Summary:

- Virgin Galactic’s Q1 2024 results show improvements in revenue and cash burn rates, but the primary goal of generating significant revenue is still a few years away.

- SPCE’s guidance suggests higher ticket prices, but the target of becoming cash flow positive in 2026 may still be optimistic.

- The development of the next-gen mothership is delayed, and the current generation will need to increase flight frequency to meet ambitious goals.

Neilson Barnard/Getty Images Entertainment

The Virgin Galactic Investment Thesis

Seeking Alpha Analyst Rating

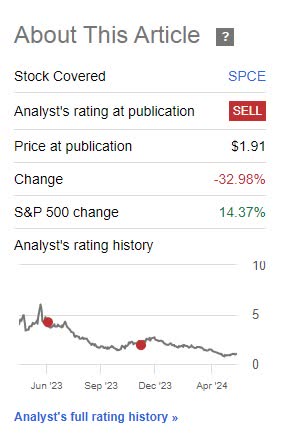

A lot has happened since my last article on Virgin Galactic Holdings, Inc. (NYSE:SPCE) last December. Therefore, I would like to see if my thesis is still valid or if I need to adjust it. At that time, I believed that the liquidity reserve might not be sufficient to reach the point where Virgin Galactic could achieve positive cash flow without further capital raising or investment, and that the planned start of Delta flights in 2026 was an optimistic estimate.

And as I will show below, I still believe that the Delta ship launch could be delayed, but the resurgence of the meme stock hype could make the financial situation better than it was a few months ago.

Virgin Galactic Q1 2024 Earnings Results

Virgin Galactic Q1/24 Earnings Presentation

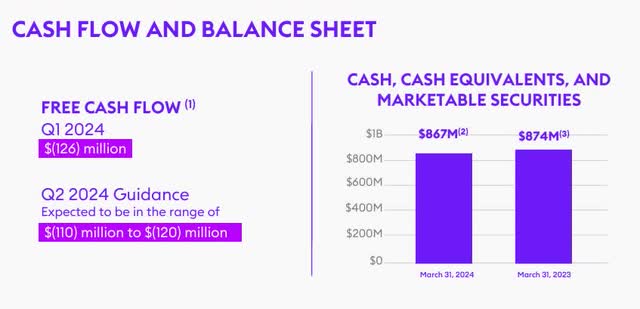

Those who find Virgin Galactic attractive are aware that they are investing in a vision of the future, which will probably only start to bear fruit in 3 to 5 years, when sales will hopefully get the first big boost. So the $2 million in Q1 revenue is a big improvement over last year’s $0.4 million, as are the lower cash burn rates in total expenses, which fell from $164 million to $113 million, and free cash flow, or FCF, which improved from -$139 million to -$126 million. However, the primary goal remains the hopefully soon achievable hundreds of millions of dollars in revenue from the increased volume of customers transported.

Virgin Galactic Q1/24 Earnings Presentation

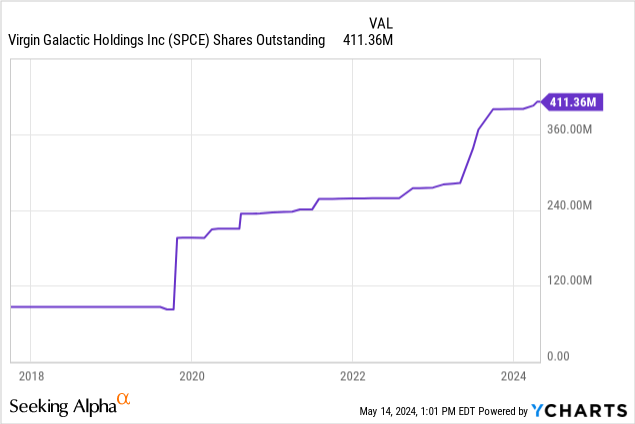

The free cash flow guidance also anticipates further advancements, and on the Virgin Galactic Q1/24 earnings call it was mentioned that 2024 is expected to be the highest cash burn year. Now, if we assume that capital expenditures begin to decline after the last commercial flight of Galactic 7 in the third quarter of 2024, I think we could see negative FCF of $80 million to $100 million per quarter from then on, which could lead to negative FCF of $320 million to $400 million per year in 2025 and over $450 million in 2024.

As a result, cash and cash equivalents of $867 million should be sufficient to fund operations for a cash runway of approximately 2 years. However, given the potential for a return of the meme stock mania, the demand for the shares could be used to raise cash through a share offering to further strengthen the cash position. AMC Entertainment (AMC), for example, has already done so with a $250 million equity offering.

Of course, this would further dilute shareholders, but I think it would be a good way for the company to raise fresh capital and strengthen its balance sheet. Because I think there is a possibility that the Delta flights could be delayed, so a stronger balance sheet would be helpful to minimize the downside risk.

Virgin Galactic’s Guidance

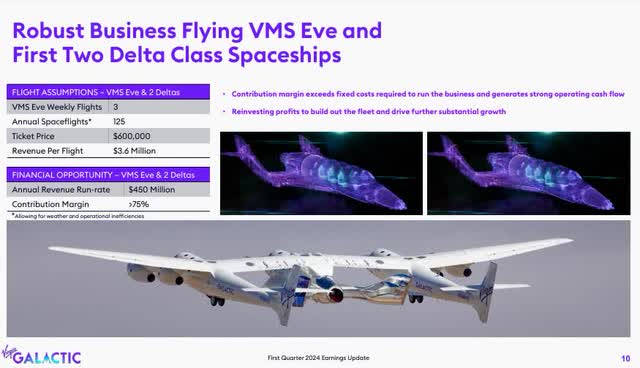

In my last article, I estimated that the Delta ships could fly about 2 times a week, or 104 times a year, and probably earn between $2.7 million and $3.6 million per flight. And that would result in a revenue range of $280 million to $374 million. At the time, I estimated that the seats would average between $450,000 and $600,000 because of the backlog of 800 people who needed to be cleared.

However, the average ticket price for the Galactic 7 is over $800k and the new ticket price is over $600k. This means that the updated guidance is probably on the high end of my estimate, and that customers are apparently willing to pay even more.

Virgin Galactic Q1/24 Earnings Presentation

In fact, the new forecast now assumes up to 3 weekly flights, which would allow for 125 flights at an average price of $600,000, resulting in annual revenues of $450 million. They are even higher than my estimates, although you have to consider that the backlog has to be cleared first, which is expected to take until 2026 and 2027.

This means that in 2026 and 2027, if all flights are operated as planned, revenues will still be less than $450 million. Therefore, I think the target of Virgin becoming cash flow positive in 2026 is still optimistic, as costs are expected to consume a large portion of revenues. In what is probably a very capital intensive industry like this, I would imagine that higher volume with higher ticket prices would be necessary to achieve this goal of becoming cash flow positive.

And then there is the lawsuit with Boeing (BA) and its Aurora Flight Science Unit, which was supposed to help develop the mothership Jet Carrier. And here we can see that Aurora has not been working for Virgin Galactic since May 2023, and that the new mothership is unlikely to be ready before 2028, as mentioned in the last earnings call.

As we balance our desire for rapid growth with our spending pace ahead of meaningful revenue, we will target 2028 for delivery of the first of our next-gen motherships.

That means that the current generation of Eve would have to fly 2–3 times a week, which would be a big increase from the current ~ 1 time a month rhythm. Whether this goal is realistic remains to be seen, but it is in any case a very ambitious one. So I would not be surprised if they slowly move towards that goal to see if the new intervals really work.

A very interesting article on this topic entitled “More Downside Expected After Boeing Lawsuit” has also been written by Ahmed Abdelazim here on Seeking Alpha. In my opinion, it is well worth reading.

Conclusion

I still believe that the space tourism industry could be very attractive in the future because the barriers to entry are very high due to the incredibly high regulatory hurdles and the costs for research and development. But with competitors like Blue Origin (BORGN) and SpaceX (SPACE), which are well-funded thanks to Jeff Bezos and Elon Musk, respectively, and which may offer a better experience at a higher price, the market is highly competitive.

In addition, I would like to see weekly flights before I am fully convinced that Eve, along with Delta and Unity, will be able to launch 2–3 times a week with passengers on board. Because I think it will be a big step, and it will not be easy. But if Virgin Galactic is successful, it will probably influence my opinion of Virgin Galactic in a very positive way as far as future prospects are concerned.

However, since Virgin Galactic recently stopped flying to focus on developing Delta, we won’t know for a few years, and until then, it will be important to know how long the cash will last. Therefore, I think the meme stock hype and the hope of a short squeeze that many retail investors have, as the short interest on Virgin Galactic is 29%, could be a good opportunity to strengthen the cash position.

But for now, I am maintaining my rating and not upgrading Virgin Galactic, but if the cash burn improves significantly, and they strengthen their financial position, I might consider it in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.