Summary:

- I delve deeper into XPeng’s growth potential, but also its future hurdles before it can make its name in the EV space.

- Taking into account the company’s current financials and future growth trajectory, I use a simple EPS projection to determine a fair value for XPEV stock.

- Under optimistic assumptions, I arrive at a fair value of $7.69, and issue a ‘Hold’ rating for XPEV stock.

Robert Way/iStock Editorial via Getty Images

Fans of up-and-coming EV companies would definitely have heard of XPeng Inc (NYSE:XPEV). Not too long ago, the company was considered as one of the best investments in the Chinese EV space – with its stock hitting an all-time high of over $70 in late 2020. However, the narrative has changed significantly since then, with the company stock trading at just over a tenth of its all-time high. In this article, I delve deeper into the potential of this young EV company, but also analyse the challenges and risks involved in the near future. I conclude my analysis with a simple EPS projection, and issue a ‘Hold’ rating for XPEV stock.

The Good

We first look at what’s good about this company. Let’s start with XPeng’s growth trajectory.

Consistent delivery growth

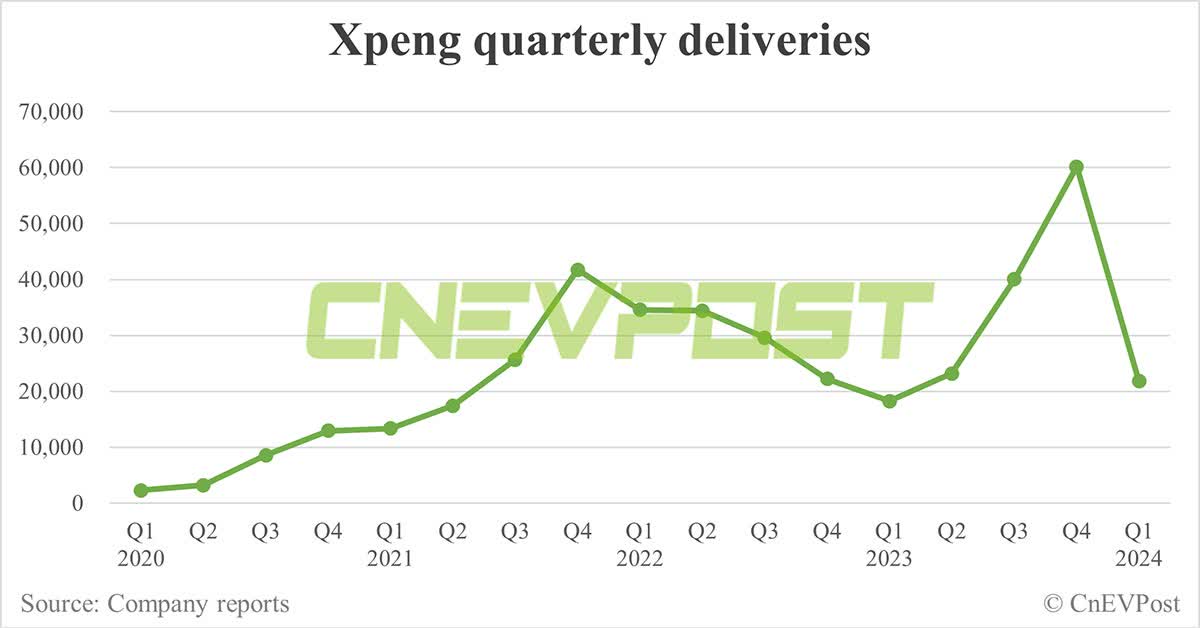

XPeng Quarterly Deliveries (Till Q1 2024) (CNEVPOST)

One of the most important metrics when evaluating an EV company is the consistency and growth in its deliveries. XPeng presents a strong case, with sustained increase in quarterly deliveries since 2020. In particular, the company delivered a staggering 141,601 units in 2023, a 17% increase from the year before. Now, it’s difficult to ignore the stark drop in deliveries in Q1 2024. However, I believe that this isn’t too big of a problem considering the seasonal nature of Chinese EV deliveries in general. Deliveries in the first quarter are typically worse due to the celebration of Chinese New Year, where production slows down during the holiday season. In addition, according to XPeng Chairman and CEO He Xiaopeng, the company had undergone organisational restructuring and re-strategising in Q1 2024 to pave the way for more profitable quarters to come. All in all, the company is on the right track when it comes to production and deliveries, and I do believe it is a trend that can be sustained in the years to come.

International expansion

After famously announcing its entry into the German market, XPeng has continuously stepped up its internationalisation efforts. Just a month ago, the company has closed a deal with a Malaysia’s Sime Darby Group to break into the Hong Kong market. The company’s main vehicle models are expected to debut in Hong Kong in the middle of this month, and deliveries are expected to begin two quarters later. In addition, the company has also partnered with Australia’s TrueEV to tap on the Australian market. By Q4 of this year, the company’s G6 SUV is set to debut in Australia. Strategic partnerships with these various distributors give the company access to a much wider and diverse consumer market – a good sign that deliveries will continue their trajectory of sustained growth.

Quality of vehicles

While production is important, the quality of what the company is actually producing is also a key consideration. Thankfully, XPeng’s vehicles boast strong safety ratings, with its G9 achieving a 5 star safety rating from Euro NCAP in 2023.

XPeng P7 Achieves 5-Star Safety Rating on C-NCAP (Green Stock News)

In the same year, the company’s P7 model also received this rating on Euro NCAP and C-NCAP, and ranked first among electric vehicles in China. In summary, XPeng concluded last year with 3 maxed out ratings from C-NCAP and two from Euro NCAP – an excellent showing of workmanship and effectiveness of safety features.

The Bad

Now, with all that being said, there are risks we cannot overlook.

Intense competition

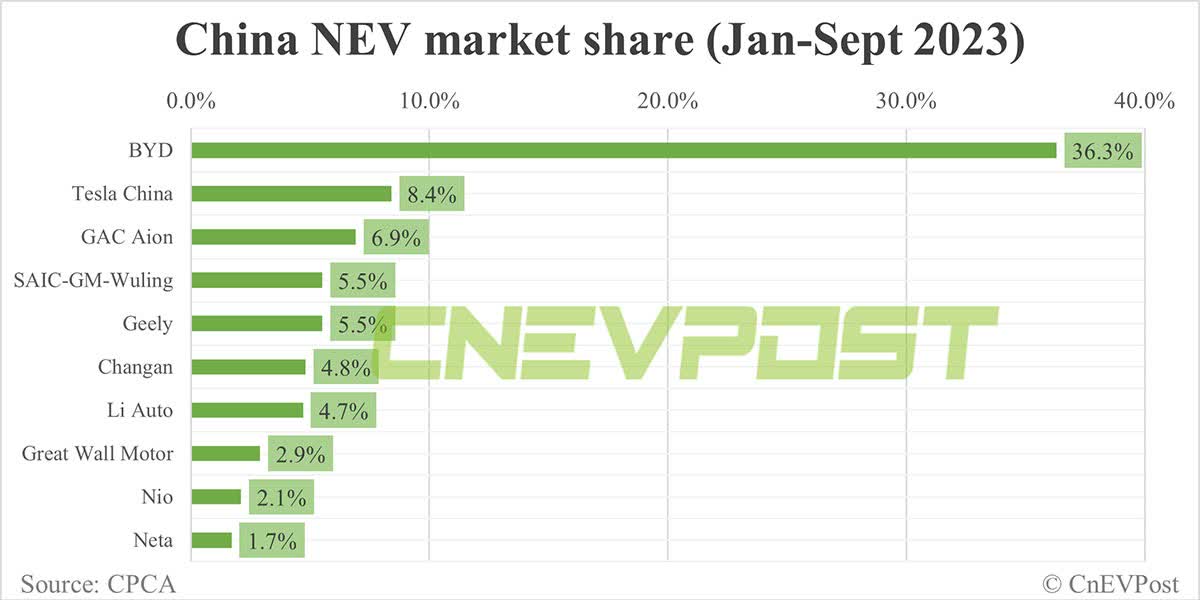

China NEV market share (Jan – Sep 2023) (CNEVPOST)

One of the biggest hurdles faced by XPeng is the fierce competition in the EV space. Clearly, BYD (OTCMKTS:OTCPK:BYDDY) holds majority of the NEV (New Electric Vehicle) market share, and it beats the other members in this list by a long shot. That being said, it is still surprising that XPeng did not even make the list despite high deliveries and strong vehicle offerings. It’s fair to say that in view of the intense competition, it is uncertain whether XPeng is able to hold its own as the EV industry evolves in the coming years. The company either makes a name for itself as one of main names in the EV space, or gets driven out by the bigger players like BYD and Tesla – both of which have already begun slashing prices to stay ahead in this price war. This is a risk that must be considered by potential investors of XPEV stock.

Supply chain and management concerns

A big problem many experts foresee for the EV space is the tightening supply chain. With semiconductor parts and critical metals being huge necessities for production, it remains to be seen if the supply chain can keep up with the exponential increase in demand for electric vehicles. This problem applies to not just XPeng, but all companies in the space. Big players like Tesla (NASDAQ:TSLA) can mitigate this by producing their components in-house, but this may prove to be an issue for smaller companies like XPeng – which tend to be more reliant on foreign-made parts from semiconductor suppliers like Nvidia (NASDAQ:NVDA). Another concern is that XPeng had recently suspended its supply chain boss due to corruption. Existing corruption within the company’s supply chain management team would only prove to worsen the issue in the years to come. While it is commendable that the company was prompt in taking action against the former vice president in-charge of supply chains, it also begs the question of whether there are more undetected cases of corruption within the management. In addition, the macro-issue of the EV supply chain still looms over the industry – particularly for the smaller, more reliant companies.

The Ugly

The dealbreaker for me is that the company’s financials leave a little too much to be desired.

Crumbling Bottom Line

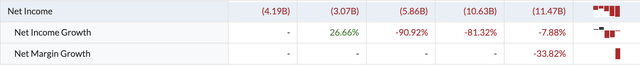

XPeng Revenue (2019 – 2023) (MarketWatch) XPeng Net Income (2019 – 2023) (MarketWatch)

As we observe the company’s net income from 2019 to 2023, we don’t see much progress, even after economies have bounced back from the mini-recession caused by the Covid-19 pandemic. In fact, the company’s current bottom line is almost thrice as bad as it was in 2019. Net margin growth is also concerning – standing at -33.82%. This is even more shocking when we consider the fact that the company has actually grown tremendously in revenue – from 2.63B in 2019 to 33.9B in 2023. Somehow, the company has managed to generate over ten times its sales in 2019, but its net income continues to crumble. Let’s look deeper into this.

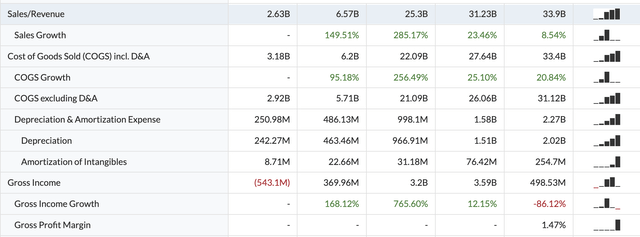

XPeng income statement metrics related to sales (2019 – 2023) (MarketWatch)

We see that while sales have grown tremendously, costs have also followed suit. In fact, the company’s cost of goods sold (inclusive of depreciation and amortisation) is increasing faster than its sales. In addition, XPeng’s gross profit margin stands at a pretty miserable 1.47%, a far cry compared to its competitors.

XPeng’s gross profit margin against competitors Nio and Li Auto (Prepared by author)

While one can give the benefit of the doubt for a young company in an emerging industry, there are other companies of similar profile that are doing far better financially.

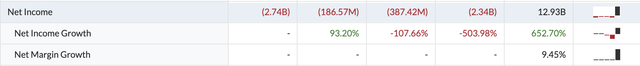

Li Auto Net Income (2019 – 2023) (MarketWatch)

Compare XPeng’s numbers with its close rival Li Auto (NASDAQ:LI) and we see that the latter has managed to achieve a positive net income and net margin growth. In particular, Li Auto has managed to achieve a net income growth of 652.70% from 2022 to 2023. Considering that both companies are in the same EV space and offer their products to similar markets, we clearly see that XPeng may not be the best candidate if you’re looking to invest in a young and potentially profitable Chinese EV company.

Concerning Free Cash Flow

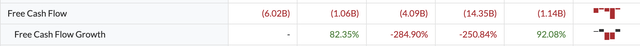

XPeng Free Cash Flow (2019 – 2023) (MarketWatch)

While the company’s free cash flow position is improving, it’s difficult to discount the fact that this metric has been negative for the past 5 years. This means that the company has no excess cash after accounting for operating and capital expenditures. Free cash flow is a powerful tool for companies to reinvest, issue dividends, buy back shares and also pay down debt – but we see that XPeng is still lacking in this area.

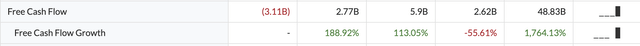

Li Auto Free Cash Flow (2019 – 2023) (MarketWatch)

In comparison, companies like Li Auto have much more freedom to innovate, pay off obligations or benefit investors due to their stronger free cash flow position. Now, it is definitely possible that XPeng may potentially increase its free cash flow, especially after its expansion efforts. However, as of the current situation, I would be wary.

Valuation

Now, I usually initiate coverage on companies with a proven track record. I prefer when trends in earnings-per-share and free cash flow figures are more or less established. However, in the case of XPeng, the company’s earnings and free cash flow are still deeply in the red.

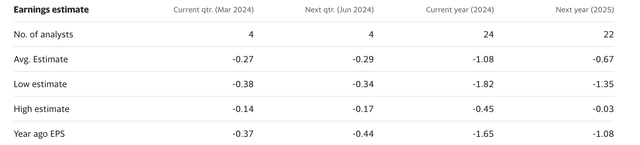

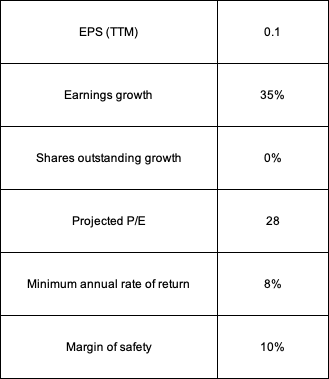

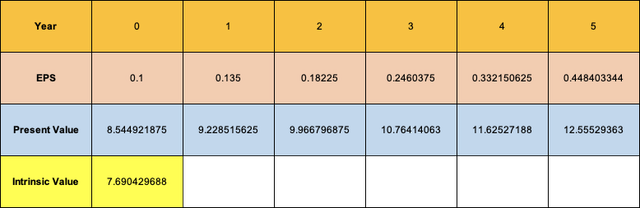

Analyst projections for XPeng’s earnings (Yahoo Finance)

Clearly from above, analysts expect the earliest breakeven point for XPeng to be in 2025. Nevertheless, I will use the most optimistic assumptions to do my calculations. Let us assume that the company breaks even this year – an assumption that surpasses most analysts’ projections. I will also assume a 35% annualised growth in earnings over the next 5 years, since the company does have immense growth potential. I’ll go for a projected P/E of 28 – which I believe is a fair multiple to pay for a car company – and will discount future values with a minimum annual rate of return of 8%. Finally, I’ll slap on a modest 10% margin of safety, though it should really be higher than that.

Assumptions used in EPS model (Prepared by author) EPS Model for XPeng (Prepared by author)

Now, we see that we have arrived at a fair value of $7.69 for XPEV stock. Keep in mind that these are based on assumptions that exceed the upper bound of analyst estimates. Currently, the stock trades at over $8 a share. This would imply that even in the most optimistic case, XPEV stock is overvalued.

Investment decision

To conclude, it cannot be denied that XPeng is a company with huge growth potential. It is also without a doubt that the company produces quality vehicles, and stands to gain more market share with its expansion efforts. That being said, the potential hurdles in the future, coupled with its current financial struggles, indicate to me that the risk-to-reward ratio of investing in the company stock is not the most favourable at the current moment. In addition, further quantitative analysis shows that even in the most bullish of estimates, you’d still be paying a premium if you had invested in the stock today. I’m a sucker for growth, so this is not necessarily a ‘Sell’ to me just yet, but let’s all give the company time to stabilise itself. I conclude my analysis with a ‘Hold’ rating on XPEV stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.