Summary:

- Innovative Industrial Properties, Inc. offers a unique investment opportunity in the cannabis real estate sector. It offers a safe dividend and solid financial situation while holding the top position.

- The company’s strong financial performance proves noteworthy, with solid profitability ratios and excellent metrics.

- The Cannabis market is positioned for very fast growth in the coming years, as it welcomes millions of consumers and becomes every more accepted.

- The IIPR stock has a great combination of a sound financial position, a track record of dividend growth, dividend safety, and a leadership position in a growing market.

VeeStudio89

Investment Thesis

Innovative Industrial Properties, Inc. (NYSE:IIPR) is the leader of the nascent legal cannabis REITs market segment; with an extremely solid financial situation, a safely covered dividend of 5.61%, and plenty of growth potential, this stock is an excellent opportunity to get into a market that could explosively grow in the coming years.

The Fast-Growing Cannabis Industry

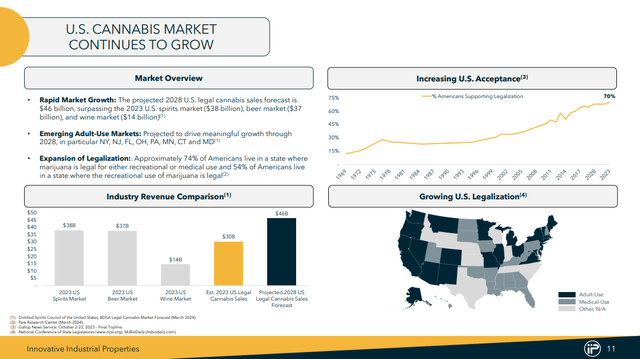

The U.S. is experiencing a green rush, with cannabis recreational and medicinal uses both seeing a growing trend; marijuana, once illegal in all 50 states and highly persecuted, has now become an attractive investment opportunity.

I have already written about how this industry is poised to grow at a 12.1% CAGR until 2030 in my previous analysis of NLCP.

We are now at an inflection point, with record numbers of cannabis even surpassing beer in the U.S. and landslide support for legalization.

This market is clearly on an uptrend, and I believe, as a result of my analysis, that the best shots for upside in this industry are young REITs specialized in the market.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

Both unburdened by previous experiences and strategies, they can focus on what works in a new market and evolve alongside it.

However, new markets can compound the inherent dangers of new companies, so REITs actually act as hedges; instead of depending on just one cannabis stock, you can charge rent on dozens or hundreds of them.

During the gold rush in California, it would have been much less risky and overall more profitable to hold a REIT that charged rent on mining businesses and services that the miners use, instead of just investing all into a mine.

The principle is the same for the cannabis green rush.

The market is expected to reach 46 billion in sales by 2026, making it one of the fastest-growing consumer markets with significant overlap in the healthcare industry, adding an interesting profile.

IIPR And Its Place In The Green Rush

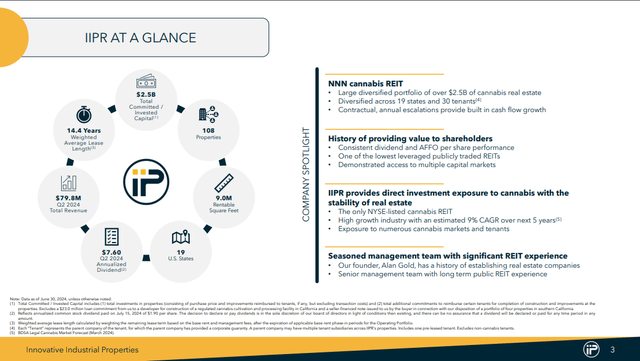

Innovative Industrial Properties holds the first place in the cannabis REITs segment; with a market cap of $3.79B, there is still plenty of space to grow.

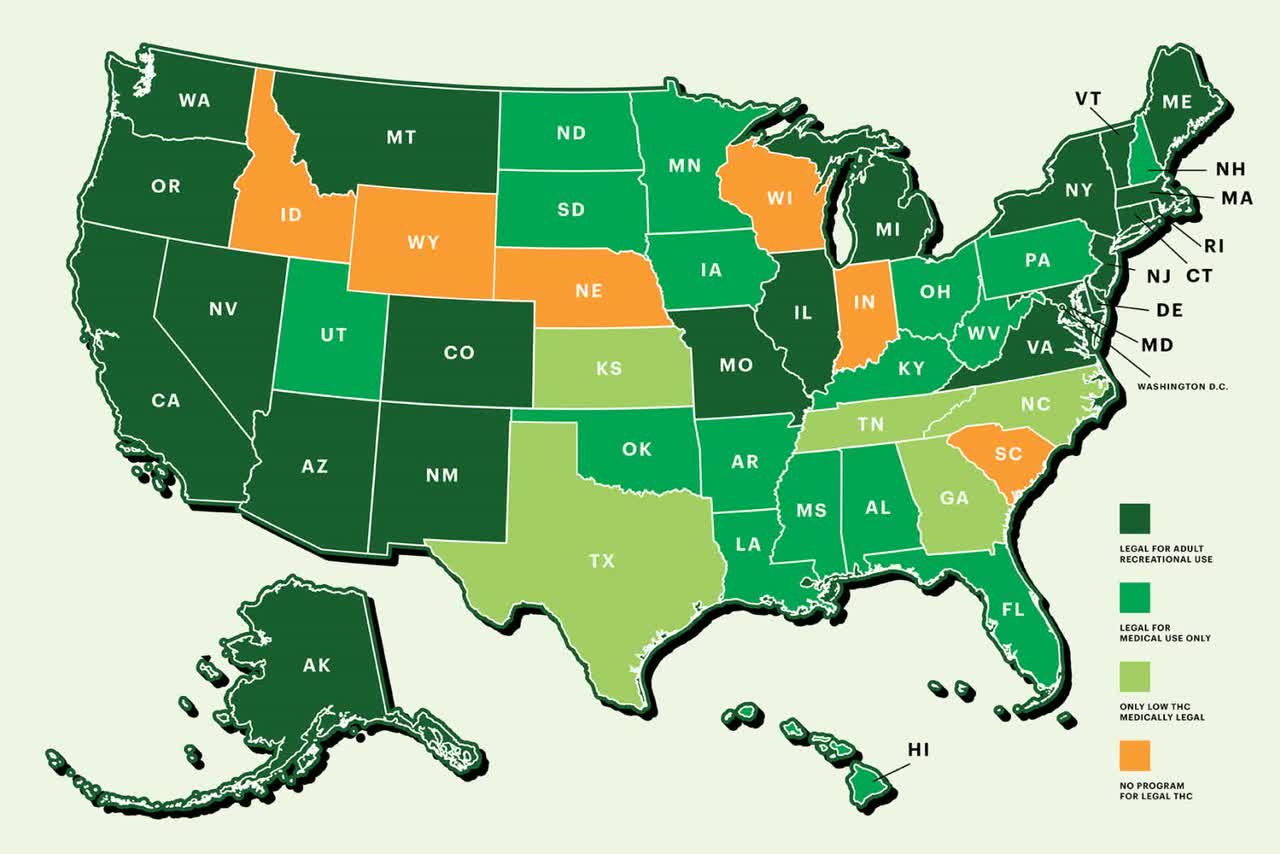

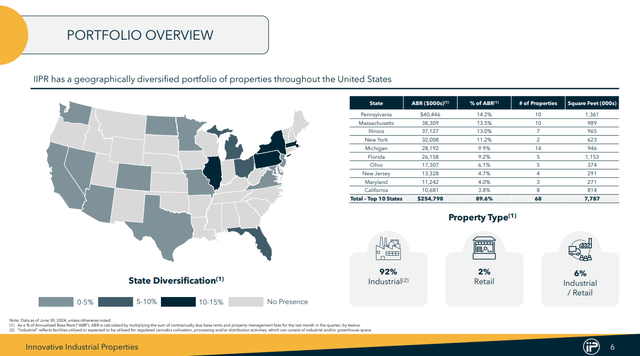

IIPR has a well-diversified portfolio, with 7 million square feet of rentable space and 100% of its current tenants under a triple lease net. It is located in 19 states, including the largest cannabis market in the U.S., Michigan.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

The green rush has created many investment opportunities, and so far, IIPR has managed to make a few of them its renters; with 30 tenants and 2.5B of Cannabis real estate under its wing, it holds a strong first place.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

Of course, more diversification and more markets should be the primary goal of IIPR, as I believe it should really continue expanding and growing to better corner the cannabis market and establish an ever more firm holding on the newly legalized industry.

As 24 states have legalized both recreational and medical cannabis and 38 states allow for only medical marijuana, it’s critical for continued business success to expand into as many markets as possible before the competitors do.

In other words, the cannabis market is in a stage where territorial expansion is critical for future success, as I believe the market is mainly currently expanding geographically. In contrast, in the future, most of the growth will come from more consumers and brands of established cannabis brands.

However, to gain brand recognition and build a loyal customer base, IIPR needs to develop excellent relations with local governments and local building companies and suppliers.

This combination of well-established brands that can expand with Innovative Industrial Properties and IIPR, having built a reputation as a recognized REIT, will help propel growth in the future and make it easier to obtain approval for more real estate investments.

I rate this as a strong point for the IIPR stock, but one that should expand regularly to keep its market share, as it’s relatively simple: if you don’t expand on a growing market, you are losing market share.

IIPR Earnings

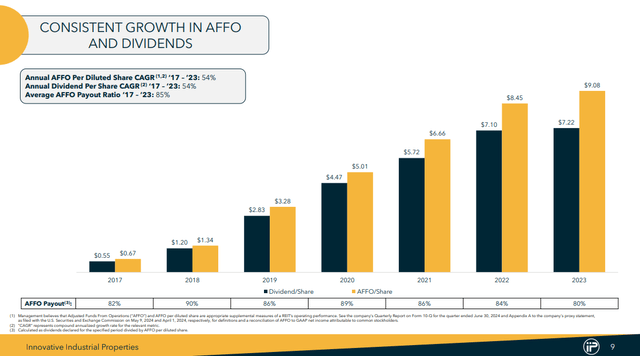

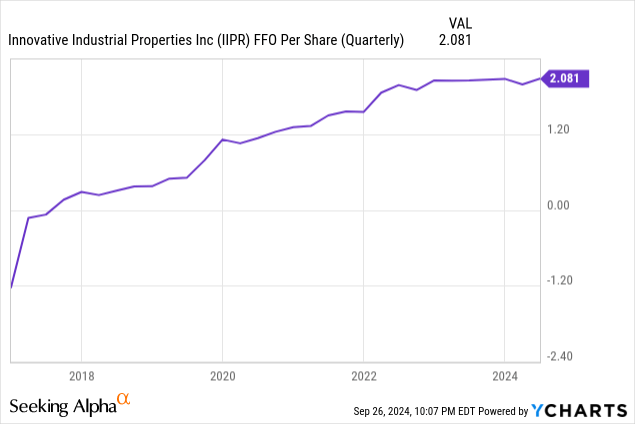

Innovative Industrial Properties has been on a secular trend for earnings as measured by the AFFO per share.

Since 2017, AFFO per share has grown, but most recently, it has shown signs of slowing down in 2023; this could be a wake-up call, considering the cannabis market also faced some headwinds in 2023.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

REITs, as a product of their capital-intensive nature and long-term orientation, are slower to react to market shifts compared to companies that are dependent on product sales.

If we look at FFO per share measured quarterly, the slowdown in 2023 is even more apparent; as of Q2, a plateau could be forming for IIPR earnings in the short term.

I will be particularly interested in further signs of stagnation in Q3 and Q4. I believe the overall long-term trend of growth is a positive sign for the IIPR stock, but it should still be cautiously evaluated in the near future.

While periods of slowing growth are natural, they should not last more than a few quarters for a young company in a rapidly expanding market.

Balance Sheet Analysis Of IIPR Stock

Overall, IIPR seems to be in a robust financial position.

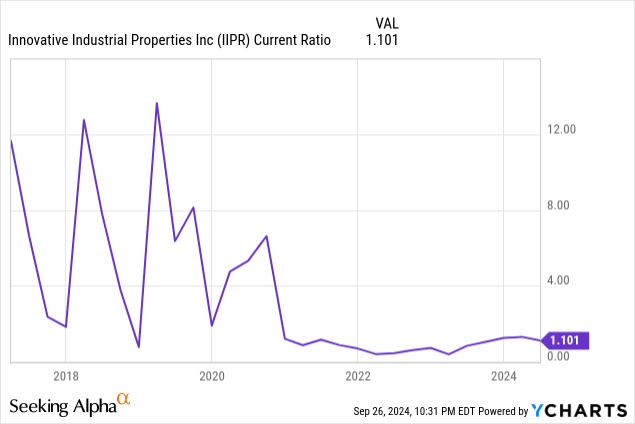

Its current ratio shows 1.101, meaning that short-term liabilities are covered by short-term assets; this is a good sign for any company.

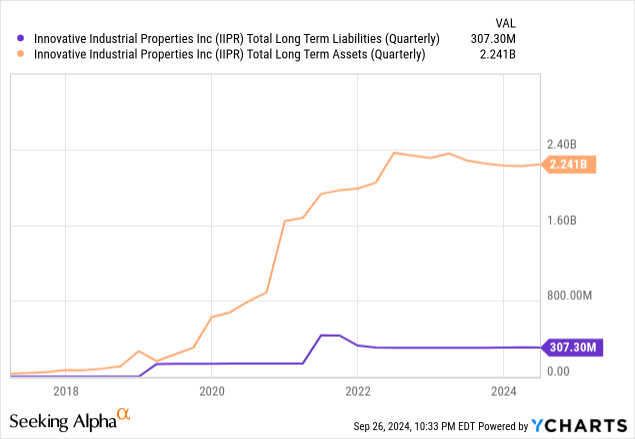

In the long term, the situation is even better, with $2.241B in long-term assets far outweighing the $307.30M in long-term liabilities. This makes for a very strong balance sheet and makes IIPR a stock more than capable of holding its weight against future obligations.

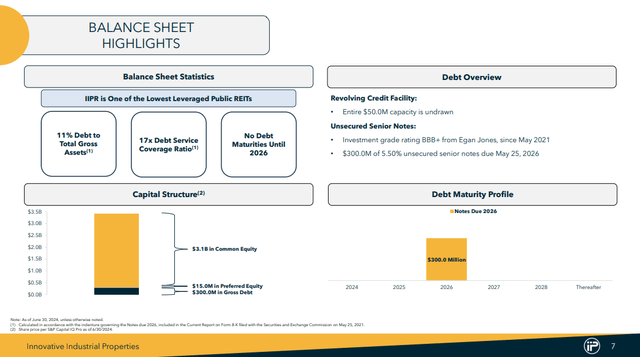

The company knows this and has made it one of the highlights of its Investor’s Presentation for August 2024.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

The debt-to-equity ratio is also extremely good, at only 15.33%, making the already robust financial health of IIPR even better.

Yet one problem remains the lack of laddering in the debt structure; while the debt is low, it would have been even better to have it more spread out, at least into 2 or 3 years, to better mitigate risks.

I have not found anything that would make me think that Innovative Industrial Properties Inc. won’t be able to pay the total $300 million in debt in 2026, but that doesn’t mean that the black swan event couldn’t swoop down and cause issues for IIPR down the line.

It also distorts financial statements, as years of what appears debt-free company life suddenly face a large lump sum debt repayment. I believe having laddered maturities as the industry standard makes for a smoother financial ride and provides lower overall risk.

Still, IIPR stock so far has proven to be in a secure financial situation with very low debt and plenty of opportunities to finance future investments and continue growing.

Cash-wise, the company holds $120.8 million, a comfortable yet not impressive sum.

For that, I rate this as a strong point for Innovative Industrial Properties.

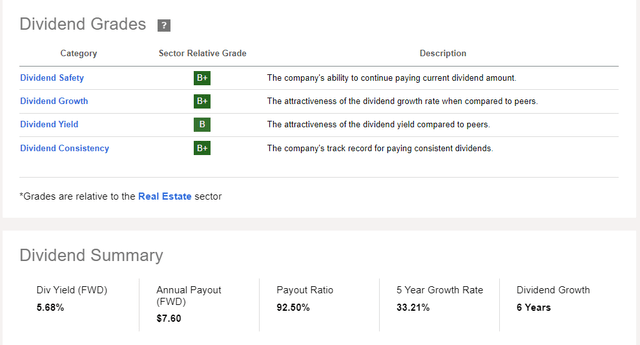

IIPR Stock Dividend

The 5.68% dividend is well covered by the AFFO and has been increased for the last six years.

While not exceptionally high, it is on the safer side of the dividend spectrum, and the solid financial position of the company also helps prop it up.

I rate this as bullish for the company. Still, I expect further raises down the line, especially considering the strong margins that the company currently holds and its significant growth prospects.

Still, I believe so far, management has proved to take on a balanced approach and avoid raising the dividend too much and too fast, leaving plenty of space for further investing and capital growth.

Profitability For Innovative Industrial Properties

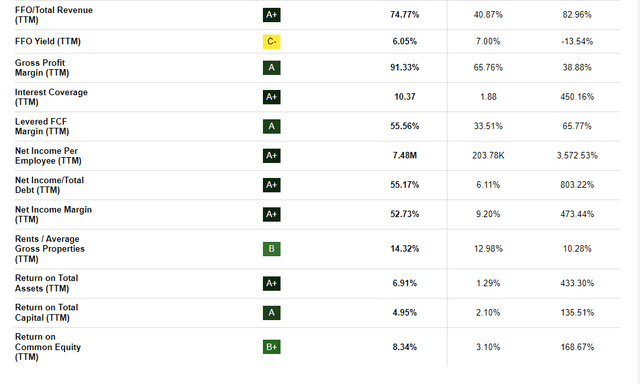

IIPR has shown a strong capacity for making a profit.

The high margins of the young industry are in full effect, as, in my opinion, there is a premium associated with the higher risks coming from the greyer financial and regulatory areas where cannabis finds itself.

Any industry, as it matures and attracts more participants, is bound to have lower margins, something the Cannabis REITs are yet to experience.

The key metrics to watch here are Gross Profit Margin, Interest Coverage, Net Income Per Employee, and Return on Total Assets.

The Gross Profit Margin is at a very attractive 91.33%, showcasing a powerful capacity for capturing profits at the top line. The interest coverage of $10.37 is an excellent addition to the already robust financial health of the company; not only are debts low, but the interest from that low debt is well covered.

Net Income per Employee is at a staggering 7.48M per employee, showcasing how little bloat there is in the workforce for IIPR.

Finally, the return on total assets of 8.34% proves that Innovative Industrial Properties is making good use of its assets to generate net income.

Overall, this paints a picture of a very profitable company that finds itself in the midst of the super-normal stage of a young company cycle.

They are great, yes, but they are most likely not bound to last.

The real test of the quality of IIPR stock is how well they invest these profits for the future and to face fiercer competition in the coming years as the industry becomes increasingly more open to competition.

Competition In The Green Rush

IIPR holds first place among the Cannabis REITs, with second place being NewLake Capital Partners, Inc. (OTCQX:NLCP), another exciting company that I have already written about.

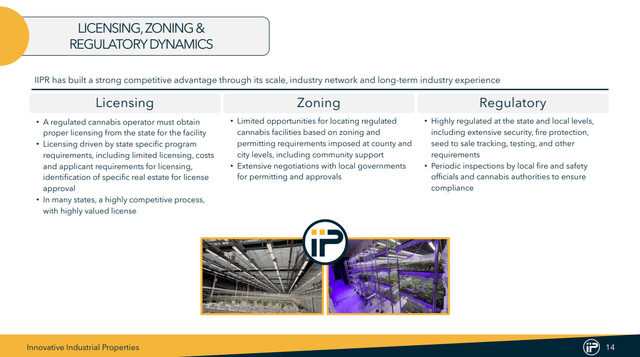

The Cannabis market is significantly regulated, with tough licensing at a state level and highly valued licenses.

There are also zoning requirements controlled by local governments, which can understandably find cannabis not that appealing in their jurisdiction.

INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION – AUGUST 2024

This creates a regulatory moat around cannabis enterprises that protects the current REITs from broader competition.

A recent comment in my previous analysis mentioned the dangers of a looser regulatory environment and how tobacco companies, with their massive resources and know-how, could quickly make inroads in the cannabis industry, pushing aside the smaller competitors.

This is, of course, a real danger to consider, but one that could be mitigated by strong branding and deep relationships with local governments, helping the younger IIPR to hold firmer against the new competition.

Older and more established companies are also slower to react and evolve to changing market conditions; this is an advantage that the younger ones must push hard, especially considering how new the cannabis market is.

IIPR Risks

From a financial perspective, Innovative Industrial Properties has an excellent position that can fuel future growth.

The main risks, I believe, are external, from changing trends in the consumer market, such as high costs from the illegal status of Cannabis on a federal level, which raises taxes and cuts access to traditional banks.

Colorado is a prime state of this, with plummeting sales forcing many cannabis enterprises to close and causing anxiety in other “green” states.

From a macro point of view, if consumer spending were continuously crunched by high inflation, the available disposable income for legal marijuana would be spent on essentials and/or cheaper unregulated alternatives.

With a current stable outlook for the present time, the previous possibility must be closely monitored and could have a potential hard impact on Cannabis stocks.

On the other side, a possibility of too much growth and further legalization could bring an avalanche of competition, causing a downward pull of prices and shrinking margins, especially if bigger and more established companies bring their resources and massive sales departments to bear.

In short, there are two main roads, and both the high road and the low road have many potential risks.

Conclusion

IIPR is a young, specialized REIT holding first place in a market with impressive growth potential. The dividend of 5.61% is well covered and safe, with a strong track record of increases in the last five years. With a very robust financial position, IIPR stock is built to last and could reap massive benefits in the coming years as it grows alongside the market. I rate it as a BUY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR, NLCP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.