Summary:

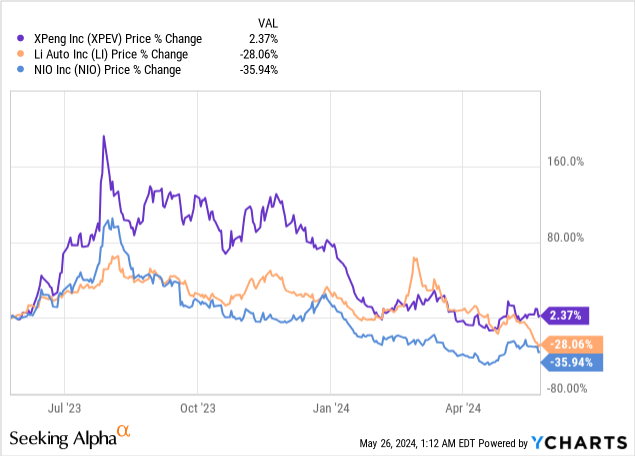

- XPeng’s shares have declined sharply YTD due to headwinds in the sector, including seasonal effects.

- Delivery growth is slowing due to waning EV demand and the inclusion of Chinese New Year holidays in Q1.

- XPeng’s margin picture continued to improve, but shares are still relatively expensive compared to other Chinese EV start-ups.

Robert Way/iStock Editorial via Getty Images

Shares of XPeng (NYSE:XPEV) have revalued sharply lower this year, although shares of the EV maker soared 26% after the company reported Q1’24 results last week. XPeng’s first quarter delivery growth continued to slow due to headwinds in the sector that include waning EV demand as well as growing price competition among an increasing number of players in the industry that are vying for market share. While XPeng’s delivery accomplishments were not the best, the electric vehicle maker did see an improvement in its margin picture… which was a positive take-away from the earnings report. With shares still being expensive relative to other Chinese EV start-ups, I believe the best rating for XPeng remains a hold!

Previous rating

I rated shares of XPeng a hold in February — Sitting On The Fence For Now — as the company was falling behind NIO and Li Auto in terms of delivery growth. Li Auto especially crushed expectations by delivering triple-digit delivery growth rates as well as strong margins in the EV business that left the competition, including XPeng, in the dust. XPeng is seeing slightly improving margins, but I still have concerns about the valuation as Li Auto makes a stronger value proposition, in my opinion.

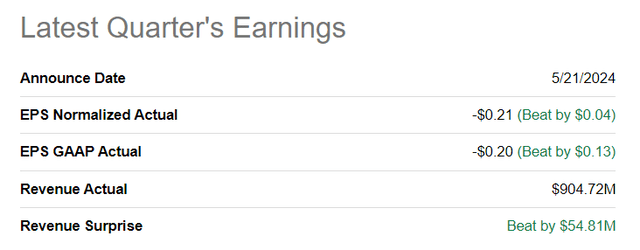

XPeng beats Q1’24 estimates

Although XPeng only saw 20% Y/Y delivery growth in the first fiscal quarter, the EV maker did manage to beat consensus expectations: the electric vehicle company generated $(0.21) per-share in adjusted earnings on revenues of $904.7. Both the bottom and the top-line beat consensus expectations.

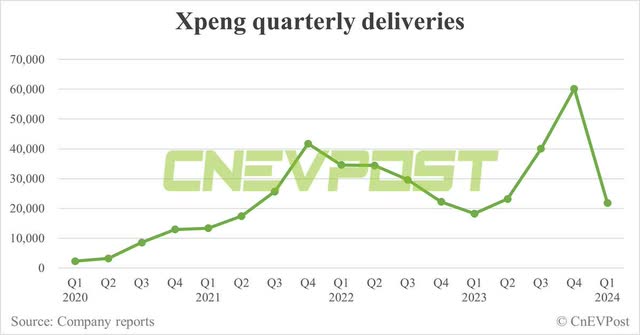

Drop-off in Q1’24 deliveries, margin trend looks better

XPeng’s delivery growth is slowing, which was one take-away from the company’s first fiscal quarter earnings release last week. XPeng delivered 21,821 electric vehicles in Q1’24, showing 19.7% year-over-year growth. In the previous quarter, XPeng’s deliveries soared 170.9% year over year. The drop-off in deliveries was related to the Chinese New Year period, which traditionally leads to factory shutdowns and a decline in sales. I expect a rebound in deliveries and revenues as the year progresses, however, a view that is supported by XPeng’s optimistic outlook for the second fiscal quarter.

Despite seasonal headwinds to the company’s delivery growth in Q1, XPeng was able to grow its vehicle-related revenues 57.8% year over year to 5.54B Chinese Yuan ($0.77B). Importantly, XPeng also saw a sequential margin improvement and quite a drastic reversal in the margin trend compared to the year-earlier period: in Q1’24, XPeng’s vehicle margin was 5.5%, showing an 8 PP swing year over year.

For XPeng especially, I cited a negative margin trend as a key operational risk for the EV maker as well as a top investment risk for investors in May 2023. The improvement in the margin trend was definitively a positive development for the EV maker in the first fiscal quarter.

XPeng also squeezed out a 1.4 PP margin improvement compared to the previous quarter, indicating that despite slowing delivery and top-line growth, the actual operations have become more cost-effective. XPeng has been laser-focused in the last year to improve operational efficiencies. XPeng even entered into a collaboration and investment partnership with German car maker Volkswagen last year in a bid to share risks and costs related to the development of EV technology.

Forecast for Q2’24

XPeng’s forecast for second fiscal quarter deliveries were the reason why the firm’s shares soared up to 26% immediately after the company reported earnings results (although those gains were not sustained).

XPeng sees deliveries of 29,000 to 32,000 EVs in the second-quarter, which would indicate an up to 38% year-over-year growth rate. In other words, XPeng does expect a growth acceleration of its quarterly delivery volume in Q2’24 which could also further support the company’s drive to improve its margin profile. In terms of revenues, XPeng expects 7.5-8.3B Chinese Yuan ($1.05-1.17B), implying a growth rate of as much as 64% Y/Y.

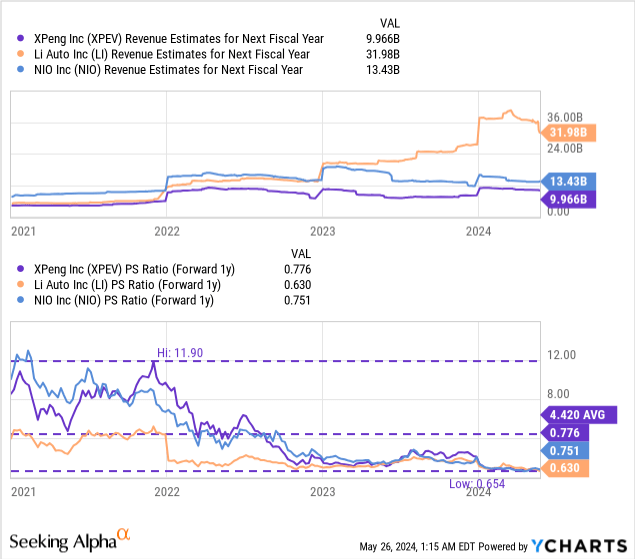

XPeng’s valuation

The main reason why I am staying with my hold rating for XPeng, despite the EV maker making progress on the thorny issue of vehicle margins, is that the company is still fairly expensive relative to its electric vehicle rivals. Li Auto, in my opinion, continues to represent the best value for EV investors, largely due to its impressive delivery growth as well as stronger vehicle margins (Li Auto had a vehicle margin of 19.3% in Q1’24 which was 3.5X higher than XPeng’s margin).

Both Li Auto and NIO are trading at lower revenue multiplier factors than XPeng which, given Li Auto’s leading margin profile, is not warranted, in my opinion. XPeng is currently priced at a price-to-revenue ratio of 0.78X, which is way below the 3-year average P/S ratio of 4.4X. In my last work on XPeng I stated that I see a $9.50 per-share fair value for XPeng (based off of an average industry group P/S ratio of 0.8X). Shares of XPeng are currently trading at $8.20, so they are trading slightly below my fair value estimate. However, I am staying with my hold rating here due to XPeng having much lower vehicle margins and because I believe that Li Auto continues to offer the deepest value for EV investors in the industry group.

Risks with XPeng

The margin trend is worth following because only EV makers that achieve positive vehicle margins for electric vehicle mass production have a chance to actually achieve a profit on the bottom line. A return to negative vehicle margins would clearly be the worst-case scenario as far as I am concerned, but also a drop in margins in successive quarters (potentially driven by more aggressive price promotions in the EV sector) would be a negative development.

Final thoughts

XPeng delivered a solid earnings sheet for Q1’24 and beat consensus predictions on the bottom and the top line. Delivery growth slowed, which was expected due to seasonal effects, but the margin improvement I believe was the main take-away from the EV maker’s earnings release. XPeng still has a ton of potential to scale its production going forward, and the outlook for the second fiscal quarter indicates a typical second-quarter rebound in deliveries. The only thing that I don’t like about XPeng is that the EV maker is relatively expensive relative to its rivals in the Chinese EV start-up sector. As a result, I am staying with my hold rating after XPeng’s Q1’24 earnings report!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XPEV, LI, NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.