Summary:

- Abercrombie & Fitch is committed to malls, upgrading stores, and growing sales through its 2025 Always Forward Plan, despite declining mall foot traffic.

- The company maintains a healthy financial position with $738 million in cash and a current ratio of 1.43, though its price/book ratio is high at 6.12.

- Risks include declining mall traffic, changing fashion trends, and potential drops in consumer confidence, but improving margins and profitability trends are promising.

- I recommend Abercrombie & Fitch as a buy, with a strong brand and potential for impressive earnings growth, especially if they restore their dividend.

tupungato

It’s probably because I grew up in the mall-crazy period of the 1980s, but I’m constantly fascinated with retail outlets, which were or are tied to the fate of the American shopping mall industry. Some of those companies, like Sears, have come and gone, while others have done much better.

Today, I want to look at one of the companies that has faced the decline in mall traffic and instead of fleeing to standalone outlets, has decided to stick it out in the malls, and work to upgrade their stores inside those locations. That company is Abercrombie & Fitch (NYSE: ANF).

Abercrombie & Fitch is a very familiar global retailer of apparel and personal care products. They are a mainstay in US shopping malls, but also have a strong presence in Europe and locations in Asia, the Middle East and Africa. The company owns Hollister, which is an important retailer in the company’s overall portfolio. Hollister actually has more physical locations than Abercrombie & Fitch-branded stores themselves.

The company has made much of their plans to grow. Dubbed the 2025 Always Forward Plan, this plan is built around growing sales through marketing and store investment.

Balance Sheet: A Premium, But at a Flexible Cash Position

|

Cash and Equivalents |

$738 million |

|

Total Current Assets |

$1.5 billion |

|

Total Assets |

$3.0 billion |

|

Total Current Liabilities |

$1.05 billion |

|

Total Liabilities |

$1.8 billion |

|

Total Shareholder Equity |

$1.2 billion |

(source: most recent 10-Q from SEC)

In 2020, at the height of the COVID-19 pandemic, Abercrombie & Fitch suspended their dividend, citing the need to maintain financial liquidity. It was a tough period for all retailers, and a look at the balance sheet shows that the effort was largely successful.

Abercrombie & Fitch has $738 million in cash available right now, and a current ratio of 1.43 looks to be in a pretty healthy financial position. That’s important, as the apparel retail industry is cash intensive and has to constantly reinvent itself to maintain consumer interest.

Not that everything here is great. Abercrombie & Fitch trades at a price/book ratio of 6.12, which is quite high. It’s not unheard of for a strong brand name to command such a premium, but the sector median is only 2.26, and this does raise concern that we’re being asked to pay an awful lot for the company right now.

The Risks – A Mall-Centric Company in the Post-Mall Era

Obviously, the big risk for Abercrombie & Fitch, and indeed anyone who is so strongly connected to shopping malls, is the fact that foot traffic in those malls has been steadily declining for years. It’s not a death knell for every company in the mall, but it is clearly a challenge, and the company has to be able to continue to attract the customers into their stores.

The other challenges are those related to most apparel outlets. They need to anticipate demand and react to ever-changing fashion trends, and importantly, they need to maintain their strong reputation if they want to keep attracting customers.

They also have the risk that is totally out of their control, that consumer confidence could worsen and that would necessarily impact sales. Right now, customers seem to be fairly upbeat, but we never know when that might change, and how it will impact Abercrombie & Fitch when it does.

Improving Margins

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Net Sales |

$3.7 billion |

$3.7 billion |

$4.3 billion |

$2.2 billion |

|

Gross Profit |

$2.3 billion |

$2.1 billion |

$2.7 billion |

$1.4 billion |

|

Gross Margin |

62.2% |

56.8% |

62.8% |

63.6% |

|

Operating Income |

$343 million |

$93 million |

$485 million |

$305 million |

|

Operating Margin |

9.3% |

2.5% |

11.3% |

13.9% |

|

Net Income |

$263 million |

$3 million |

$328 million |

$247 million |

|

Diluted EPS |

$4.20 |

5¢ |

$6.22 |

$4.64 |

(source: most recent 10-K and 10-Q from SEC)

Abercrombie & Fitch had a bit of a tough year in 2022, but apart from that has been trending toward better profit and higher margins. That could be very good news for profitability going forward, and especially if they are able to keep the revenues strong alongside that margin improvement.

Estimates seem to favor that trend. The expectation for this year is $4.81 billion in revenue and earnings of $10.35 per share. The next year continues to get slightly better, with revenue of $5.06 billion and earnings per share at $10.41.

That gives us the P/E ratio of 13.96, which isn’t bad at all, and is indeed better than the sector median of 17.34. With the company cash-flow positive and expecting to continue growing, that’s not at all a bad proposition.

In fact, the company has beaten substantially on its Q2 earnings. Moreover, they offered guidance for the rest of the year which show continued improving sales and margins are what they expect as well.

Conclusion

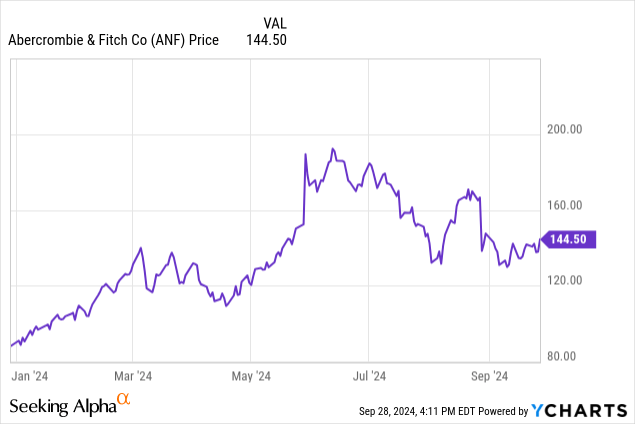

Abercrombie & Fitch is off its 52-week highs, but is still on the higher end of the overall range. That said, I like the combination of profitability and improving margins, and I view the company as a buy.

The price/book ratio is high, but the company is a strong earner, and signs point to that continuing. They are a well-known, popular brand, and in my mind the premium to book is not totally unwarranted to a value investor.

The thing they could do to really make me impressed with them would be to restore the dividend. Abercrombie & Fitch only ever paid a fairly modest dividend, 20¢ per quarter. It was responsible to suspend it during COVID-19, but they could readily afford to reinstate, and even grow it right now without significant impact to their balance sheet. They need to maintain financial flexibility, but a dividend would show confidence in their progress since the pandemic.

For investors, I would advise keeping a close eye on the company’s growth and especially their operating margins because if those continue to improve the way they have, they could really show very impressive earnings growth as a result. That’s something everyone invested in the company would definitely appreciate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.