Summary:

- NEE has positioned itself well to meet the challenges and opportunities posed by the renewable energy transition.

- The company boasts a diversified portfolio of electric generation assets that provide stable and predictable cash flows, rendering it one of our top defensive stock picks.

- NEE will likely continue delivering steady revenue and earning growth through investments in renewable generation capacity and monetization of its gas-fired fleet.

SanderStock

Investment Thesis

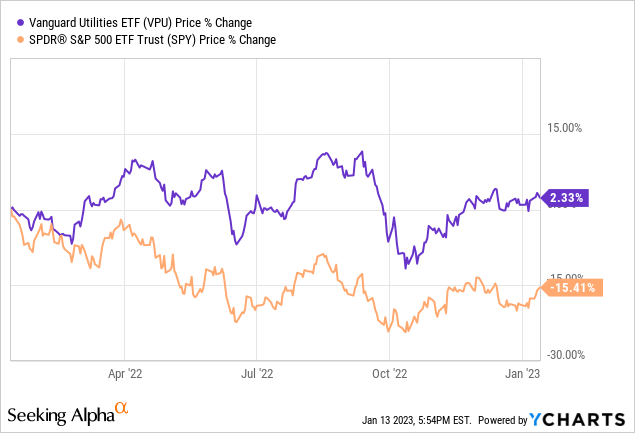

As pundits sound the alarm over the US economy, investors are increasingly seeking shelter in defensive stocks, namely Utilities, characterized by low earnings variability and stable dividend, underpinning the sector’s performance in the past twelve months.

The problem is that the shifting regulatory landscape has made the investment decision among different utility companies more nuanced than in the past. Although the average Utility stock may be a safe option, there are differences in the outlook among certain companies due to factors that include regulatory changes, State and local policies, and the corporate strategy in response to these dynamics. Simply put, there are discrepancies in the level of preparedness for current environmental trends among utility companies in the electricity-generation market. These differences create risks and opportunities to identify stocks with better prospects that stand not only to whether these changes but also benefit from the era of the energy transition.

Taking these factors into account, I think NextEra Energy (NYSE:NEE) is the top defensive pick for 2023. The company provides investors with a valuable defensive component to their portfolios, with high-quality earnings and dividend stream, but also a growth element that is rarely seen in the sector. Below, we look at Florida Power & Light “FPL” and NextEra Energy Resources/Transmission “NEER,” the two primary divisions that make up NEE.

FPL

Due to technological and economic factors, a single electric Utility supplier can often meet market demand at a lower price than a collection of smaller providers could individually. These conditions are not conducive to healthy competition, and eventually, all but one business will leave the market. In a free market, these natural monopolies that make it through can limit output and set prices higher than are economically justifiable.

For this reason, electric utility companies are regulated by the State, federal, and municipal bodies governing billing rates, conditions of service, development plans, and energy efficiency initiatives. Regulators try to balance the interest of all parties (consumers, providers, investors, environment, etc.) guided by a comprehensive framework that attempts to ensure reliable service at a reasonable cost within the regulator’s environmental goals with proper incentives to encourage continued improvements and innovation, including capacity building to meet increasing demand. For FPL, this translates to a 10% to 11% return on equity “ROE” set by State of Florida officials.

FPL is not only the largest electric utility in Florida but also among the largest in the United States, serving 5.7 million people in the Sunshine State, With 28,450 MW of net producing capacity.

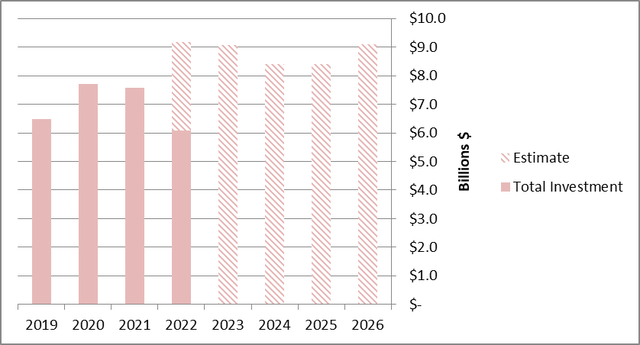

The company has, I believe, close relations with officials and has extensive growth plans in the State, with a total backlog of $38 billion in capacity and transmission projects planned for the next five years, far exceeding depreciation, pointing to a healthy increase in total invested capital, and subsequently, revenue.

NEE Capital Investments (NextEra)

There are many factors that could impact NEE’s short-term revenue and earnings in the short run, including hurricanes, temperature levels, and changes in fuel prices, namely natural gas. However, these have a limited impact on cash flows, given the cost-recovery mechanisms that allow NEE to recoup these expenses.

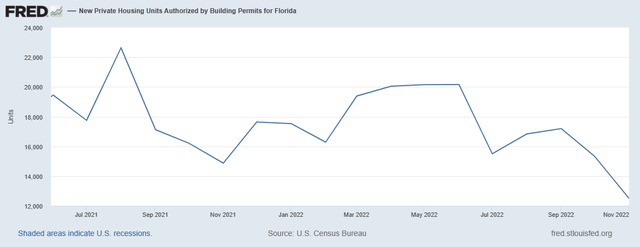

What matters in NEE’s case is its consumer base and consumption per customer, and these two factors are driven by population and GDP. We have seen a decline in Florida housing permits in recent months. However, I believe that the State is an attractive place to live and work, contributing to its above-average population growth. Last summer, FPL customers increased by 87,000 or 1.5% compared to the same period of last year, driven by population growth.

Florida Housing Permits (“FRED”)

NEER

The stock performance of renewable energy companies has been mediocre at best, underpinned by flawed business models, such as US solar panel manufacturers with cost disadvantages competing with Asian manufacturers in what is essentially a commodity market. One example is Solyndra which is now defunct. Other business models in the renewable energy sector that have proliferated in recent years are residential solar energy system providers who are more like engineering contractors than anything else, e.g., SunPower (SPWR).

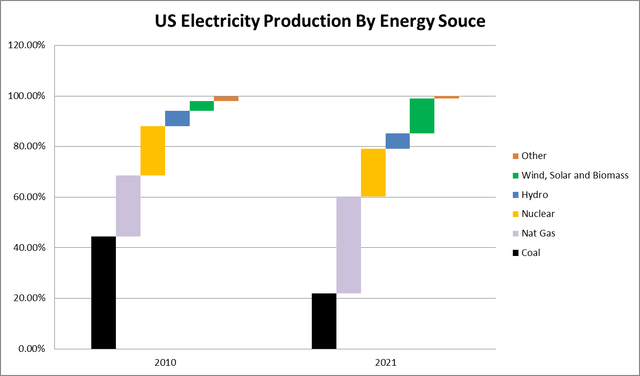

The performance of these companies does not reflect the magnitude and the speed of the US energy transformation. Despite all the technological, political, and economic barriers, coal energy generation as a percentage of total electrical production declined from 45% to 22% in a decade. This is an impressive rate for a capital-intensive and heavily regulated industry such as Electric Utilities, where such transformations are often slow. Gas turbines were the main replacement for coal generators, but we also saw strong growth in wind and solar, with market share increasing from 4% to 14% as of 2021.

US Electricity Production By Source (“EIA”)

Carbon emissions tariffs have choked the coal industry in much the same way they have done to the communities in which they operate. Companies that weren’t prepared for this transition saw themselves in dire need of capital to expand into less polluting power generators to preserve generation capacity while higher demand needs were met by the likes of NEE.

As an early adopter of Wind and Solar energy, NEE benefited from government incentives that allowed it to build its renewable generation fleet. In 2014 alone, NEE realized $1.6 billion in Cash Investment Tax Credits and continues to amortize hundreds of millions of these benefits each year.

At this point, Wind and Solar have reached enough scale to compete with other energy sources. Today, NEE is preparing itself to leverage the next frontier of government subsidies aimed at less mature segments in the renewable sector, such as hydrogen, paved by the recently introduced Inflation Reduction Act. Last quarter, the company announced it started converting its gas turbine fleet to hydrogen-powered generators. I believe that there is an opportunity for NEE to repeat its successful early adopter advantage in the Hydrogen economy.

Balance Sheet and Valuation

A sizable portion of NEEs $11.5 billion debt comes due next year, including $5.7 billion debentures and a smaller amount of senior unsecured notes. Interest rates have increased substantially in the past few quarters, increasing refinancing risk. Despite these challenges, management is confident it will be able to refinance the debt without issue, given its strong cash flow position and solid balance sheet. The company also made the following comment on interest rates.

We have $15 billion of interest rate swaps to manage interest rate exposure on future debt issuances. With the swaps in place, we’re in good shape to manage 2023 and 2024 maturities and new debt issuances despite the current interest rate environment. Kirk Crews, Q3 2022.

| NEE Debt Profile | Debt (million $) | Interest | Maturity |

| Revolving credit facilities | $ 850 | Variable | 2023 |

| Debentures | $ 5,375 | 2.94 – 5% | 2024 |

| Debentures | $ 400 | Variable | 2024 |

| Debentures, related to NEE’s equity units | $ 2,000 | 4.60% | 2027 |

| First mortgage bonds | $ 1,500 | 2.45% | 2032 |

| Senior unsecured notes | $ 1,444 | Variable | 2024 – 2072 |

On valuation, the company is trading above industry averages, but that is normal, given its expected earnings and dividend growth in an industry with nearly zero change in either. With an FWD P/E ratio of 34x, and a dividend yield of 2%, NEE is unlikely to outperform the market in the long run, but at least it offers adequate protection in the case of a recession.

Summary

NEE’s current business model and long-term strategy to become a leader in the energy industry positions it well to capture opportunities created by the renewable energy transition. The company demonstrates both resilience and agility as it continues to pursue growth in a highly regulated industry. NEE boasts a diversified portfolio of electric generation assets that provide stable and predictable cash flows over the long term, giving it the ability to continue generating substantial results for investors despite the uncertain regulatory landscape. As we advance, I expect the company to continue delivering steady revenue and earnings growth through investments in renewable generation capacity and the monetization of its gas-fired generation fleet.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.