Summary:

- Virgin Galactic Holdings shares have experienced a significant decline and underperformed the S&P 500.

- SPCE stock price movement indicates an immature business model and weak financial health, with increasing negative cash flows and reliance on debt.

- Technical and operational challenges, as well as high valuation, suggest a further downside for the stock.

Yuichiro Chino/Moment via Getty Images

Investment Thesis

Virgin Galactic Holdings, Inc. (NYSE:SPCE) shares have been on a strong downward trajectory after experiencing exponential growth between 2020 and 2021. Over the last three years, the stock has lost about 96.33%, underperforming the S&P 500 with a margin of 123.61%.

Despite such a big loss, it is unfortunate that this stock is faced with several serious challenges which I believe will drive a further downside. For this reason, I am bearish on this stock and I rate it a sell because I find it to be a high-risk proposition that needs a lot of patience and tolerance for volatility, which to me is not worth it given its immature business as will be demonstrated later in this analysis.

My Take On The Price Chart

In this section, I would like to walk you through the price movement, my thoughts about it, and why I believe a further downside is inevitable. To begin with, I will look at the price chart.

Looking at the above chart, I have marked three major zones that will help us understand this stock better. In The first phase, the price is characterized by a plateau phase with no significant price changes, marking the market-neutral outlook on the stock since its IPO. These make sense a lot to me because in the first place, this was, and I still believe is a startup given its lack of mature financials in the sense that profits are far from being realized, and operational challenges are still plaguing the company, a sign that its business model is yet to mature.

The second phase is marked by exponential growth of share prices, which to me remains illusive because the company’s fundamentals were weak to warrant such a price movement. I say so because the company’s financial health got weaker between 2020 and 2021 when this upward trend occurred. In those two years, the company’s net operating income declined from negative values of $275 million in 2020 to $320 in 2021 and net loss also worsened from $273 million in 2020 to $353 million in 2021. With these figures, I believe the absurd share growth witnessed in phase two was just a hype associated with the company’s ambitious vision and milestone, as well as speculations around space tourism.

However, after about a year of exponential share price growth, the hype appears to have faded and the market entered a correction phase which is marked by phase three. In my view, this phase has been accelerated by several factors such as the company’s financial challenges, technical operational challenges, and very unjustifiable valuation which also form my bearish outlook of this stock and whose details are provided in the succeeding section.

Why I Believe A Further Downside Is Inevitable

While looking at the price chart it could appear that this stock has bottomed and is consolidating, potentially ushering in a trend reversal, I am of a descending opinion. I believe so because the company is faced with three major headwinds which I believe will fuel a further downside movement. To begin with, there are the technical and operational challenges that it faces in delivering its services. SPCE’s business model heavily relies on the development and operation of reusable space vehicles that can be launched from and land on conventional runways. Nevertheless, designing, and testing them has proven to be a complex, costly, and risky venture as exhibited by several delays and setbacks, including accidents in the recent past.

For example, in 2014, SpaceShipTwo, the company’s first space plane, crushed during a test flight, killing the copilot and injuring the pilot. Further, in 2020, the company aborted a test flight for its “Unity” plane, citing an engine malfunction. As that was not enough, in 2021, it postponed other test flights alleging technical issues and maintenance requirements. To add to this crisis, in 2022, the company revealed an upgrade it had to make on its WhiteKnightTwo to solve an alignment pin issue that could affect the vehicle’s performance and safety. While this appears to be an annual problem, in 2023, SPCE was faced with scrutiny from the FAA following its deviation from the planned flight path during a test flight that was carrying Branson, the founder, to space.

Given these examples, it is evident that this company is faced with serious technical and operational challenges which need to be addressed. From where I stand, I believe these consistent flaws raise safety and quality concerns over its products, which I believe will affect its reputation and sales. Also, to me, these recurring faults show that this company’s business model, particularly technology, is immature and that it has a long way to go before achieving consistent and reliable operations.

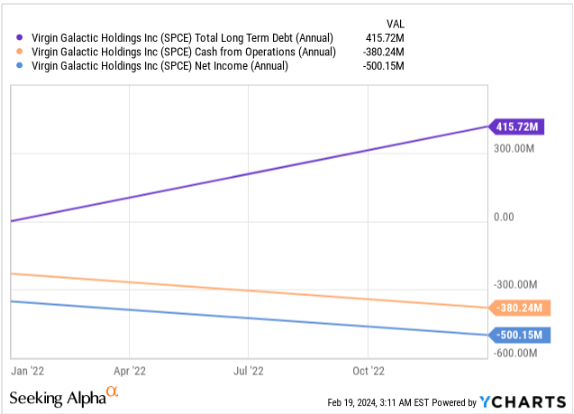

The other challenge which I believe will propel a further downward movement of the share prices is the financial problem. I strongly believe that any company’s sustainability rests on its financial health and ability to generate decent cash flows from its operations. With this in mind, it is concerning that this company is characterized by increasing negative cash flows and operating losses, and the most disturbing aspect is its reliance on debt as signified by the increasing debt levels. To me, this is quite unsustainable, and I foresee a major solvency crisis on the horizon if nothing changes.

Ycharts

Just to gauge how soon this could change, I will refer to the Q3 2023 earnings report, where the company reported revenue of $1.73 million. This was against the company’s flight operational cost of $25.6 million, which doesn’t even account for other expenses like the R&D, and SG&A expenses. This being the first quarter the company transported paying customers; it shows that the above worrying phenomenon is set to continue before this company realizes positive operating cash flows and profitability. To me, this is another reason to believe this start-up is very young in its growth story, and it’s far from paying off investors’ investments here.

The other reason I believe that the bear trend is not likely to reverse is the company’s high valuation. Based on relative valuation metrics, this stock is exorbitantly priced, and therefore I expect a further downward trend. Its trailing EV/Sales ratio is 37.24 compared to the sector median of 1.84 and its forward EV/Sales ratio is 25.94 compared to the sector median of 1.81. This means that the stock is overvalued by 1,928.44% and 1,330.15% on the trailing and forward basis, which is quite high and subject to further correction. In addition, its trailing and forward PS ratios are overpriced by a whopping 7,797.42% and 7,117.35% which is quite high and reasonable enough to believe a significant share price drop could be on the horizon, especially given the company; weak financial performance and outlook given its consistent technical and operational challenges.

In conclusion, SPCE is faced with strong headwinds which in my view point out an inevitable downward trajectory. Based on the above information, it is apparent that this start-up is far from maturing, and it is even struggling to achieve operation and technical efficiency, which I believe is the basic thing here to get it right; otherwise it will have nothing to offer because no one would settle for their products if they keep being faulty.

It should worry investors even further given that the founder, Richard Branson, has openly stated that he doesn’t intend to put more cash in this business, and therefore it means that there is no reinforcement if things keep going south on the financial front. This simply means that efficiency is needed here and if it isn’t achieved, more financial problems could arise.

One More Thing: My Expectations For Q4 2023

With this company expected to release its Q4 2023 earnings report on 27th Feb. 2024, here are my expectations. I expect a net loss of around $148 million, which is slightly lower than Q4 2022. This is despite my expectations that SPCE will keep incurring significant expenses related to test flights and other operations, but I expect a slight improvement in revenue to boost the margin. I expect revenue in the region of $2 million, slightly above the $1.73 in Q3 2023 because I expect them to realise some revenues from its contracts with NASA and the Italian air force. In a nutshell, I expect a slightly better Q4 2023 earnings report compared to the Q3 2023 report, which I anticipate will cause a short-term volatility. However, despite my expectations, my bearish stance prevails because this company will take time before reaching maturity to warrant a buy rating.

Investment Take Away

Based on this analysis, after what I would term as hype between 2020 and 2021, the stock has been on a downward trajectory, and based on my analysis, it is yet to reverse. The company’s financial situation is weak, and it is clearly in its young growth phases where adaptability and efficiency are key for there to be consistent results. In my opinion, this company is far from reaching maturity and a stable stage where it can consistently generate positive returns to shareholders and pay for its investment. For these reasons, I believe this is a sell at the moment because its payback period is far from speculation. I would keep tabs on this stock once it achieves positive operating cash flows or at least it goes for about two years of successful test flights without setbacks, a sign that its business model could be maturing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.