Summary:

- Textron’s Q2 revenue grew by 3%, but missed estimates, while EPS beat expectations due to share repurchases, despite a decline in net income.

- Aviation and Bell segments showed strong performance, but the Industrial segment’s decline significantly offset overall gains, raising concerns about its impact on the business.

- Significant backlogs in Aviation, Bell, and Systems present opportunities, but supply chain inefficiencies and a potential strike pose risks.

- Despite challenges, Textron’s stock has upside potential, driven by share repurchases and undervaluation compared to peers, though it lacks a meaningful dividend.

Boarding1Now/iStock Editorial via Getty Images

Textron (NYSE:TXT) posted its second quarter results on the 30th of July. In response to the earnings report, the stock dropped, and perhaps we should not be surprised about that anymore. After the first quarter report, TXT stock dropped to a three-month low. While the company beat Wall Street estimates for the second quarter, the earnings were still underwhelming. In this report, I will analyze the results, discuss the risks and opportunities and assess the stock price target and rating.

Textron Revenue Growth Does Not Translate To Earnings

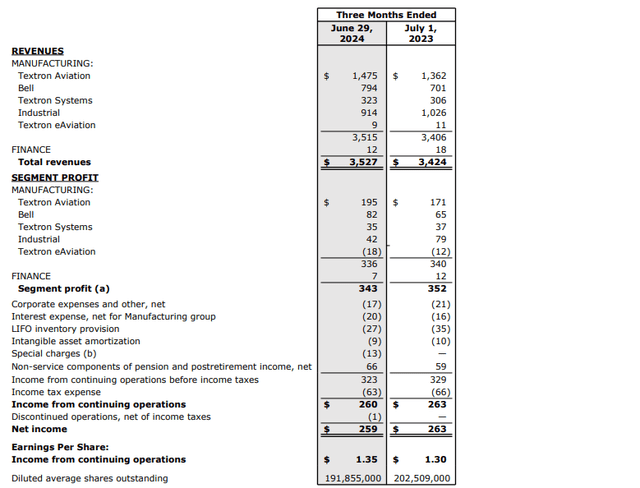

Textron reported revenues of $3.527 billion, missing the consensus by $27.7 million, while its core earnings per share of $1.54 beat estimates by $0.07. Year-on-year revenues grew by 3%.

Textron Aviation reported revenues of $1.475 billion, which was up 8.3%. The revenue increase was driven by higher pricing and higher volumes. Earnings expanded 14% to $195 million driven by the same revenue growth drivers, partially offset by unfavorable performance impact. The supply chain remains challenging for Textron and part of its hired team members have yet to get to full efficiency, so some performance impact is to be expected. Perhaps the miss on revenues can also be explained by some deliveries of the Cessna Citation Latitude business jet slipping into the subsequent quarter. While there have been some pressures on the business, the margins increased from 12.6% to 13.2%.

Bell revenues increased 13.3% to $794 million, reflecting the ramp up of the FLRAA program, while profits jumped by 26.2% to $82 million, indicating margins of 10.3% compared to 9.3% in the same period last year, driven by lower research and development costs partially offset by a less favorable sales mix.

Textron Systems revenues grew by 5.6% to $323 million, but profits declined from $37 million to $35 million, driven by higher volumes. The industrial segment is a challenging one for Textron, and it showed in the quarter, with revenues declining 10.9% to $914 million while profits declined 46.8% to $42 million.

The Industrial segment was the only part of Textron to experience a revenue decline, falling 4.3% to $892 million, driven by lower volume and a mix of $51 million offset by $16 million revenue growth driven by pricing. Segment profit decreased from $41 million to $29 million. The softness in the industrial segment already triggered a restructuring as I discussed previously, and I wonder whether this is a segment that Textron would like to remain active in as the strong performance at Bell and Aviation was pretty offset by the Industrial earnings decline.

Textron eAviation saw its revenues decrease from $11 million to $9 million, with losses widening from $12 million to $18 million. Finance revenues were $12 million, down $6 million, and profits declined from $12 million to $7 million.

Overall, Textron booked a 3% growth in sales, but segment profits declined 2.6% to $343 million while net income declined from $263 million to $259 million and the reason why the earnings per share actually went up is because the shares that Textron repurchased bringing the total share count down by 5.3%.

What Are The Opportunities And Risks For Textron?

Currently, we see that demand for business jets is high, but inefficiencies from an inexperienced workforce and ongoing aerospace supply chain challenges are causing delivery delays. With a $7.5 billion backlog for Aviation, $4.1 billion for Bell and $1.7 billion for Textron Systems, the company has a significant backlog to capitalize on. However, I view the Industrials segment as a drag on the business and as FLRAA revenues ramp up, there could be some margin pressure as the FLRAA program is still in the lower margin EMD (Engineering, Manufacturing and Development) contract phase.

Another risk is that the International Association of Machinists and Aerospace Workers called for a strike against Textron Aviation. Approximately 5,000 of the 10,000 at the Wichita facilities are impacted and while the company has implemented a continuity of operations plan, the strike could have an adverse impact.

Textron Stock Has Upside Despite Challenges

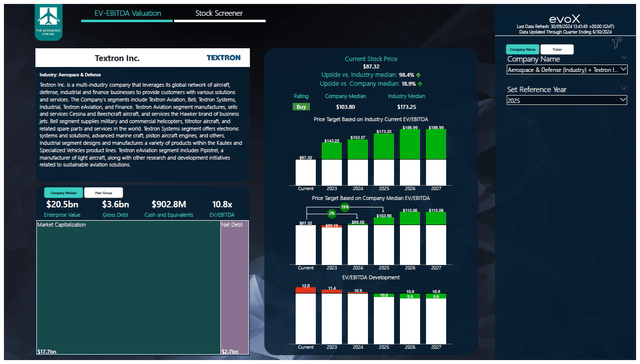

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

I processed the Textron balance sheet and forward projections into my stock screener to parse a price target. My price target for 2024 has increased from $88.80 to $89.50. This was primarily driven by the strong share repurchase activity, and I expect the company to continue repurchasing shares. EBITDA estimates between 2023 and 2026 have come down by 0.5% and 3% for free cash flow, while the annual growth rate for EBITDA is 5.9% and 6.5% for free cash flow. That is not a huge growth rate, but still provides an upside of 2% for 2024 and 19% when valuing the company at its median EV/EBITDA with FY25 earnings in mind. I also note that the company has additional upside in 2026. Our stock screener shows no upside for 2027, but that is because we have no estimates available for 2027 yet. Furthermore, it should be noted that the company is significantly undervalued compared to aerospace and defense peers. At this point, what is somewhat disappointing is that Textron is not paying a meaningful dividend, with a yield of less than a percent and no growth prospects for dividends. That makes the stock somewhat less appealing.

Conclusion: Textron Is Not The Most Attractive Aerospace Name

Textron is not the most attractive name in the aerospace industry, and that is driven by the fact that its Industrial segment is not performing well currently. I believe that Textron could be trading at higher multiples if it would sell the Industrial segment and becoming a pure aerospace and defense company. We also see that strong aerospace and defense earnings were offset by lower earnings for the industrial segment. Currently, I am maintaining my buy rating as I believe that aerospace supply chain issues will ease and that should aid Bell and Textron Aviation. However, I am also mindful about the risks of the strike. All things considered, I do believe the stock has upside, but it is not my favorite aerospace and defense investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.