Summary:

- TXN continues to report robust profit margins and expanded R&D returns due to the mature nodes’ longer product life cycle of up to 15 years.

- The company will also reap the benefits of Chips Act, tempering some of the $30B Capex headwinds and sustaining robust shareholder returns through 2025.

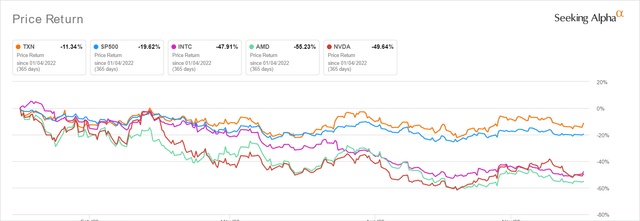

- Investors would be well advised to diversify their portfolios, though TXN may seem less exciting than market darlings such as NVDA or AMD.

Nuthawut Somsuk/iStock via Getty Images

The Analog Investment Thesis

Texas Instruments (NASDAQ:TXN) is a global semiconductor company that specialized in analog and embedded processing chips, i.e.: mature nodes. The company has been making strategic investments toward the 45-nm to 130-nm technologies, which may improve the 300-mm manufacturing cost efficiencies while meeting mature node performance requirements. These are done through the $900M Lehi Fab acquisition from Micron (MU) and the new $30B 300-mm wafer fab in Sherman, Texas. Lehi already commenced production by early December 2022, with the new fab scheduled to begin operations by 2025. These aggressive expansion efforts have naturally contributed to the company’s elevated capital expenditure of $3.11B in the last twelve months [LTM], growing by 367.4% from FY2019 levels.

For now, we are not concerned about TXN’s Free Cash Flow [FCF] generation, since it may accrue up to $200M in investment tax credit from the Chips Act. Furthermore, the company will be applying for the manufacturing grant once the application window opens from February 2023 onwards, partaking in some of the $52.7B IRA pie. Now, why should investors consider TXN, since it is a relatively less exciting stock compared to market darlings such as Nvidia (NVDA), Advanced Micro Devices (AMD), or even foundry-to-be Intel (INTC)? We believe that it’s always a good idea to diversify portfolios, instead of only investing in popular semiconductor stocks with high growth rates. Let us explain why.

TXN has had a more efficient R&D effort of $1.62B attributed to its Analog chips, or the equivalent of 8.04% of its revenues in the LTM. Something similar has been observed with ON Semi (ON) at R&D expenses of $624.4M/7.7% and, to a smaller extent, Analog Devices (ADI) at $1.7B/14.5%. These numbers are relevant, since TXN’s analog chips record a longer product replacement cycle of up to fifteen years, against digital chips such as GPUs for five years and PC CPUs for six years. Therefore, it made sense that its digital chip peers had to innovate more quickly to keep up with the respective digital cycle and intense market competition, prompting AMD’s higher R&D expenses of $4.45B/ 19.5% of annual revenue for cutting-edge x86 CPUs/ GPUs/ APUs/ SoC chips, NVDA at $6.85B/ 23.9% for specialized GPUs/ SoC chips, and INTC at $17.11B/ 24.6% for x86 CPUs/ GPUs, respectively.

The mature chips market also contributed to TXN’s robust operating margin of 54.7% in the analog segment and 39.1% in the embedded processing segment in FQ3’22, growing by 2 and 0.9 percentage points YoY, respectively. In addition, it is important to highlight the company’s reasonable Stock-Based Compensation of $67M in the latest quarter ($277M over the LTM), since its GAAP margins remain stellar, with EBIT/ net income/ FCF margins of 52.2%/ 43.6%/ 37.7% at the same time (52.6%/ 44%/ 29.3% over the LTM).

On the other hand, NVDA has unfortunately suffered as a result of the recent PC destruction, making a direct comparison inaccurate. However, if we were to look at its performance in FQ1’23 (or the equivalent of Q1’22), the GPU company reported stellar operating margins of 53.6% in the Graphics segment and 43.7% in the Compute & Networking. Then again, after adjusting for other costs, including SBC expenses of $578M for the quarter ($2B in FY2022), its GAAP numbers have suffered with EBIT/ net income/ FCF margins of 38.9%/ 35.8%/ 16.5% for the quarter (37.3%/ 36.2%/ 30.2% in FY2022), despite the excellent gross margins of 53.6% at the same time (64.9%). This is how the GPU designer has justified the elevated SBC expenses in the recent quarterly financial report:

To be competitive and execute our business strategy successfully, we must attract, retain and motivate our executives and key employees and recruit and develop diverse talent… Competition for personnel results in increased costs in the form of cash and stock-based compensation… Failure to ensure effective succession planning, transfer of knowledge and smooth transitions involving executives and key employees could hinder our strategic planning and execution and long-term success. (Seeking Alpha)

As a result, TXN’s improved R&D returns and lower SBC expenses make a robust case for investing in mature analog companies indeed, since ADI similarly expects robust adj. EBIT margins of up 50.7% in FQ1’23. The cutting-edge technology and corresponding world-class talent, come at a price, after all.

In addition, the growth and adoption of analog chips remain reasonable, with the market expected to expand from $73.89B in 2021 to $112.5B in 2027 at a CAGR of 7.28%. The automotive end-market may continue to record sustained demand for the short term, since many automakers are increasing their EV production output. Every vehicle requires hundreds of analog chips for power management, sensors, electric motors, entertainment displays, and audio systems, significantly boosted by the integration of 5G capabilities in newer EVs. Therefore, it is unsurprising that market analysts expect analog chip usage per vehicle to increase by another 26% by 2023.

We expect the smartphone and PC market demand to return by 2024 as well, once the Feds reduce interest rates and macroeconomics recover, reviving the semiconductor market as well. Notably, personal electronics comprise 24% of TXN’s annual revenue. As a result, with 86.4% of the world’s population owning smartphones at the time of writing, we are looking at an immense volume of 6.92B devices. With a product replacement cycle of 2.75 years, it is natural that the rising penetration may fuel the demand for chips globally, with market analysts projecting up to 18.22B of smart devices by 2025. In spite of the short-term volatility, TXN’s long-term investment thesis remains stellar indeed.

So, Is TXN Stock A Buy, Sell, Or Hold?

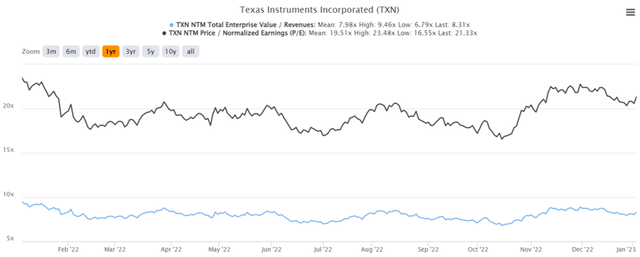

TXN 1Y EV/Revenue and P/E Valuations

TXN is currently trading at an EV/NTM Revenue of 8.31x and NTM P/E of 21.33x, higher than its 3Y pre-pandemic mean of 6.61x and 20.59x, respectively. Otherwise, it is still trading higher than its 1Y mean of 7.98x and 19.51x, respectively. However, we must also highlight that the stock has notably traded steadily at these levels, with the temporary exception of a peak of 35.05x P/E in July 2020.

The same, unfortunately, cannot be said of AMD or NVDA indeed. The former is currently trading at NTM P/E of 20.25x, down from its 3Y pre-pandemic mean of 97.75x and 3Y pandemic mean of 38.46x. NVDA is also trading at an NTM P/E of 37.88x, moderated from the 3Y pandemic mean of 44.72x. Despite owning all three stocks, we are certainly pleased with TXN’s steady valuations as they suggest a more predictable long-term investment.

TXN 1Y Stock Price

Based on TXN’s projected FY2024 EPS of $8.46 and current P/E valuations, we are looking at a moderate price target of $180.45. This number mirrors the consensus estimates of $178.61 as well, indicating a minimal margin of safety for those who add at current levels. Due to the recent 14% stock recovery from October bottom, we must also highlight the notable baked-in premium, since the company is not expected to report significant top and bottom-line growth through FY2024 at a CAGR of 2.4% and -0.1%, respectively. These numbers are probably attributed to the management’s prudent guidance of FQ4’22 revenues of up to $4.8B and EPS of $2.11 against the consensus estimates of $4.94B and $2.23, respectively.

Nonetheless, the analog thesis has further aided in TXN’s growing balance sheet by 68.9% since FY2019 to $9.09B in cash/ equivalents and by 78% to $6.48B in net PPE assets in FQ3’22. While its long-term debts have also increased by 40.1% to $7.43B and annual interest expenses by 19.4% to $203M at the same time, we are not overly concerned since only $800M will be due through 2024. The rest is remarkably well-laddered through 2052 as well, suggesting the company’s improved liquidity through the uncertain macroeconomic outlook.

TXN’s growing profitability has also contributed to the immense shareholder returns thus far, with $2.9B of shares repurchased and $4.23B of dividends paid out over the LTM. These numbers indicate an excellent 41% increase in cash flow set aside for dividends compared to FY2019 levels, with a 46% growth in annual dividends to $4.69 in FY2022. Existing shareholders have more reasons to rejoice, too, with an expanded share repurchase authorization of $15B by September 2022 to a total of $23.2B.

However, due to the reduced margin of safety, we prefer to rate the TXN stock as a Hold for now. The company’s elevated inventory of $2.4B in FQ3’22, growing by 29% YoY, may also suggest a softening demand for analog chips in the industrial segment, where 62% of revenues are derived together with the automotive segment. It makes no sense to chase the rally when market sentiment and demand are unlikely to return in the short term indeed. Dave Pahl, Head of Investor Relations in TXN, said:

I would say if you look at the third quarter results across the board and also inclusive of industrial, the quarter came in as we had expected… But as we described, the weakness began to broaden into that… And in fact, we expect that weakness to broaden into most of the other markets as well as we move into fourth quarter, of course, with the exception of auto… If you look at order rates quarter-to-date, they are of course consistent with our outlook, but they are weak quarter-to-date. (Seeking Alpha)

Investors would be well advised to wait for a moderate retracement to TXN’s previous $150 support levels. Based on the consensus projected FY2024 dividends of $5.34, we are also looking at an improved dividend yield of 3.56% at those levels, against its 5Y average of 1.14% and sector median of 1.55%. In the meantime, long-term investors like ourselves should simply ignore the noise, enjoy the dividends, and drip accordingly.

Disclosure: I/we have a beneficial long position in the shares of TXN, INTC, AMD, NVDA, MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.