Summary:

- Eli Lilly received FDA approval for Ebglyss for the treatment of moderate to severe atopic dermatitis this month.

- Ebglyss’ efficacy looks comparable, if not slightly superior, to current market leader Dupixent.

- Ebglyss has launched successfully in Germany and Japan, and I expect the launch in the U.S. to go at least as well as Dupixent’s launch in 2017.

- Additional opportunities for Ebglyss are indications like allergic rhinitis and chronic rhinosinusitis, with phase 3 trials expected to report results in 2026.

- I expect Ebglyss to become one of Eli Lilly’s largest products outside of obesity by the end of the decade.

Michael H/DigitalVision via Getty Images

With all the focus on Eli Lilly’s (NYSE:LLY) obesity business, the recent FDA approval of Ebglyss (lebrikizumab) for the treatment of moderate to severe atopic dermatitis has gone unnoticed. I believe Ebglyss will become one of the company’s largest products by the end of the decade and will challenge Sanofi’s (SNY) and Regeneron’s (REGN) Dupixent in the large atopic dermatitis market, as well as in other conditions it is being developed for.

Ebglyss has similar efficacy and safety to Dupixent, but with one key advantage: the convenience of maintenance dosing every four weeks versus every two weeks for Dupixent. That will probably not be enough to overtake Dupixent in terms of annual sales (Dupixent has a much broader label than Ebglyss that includes many other large indications such as asthma), but I expect Ebglyss to become a multibillion a year product for Eli Lilly in all the territories it controls.

Ebglyss’ competitive data and convenience position it well for success in the large atopic dermatitis market

Ebglyss (lebrikizumab) is an interleukin-13 (IL-13 for convenience) antibody, and it generated positive phase 3 results in moderate to severe atopic dermatitis patients and received FDA approval on September 13. The main competitor will be Dupixent, which is an IL-4 receptor alpha antibody.

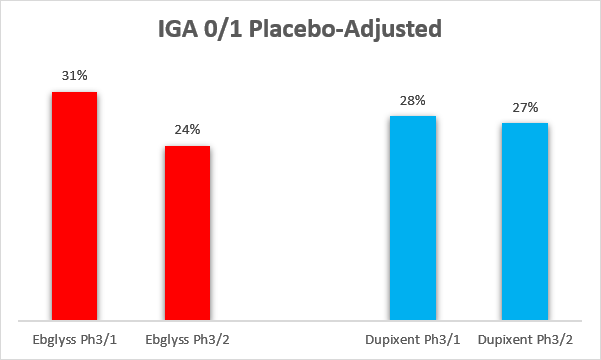

Ebglyss achieved strong topline efficacy in atopic dermatitis patients. With the caveats of cross-trial comparisons, Ebglyss looks at least as good, if not slightly better than Dupixent on both the IGA 0/1 score (Investigator’s Global Assessment), and the EASI-75 score (75% or greater reduction in the Eczema Area and Severity Index). Both comparisons below are on a placebo-adjusted basis.

Ebglyss label, Dupixent label Ebglyss label, Dupixent label

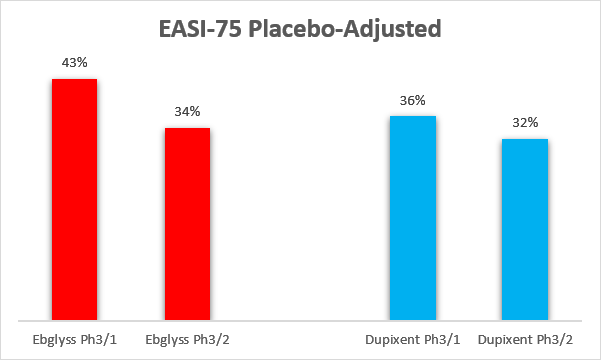

Longer-term data also look favorable, with Ebglyss having higher maintenance of response at week 52 (these are also cross-trial comparisons, as no head-to-head clinical trials were conducted).

Eli Lilly, Sanofi

Last week’s long-term follow-up data also indicate Ebglyss is safe and effective up to three years of treatment, with no major differences in efficacy between the once every two week dosing regimen and the once every four weeks dosing regimen.

The safety of the two products looks comparable with both having warnings and precautious in their product labels for hypersensitivity reactions, conjunctivitis and keratitis, and parasitic (Helminth) infections.

Both products are administered as subcutaneous injections, but Ebglyss is more convenient as its maintenance dosing is every four weeks compared to every two weeks for Dupixent. I should mention that Ebglyss does have an induction period where it needs to be dosed every two weeks until week 16.

Dupixent is already one of the most successful products in the industry with global net sales exceeding $3.5 billion ($14 billion annualized) in the second quarter, and while these sales were generated in multiple indications, the atopic dermatitis was the first approved indication, and by far the largest one, and I believe Eli Lilly can compete effectively based on the efficacy and safety data it generated, as well as the improved convenience in the maintenance period.

Partner Almirall makes progress following the late 2023 launch in Germany

Eli Lilly’s partner Almirall is making progress in Europe following the late 2023 approval by the EMA and the December 2023 launch in Germany. The reason Ebglyss is partnered in Europe is because Eli Lilly inherited the partnership when it acquired Dermira for $1.1 billion in 2020 and under the partnership terms, Eli Lilly is entitled to modest milestone payments (up to $85 million at the time of the 2019 deal announcement between Dermira and Almirall) and royalties on net sales in Europe ranging from the low double-digits to the low 20s.

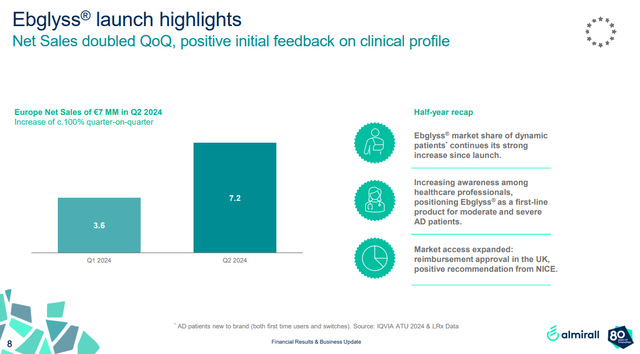

It may not look like it based on the numbers, but Ebglyss is off to a decent start in Germany, with quarterly net sales doubling in the second quarter to $8 million (€7.2 million). Almirall also says its “market share of dynamic patients continues its strong increase since launch” and that Ebglyss is becoming a first-line product for moderate to severe atopic dermatitis patients.

Almirall investor presentation

Even though Europe may seem like a large market, the fact is that Dupixent’s net sales in Europe accounted for only 11% of its global net sales in 2023 (approximately $1.35 billion out of $11.8 billion) and the U.S. is by far the most important market and Eli Lilly holds 100% of the U.S. rights.

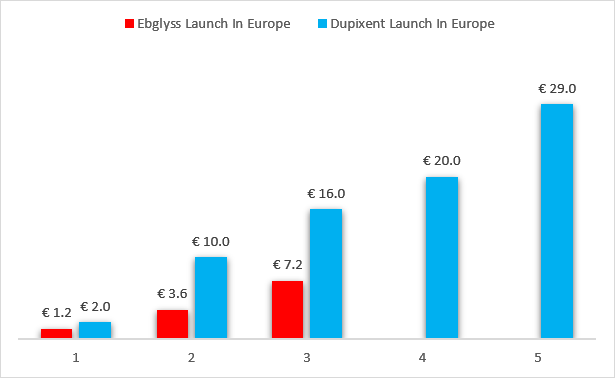

Incidentally, Dupixent was also launched in December (2017) by Sanofi, and also in Germany for the treatment of atopic dermatitis, and we can almost make apples-to-apples launch comparisons. And I am saying almost because I do not know how fast Sanofi managed to launch Dupixent in other countries in Europe, but I imagine it has done it faster than Almirall given the differences in the size of the two companies and Sanofi’s more formidable commercial infrastructure. Given the circumstances, this launch looks pretty good to me, and I believe Eli Lilly can do better in other territories.

Almirall earnings reports, Sanofi earnings reports

I should also add that Ebglyss was launched by Eli Lilly in Japan at the start of 2024 with quarterly net sales of $3.1 million and $4.3 million in Q1 and Q2, respectively, but I have no comparable data for Dupixent since Japan is lumped into the “rest of the world” in Sanofi’s earnings reports.

What the launch could look like in the United States

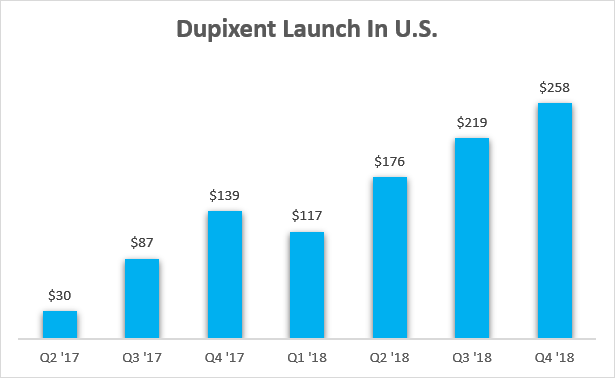

The launch of Dupixent in the United States can once again serve as a decent benchmark for Ebglyss. Dupixent received FDA approval for the treatment of atopic dermatitis in late March 2017 and this is how the launch looked like through the end of 2018. I am intentionally cutting off the sales at the end of 2018 since Dupixent was approved by the FDA for the treatment of asthma in Q4 2018 and sales in future quarters are no longer just for atopic dermatitis.

Sanofi earnings reports

It took Dupixent seven quarters to reach an annualized net sales run rate in excess of $1 billion, and I believe Eli Lilly can achieve the same or even better launch numbers in the next 7–8 quarters with Ebglyss. The primary reason is not the improved convenience of Ebglyss, but the significantly increased awareness of the excellent safety and efficacy of biologic therapies for the treatment of atopic dermatitis in the last seven years. As such, I believe the launch number of Dupixent should be the minimum for Eli Lilly with Ebglyss, allowing for quarterly variability due to seasonality and inventory changes.

Other shots on goal for Ebglyss

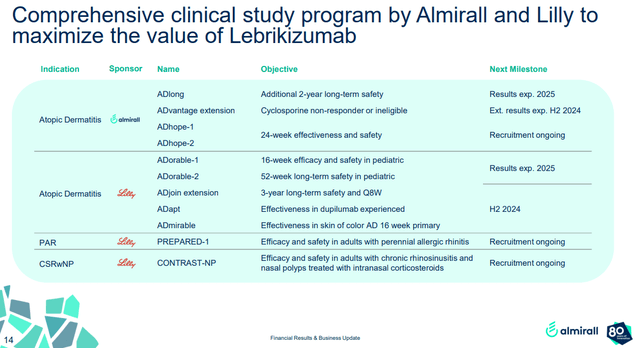

Eli Lilly and Almirall are also developing Ebglyss for the treatment of adults of perennial allergic rhinitis and for the treatment of adults with chronic rhinosinusitis and nasal polyps treated with intranasal corticosteroids. Both phase 3 trials were initiated this year and are expected to report topline results in 2026. These markets are not as large as atopic dermatitis, but serve as sales accelerators in 2027 and beyond, assuming the results from both trials are positive.

Almirall investor presentation

I am not aware of other development plans at the moment, but believe it would be natural for Eli Lilly and partner Almirall to go after additional indications such as asthma.

Conclusion

The FDA approval of Ebglyss went largely unnoticed, but I believe it can become one of Eli Lilly’s larger products by the end of the decade, based on comparable (if not slightly superior) efficacy to market leader Dupixent and the improved convenience. The launch of Dupixent in the United States is a good benchmark for Ebglyss and I believe it should serve as a floor for Ebglyss (allowing for quarterly variability and inventory fluctuations) considering the significant increase in awareness of safety and efficacy of biologic therapies in the atopic dermatitis market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.