Summary:

- Nike delivered an excellent 2Q23 and beat both top and bottom line estimates by analysts by a big margin.

- Nike continues to see rising inventory levels, but these are mostly the result of easy comparisons to last year and higher input costs.

- I believe Nike has solid growth drivers in place and could easily see double digit growth over the next decade.

- The financial performance from Nike is very impressive but the current price is challenging as I calculate price target of $120, leaving it with very little upside potential.

Robert Way

Nike Inc.

Nike (NYSE:NKE) will be a very familiar brand to most people, but I will give it a short introduction anyway. Nike is an American multinational that designs, manufactures, and sells mostly footwear and apparel. Nike is headquartered in Beaverton, Oregon, and is the largest supplier of athletic shoes and apparel under its famous “swoosh” logo. I am yet to meet anyone unfamiliar with the Nike logo and it will therefore be to no one’s surprise that Nike has the tenth highest brand value in the world. The company has created many icon products over the years such as Nike Air Max, Air force one sneakers, and a Jordan line. Nike also owns the converse brand which is most known for its All-stars shoes.

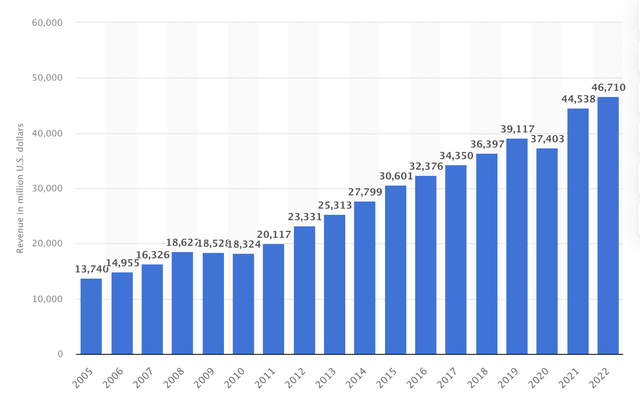

Thanks to its famous brand, Nike has been able to grow its top-line at an impressive pace with 2022 revenue coming in at $46.7 billion, which means revenue doubled over the last 10 years.

Nike annual revenue (Statista)

Nike has a total of 79,100 employees working for them and operates a total of 1046 retail stores. Remarkably, this total has been coming down over the last couple of years as Nike is shifting its focus toward digital sales. In 2018, the total store count was still over 1150.

Nike derives most of its revenues from North America. In 2022 this region accounted for over 41% of revenue. Coming in second is the EMEA region with a 28% share of revenue. Greater China and Asia Pacific & Latin America accounted for 17% and 13.4%, respectively. This shows us that Nike has a very well-diversified business with no region accounting for over half of total revenue.

Despite a significant drop in share price over the last year, Nike has been an excellent investment over the last decade with the stock price increasing by over 300% over that time period. As I mentioned earlier, revenue increased by 100% over the same time frame. With a net income of a little over $6 billion for FY22, Nike has increased its net income 2.73x over the same ten years, so it is safe to say that Nike had had an incredible decade of growth. But the question most important to investors right now is whether Nike is still a good investment for the next decade.

Within this article, I will discuss the most recent financial results of Nike since it released its 2Q23 earnings on December 20th. In addition to this, I will also discuss the main growth drivers going forward, the financials, valuation, and risks of Nike. In the end, we should be able to determine whether Nike is a buy at current prices.

Let’s get to it!

Second quarter results

It is important to first remember that during the first quarter of Nike’s fiscal year, the company saw an extreme increase in inventory due to a slowdown in sales as people started to lower their spending due to high inflation. As a result, Nike saw higher markdowns than expected as it had to burn through old inventory. When Nike reported its 1Q23 results, it was butchered by the market as many analysts and investors started worrying about the resiliency of Nike during a recession. Now, after reporting its 2Q23 results, Nike stock skyrocketed over 13% higher aftermarket, the opposite of what happened the previous quarter. So, what was so good about these results?

Nike reported second-quarter revenue of $13.3 billion, an increase of a very solid 17% YoY and a massive 27% increase on a currency-neutral basis. This is very impressive top-line growth shown by Nike when the company is seeing significant headwinds due to a difficult economic environment. This tells us that consumer spending is not slowing down by as much as was expected. Revenue topped analyst expectations by a significant $740 million.

Nike Direct sales accounted for $5.4 billion of revenue and were up 16% YoY. Digital sales even increased by 25% and 34% on a currency-neutral basis. Wholesale revenue increased by 19% or 30% on a currency-neutral basis. I would have preferred to see stronger growth for Nike Direct sales compared to revenue from wholesale as this carries higher margins for Nike and this segment has been growing as a percentage of revenue over the last decade. Still, all segments showed strong growth overall.

If we take a closer look at growth by region, we can see that the North American segment was the largest contributor to the strong growth (on a currency-neutral basis) with growth of 30%. Asia Pacific & Latin America followed with growth of 19% and EMEA with growth of 11%. China was a drag on revenues with a 3% drop YoY.

The gross margin did decrease by 300 BPS to 42.9% The decrease in margin was the result of higher markdowns to liquidate excess inventory. This did not come as a surprise and even outperformed the consensus of 42.1% gross margins. Margins were also hit due to unfavorable foreign currency exchange rates and elevated freight costs. Nike is definitely feeling the results of high inflation, but it is not as bad as expected by analysts. Nike continues to perform strongly in a difficult environment, and I feel like it is well-positioned to continue doing this over the next couple of quarters, but I will discuss this in more detail in the next section.

As a result of the margin headwinds, net income came in at just $1.3 billion, which was flat YoY, and EPS increased by 2% to $0.85. This puts the net income margin right under 10%.

The inventory issues experienced by Nike over the first quarter of its fiscal year were again a problem in the second quarter, but to a lesser extent than expected. Inventories for Nike increased by 43% YoY to $9.3 billion driven by an increase in units from lapping prior year supply chain disruption, as well as higher input costs. This means Nike is saying that consumer spending remains strong, but the increase in inventory is simply due to easy comparisons from last year in combination with higher input costs due to inflation. If this is the case, we should see inventory growth go down over the following quarters as a result of a better comparison and hopefully lower inflation numbers. It is important to note here that these issues are short-term and should be of no significant influence on the long-term growth story for Nike. As a long-term investor, it is important to look through this near-term weakness. Of course, it is not completely without consequences as Nike has seen its balance sheet worsen as a result of lower margins and lower net income. Nike reported total cash on the balance sheet of $10.6 billion, which is still very strong, but down $4.5 billion from last year. This is mainly due to free cash flow being offset by continued share repurchases, dividend payments, and lower free cash flow due to lower margins.

Long-term growth drivers

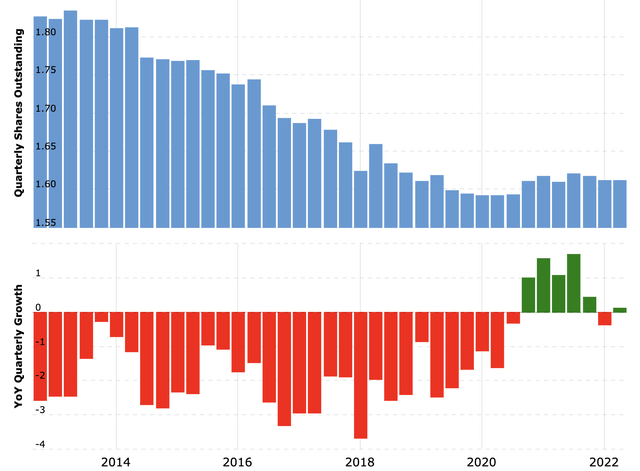

Now that we know how Nike performed over its latest fiscal quarter, we can start looking at future growth opportunities. One way of increasing shareholder value is by buying back shares. Nike currently has an active share repurchase program worth $18 billion over 4 years. Over the latest quarter, Nike repurchased 16.5 million shares worth $1.6 billion, and ever since November 30, Nike repurchased another 19 million shares for a total of approximately $1.9 billion. Through strong repurchases over the last decade, Nike has lowered the total share count from 1.826 billion to 1.56 billion as of the latest quarter. This means Nike lowered the share count by 14.5% over the last decade, increasing shareholder value and EPS. I believe Nike will continue to do so through new repurchasing programs as the business will grow its margins over the next couple of years and increase free cash flow – leaving it with more room to repurchase its shares.

Nike share count over the last decade (Macro trends)

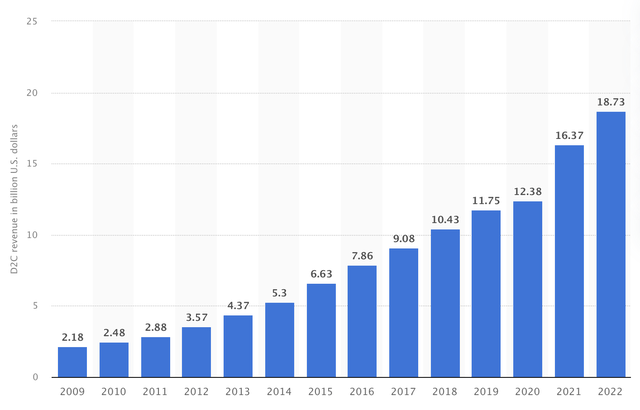

This brings me to the next growth driver for Nike and that is margin growth through Nike Direct. For many years Nike has been increasing its direct sales over wholesale. Nike already has strong margins compared to other apparel companies but is expected to increase margins even more going forward. Nike is shifting to a Direct-to-consumer model which should drive margins as it controls the price of its product and takes the full profit for itself. The graph below shows the increase in Nike Direct revenue.

Nike Direct Revenue (Statista)

This increase in Nike Direct is driven by the increase in digital sales, which is also part of the reason for the decrease in retail store count. Nike is adapting very well to the digital climate which was boosted by the covid-19 induced lockdowns. This shift is also visible in the graph above as Nike Direct revenue significantly increased in 2021 as this is dominantly from digital sales. I expect Nike to continue working on this strategic shift and believe it will be able to increase its margins as a result. In turn, this will drive EPS higher as well. Margins are currently under pressure by inventory write-downs, but this is due to macro-economic circumstances, and I expect these to disappear over time, and when they do, Nike will be in the perfect position to increase its margins again above the record 46% margins witnessed over the last decade. To prove my point, analysts are currently projecting Nike to report a 27% drop in FY23 EPS, but to already recover in the 2 years after by growing over 20%, to then continue growing by solid double digits in the years after.

Besides margin and EPS growth, there is also still significant upside potential for top-line growth as it has shown just last quarter with impressive 27% growth YoY. It is also worth mentioning that Nike managed to increase its top line even during the financial crisis. So even when the bottom line is hit by increasing prices, revenue growth is more resilient. Analysts are currently projecting Nike to grow its revenue by high single digits over the next 5 years including the current fiscal year. This is strong growth and I feel like Nike could very well be able to outperform this as its clothes are increasingly worn as casual clothing by younger generations, even on the work floor.

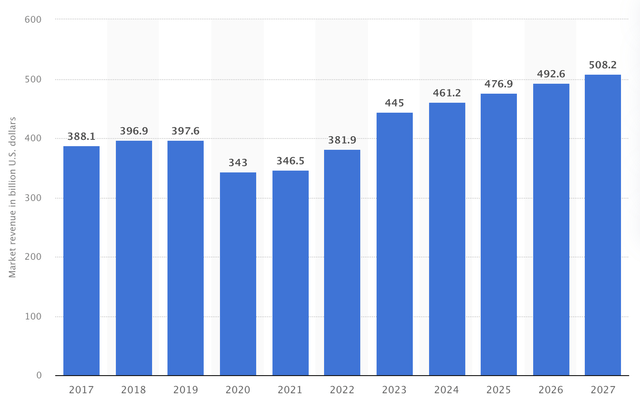

In addition to this, the global apparel market is expected to grow at a CAGR of 6.1% until 2026. The footwear market is also expected to keep increasing until 2027 to reach a market size of over $500 billion.

Footwear industry size (Statista)

Footwear is by far the largest business segment for Nike with a 66% share of revenue in FY22. Through its incredible brand strength Nike is very well positioned to benefit from growth in both industries and I, therefore, expect Nike to be able to grow its revenue by low double digits over the next few years after a small dip in the current fiscal year. Even though Nike is a very mature company it continues to call itself a growth company and I believe it will be able to live up to it!

Valuation and dividend

Despite a very solid growth outlook, this does not make it a buy necessarily. Valuation plays a big role and a company like Nike is never cheap. Nike is currently valued at a forward P/E of 37.35 which is on par with its 5-year average, yet growth is expected to be lower over the next couple of years. I believe the company deserves a high valuation thanks to its resiliency and incredible brand strength which gives it a significant competitive advantage.

As a result of the strong 2Q23 results, I believe current revenue and EPS estimates by analysts are slightly too low and should be revised upwards as margins are better than expected and consumer spending remains strong, resulting in higher sales numbers. I expect margins to slightly increase as inflation eases and Nike gets it supply chain under control. Based on these facts, I expect Nike to report EPS of $3.74 over the next 4 quarters with a net income margin between 10% and 11%. Based on a 32x P/E ratio, which I believe is fair for Nike, I calculate a price target of $120 per share.

(I project 3Q23 revenue of $12 billion and EPS of $0.77)

Based on these estimates and a current price of around $117, upside is very limited at less than 3%. I would prefer the valuation to come down when taking into account the possibility of more downside in 2023 as the risk of a potential recession grows larger. If we would enter a severe recession in the second half of 2023, this would result a lower revision of estimates and more downside in share price.

Looking at the dividend yield, Nike might not look like the most attractive stock pick with a forward yield of 1.32%. This becomes a lot more attractive if we look at the dividend growth history and potential. Nike has been increasing its dividend at an 11% CAGR over the last 5 years and increased the dividend by 10% this year. With the company expected to increase its top line over the coming years, there is plenty of upside potential in the dividend and this makes Nike an attractive stock for dividend growth investors. Nike also has a strong track record already with 21 consecutive years of increasing dividend payouts. With the payout ratio right around 35%, the dividend also seems very safe and with plenty of room for upside.

Risks

There are still many risks for an investment in Nike stock, but I feel like most of them are short-term issues and will not have a long-term effect. The most obvious risk is that of the current economic turmoil involving high inflation, rising interest rates, and the risk of a recession. The latest financial results already showed the effect of the high inflation in the form of higher freight costs and production costs, resulting in lower margins. I am expecting this to continue to be a drag on earnings over the whole of 2023 and possibly into the first half of 2024. This will mainly be a drag on net income and free cash flow. Besides having an impact on the balance sheet, I do not foresee many issues for Nike, and I feel like most of these headwinds are already priced in.

If we would enter a recession somewhere in 2023, this could have an additional negative effect on Nike as consumer spending would most likely take a hit. Less consumer spending would result in less revenue growth for Nike, but I believe Nike is protected by its incredible moat and higher prices. Still, if we would enter a severe recession, there is much more downside for Nike, and revenue growth could turn slightly negative under the worst-case scenario.

The increase in inventory should also be of no concern as this is also temporary according to Nike and should ease off over the next couple of quarters.

Conclusion

Nike is a truly incredible company with a very impressive moat. In my view, the company still has strong growth ahead, although maybe not as strong as it has been. Most growth is expected to come from margin increases and top-line growth thanks to an increasing apparel and footwear industry. I do see Nike increasing its bottom line at solid double digits for at least the next 5 years, while it will grow its revenue by low double digits. FY23 may be a less positive story with Nike continuing to struggle with high inflation and a possible recession. This will be a drag on margins and net income.

Despite this, Nike had an excellent second quarter and delivered yet again. The significant outperformance compared to analysts’ expectations shows us that Nike is being underestimated and is more resilient than it’s given.

The valuation is a bit on the high end for me, but I would not call it a no go. I believe it is important to invest carefully under the current circumstances as even the best-looking companies could have much more downside over the next 6 months with the economy getting worse. This is still highly unpredictable.

Despite the impressive quarterly results and strong growth drivers, I rate Nike a hold due to the increase in share price following its 2Q23 results. The stock does not offer a lot of upside potential at prices around $117 per share and a price target of $120. I do remain of the opinion that the company is a strong long-term investment and will start buying if the stock gets close or below $110 again.

Yet, at the current price of around $117, Nike is a hold for me as upside is limited and the economic outlook is uncertain.

Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.