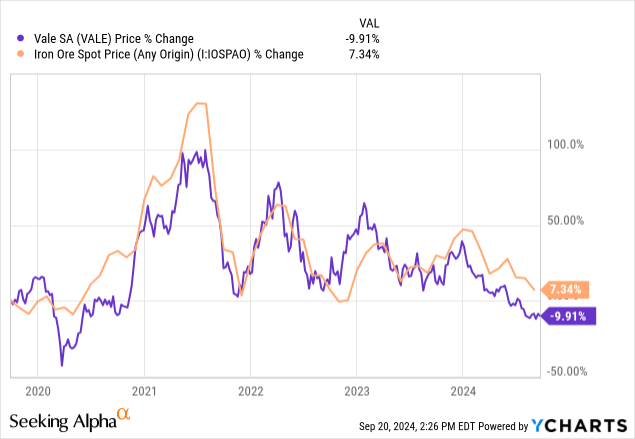

Vale shares have plummeted 25% this year, now trading just above $12. The problems behind this underperformance are nothing new: governance and commodity swings.

The first involved the transition to the company’s next CEO. There was a lot of noise that Brazil’s Federal Government might appoint a CEO who would please the current government of President Luiz Inácio Lula da Silva. Even though Vale is a corporation without a defined controlling shareholder, the Banco do Brasil pension fund is the largest shareholder in the company, which is state-owned, and the fact that the federal government owns golden shares in Vale gives it indirect ownership. Despite these noises, after a long imbroglio, Gustavo Pimenta, who was the company’s CFO and has more than 20 years of executive experience, was elected CEO.

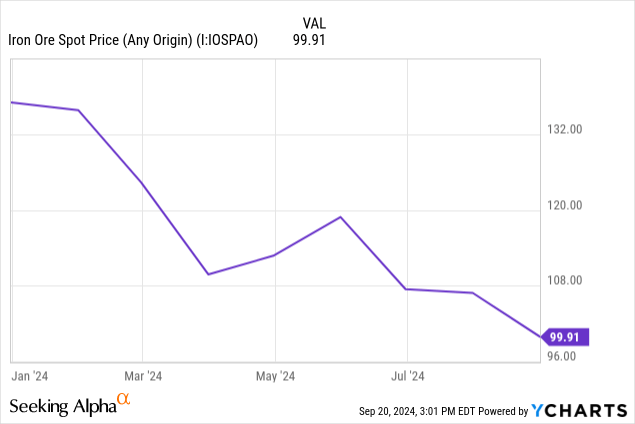

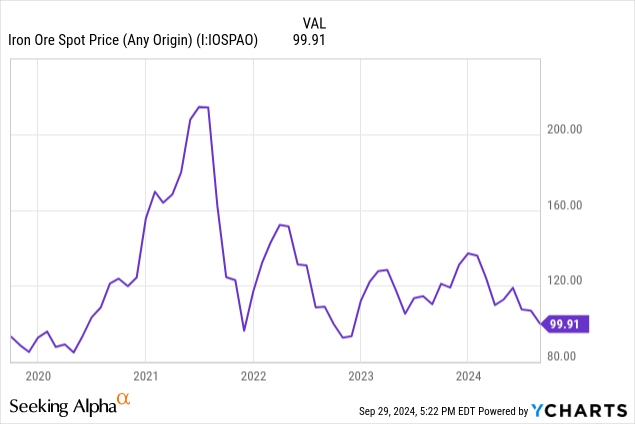

The second point is that as Vale is highly dependent on iron ore, the company faces problems when the price of iron ore is under pressure since prices in China are weak and have weakened further in recent weeks. If you look at the iron ore chart, you’ll see a steady drop in 2024, which became more pronounced in April and also in June. This reflects the difficulties China is facing in its real estate sector.

The Chinese real estate sector has been in crisis since 2022, and Vale exports most of its products to Asia, which are used in construction. With lower demand, Vale’s share of sales to Asia declines, causing the company to suffer more. If we zoom in on the iron ore graph, there is a significant drop from 2022 to now. When comparing this graph with Vale’s, it becomes clear that they are closely correlated, with a major peak in 2021 followed by a sharp decline from 2022 onwards.

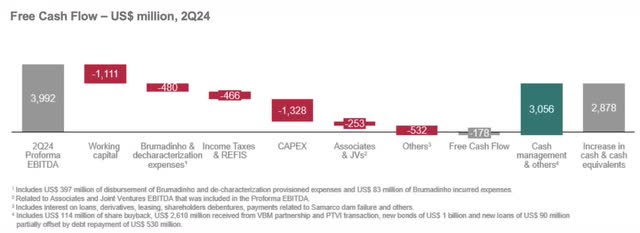

In this scenario, not even Vale, reporting robust bottom line results in Q2 results, was able to turn things around. Vale reported a net profit of $2.76 billion during the June quarter, up 210% year-over-year, when the consensus expected $1.7 billion. But it’s worth noting that one of the main reasons was the increase in cash and cash equivalents by $2.87 billion as a result of a divestment in a subsidiary, which generated around $155 million for Vale and also 10% from the sale of Vale Base Metals to Manara Minerals, for $2.5 billion.

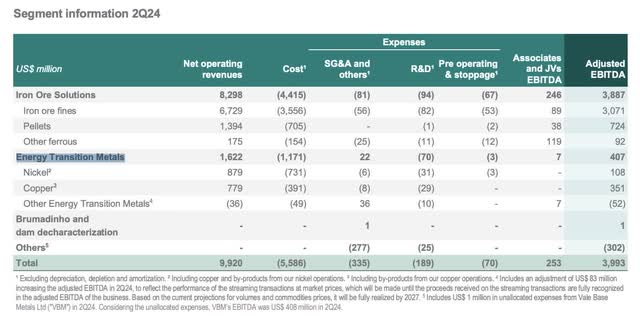

Additionally, iron ore production increased by 3%, while sales rose 7% year-over-year. If we analyze the volume of ores and metals sold by Vale in the second quarter of 2024, we see that iron ore production was 79 million tons, while nickel and copper were 34,000 and 76,000 tons, respectively.

Although these figures are significant, the problem arises in costs since those linked to iron ore rose by more than 16% in the period, while metals for energy transition, such as nickel and copper, fell by 14%. In terms of net revenue, iron ore still accounts for more than 80% of Vale’s revenue, much more than energy transition metals.

This dependence on iron ore continues to be the main risk of investing in Vale, even with its efforts to diversify into energy transition metals. The problem is that potentially one of the main reasons that has put pressure on the price of iron ore is a possible over-supply, which means even more production capacity than we see today. This is directly related to another company in the sector, Rio Tinto (RIO), which is larger than Vale and occupies second place in the world ranking of mining companies. Rio Tinto has started its largest mining project in the world, known as the Simandou Project. This project has an unprecedented iron ore production capacity, with the highlight being the high quality of the ore found, which has an average steel concentration of over 65%, similar to Vale’s largest project, Carajás.

This iron ore is expected to start flooding the market in 2025, reaching its maximum capacity in 2028. But these expectations have yet to come to fruition. In any case, given this scenario, it has made little difference to investors in Vale’s recent results of growing profits.

How Vale Can Overcome Its Iron Ore Dependence

Faced with the uncertain outlook for iron ore, Vale has increasingly sought to explore the production of materials that contribute to the energy transition, such as the production of batteries for electric cars and other renewable energy inputs.

In June, Vale held a webinar where it presented the guidance and the expectation of results for a new division, Vale Base Metals, which focuses on essential products for this energy transition, such as copper and nickel. It is precisely this segment that currently accounts for 16% of Vale’s revenue last quarter.

In addition, Vale revealed some important details about this operation. The first is that this new division will have its governance, which is positive for the future of the division and the possibilities for growth. The second is that, to get this operation up and running, Vale has received an investment from Saudi Arabia. As I mentioned in the previous section, around 10% of the base metals business was sold.

The third point I want to highlight is the guidance that Vale has given for this division. By 2026, copper production is expected to grow by 5%, while costs will fall by around 10%. Nickel, on the other hand, should see a 10% increase in production and a 10% drop in costs. In addition, Vale highlighted the increase in capacity at Salobo in the U.S., the increase in production at Sudbury, also in the U.S., and the maximization of capacity at Voisey’s Bay in Canada.

Of course, it may still be too early for this to be a relevant diversification in Vale’s P&L to mitigate the risk of iron ore demand in China. However, it is a project that I see with optimism, especially considering that Vale continues to be extremely efficient in iron ore production, which should continue to be the company’s competitive differential for several years to come.

Why Vale Still Trades Cheaply Despite Its Core Strengths

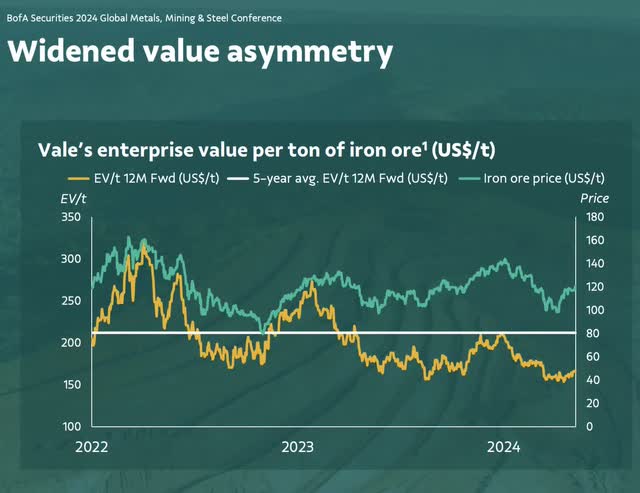

But back to today’s reality, it’s important to note that Vale shares remain extremely attractive when we consider the price of iron ore compared to the enterprise value per tonne produced, especially in an average of the last five years.

When we look at the graph above, presented in May when Vale was trading above $12 per share, we can draw the following conclusions:

-

Firstly, the green and yellow lines have always run together, but in recent months, a very large gap has opened up. In other words, the price of iron ore has remained stable, but the price per ton sold has never been so low. This gap may indicate that the stock is cheap compared to the historical average.

-

When we compare Vale’s price per ton sold to the 5-year average EV/t (the white line), we can also see that the company’s enterprise value is cheap when compared to its historical average.

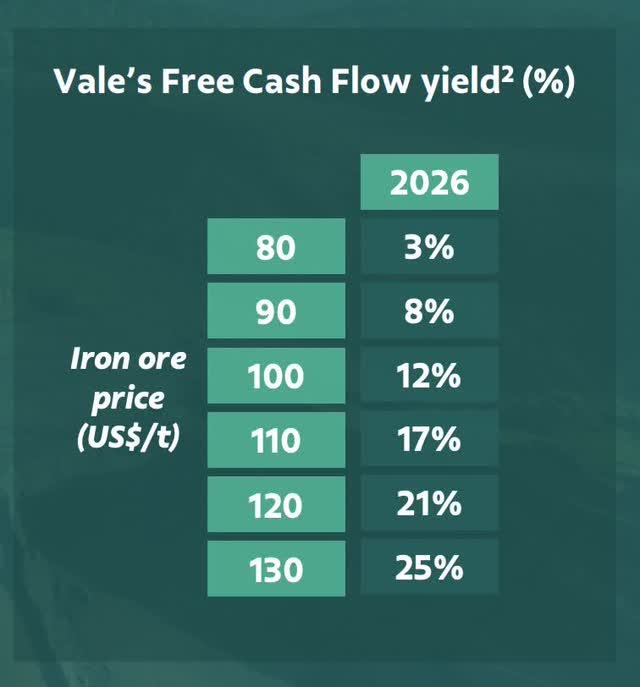

Now, to further demonstrate that Vale appears undervalued, we can look at the table below of the company’s free cash flow yield, which is nothing more than free cash flow divided by market value. Considering Vale’s sensitivity to the price of iron ore, if the price of the commodity falls, Vale generates less cash; if the price of iron ore rises, it generates more cash.

But one interesting thing is that Vale has projected production for 2026 of 340-360 million mt/year by 2026. In this case, if the price of iron ore is $80, the free cash flow yield will be 3%. If it’s $130, it will be 25%. Adopting an assumption that is neither too conservative nor too optimistic, with $110 being the average of the last ten years, if I’m right, the free cash flow yield would be 17%. Put simply, this implies Vale’s condition to remunerate its shareholders in dividends or buybacks by 17%. And this is one of the main reasons why I believe Vale could be a good investment at the moment.

It’s also worth noting that, in any scenario, if this price level materializes, the company will be able to pay more than double-digit dividends in USD. Even if the USD appreciates against the BRL, this is still a positive thing for Vale because its revenue is in USD, and part of its costs are in BRL, especially labor, some energy costs, and other costs. This theoretically would increase Vale’s margins. So this yield, as well as being high, has the connotation of being exposed to a strong currency, which is the dollar, which is very positive.

Key Risks to the Bullish Thesis

The main risk that could derail my bullish thesis on Vale is if iron ore prices fall and remain below $80 for a significant period of time. Although I think it’s unlikely, considering that the price hasn’t fallen below $84 since 2020, this would reduce Vale’s free cash flow yield to less than 3% and there would be practically no resources left to allocate to dividends and buybacks, losing all sense of the thesis.

The second risk that will always accompany Vale is the potential for state intervention. Although the company’s entire governance structure has recently been tested and, in my opinion, had a happy ending for shareholders, the chance of an intervention, although remote, can cause noise and can be a short- to medium-term detractor of investor sentiment.

Final Remarks

Vale continues to benefit from being a low-cost producer, and based on average iron ore prices, it offers an extremely attractive return to shareholders through dividends and buybacks. Additionally, trading at 4x EV/EBITDA and with an enterprise value per tonne produced well below the five-year average.

I believe this is an ideal time to add more shares. While short-term headwinds related to commodity prices and political concerns may create volatility, I believe the focus should be on the long-term outlook. In my view, Vale is a strong buy opportunity for those seeking dividends at a very reasonable price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.