Summary:

- Virgin Galactic faces a bleak future due to its dwindling cash reserves, limited market capitalization, and uncertain path to profitability.

- While the introduction of Delta Class ships could help the company ramp commercial operations, this is at least 2 years away and will require significant investments.

- Virgin Galactic’s market capitalization makes raising capital difficult, meaning that any issues or delays are likely to prove fatal.

adibilio/iStock Editorial via Getty Images

Virgin Galactic (NYSE:SPCE) finds itself in the unenviable but fairly common position of large losses, a dwindling cash reserve and a murky path to profitability. Given the company’s current market capitalization and financials, there is limited leeway in demonstrating that the business is viable so that capital can be raised on more favorable terms. This is heavily dependent on bringing new Delta Class ships into operation and significantly ramping flight volumes, while maintaining cost discipline.

I previously suggested that Virgin Galactic had all of the hallmarks of a bubble; a small market capitalization, high uncertainty over fundamental value, leadership in a new industry which captures the imagination of retail investors and the potential for extraordinary returns if the company is successful. This has subsequently proven to be the case, with the stock down by around 97% since then. While Virgin Galactic is no longer a bubble, the company still hasn’t demonstrated that it is financially viable. In addition, Virgin Galactic probably doesn’t have enough liquidity to reach breakeven and may not be able to raise enough additional capital.

Market

In recent years the private space sector has grown rapidly, supported by declining costs. This rapid decline in costs is enabling applications like:

- Human spaceflight

- Launch & transport

- Scientific research

- Space infrastructure and services

- Space energy

Virgin Galactic has chosen to enter this market by primarily offering human spaceflight for recreational purposes. As a new market, there is considerable uncertainty regarding demand for this type of service. Virgin Galactic’s initial reservations indicate strong demand though.

I question how demand will hold up if any service providers manage to genuinely scale though, as space tourism demand is likely to be driven in large part by exclusivity. Repeat customers will also likely be the exception rather than the rule, making the long-term viability of the business questionable.

This is exacerbated by the fact that Virgin Galactic’s claim to space travel is somewhat tenuous. There is no rocket launch and Virgin Galactic only reaches an elevation of 50 miles, below the Karman line at 100 km, the more widely accepted barrier to be considered an astronaut.

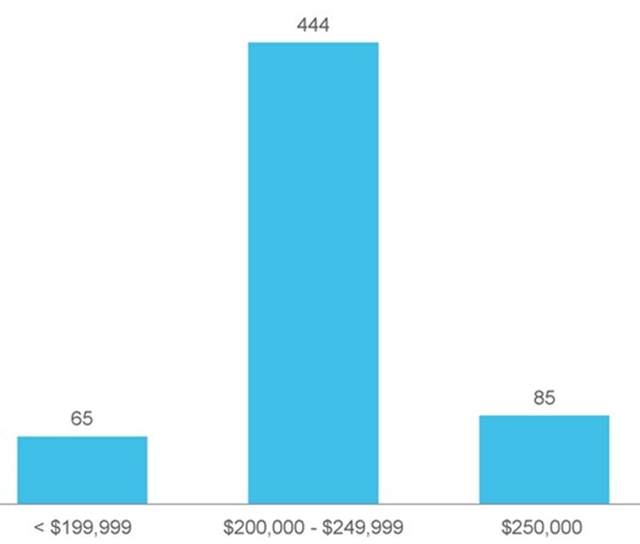

Figure 1: Initial Distribution of Reservation Prices (source: Virgin Galactic)

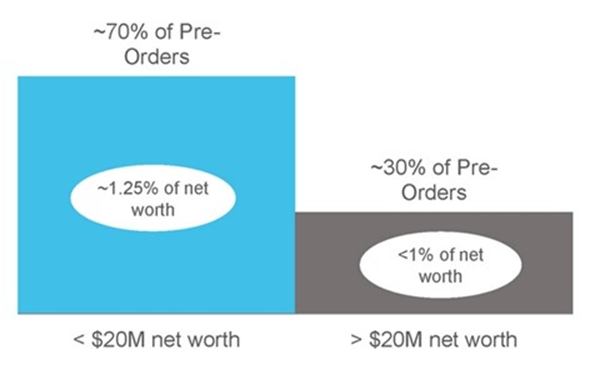

Research suggests that consumers are willing to spend 1-1.5% on their net worth on a single discretionary purchase, which Virgin Galactic believes is supported by its reservations.

Figure 2: Virgin Galactic Reservations (source: Virgin Galactic)

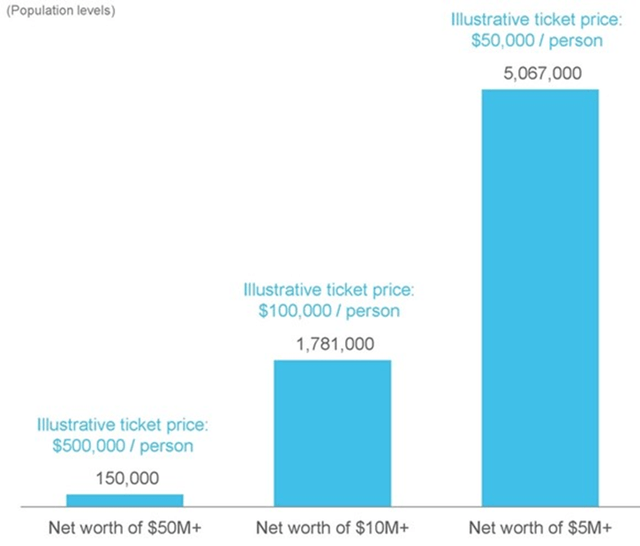

Based on this, Virgin Galactic has estimated its core TAM based on the number of individuals with a net worth in excess of 10 million USD. Demand appears to be highly elastic, meaning that the market could be expanded significantly if ticket prices can be reduced below 100,000 USD. Based on Virgin Galactic’s current cost predictions, it appears unlikely that the company can offer ticket prices below 200,000 USD in the near-term though.

Figure 3: Potential Impact of Ticket Price on Demand (source: Virgin Galactic)

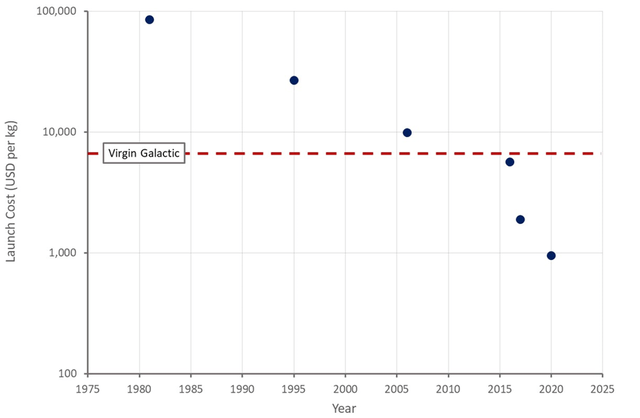

Virgin Galactic is currently planning on pricing tickets at around 600,000 USD each. While this may be viable initially, it may not be sustainable in the face of increased supply and even moderate competition. Launch costs are well below Virgin Galactic’s price point and declining rapidly. Pricing will presumably converge towards launch costs over time.

Figure 4: Satellite Launch Costs (source: Created by author)

In addition to its core space tourism market, Virgin Galactic wants to expand into high-speed point-to-point travel. The commercial aviation market is worth in excess of 900 billion USD, with the commercial passenger travel market alone worth more than 600 billion USD.

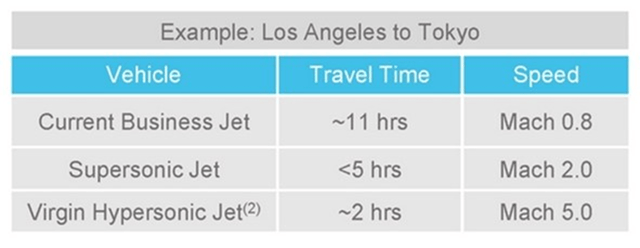

Figure 5: Illustrative Travel Times (source: Virgin Galactic)

Competition is a critical consideration, as the economics of space tourism could be terrible if the market becomes commoditized. Blue Origin is probably Virgin Galactic’s primary competitor at this point in time. Blue Origin has a more diversified business than Virgin Galactic, with its offerings including launch services, space tourism and aerospace manufacturing. The company’s spaceship consists of a reusable booster rocket and a crew capsule, which can hold up to six passengers. The capsule actually crosses the Karman line before returning to Earth using three parachutes and a solid rocket. Blue Origin has now flown 37 private astronauts.

Figure 6: Comparison of Virgin Galactic and Blue Origin (source: Virgin Galactic)

Virgin Galactic

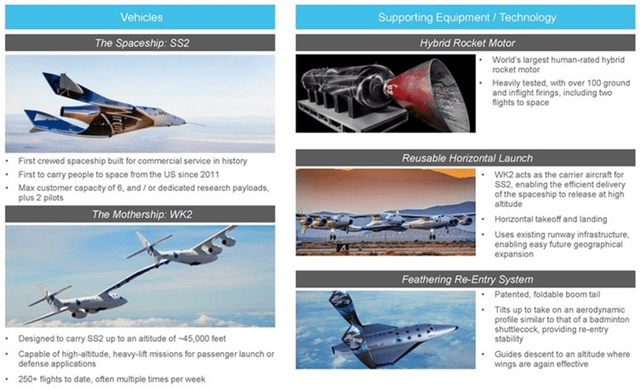

Virgin Galactic has developed the VMS Eve mothership to transport its spaceship to 45,000 feet, reducing the thrust required to reach space. VMS Eve is the world’s largest all composite aircraft in service. Virgin Galactic believes that using a specialized aircraft for the first stage of flight enables more frequent operations.

VMS Unity is Virgin Galactic’s spaceship. It was the first private, crewed spacecraft built for commercial service and is capable of transporting up to 6 passengers. The company’s first passenger flight was in early 2019, although progress has been fairly limited since then. Unity utilizes a hybrid rocket engine to propel the craft to over Mach 3. The Unity ship reaches a height of 50 miles, with passengers briefly experiencing microgravity, before reentering the Earth’s atmosphere and gliding back to the spaceport.

Figure 7: Virgin Galactic’s Technology (source: Virgin Galactic)

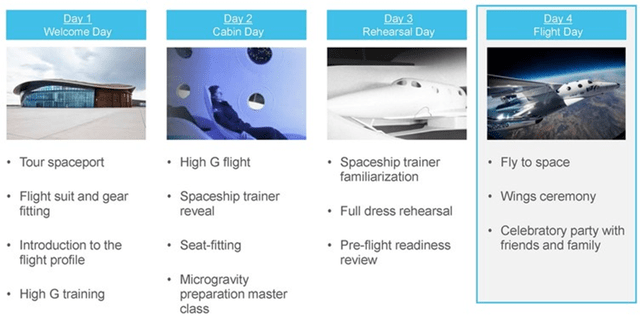

Virgin Galactic’s experience extends to training and peripheral services (spaceport tour, ceremony, celebratory party, etc.). The company currently has one spaceport, which Virgin Galactic believes can support revenue in excess of 1 billion USD annually.

Figure 8: Virgin Galactic’s Service (source: Virgin Galactic)

Virgin Galactic is still in the process of establishing a commercial service, which will be aided by the introduction of a new spaceship that can fly more frequently. After this is achieved, Virgin Galactic wants to reduce prices as the business scales, supporting market expansion. Virgin Galactic then wants to expand globally, and eventually enter the long-haul travel market.

Galactic 7 on June 8th was the last commercial flight for VSS Unity. This was Virgin Galactic’s seventh commercial flight and 12th overall spaceflight. The flight carried a mix of private and research astronauts and was expected to realize an average per-seat price of over 800,000 USD. While Unity is being replaced, it will continue to play a role in training, and will reside in Spaceport America.

Based on insights from initial flights, Virgin Galactic is now in the process of moving to a new spaceship design which will be capable of flying more frequently. Delta ships will provide the same experience as Unity but require less maintenance, enabling weekly flights. The Delta ship is also larger and will transport 6 passengers instead of 4.

Virgin Galactic expects to commence commercial services with two Delta ships in 2026. This appears to be a very aggressive timeline though. The Delta ships are reportedly heavily based on the VSS Imagine, which was built in 2023 but never flown. This could help streamline the introduction of the Delta, but this is far from guaranteed. After the first 2 Delta ships become operational, Virgin Galactic expects to be cash flow positive.

Virgin Galactic is also leveraging an Iron Bird test rig to support the introduction of the Delta class ship. The Iron Bird allows Virgin Galactic to test and verify the operation of Delta subsystems (avionics, feather actuation, and pneumatics) on the ground and in parallel to assembly. The company hopes that this will help to streamline flight tests. Ground testing of the Delta Class spaceship has already commenced.

For the Delta development program, Virgin Galactic is in charge of design and is leveraging the manufacturing and engineering capabilities of key industry partners. Incremental Delta ships are expected to cost 50-60 million USD each. Future costs are relatively low because the designs are already completed, and a supply chain will be in place.

Following the conclusion of the Delta spaceship design, Virgin Galactic will begin moving resources towards its next-gen mothership program. The company is currently targeting a 2028 delivery date for the next-gen mothership. While Virgin is trying to manage its cash position by delaying the introduction of a new mothership, it is not clear that this will meaningfully alter the company’s trajectory.

Issues with Boeing are also likely driving the delayed introduction of the new mothership. Boeing’s Aurora Flight Sciences was supposed to be helping design the new mothership, but this relationship fell apart, with Aurora claiming that the ship would cost more to develop than expected, and Virgin Galactic claiming that Aurora performed “shoddy and incomplete work”. Boeing has sued Virgin Galactic for failing to pay for work and return IP. Virgin Galactic believes that the issues with Boeing are not material, stating that it received unacceptable work from Boeing. The company also believes that the IP in question is either owned or licensed.

Until the new mothership is deployed, Virgin Galactic will need to increase flight frequency using its current ship. A major enhancement program for VMS Eve was completed in 2023. Virgin Galactic is also developing a targeted maintenance plan and operations schedule for Eve which it expects to result in three space missions weekly. Relying on a dramatic increase in flight frequency to avoid bankruptcy is risky though.

Financial Analysis

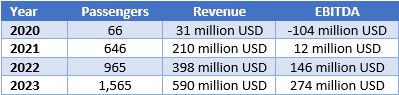

At the time of its SPAC, Virgin Galactic expected its revenue to begin ramping in 2020, with the company reaching EBITDA breakeven at around 200 million USD revenue. Virgin Galactic was also projecting a gross profit margin approaching 75% and an EBITDA margin of close to 50%, although both of these figures appear very optimistic.

Table 1: Virgin Galactic Projected Financials at Time of SPAC (source: Created by author using data from Virgin Galactic)

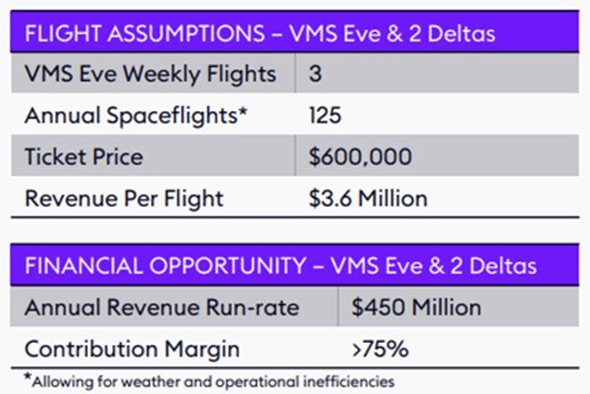

The company now expects revenue to increase significantly with the introduction of the Delta ship in 2026. Virgin Galactic also plans on raising ticket prices to better capitalize on its pricing power. There is a backlog of lower priced flights that must be worked through before Virgin Galactic fully begins to realize higher prices though. There is a little over 600 astronauts at lower price points, which will likely take around a year to work through. Virgin Galactic’s projections are for when this lower priced backlog has been exhausted. The company is working on an assumption of 600,000 USD ticket pricing and 125 flights per year, with 6 passengers per flight. This would give the company a 450 million USD annual run-rate.

Figure 9: Assumptions for VMS Eve & 2 Deltas (source: Virgin Galactic)

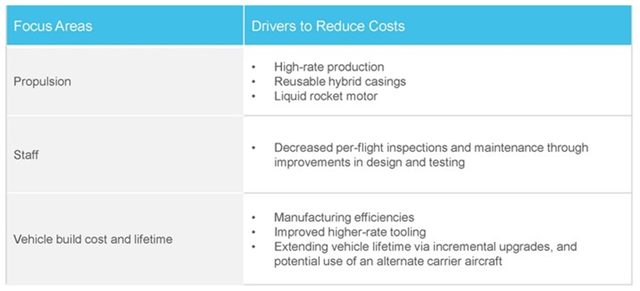

Virgin Galactic’s projected annual revenue run rate would likely not be enough for the company to achieve profitability, even with a 75% contribution margin for each flight. Operating expenses remain in excess of 100 million USD, driven by R&D. R&D spending is primarily related to the development of the Delta class spacecraft and will presumably decline substantially once development is complete. Virgin Galactic will need to shift some spending towards the development of its next-gen mothership though.

Virgin Galactic’s free cash flow was negative 126 million USD in the first quarter, with the company expecting a further 110-120 million USD cash outflow in the second quarter. At the end of March 2024, the company had 867 million USD cash, cash equivalents and marketable securities. I do not believe the Virgin Galactic has sufficient liquidity to reach breakeven. Even if there are no issues, the company is still 2 years away from generating meaningful revenue. Virgin Galactic already has close to half a billion dollars debt and its low market capitalization will make it difficult for the company to meaningfully extend its runway.

Figure 10: Potential Cost Reduction Levers (source: Virgin Galactic)

Conclusion

Virgin Galactic may appear attractively priced given the size of the opportunity ahead of it, but this reflects the company’s precarious financial position and long path to commercial operations. If Virgin Galactic could achieve positive free cash flow without significantly diluting existing investors, there would be substantial upside. I don’t see how this is possible given that Virgin Galactic needs to finance operations for at least the next 2 years and develop and build its Delta Class ships.

Even if Virgin Galactic can successfully scale up its business, I am not overly optimistic about the company’s prospects. I tend to think that demand will be less than anticipated and that pricing is unlikely to hold up long-term. With even a modest amount of competition, margins are also likely to be quite low. As a result, I believe there is far too much risk for the relatively limited upside.

Figure 11: Virgin Galactic Enterprise Value (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.