Summary:

- NextEra Energy seems like an ideal pick for dividend growth investors: a large and safe utility with good future prospects and decent dividend growth.

- Their stock price seems very elevated though, but quality often comes with a price.

- In this article, we will look at the dividend growth of NextEra Energy and assess the future stability of the company.

- Also, I will use graphs and data to see if the current dividend growth seems sustainable.

Daniel Balakov/E+ via Getty Images

NextEra Energy (NYSE:NEE) is a large utility which provides electricity to millions of people in the US. Apart from being the largest utility measured by market capitalization, its subsidiary NextEra Energy Resources is the world’s largest operator of wind and solar projects. As a well-diversified utility company, NextEra also is involved in generation of electricity from other sources, mostly natural gas and nuclear.

NextEra Energy owns operations in almost the whole US and some in Canada, as can be seen on this interactive map. Most of their operations however are centered in three areas: Florida, the East Coast and California.

NextEra has been growing its dividend for over the last 27 years, which can be seen on this helpful Seeking Alpha dividend scorecard. Not only this, but their 5 year dividend growth rate is 11.6%, which I consider to be very high for a utility company.

Being mainly a dividend growth investor myself, all these factors seem quite positive. Which brings me to one of my main reasons why I’m not loading up the truck with this stock as we speak.

Their share price seems to be constantly overvalued

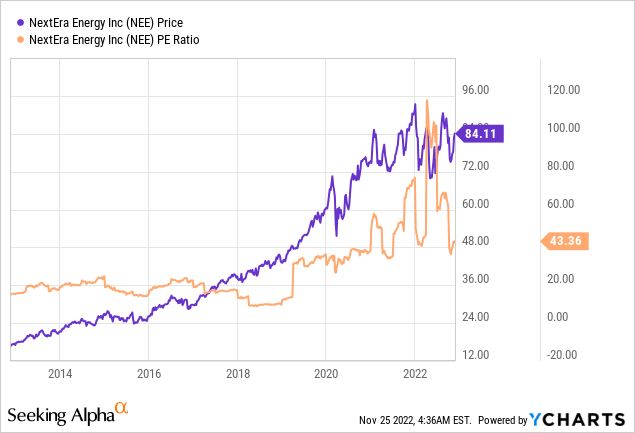

Let us take a look at the share price development of NextEra during the last decade.

Graph 1: NextEra Energy share price and profit/earnings ratio over the last 10 years (Source: YCharts)

As we can see in the graph above, for a solid and well-diversified utility, the share price of NextEra has experienced some healthy increase during the last decade. But as can also be seen in the graph, their P/E ratio has risen to a dramatic level during the last couple of years. During the last decade there were a couple of moments where the company’s P/E ratio was below 10, but looking at the graph, a ratio of 20 seems more normal for the company.

Since the year 2019, NextEra’s P/E ratio has remained around 40, which seems very high, even for a stable company with good dividend growth. Due to recent fluctuating earnings numbers there have been some P/E outliers to above 100 which seem safe to ignore, but the current ratio of more than 43 seems very expensive.

But their dividend growth looks very juicy though

Let us continue to look at some more positive factors for this stock’s analysis and one of the main reasons why I am interested in NextEra: their dividend growth.

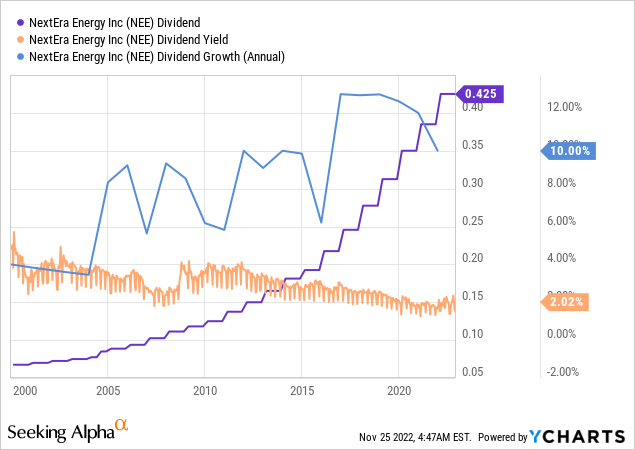

Graph 2: NextEra Energy quarterly dividend payout, annual yield and annual dividend growth since the year 2000 (Source: YCharts)

NextEra has been growing its dividend for the last 27 years, but this graph only shows the data since 2000. Their quarterly dividend payout line looks beautifully upward sloping. The annual dividend growth confirms this, and it even seems to have accelerated during the last couple of years to levels above 10%. It is not very common for a large and stable utility company to consistently increase its dividend by these percentages.

When we take a look at the dividend yield of NextEra though, we can see that this has trended down since 2000, more or less in line with their valuation, from about 4% to a mere 2%. In an environment with increasing interest rates and inflation, a dividend of only 2% might not be good enough to enchant income investors.

NextEra Energy currently pays a quarterly dividend of $0.425, which is $1.70 on an annual basis. If we extrapolate this dividend with a 10% annual increase to the next 10 years, which seems entirely possible looking at their historic graphs, we end up at a dividend payout of $4.41 after 10 years. This would be a yield of about 5.2% against today’s prices, which is not very high (still below current inflation rates in most parts of the world) but much more than the current 2%.

| 2022 | $1.70 |

| 2023 | $1.87 |

| 2024 | $2.06 |

| 2025 | $2.26 |

| 2026 | $2.49 |

| 2027 | $2.74 |

| 2028 | $3.01 |

| 2029 | $3.31 |

| 2030 | $3.64 |

| 2031 | $4.01 |

| 2032 | $4.41 |

Table 1: NextEra Energy annual dividend if it would continue to grow at a rate of 10% annually (source: author’s own calculations)

Investors focusing on higher (but non-growing) income might be better off with NextEra Energy baby bonds (NEE-N), about which you can read here.

These potential future dividend increases all look very optimistic, but the big question is: how likely are they?

Is their dividend growth sustainable?

The question whether dividend growth of a company is sustainable for the near and more distant future is often a difficult one, since answering it involves all kinds of macro risks, company-specific risks and needs information about the financial stability and outlook of a company. But depending on the company, we can still look at past performance to imagine what the future might look like, especially for large stable companies like utilities.

Let us make an attempt at a start for NextEra by looking at their profit margins, net income and dividend payout ratio for the last decades.

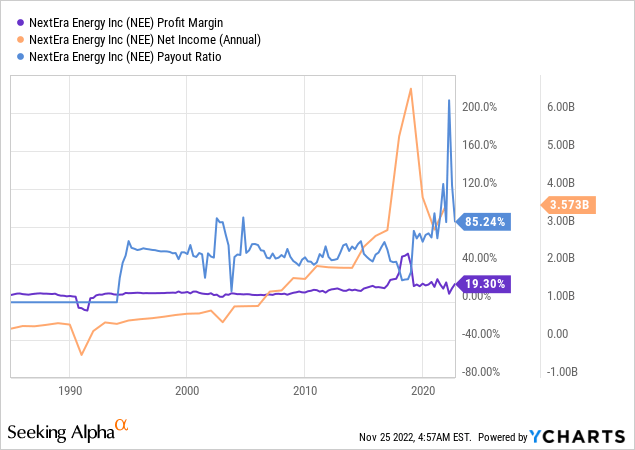

Graph 3: NextEra Energy profit margin, annual net income and dividend payout ratio over the years (Source: YCharts)

Some things I find interesting about this graph:

- The profit margin of NextEra has remained surprisingly constant throughout the years, with the negative exception being the start of the ’90s and the positive exception being the end of last decade.

- NextEra’s net income has shown some healthy increase, albeit with some outliers, of which the most recent one seems to be the most impactful (this was mostly because of a $3.8 billion dollar one-time gain they had from changing the structure in which one of their subsidiaries, NextEra Energy Partners (NEP) was incorporated in NextEra).

- After being around 50% for the biggest part of the last decades, NextEra’s dividend payout ratio has fluctuated quite a bit lately. This could be a sign that future dividend growth will become slower, but to check this one has to look closer at the causes of the fluctuating payout ratio.

When looking at this graph we can see that their strong dividend growth was certainly sustainable up to 2018-2019, after which the payout ratio started to go up and fluctuate. The payout ratio is still not alarmingly high, but I would assume that large dividend increases of 10% and higher are less likely in the coming years than they were in the past.

What about debts?

It is very important that increasing dividend payouts do not go hand-in-hand with strongly increasing debt, since this would prevent the company from being able to continue to increase its dividend increases in the future. Let us take a look at the debt of NextEra.

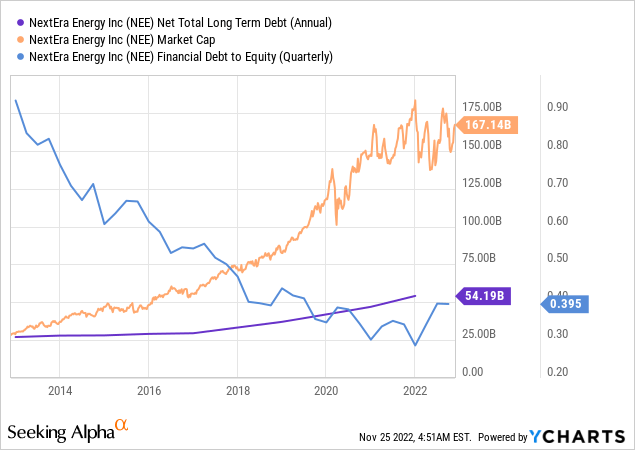

Graph 4: NextEra Energy market capitalization, total long term debt and financial debt to equity ratio (Source: YCharts)

In this graph, a couple of things immediately catch the eye:

- As the market capitalization of NextEra has increased, so has its debt.

- But the financial debt-to-equity ratio has actually decreased during the last 10 years. Although the P/E ratio of NextEra has increased as well (it has more or less doubled since the last years of last decade), this is not the sole explaining factor of this decrease in debt-to-equity ratio, since this ratio has gone from almost 1 to about 0.4.

- Since 2018-2019, the fact that NextEra’s valuation climbed so much is likely at least for a big part the reason that its debt-to-equity ratio has not gone up again. Though the graph looks good, if the valuation of the company would drop, its debts would look bigger on a relative basis.

Utility companies are not unknown to high loads of debt. Because of the large amount of capital which is required to setup the immense infrastructure needed to produce and distribute electricity, these types of companies often have to take on large loans. Still, even if NextEra’s debt-to-equity ratio would increase because of a drop in its share value, its relative debt would not immediately become alarmingly high. One potential problem for the future could be the increase in interest rates and inflation and the question whether debt can be refinanced for attractive rates. But usually, utility companies are relatively well-insulated against inflation.

Stability and safety of the company on the long term

Being the largest utility by market capitalization brings along a strong moat and market power – though the electricity market is a regulated one. But there are always risks to be considered, even existential ones. Not so long ago, there was the bankruptcy of another large US utility company, PG&E because of liabilities from multiple forest fires. Of course, we cannot assume that something like this could never happen to other utility companies like NextEra, but the history of the Californian electricity market shows that it is a quite special case.

Still, the geographical areas in which NextEra is most active (East Coast, Florida and California) are not immune to natural disasters or other large-scale risks, but at least NextEra is one of the best diversified utilities; owning subsidiaries such as Florida Power & Light, NextEra Energy Resources, NextEra Energy Partners, Gulf Power Company and NextEra Energy Services. Also, on the map which I mentioned earlier it is clearly visible that the company is also well-diversified geographically.

Conclusion and takeaway

NextEra Energy is the largest utility company measured by market capitalization, and seems to be a very interesting investment for dividend growth investors focusing on the long term. The company looks well-diversified and has their priorities in order with regard to the energy transition.

But there are a couple of important issues for dividend growth investors. First, NextEra’s share price seems to be constantly overvalued and the current dividend yield is a mere 2%. Also, their payout ratio has been relatively high during the last couple of years which makes them less likely to be able to sustain the pace of 10%+ annual dividend increases. And last but not least, the company is carrying an increasing load of debt. This is not directly a problem since many utility companies are relatively debt-heavy, but might become a more pressing issue if interest rates continue to increase.

I would rate NextEra Energy a hold for dividend growth investors. Their share price seems a bit high at the moment, and with the data I presented in this article I would not be surprised if they would decelerate the rate of their dividend increases during the next couple of years. Doing this will likely impact their share price and create a better entry point.

Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.