Summary:

- JinkoSolar’s Q4 earnings report caused an initial 10% drop in stock price due to missed earnings and declining profit margins.

- Despite the drop in stock price, JinkoSolar is still leading in cost structure, capacity, and technology in the solar industry.

- The company is expecting increased demand for clean power generation due to the expansion of AI and electric vehicles, and is well-positioned to play a crucial role in the energy crisis and transformation.

- JKS stock remains the cheapest in the solar industry and is now returning value through dividends and share buybacks.

FilippoBacci

JinkoSolar’s (NYSE:JKS) latest earnings report was not received well and the stock dove initially 10%. The fourth quarter earnings missed and margins took a nose dive. However, according to management the company is still leading in cost structure, capacity and technology. The CEO, Li Xiande, mentioned in the earnings call:

In the mid to long term, the rapid expansion of AI and electrical vehicles may lead to a tight power slide in the world, and the demand for clean power generation is expected to further increase. So far, reduced solar cost has significantly increased the competitiveness of solar in energy sectors. In the future, solar as a new quality productive force is set to play an increasingly important role in face of energy crisis and energy transformation.

JinkoSolar Shares Drop On Weak Profit Margins

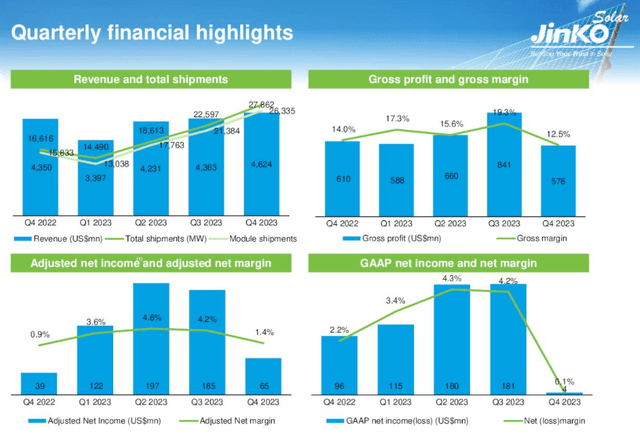

Despite the panic in stock price, there is still a lot to like. As the prices of solar panels continue to drop, the demand grows towards to opposite side. Shipments were up 23% quarter-over-quarter and up 67.7% year-over-year to 27.8 GW. Nonetheless, due to declining module prices revenue grew only 9.4% year-over-year. In the fourth quarter, expenses consisted for around $40 million in one-time cost, making adjusted net income a better comparable. When we compare adjusted net margin with Q4 2022, we can see that cost efficiency through the integrated manufacturing process managed to expand margins despite declining prices.

Zooming out again, JinkoSolar is operating excellently and above all competitors in terms of technology and ESG efforts. The company has been granted 330 TOPCon patents, and reached a licensing deal with one of the top 5 solar cell companies worldwide. In addition, the company is guiding solar module efficiency of 26.5% in mass production by the end of 2024, up from 26%.

Further, Jinko’s MSCI ESG rating was upgraded by two levels to “BBB”, which is overshadowed a lot by negative criticism around Chinese manufacturing. They go even further, in February Neo Green Panels were launched made in their “Zero Carbon Factory”.

In 2024, module shipments are expected to exceed 100-110 GW with a 90% proportion of N-type products. This is beneficial for margins, since they are sold at a premium compared to P-type products.

Market Dynamics

More than 50% of shipments were domestically in China and in Southeast Asian countries. The European market has been struggling of surplus inventory, and this can be seen in the market breakdown by region. Management shared some information that the destocking is almost finished in Europe and they expect some growth in both the utility and distribution business side.

On the other hand, Jinko is ready to be the top player in North America. In 2024, 2 GW of module manufacturing comes online in the U.S. alongside 12 GW of vertical integrated manufacturing outside of China with full traceability. Emerging markets is another large pillar of growth in the coming years.

Importantly, JinkoSolar is not the only one getting pressured on margins. Similarly, Canadian Solar’s (CSIQ) margins also dropped to 12.5% equal to Jinko. Partly because of declining ASPs but also by selling most panels in China compared to Europe or the U.S. were panels sell for higher ASPs.

Smaller players without vertical integration to reduce cost will struggle in the current environment, which will result into consolidation in the market and even more market share gain for the most efficient players. According to management, market share for the top 10 module manufacturers is expected to increase from 70% in 2023 to over 90% in 2024.

JKS Stock Valuation Remains Low

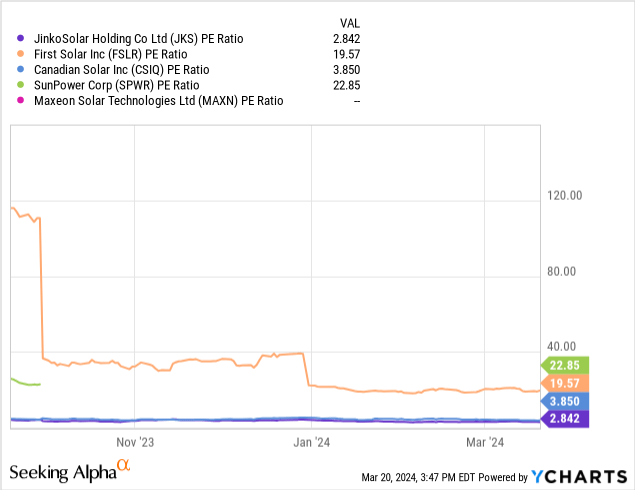

In comparison to peers, JinkoSolar remains the cheapest solar stock in the market. Only Canadian solar is close with a price-to-earnings ratio of 3.8x. But that is still a significant difference from the 2.8x price-to-earnings of JKS.

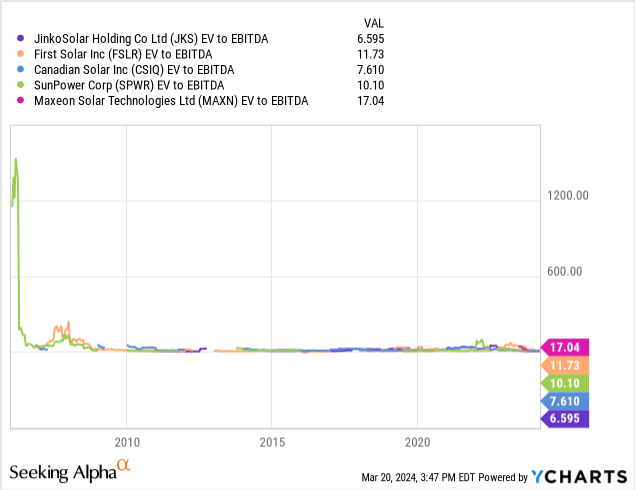

In terms of EV-to-EBITDA, JinkoSolar again scores the best. The reduction in net debt from 2.3 billion to 1.6 billion helped a lot in achieving a better ratio. Maxeon Solar Technologies (MAXN) is topping the tables here and is way more expensive or unprofitable.

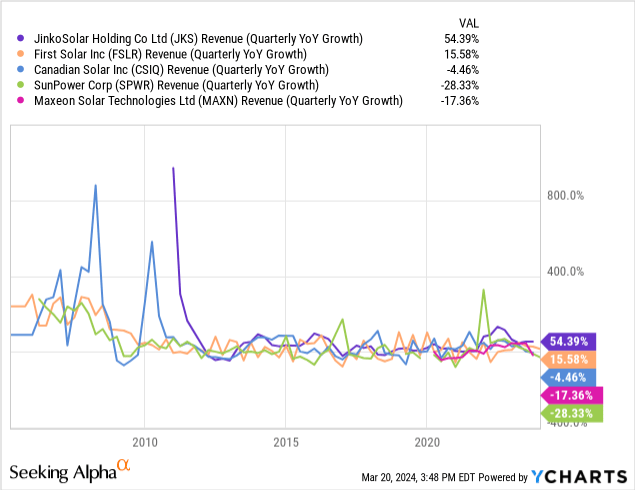

The last quarters have been troublesome for the solar panel manufacturers across the board. Including Jinko’s latest quarter of 10% growth, it is the only grower next to First Solar (FSLR). First Solar has been benefitting from the difficult access of Chinese solar panels into the U.S. and by the large backlog the company has.

Furthermore, JinkoSolar has started an annual dividend to increase shareholder value. The dividend yield is sitting at 5.6% and can definitely count. Alongside, there is still a share buyback program running of $190 million or 15% of the current market cap. The effect is likely to limit downward pressure when executed and could create positive momentum in the coming years. By the end of February, they repurchased approximately $28 million of shares outstanding.

Risks

Investors need to keep in mind that JinkoSolar has been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company may be delisted by 2024, if they do not show the right auditing under the rules of the United States. Even so, the company is confident that the latest annual report followed the rules and that they should not be delisted.

On macro level, higher interest rates for longer could affect demand from Europe and North-America in the short to medium term. In the long term, the tailwind of the green energy transition should drive further demand.

JinkoSolar has the largest global manufacturing capabilities covering a wide number of countries. This reduces the risk of being dependent on one or two countries. However, China is still a large part of the client base, and more pressure of module prices in the Chinese market can pressure margins in the coming quarters.

Takeaway

Since my last article on JinkoSolar, the thesis remains in place. JinkoSolar is an undervalued industry leader in terms of cost structure, technology and ESG initiatives. The company is set to benefit from higher ASPs in North America after being able to avoid the U.S. import tariffs.

The first half of the year is likely to be the bottom in margins and demand is likely to remain strong while module prices are low and the surplus inventory in Europe is about to subside.

In the west, energy is almost an obvious thing, however in emerging countries, energy is extremely scarce. On my latest trip to South Africa, power went down for almost 6 out of the 24 hours. Solar is going to be on high demand by countries like Brazil, India and South Africa and the supplier is JinkoSolar.

I rate JinkoSolar a ‘Strong Buy’ at $25 a share and could see myself averaging down in the coming weeks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JKS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.